• Softer tone. Equities lost some ground & bond yields dipped back overnight. Oil still on the backfoot & the USD remains under pressure.

• AUD upswing. AUD’s positive run continued. AUD above ~$0.66 for the first time since early-August. But following its rapid rise it may face some local hurdles.

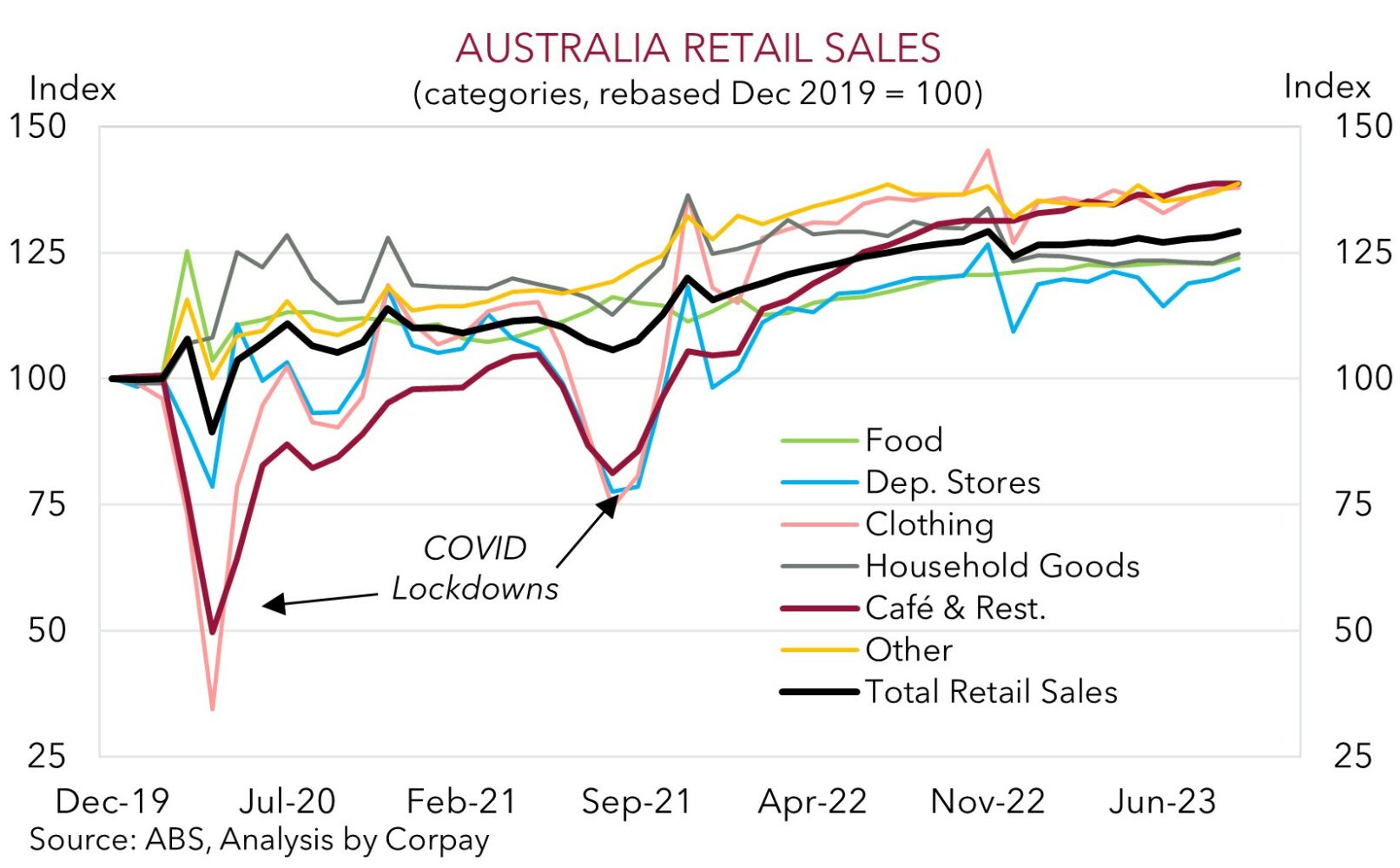

• Local data. AU retail sales due today & monthly CPI released tomorrow. Did cash conscious households hold back their spending for the ‘Black Friday’ sales?

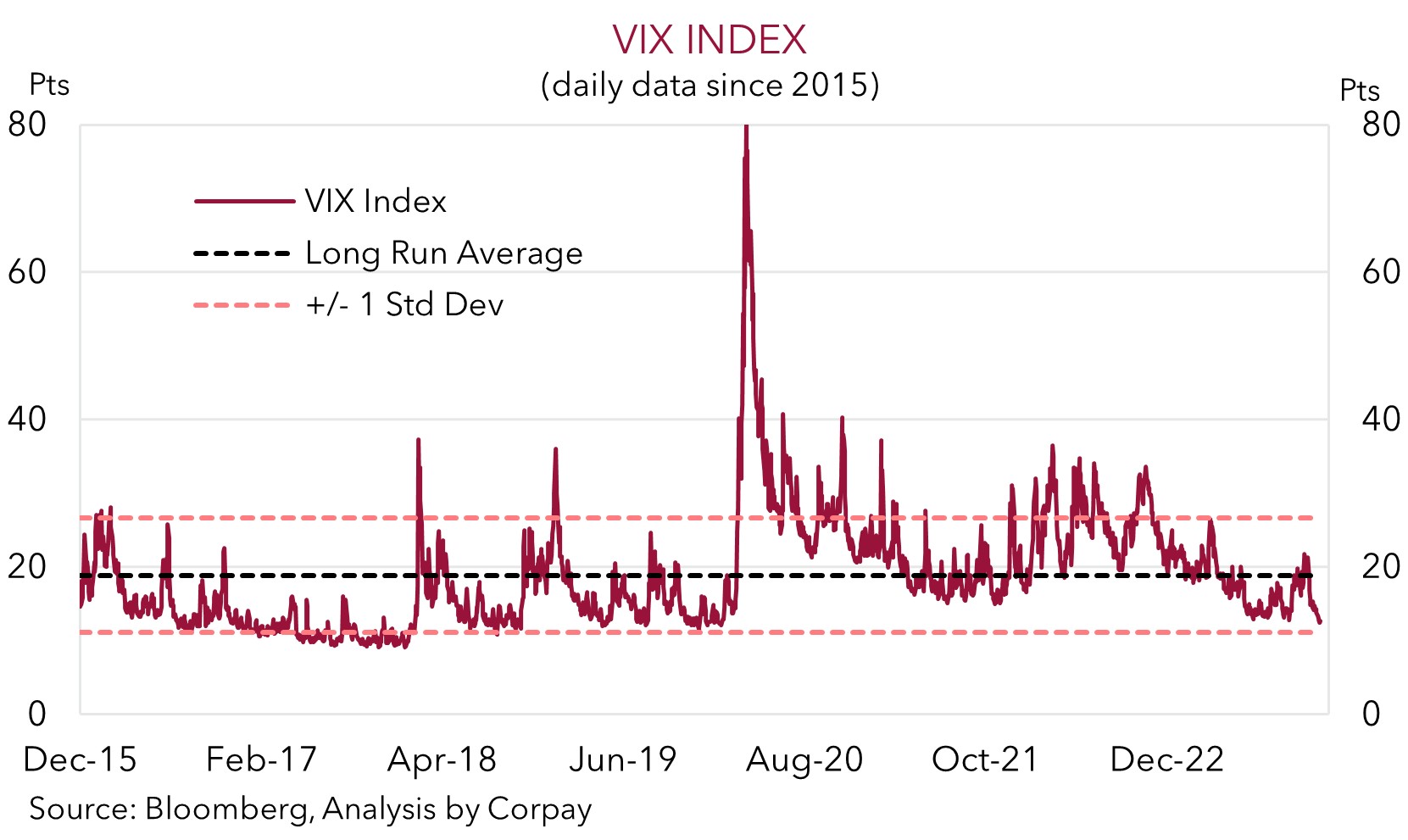

It has been a rather subdued start to the week. As our chart shows, the VIX Index (the volatility measure for the S&P500) is at the bottom of its 2023 range. In terms of the specifics, equities shed a bit of ground with the US S&P500 (-0.2%) holding up better than the major European (EuroStoxx50 -0.4%) and Asian (Hang Seng -0.2%) indices. After rising late last week bond yields reversed course. The 10yr rates in Germany (-10bps), the UK (-7bps), and the US (-8bps) fell, though this only unwound some of the recent lift. At 4.39% the US 10yr yield is back where it was trading last Wednesday. Markets are continuing to factor in only a slight chance of another US Fed rate hike this cycle (~8% by January) and for a series of rate cuts to start from mid-2024. Elsewhere, oil remains on the backfoot with WTI crude down another 0.7% to ~US$75/brl (this is below its 1-year average). Resistance from several members to further production cuts to rebalance demand and supply has seen expectations of any changes at this weeks delayed OPEC+ meeting scaled back.

Across FX, the USD remains under pressure, although moves have been modest. EUR has nudged up towards ~$1.0960 (the upper end of the range occupied since mid-August). GBP is a little firmer (now ~$1.2628), while USD/JPY (now ~148.63) and USD/SGD (now ~1.3370) have slipped back. AUD and NZD have extended their respective rallies. Ahead of tomorrow’s RBNZ meeting where the central bank is expected to keep rates on hold, but stress cuts are a long way off, the NZD has risen above ~$0.61 for the first time in over 3-months. The AUD has poked its head over ~$0.66 for the first time since early-August.

Data wise, US new home sales declined more than anticipated, down 5.6% in October. While existing mortgage holders in the US don’t feel the pinch of Fed policy changes as Australian households do given they are fixed for 30-years, as we have pointed out new borrowers and people that refinance are facing substantially higher and prohibitive rates. Credit is the lifeblood of the US economy, and tighter conditions are working with the interest rate sensitive housing sector losing steam. The Dallas Fed Manufacturing Index also underwhelmed with new orders particularly weak and employment intentions softening.

The run of data is inline with our view that the US activity and Fed policy impulses which propelled the USD higher have passed pivotal inflection points (see Market Musings: USD losing its shine). A further deceleration in the PCE deflator (the US Fed’s preferred inflation gauge) (released Fri AEDT), and/or another month of the ISM manufacturing survey being in ‘contraction’ (released Sat AEDT) should reinforce assumptions the next move by the Fed will be a rate cut, albeit in H2 2024. When coupled any signs of improvement in the China PMIs (released Thurs) we think the USD can remain heavy.

AUD corner

The AUD has continued its march higher. The softer USD on the back of some subpar US data and lower bond yields have helped the AUD edge above ~$0.66 for the first time since early-August. The AUD also ticked up against the EUR (+0.2% to ~0.6030), CAD (+0.3% to ~0.90) and CNH (+0.5% to ~4.73, the upper end of its ~4-month range). By contrast, AUD/JPY eased slightly, however at ~98.17 the pair remains near its cyclical highs. We see more medium-term downside than upside potential from current levels in AUD/JPY. Statistically, since 1995 AUD/JPY has only traded above where it is ~4% of the time. Ahead of tomorrows RBNZ meeting AUD/NZD is tracking near its 100-day moving average (~1.0818).

The AUD’s rebound over recent weeks has been inline with our thoughts that ‘too much bad news’ had been factored in and that it was tracking too low compared to its fundamentals (see Market Musings: AUD: Always darkest before the dawn and Market Wire: RBA: it ain’t over till it’s over). Our longstanding forecasts have been for the AUD to reach ~$0.66 by year end, before pushing on to ~$0.68 in Q1, and ~$0.70 in a years time as the USD weakens, China’s economy reaccelerates, and given our assessment that relative yield spreads should turn in favour of a stronger currency.

However, markets don’t move in straight lines. Following its rapid ascent we believe the AUD could face some near-term domestic data hurdles that may counteract the weaker USD (see above). Today, retail sales for October are released (11:30am AEDT) and RBA Governor Bullock appears on a panel (from 12:15pm AEDT), while tomorrow the monthly CPI indicator is due. As we have flagged over the past few days, some technicalities may see the data underwhelm consensus forecasts. If realised, we think this may see markets trim their RBA rate rise bets, taking some of the heat out of the AUD, particularly on the crosses.

In terms of retail sales, aggregate demand is being propped up by the population surge, but after a bumper September (retail sales rose 0.9%, the largest lift since January) we believe more cash conscious households may have held back their spending in preparation for the November ‘Black Friday’ sales. Additionally, given it is the first month of the quarter, the October CPI reading will be skewed towards ‘goods’ (which are on a disinflation trend) rather than ‘services’ prices. Stickiness across services is the area that drove the positive surprise in the Q3 quarterly CPI, and this is where the RBA is focusing in on. Services inflation will be better captured in the subsequent November/December CPI reports. Something similar occurred last quarter when the July CPI slowed, generating a drop in Australian interest rate expectations and the AUD, only for inflation to re-accelerate over following months.

AUD levels to watch (support / resistance): 0.6480, 0.6520 / 0.6630, 0.6650