• Partial reversal. US bond yields & the USD rebounded, while US equities dipped. There was no major economic news overnight.

• AUD pull-back. Ahead of today’s RBA decision the AUD has lost ground. No change in rates is anticipated with focus on the RBA’s forward guidance.

• US jobs. There is a slew of US jobs data out the next few days that will test expectations looking for no further Fed hikes & for cuts to start in May.

Short term gyrations continued overnight with US bond yields and the USD rebounding, while across equities the S&P500 (-0.5%) and tech-focused NASDAQ lost ground (-0.8%). There was no major news to trigger a reassessment of the outlook, rather a positioning adjustment following last weeks sharp swings looks to have washed through. Indeed, on net, the US 10yr (+6bps to 4.26%) and 2yr (+10bps to 4.63%) yields are only back trading where they were last Thursday. Across FX, lingering Eurozone growth concerns has kept EUR on the backfoot (now ~$1.0830), the interest rate sensitive USD/JPY has tracked the partial recovery in US yields to be near ~147.35, and USD/SGD ticked up (now ~1.3384). NZD has eased after hitting a multi-month high (now ~$0.6164), and the AUD has given back Friday’s gains (now ~$0.6615). Weakness across industrial metals (copper -2.5%) and energy prices (WTI crude -1.1% to US$73.25/brl, around the bottom of its ~5-month range) also helped take some of the heat out of the AUD and other cyclical currencies.

Markets are now pricing in no further rate hikes by the US Fed with an easing cycle factored in from May 2024. The US’ growth and inflation pulse has been softening, but the slew of US jobs data coming out over the next few days will be a key test for the markets expectations ahead of next weeks Fed meeting. Tonight, JOLTS job openings and the ISM services index (both 2am AEDT) are due. Later this week ADP employment (Thurs 12:15am AEDT) is released with non-farm payrolls rounding things out (Sat 12:30am AEDT).

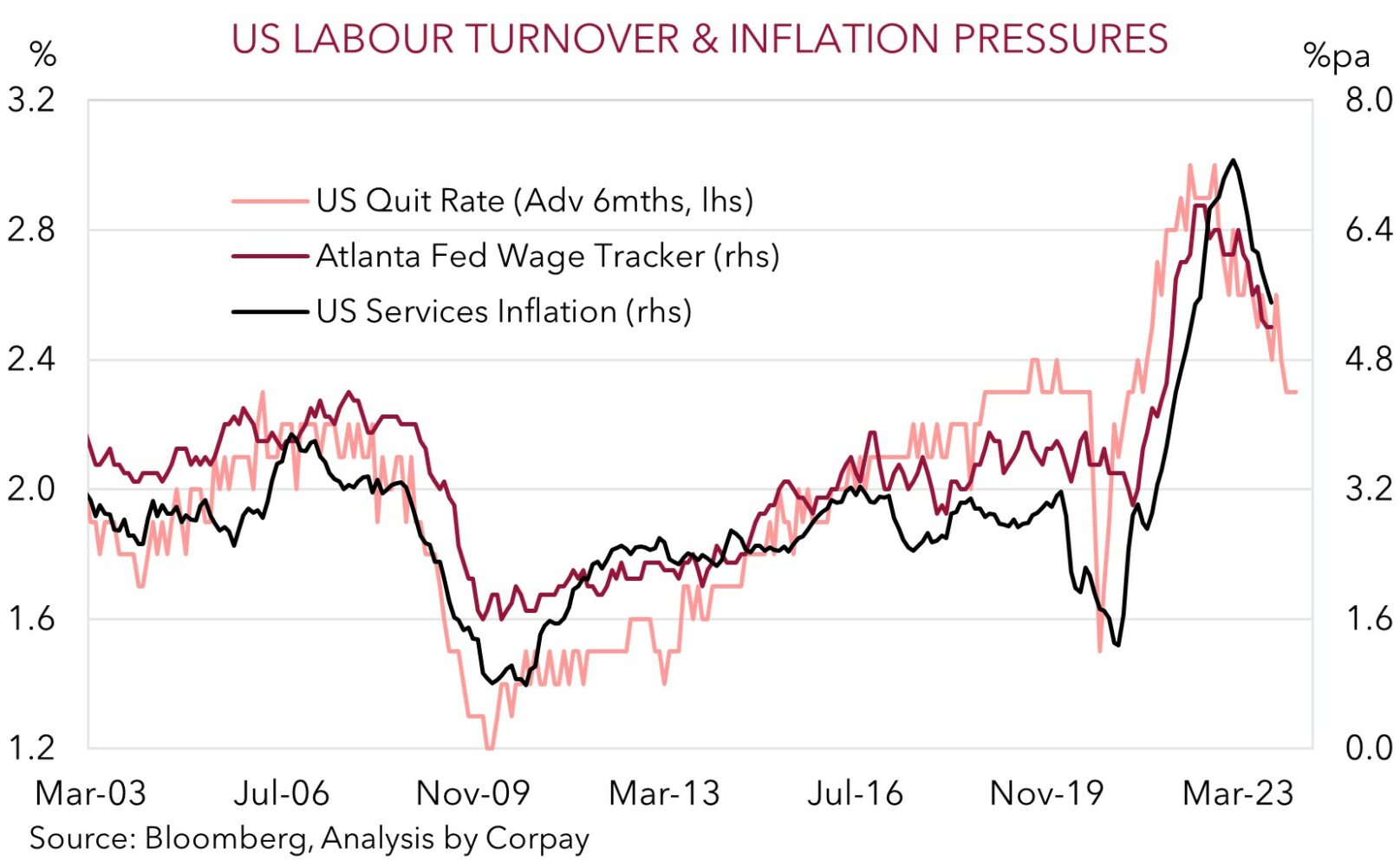

The JOLTS report is looked at closely by Fed policymakers. In addition to providing a guide for labour demand, the ‘quit rate’ is a gauge of labour market churn. Increased churn/job turnover typically goes hand in hand with faster wages and higher inflation. But as our chart shows, after jumping up over 2021-22 labour turnover has fallen back to pre-COVID levels as firms and employees have become a bit more wary about the outlook. Based on the relationship a further drop in the ‘quit rate’ would point to services inflation continuing to fall over time. This is what the US Fed is aiming for. In our opinion, more signs that US labour market conditions are loosening is likely to reinforce market pricing looking for the next move by the US Fed to be a rate cut. There will be bumps along the way, but overall we remain of the opinion that the evolving US macro backdrop should see the USD continue to deflate over the next few quarters (see Market Musings: USD losing its shine).

AUD corner

After touching its highest level since early-August the AUD pulled-back overnight. The rebound in the USD and shaky risk sentiment (as illustrated by the dip in US equities and base metal/energy prices) exerted some downward pressure on the AUD (see above). That said, at ~$0.6615 the AUD is only back near where it was trading at this time on Friday. The backdrop has also seen the AUD lose a little ground on the crosses, although moves have been relatively smaller with crosses like AUD/EUR (now ~0.6108) and AUD/JPY (now ~97.46) still around the top of their respective ranges.

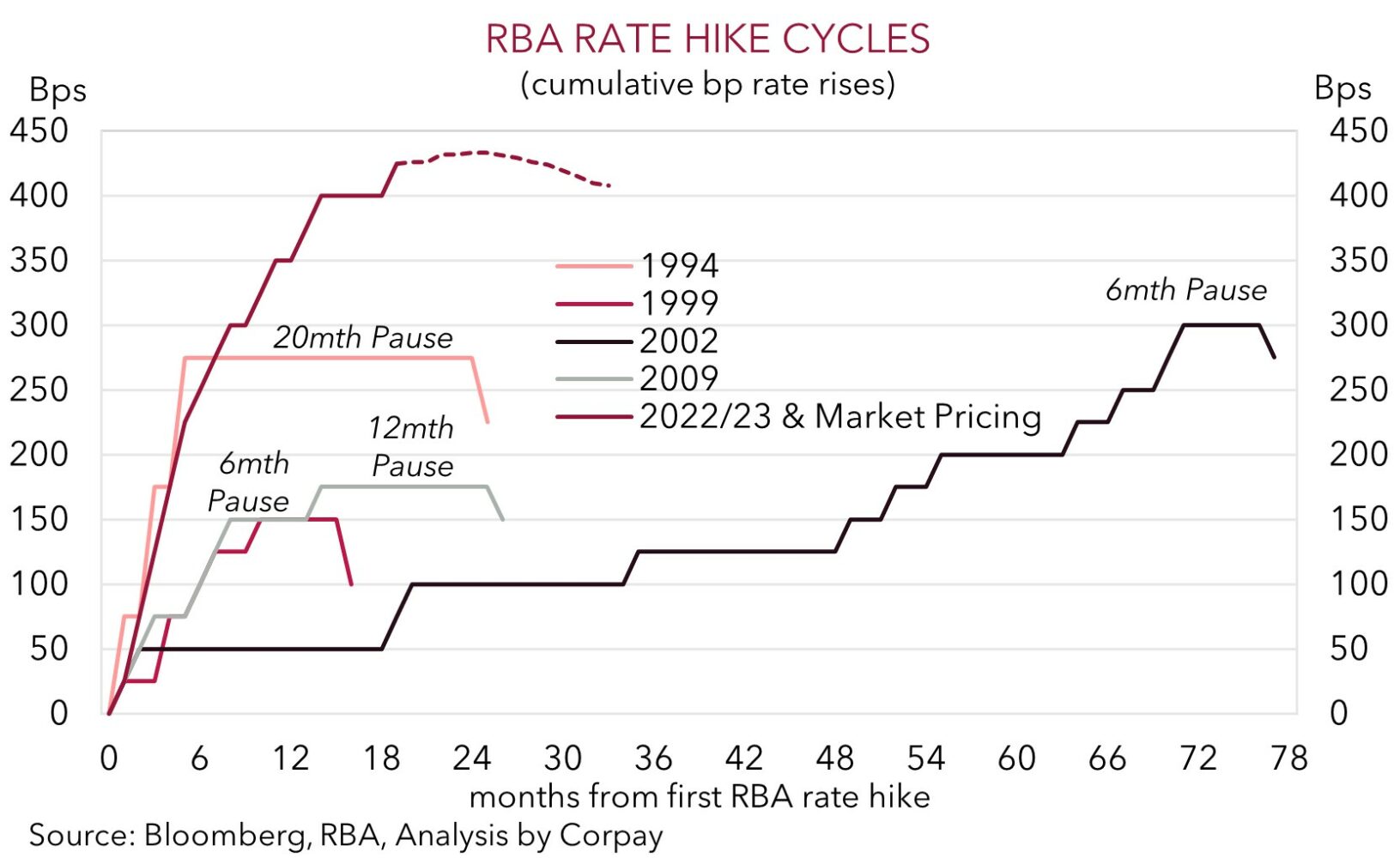

Today, focus will be on the RBA’s last meeting of 2023 (2:30pm AEDT). No policy change is widely expected (only 1 out of 27 analysts surveyed is looking for a rate hike while interest rate futures are only assigning a ~2% probability). The RBA’s softish forward guidance about ‘whether’ further action will be needed is most likely to be repeated, however we see a risk the RBA’s language turns a bit more ‘hawkish’ as per the message from the November meeting minutes and Governor Bullock’s recent speech. As the RBA Board won’t meet again until February a hawkish reminder for households could help dampen spending and inflation pressures over the holiday season, particularly as the surging population continues to be an offsetting force for aggregate demand. Indeed, based on the run of partial data released so far, particularly the jump in inventories, we believe there are upside risks to consensus expectations looking for Q3 GDP growth of 0.4% (released tomorrow). Consensus GDP forecasts will firm up today following the release of quarterly net exports and government expenditure data (11:30am AEDT).

A tweak in the RBA’s commentary would give the AUD an intra-day boost. However, overall, we think that even if the RBA holds the line with respect to its guidance the AUD’s retracement shouldn’t extend too much further with solid support likely to be found around its 200-day moving average (~$0.6580). As flagged previously, various fundamentals are shifting in favour of a higher AUD. In addition to signs China’s economy is turning the corner, bond yield spreads have narrowed. In contrast to the outlook for the US Fed where the next policy step looks set to be a rate cut, the risk of further tightening by the RBA over the coming months remains. In our opinion, signs the US labour market is cooling (JOLTS job openings are released tonight, while ADP employment (Thurs AEDT) and non-farm payrolls (Sat AEDT) are due later this week) should keep future Fed policy easing assumptions intact, exerting downward pressure on the USD.

AUD levels to watch (support / resistance): 0.6580, 0.6600 / 0.6660, 0.6710