• Mixed markets. Equities push higher with long-end yields a bit lower. USD consolidates. AUD treading water near the top of its multi-month range.

• RBNZ shift. A change in the RBNZ’s tone. Door to rate cuts opening. AUD/NZD’s upswing continues. AUD/NZD at its highest since Q4 2022.

• US CPI. Challenging base-effects could keep annual inflation steady. But the monthly pulse expected to be soft. Something for everyone likely in the data.

There was generally an upbeat tone across markets overnight, although that didn’t flow through to the major currencies as they remained range bound. US equities powered ahead with a tech-sector charge propelling the index to another record (S&P500 +1%, NASDAQ +1.2%). In Europe the major stockmarkets rebounded (EuroStoxx50 +1.1%). A dip in bond yields was supportive with long-end rates in Europe falling by ~3-5bps, while the benchmark US 10yr yield eased a touch (now 4.28%).

In FX, the USD consolidated with a slightly firmer EUR (now ~$1.0830) and GBP (now ~$1.2850) offsetting another uptick in USD/JPY (now ~161.60, near the top of its multi-decade range). GBP garnered some support from a modest paring back of near-term Bank of England rate cut expectations after policymaker Mann and Chief Economist Pill warned about persistent UK inflation risks. Market odds of a BoE rate cut in August have slipped back to a 50/50 proposition. Elsewhere, the NZD (now ~$0.6080) underperformed after the RBNZ surprised by started to lay the groundwork for rate cuts, possibly in late-2024. The AUD has tread water just above ~$0.6740.

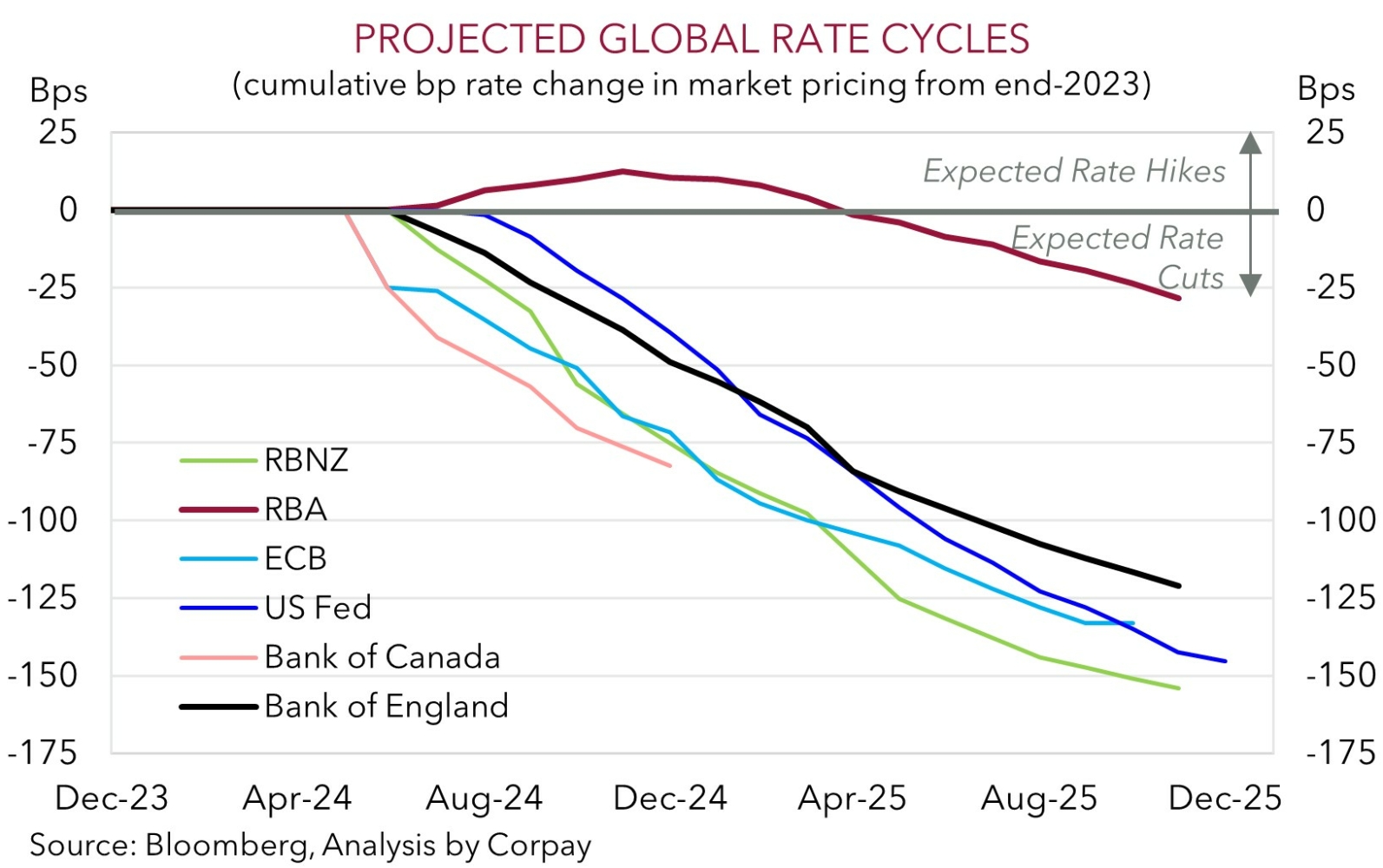

US Fed Chair Powell delivered the second day of his Congressional Testimony and he again failed to rattle markets. As per his comments yesterday Chair Powell noted that there has been “modest further progress on inflation”, that “more good data” would bolster confidence inflation is on a sustainable path to target, and that the Fed was also attentive to the “considerable softening in the labour market”. Markets are assigning no real chance of a Fed move in late-July, however the probability of a cut in mid-September is elevated (now ~70%) with two rate reductions priced in by year-end. There are three US CPI inflation prints (include the one tonight) and two jobs reports ahead of the September Fed meeting. There is enough time and data for a case to be made for the Fed’s rate cutting cycle to kick off by then, in our view.

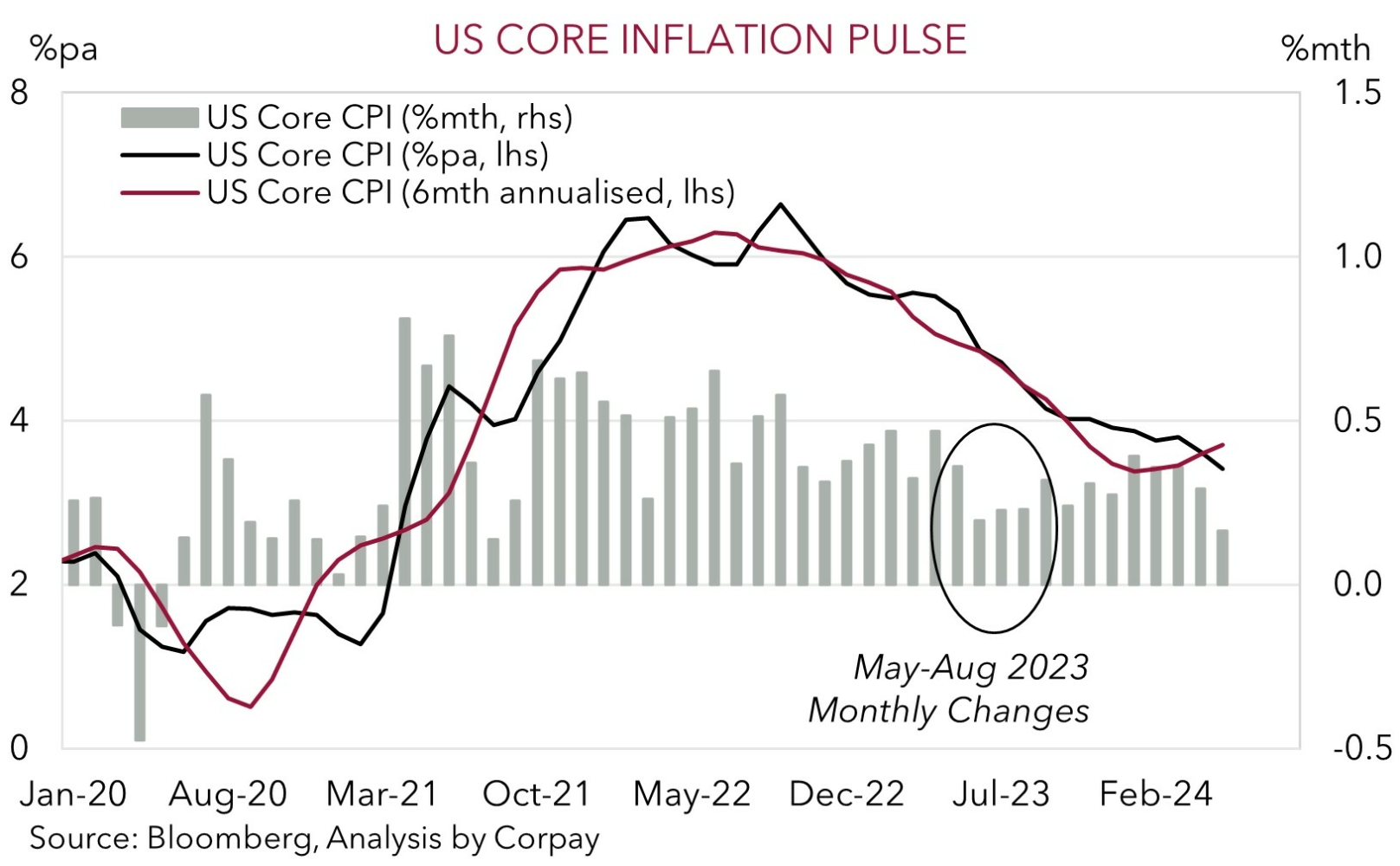

Today, Fed Governor Cook speaks on inflation and policy (9:30am AEST), but the main focal point will be the June US CPI inflation reading (10:30pm AEST). As our chart shows, because of lower prints this time a year ago, base-effects are somewhat unhelpful, and as such the annual run-rate of US core inflation looks set to hold near 3.4%pa. However, as it was last month, the monthly pulse may again be on the softer side, thanks to factors like slowing rents and wages. We feel markets should take more of a signal from the monthly data rather than the annual pace. If realised, we believe indications the monthly US inflation pulse has stepped down to a level closer to the Fed’s target could bolster rate cut expectations, dragging on US yields and the USD.

AUD Corner

The AUD has continued to consolidate with the currency hovering just above ~$0.6740, the upper bound of the range it has occupied since early-January. The AUD has been mixed on the crosses over the past 24hrs with a dip in AUD/GBP (-0.4% to ~0.5250) on the back of a slight paring back of BoE rate cut expectations coming through. By contrast, AUD/JPY has pushed even higher. At ~109.05 AUD/JPY is at levels last traded in Q1 1991 as the low volatility and upbeat risk tone support the pair. That said, we would note that AUD/JPY looks to have diverged significantly from relative Australia-Japan long-term interest rate expectations suggesting further gains may be hard to come by and/or that a pullback is a growing chance.

AUD/NZD has also extended its upswing. At ~1.11 AUD/NZD is at its highest point since October 2022. At yesterday’s meeting the RBNZ made noteworthy tweaks to its tone and guidance. The RBNZ started to soften its message as the harsher NZ economic reality appears to be hitting home. While the RBNZ thinks policy will need to remain “restrictive” the door to tinkering down the track has opened with the committee flagging that the “extent of this restraint will be tempered over time” if NZ inflation declines as anticipated. This is in line with our thinking that it was a matter of when, not if, the RBNZ starts to shift course due to the slack emerging across the NZ economy. The start of an extended RBNZ easing cycle in late-2024 looks probable, in our opinion. We believe there is more room to run in AUD/NZD with our long-held forecast being for it to edge up towards ~1.13 by Q4. For more see Market Musings: AUD/NZD – Diverging macro fundamentals.

As outlined previously, we think the stickiness in domestic inflation, resilient labour market, and still high level of activity across the labor-intensive services sectors means there is a possibility the RBA delivers another rate hike over coming months. Markets agree with ~30% chance the RBA moves in August priced in. The upcoming June jobs data (due 18 July) and Q2 CPI (due 31 July) will be inputs into the equation. We remain of the opinion that even without another rate hike the RBA is on a different path to its peers as it may lag other central banks in terms of when rate cuts start and how far it goes during the easing cycle. The economic and monetary policy divergence should be AUD supportive over the medium-term. We feel signs US inflation pressures are cooling (tonight 10:30pm AEST) could reinforce this theme with a resultant drag on US yields and the USD likely to give the AUD a boost.