• Fed speak. Some measured comments by Chair Powell & weaker ISM data reinforced expectations the next move by the Fed could be a rate cut.

• USD weaker. The drop in US bond yields has exerted more pressure on the USD. AUD has risen back up to the top of its multi-month range.

• Event radar. Locally, the RBA’s last meeting of ’23 & Q3 GDP are due. Offshore, focus will be on US labour stats with non-farm payrolls rounding things out.

Downward pressure on US bond yields and the USD returned on Friday with the previous days rebound fleeting. Comments by US Fed Chair Powell were in focus. Although Chair Powell reiterated warnings that the Fed “is prepared to tighten more if appropriate” and that it is “premature to speculate” when it may ease policy, markets are willing to call his bluff. Other comments that settings are “well into restrictive territory” and that policymakers are moving “carefully as the risks are becoming more balanced” were latched on to given the unfolding turn in the US economic cycle. Expectations the next move by the Fed will probably be a rate cut were reinforced by the lower-than-expected US ISM manufacturing survey. The index held in ‘contractionary’ territory with weak employment, production, and new orders components further evidence growth momentum is weakening.

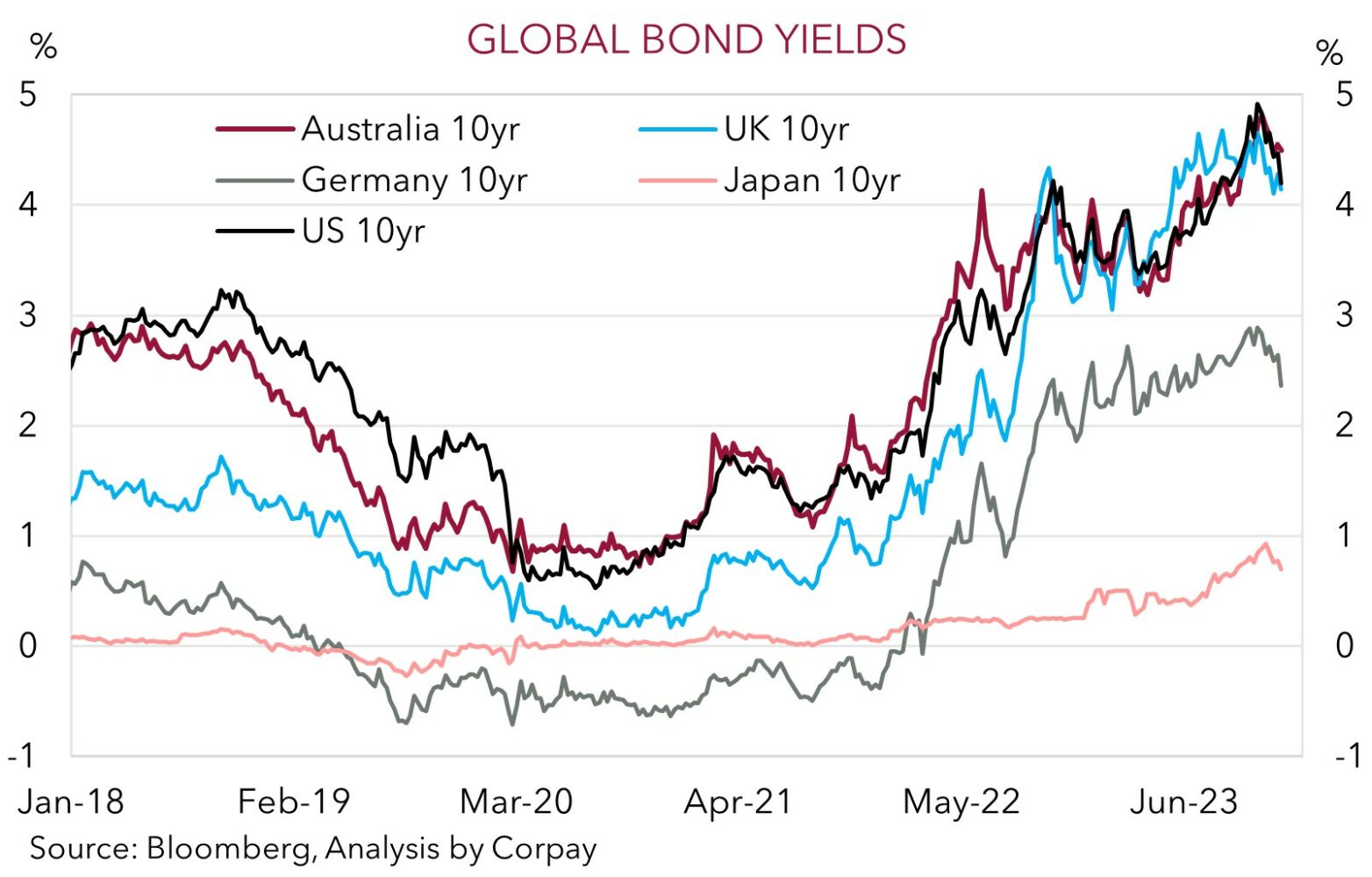

US bond yields fell sharply with the benchmark 10-year rate falling ~13bps to ~4.20%, its lowest since mid-September. The US 2-year yield also declined (-14bps), and at ~4.54% it is back where it was trading in mid-June, some 72bps below its October peak. Interest rate markets are discounting little chance of a move by the US Fed next week and are assuming an easing cycle kicks off in May. The drop in US bond yields supported risk sentiment with the S&P500 rising ~0.6%. The S&P500 is now back near its 2023 highs having risen by ~12% since late-October. And although oil prices slipped back (WTI crude -2.5%), industrial metal prices lifted. Copper increased over 2% to now be more than 11% from its October low. In FX, the USD lost ground as yield spreads moved against the US. While EUR consolidated just under ~$1.09, the interest rate sensitive USD/JPY dipped to ~146.80 and GBP rose above ~$1.27. At ~$0.6198 NZD is around the top of its ~4-month range, as is the AUD (now ~$0.6666).

We think the USD can remain on the backfoot. US labour market data is in focus this week with JOLTS job openings (Weds AEDT), ADP employment (Thurs AEDT), and non-farm payrolls report (Sat AEDT) due. The ISM services gauge is also released (Weds AEDT). A one-off return of striking autoworkers and actors may help prop up employment in November, however various leading indicators suggest overall labour market conditions should continue to lose steam with wage growth slowing and unemployment at risk of rising further. There will be bumps along the way, but our view looking for the USD to continue to gradually deflate over coming months remains (see Market Musings: USD losing its shine).

AUD corner

The AUD’s consolidation didn’t last for long. The weaker USD, drop in US bond yields and positive risk sentiment stemming from the ‘dovish’ interpretation of US Fed Chair Powell’s comments pushed the AUD (now ~$0.6666) back up towards the top of its multi-month range (see above). The AUD also outperformed on the crosses. AUD/EUR rose ~0.9% to be up at ~0.6123, its highest since late-July. The recent upswing is in line with our thinking that the AUD/EUR was set to push higher into year-end (see Market Musings: Cross-Check: AUD/EUR & AUD/GBP – the tide is turning). AUD/GBP also nudged up (+0.2%), as did AUD/NZD (now ~1.0756), while there were larger gains of ~0.6% versus the CAD and CNH.

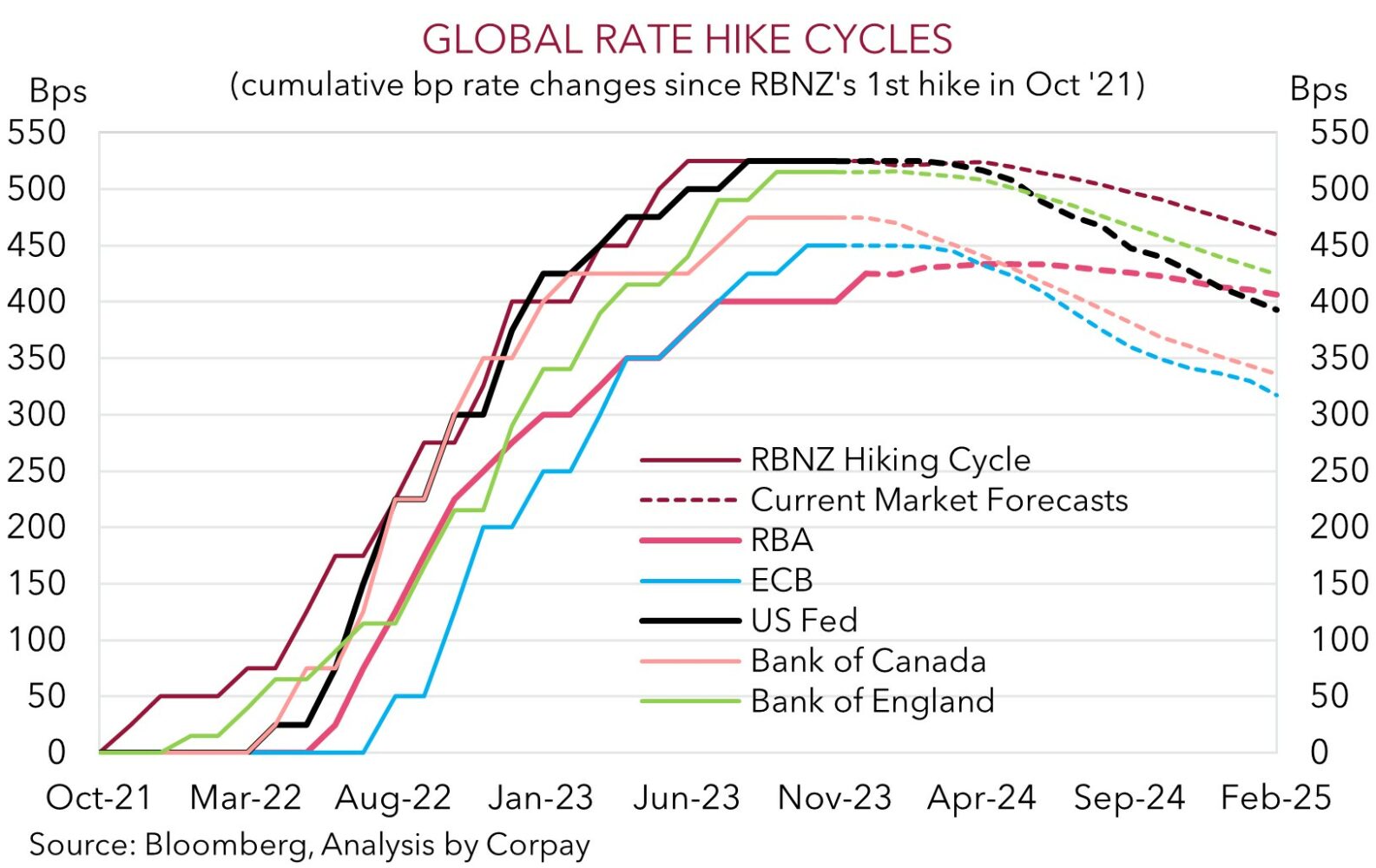

Locally, the RBA’s final meeting for the year (Tues AEDT) and the Q3 GDP report (Weds AEDT) are focal points. No change by the RBA is widely expected (only 1 out of 27 analysts surveyed is looking for a rate hike this week). Softish guidance about ‘whether’ further action is needed is likely to be repeated, however we do see some risk the RBA’s policy language becomes more ‘hawkish’ as per the message from the November meeting minutes and Governor Bullock’s recent speech. Given the RBA Board won’t meet again until February, a hawkish shot across the bow of markets and households could help dampen spending and inflation pressures over the holiday season, particularly as the burgeoning population continues to work in the other direction. Many indebted households and businesses are doing it tough as higher interest rates bite, however a larger population is propping up aggregate demand. Another quarter of modest GDP growth (mkt 0.4%) is anticipated in Q3 with consumption and investment, along with the population surge, positive contributors.

As discussed above, we think signs the US labour market is cooling is likely to keep the USD on the backfoot. This coupled with still positive domestic growth and possibility of further RBA policy tightening down the track to quell sticky services driven inflation pressures should see the AU-US yield spread continue to narrow over the period ahead, in our opinion. The AU-US 2-year spread has shrunk from -121bps in mid-August to -38bps. This adjustment is quite AUD supportive. When combined with the anticipated re-acceleration in China’s economy as stimulus injections gain traction we continue to project the AUD to lift to $0.68 in Q1 before edging up ~$0.70 in a years’ time.

AUD levels to watch (support / resistance): 0.6580, 0.6630 / 0.6690, 0.6710

SGD corner

The pull-back in the USD on the back of the sharp decline in US interest rate expectations has continue to flow through to USD/SGD with the pair falling to ~1.3336, around the bottom of the range occupied since August. On the crosses, the sluggish EUR as Eurozone growth concerns build has also exerted some downward pressure on EUR/SGD (now ~1.4515) over the past week. Elsewhere, SGD/JPY has dipped under its 50-day moving average (110.09) with the interest rate sensitive JPY supported by the drop in global bond yields as the next easing cycle is factored in.

As mentioned, we believe the USD is likely to remain under pressure this week with the wide-ranging US labour data set to show conditions have continued to loosen. This would support our medium-term view that the underlying macro forces are moving in favour of a further sustained depreciation in the USD (see Market Musings: USD losing its shine). If realised, we think USD/SGD may fall towards its mid-July lows (i.e. ~1.3172) over coming weeks.

SGD levels to watch (support / resistance): 1.3280, 1.3320 / 1.3380, 1.3420