• Fed rhetoric. Comments by the Fed’s Waller were in focus. Waller’s message supported the view that the next Fed move will probably be a rate cut.

• Market repricing. The pull-back in US bond yields & the USD extended. EUR, NZD & AUD edged up to multi-month highs. USD/JPY lost some ground.

• Trans-Tasman Events. Locally, the monthly CPI indicator due today. A slowdown in annual inflation is predicted. RBNZ expected to keep rates steady.

The pull-back in bond yields and the USD extended overnight as expectations that the US Fed’s tightening cycle has ended were reinforced by policymaker comments. The US 2-year yield fell 11bps, taking it down to 4.74% its lowest since early-August and some 50bps below the October peak. The benchmark US 10yr rate declined 5bps to be at a ~2-month low (now 4.34%). The drop in bond yields helped US equity markets consolidate, while the moves exerted more downward pressure on the USD.

Across FX, EUR is hovering just below ~$1.10, a multi-month high. GBP has pushed up towards ~$1.27, and the yield sensitive USD/JPY has slipped under ~147.50, the bottom end of its November range and ~3% below recent highs. USD/SGD has continued to fall with the pair near a 4-month low (now ~1.3320). The backdrop has kept the NZD and AUD well supported. Ahead of today’s RBNZ meeting (12pm AEDT) where the central bank is expected to keep rates steady but continue to stress that cuts are a long way off the NZD has pushed up to ~$0.6130, the top of the range occupied since August. The AUD shrugged off softer retail sales data to be up around ~$0.6645, lofty heights it hasn’t been up at since early August.

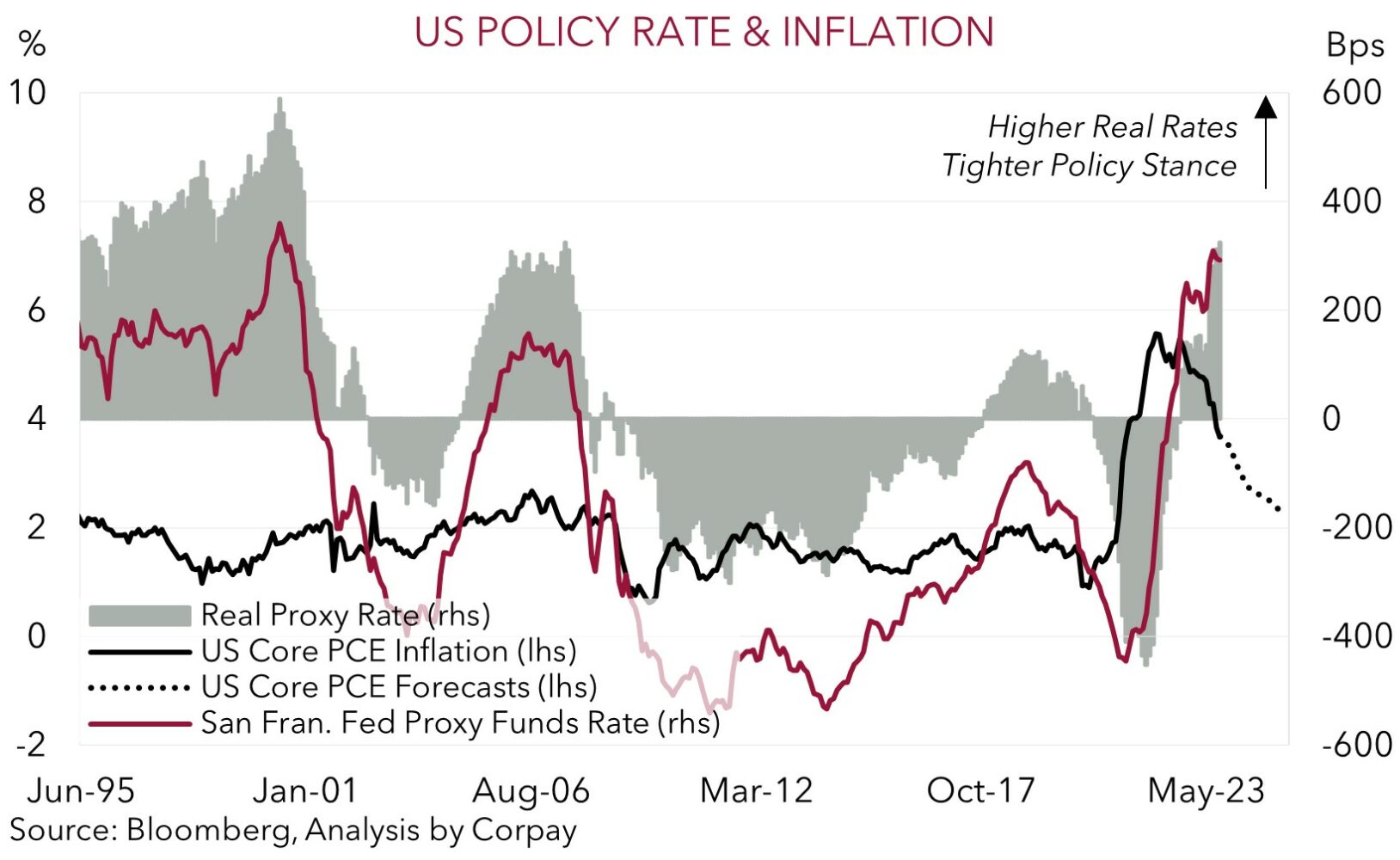

Comments by well-respected Fed Governor Waller were in focus. According to Waller, he is “increasingly confident that policy is currently well positioned to slow the economy and get inflation back to 2%…I am encouraged by what we have learned in the past few weeks – something appears to be giving, and it’s the pace of the economy”. While the door to more tightening remains ajar should inflation reaccelerate, Waller’s underlying tone supports the view that the next Fed move will probably be a rate cut. Indeed, in the Q&A, Waller noted that if inflation continues to slow over the next 3-5 months “there is no reason to insist that rates remain really high”. This is something we flagged (see Market Musings: USD losing its shine). As shown below, unless nominal settings are loosened in locked step with the decline in inflation, the Fed’s policy stance (measured by the gap between real interest rates and ‘neutral’) would mechanically become progressively more ‘restrictive’.

Markets are factoring in little chance of another Fed rate hike with easing discounted from mid-2024. Relative to history and based on how high rates are, we would argue that markets may not be pricing in enough of a reversal by the Fed. Over the past 4 cycles the Fed has, on average, delivered 350bps worth of rate cuts. Markets are only discounting ~175bps worth of Fed easing over the next few years. Looking ahead, we believe a further deceleration in the PCE deflator (the US Fed’s preferred inflation gauge) (released Fri AEDT), and/or another month of the ISM manufacturing survey being in ‘contraction’ (released Sat AEDT) coupled with improvement in the China PMIs (released Thurs) should keep the USD heavy.

AUD corner

The AUD’s upswing has continued with the weaker USD and shift in AU-US yield spreads on the diverging RBA and Fed policy outlooks swamping the softer Australian retail sales figures (see above). At ~$0.6645 the AUD is around its highest since early-August. This is nearly 6% above its late-October lows and broadly inline with its 2023 year-to-date average. But in a reflection of how USD-centric the moves have been, the AUD has been more muted on the crosses. AUD/EUR has ticked up (+0.3% to ~0.6050), as has AUD/CNH (+0.3% to ~4.74), while AUD/JPY has drifted lower (-0.2% to ~97.97). Over the medium-term we see more downside than upside potential in AUD/JPY with the pair still historically high (since 1995 AUD/JPY has only traded above where it is ~4% of the time). Ahead of today’s RBNZ decision (12pm AEDT) AUD/NZD is hovering just above its 100-day moving average (~1.0818).

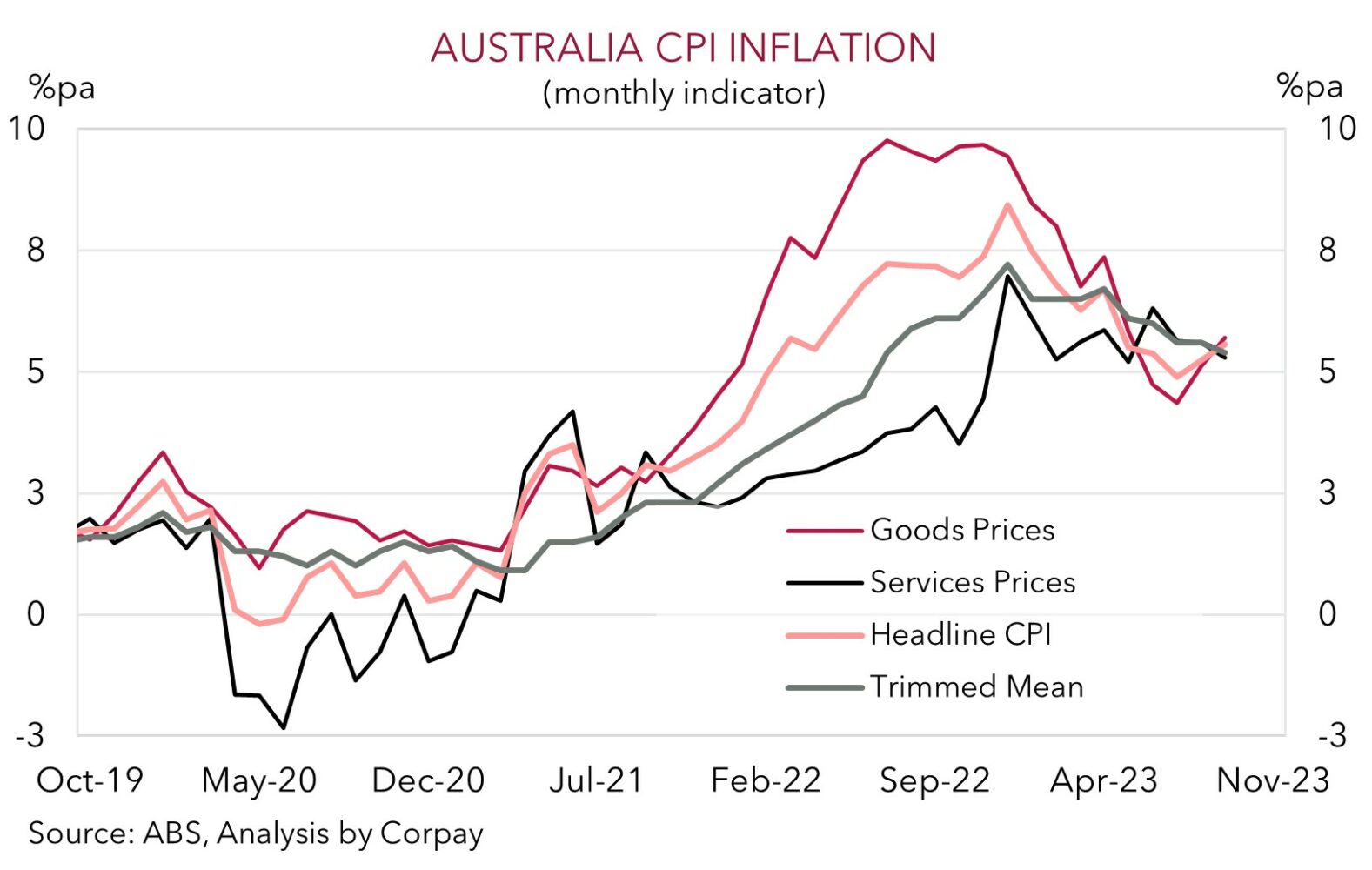

Data wise, after a strong September, and ahead of the November Black Friday sales, Australian consumers hit the pause button in October. Retail sales declined by 0.2% with falls recorded across all non-food related industries. Today, the monthly CPI indicator is released (11:30am AEDT) and it could prove to be more of a test for the AUD. As mentioned previously, given it is the first month of the quarter, the October reading will be skewed towards ‘goods’ (which are on a disinflation trend) rather than ‘services’ prices. Services inflation, which is what the RBA is focusing in on, will be better captured in the November/December CPI reports. Consensus is looking for annual headline CPI to slow from 5.6%pa to 5.2%pa in October. A larger than predicted deceleration could see markets trim some of their RBA rate rise bets which if realised may take a bit of the heat out of the AUD, particularly on the crosses.

That said, we don’t expect pull-backs in the AUD to be overly large given we think the USD should continue to lose ground as markets factor in the next Fed easing cycle, expectations for China’s economy to reaccelerate (the China PMIs are due tomorrow), and our assessment yield spreads should continue to move in favour of a stronger AUD. The AU-US two-year spread has narrowed to -51bps from -120bps in late-August. While it remains an open question whether the RBA raises rates again, we continue to believe domestic fundamentals point to it lagging its peers when the next global rate cutting cycle kicks off. Indeed, in contrast to overnight US Fed comments, when speaking yesterday RBA Governor Bullock sounded relatively more ‘hawkish’. In Bullock’s eyes given stronger than expected demand inflation pressures are remaining elevated, with the bank “starting to observe” second round effects from the rise in various costs particularly around sticky services prices. The evolving backdrop is inline with our long-standing forecasts looking for the AUD to edge up to $0.68 in Q1 and up to ~$0.70 in a years time.

AUD levels to watch (support / resistance): 0.6550, 0.6580 / 0.6670, 0.6700