• Mixed markets. Equities edged higher, bond yields rose, & the USD rebounded. The AUD has slipped back over the past few sessions.

• Data pulse. Eurozone CPI slowed more than expected, weighing on EUR. US data showed spending & inflation are moderating. Unemployment claims are rising.

• AUD dips. AUD has given back some ground. RBA next week. No change expected, but we think the pressure to move again in early-2024 remains.

A bit of a reversal of fortunes across markets overnight. However, while some of it was macro related, month-end ‘window dressing’ as investors rebalance exposures after sharp moves over recent weeks probably also played a role. The US S&P500 (+0.4%) and the major European indices ticked up (EuroStoxx50 +0.3%). This follows a very strong run. In November the S&P500 increased 8.9%, its second-best monthly result in 3-years. Long-end bond yields rose and curves steepened, with larger moves in the US (10yr +7bps to 4.33%) and UK (+8bps to 4.17%) over Germany (+2bps to 2.44%) on the back of some economic divergence. Though, like equities there were sizeable net swings in November. Even after the overnight lift the US 10yr remains ~68bps from its October highs.

In FX, the USD index recouped some lost ground with EUR a key outlet. At ~1.0890 EUR is ~1.3% from Wednesday’s multi-month peak, and below where it started the week. USD/JPY edged a little higher (now ~148.27) and GBP drifted back (now ~$1.2619). USD/SGD has tracked the USD moves to be up around ~1.3380 (where it was on Monday). NZD has held up with the more ‘hawkish’ RBNZ tone from a few days ago generating ongoing support. AUD has slipped back towards ~$0.66 as the firmer USD compounded a softer China PMI and paring back of RBA rate hike expectations since Wednesday’s monthly CPI report.

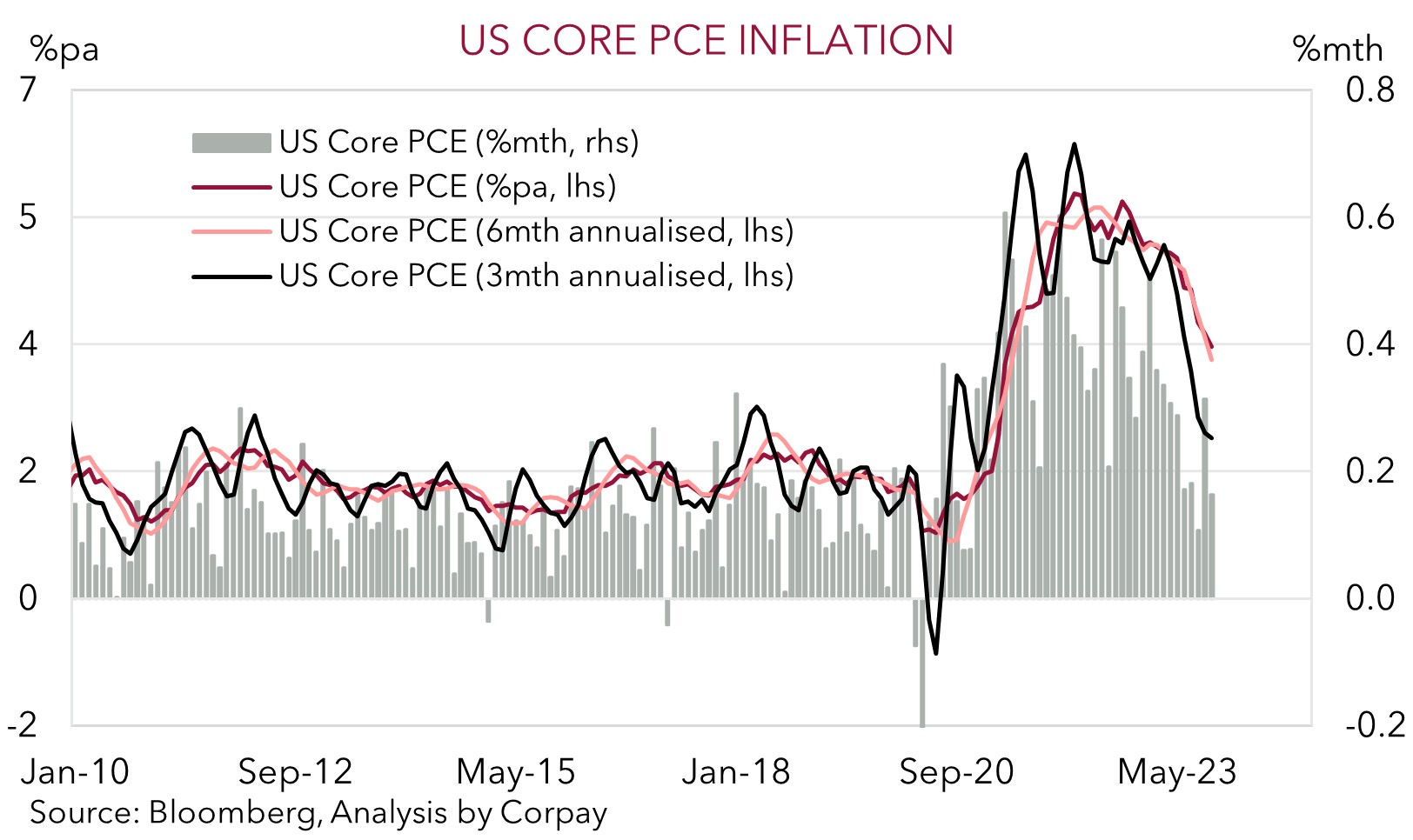

Data wise, Eurozone inflation decelerated more than expected. Headline inflation fell to 2.4%pa, while the core measure slowed to 3.6%pa (its lowest since H1 2022). The drop in inflation prompted investors to bring forward ECB rate cut timing, with markets now discounting a 25bp reduction by April. The direction looks right, but we aren’t so sure it will happen so soon. Some of the Eurozone disinflation looks to be driven by seasonal distortions which could unwind over coming months, and the improvement in sticky services is slower going. In the US, while a few members of the US Fed pushed back on the markets recent downward shift in policy expectations (Daly stated that she “is not thinking” about cuts right now and Williams said he expects policy to be ‘restrictive’ for some time) the data flow begs to differ. US continuing claims (a gauge of recurring applications for unemployment benefits) hit their highest since late-2021, personal spending moderated in October, and so did the PCE deflator (the Fed’s preferred inflation gauge). Core PCE slowed to 3.5%pa. The pulse rate is showing even more improvement. On a 6-month annualised basis (something Chair Powell has pointed to) core PCE eased again.

The US ISM manufacturing survey is due tonight (2am AEDT) and Fed Chair Powell speaks (3am and 6am AEDT). Chair Powell’s thoughts will be in focus, and could set next weeks market tone. There will be bumps along the way, but our view that the USD should gradually deflate over coming months remains (see Market Musings: USD losing its shine).

AUD corner

The AUD’s revival has paused for breath. The USD rebound, a softer China PMI, and adjustment in RBA expectations following the lower than anticipated monthly CPI print a few days ago has taken some of the heat out of the AUD with the currency slipping back towards ~$0.66 (~1% below Wednesday’s peak). However, on the crosses, outside of AUD/NZD which has maintained its post ‘hawkish’ RBNZ dip (now ~1.0730,) the AUD has held up better. A weaker EUR has pushed AUD/EUR towards its 200-day moving average (~0.6084), with AUD/GBP and AUD/JPY also ticking higher over the past 24hrs.

The AUD’s pullback is no surprise to us. Since late last week we were flagging that after its stellar run the AUD was looking vulnerable to the prospect of markets paring back their lofty RBA rate hike bets given downside risks for the incoming economic data. That said, we don’t believe the AUD’s unwind should extent too much further, with solid support likely to be found near its 200-day moving average (~$0.6581). We think the outlook for a further grind higher in the AUD over coming months remains intact. Our forecasts are for the AUD to lift to $0.68 in Q1 and up to ~$0.70 in a years time.

In our assessment the fundamental drivers for a further gradual decline in the USD over the next few quarters are moving into place. As noted above, while some US Fed members have pushed back on the recent ‘dovish’ repricing in US policy expectations, the US data pulse is softening and inflation is cooling. In our view, this should mean that the next move by the US Fed is a rate cut, with a series of reductions anticipated over H2 2024. By contrast, we think the pressure on the RBA to deliver further tightening remains. No change is expected next week, however a move by the RBA in February can’t be ruled out. The large drop in the October monthly CPI indicator largely reflected ‘goods’ prices and cost of living assistance measures that will unwind over time. Sticky services prices, which is what is concerning the RBA, will be better captured in the November/December CPI reports.

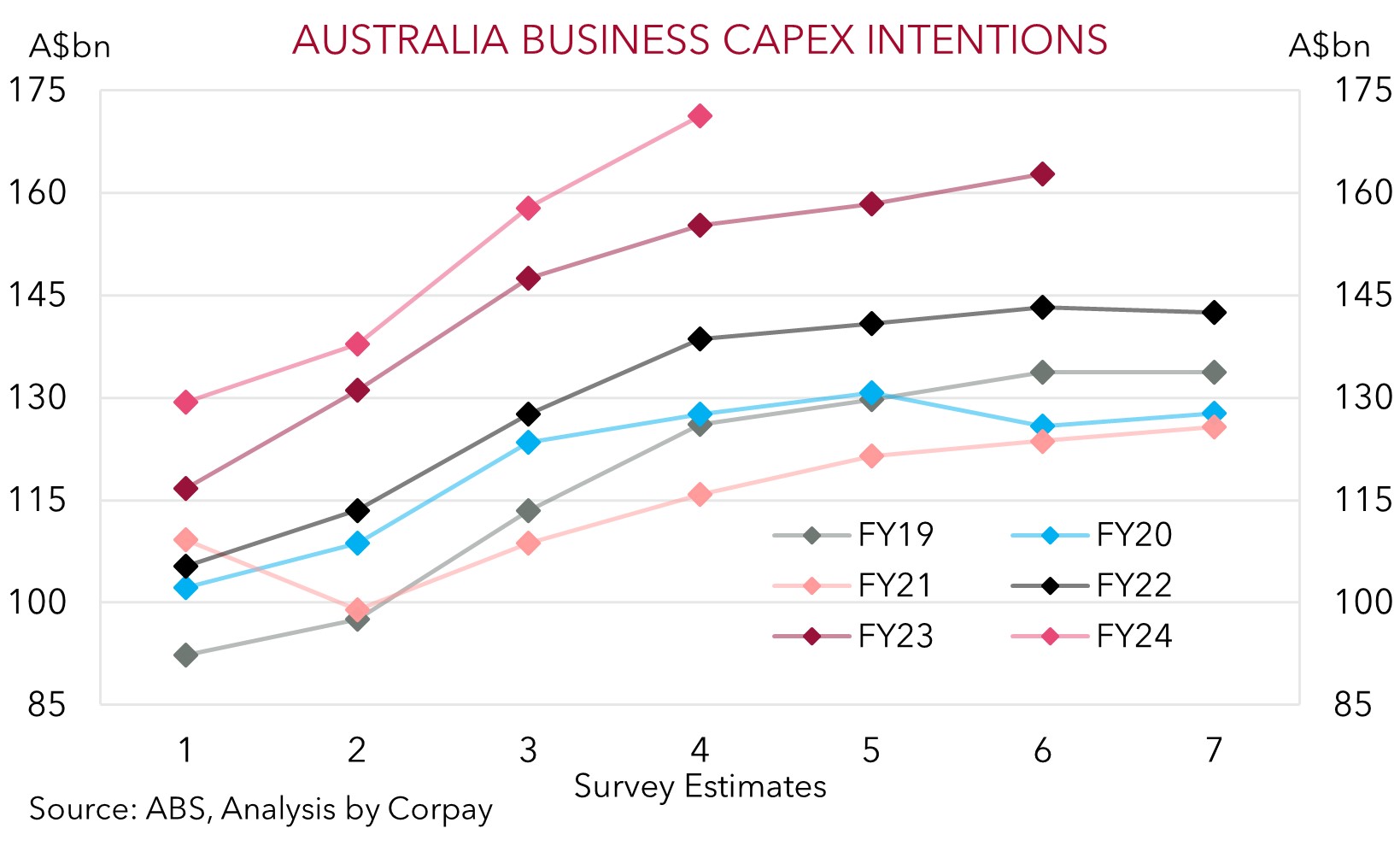

Added to that, domestic growth may continue to hold up better than feared. Many indebted households are feeling the pinch of higher rates; however, the surging population is an offset for aggregate demand. The outlook for business investment also remains a bright spot for the economy. The latest CAPEX survey shows that firms are looking to ramp up their investment to a record level in 2023-24 (see chart below). The impulse from business investment, combined with a larger population, are factors that, in our judgement, should help Australia avoid a ‘technical recession’. The projected diverging growth and monetary policy trajectories between Australia and the US, and narrower AU-US yield spreads should be a medium-term AUD tailwind, in our opinion.

AUD levels to watch (support / resistance): 0.6550, 0.6580 / 0.6670, 0.6700