• Positive tone. Equities generally added to recent gains, bond yields consolidated, oil & copper rose, & the AUD has edged up to a ~3-month high.

• Weaker USD. The USD has remained on the backfoot. The US leading economic index fell again, pointing to a sharp growth slowdown over the period ahead.

• RBA rhetoric. Today, RBA Gov Bullock appears on a panel & the minutes of the November meeting are released. Gov Bullock delivers a speech tomorrow night.

It has been a relatively quiet start to week across markets. Equities have generally added to recent gains with the US outperforming. The US S&P500 rose ~0.7%, with the nearly ~11% rally over the past 3 weeks taking the index to its highest level since August. On the back of the still very loose policy settings, solid nominal GDP growth, and weak JPY the Japanese Nikkei touched a 33-year intra-day high yesterday. Bond yields consolidated with the benchmark US 10yr rate holding near ~4.42% (a ~2-month low). Investors breathed a sigh of relief following the strong demand at a sizeable US Treasury auction. Concerns markets wouldn’t be able to fully absorb the huge amount of US bond issuance coming through on the back of years of large budget deficits was a factor that fueled the jump up in bond yields and market volatility over Q3.

Across commodities oil and copper prices continued to rally. WTI crude increased another ~2.2% to be back near US$78/brl, while copper (+1.9%) recorded its 5th gain in the past 6 sessions. For oil this weekend’s OPEC+ meeting is in focus. The rebound in prices has been fueled by expectations production cuts, to recalibrate demand and supply, may be extended. Failure to meet these expectations could see oil reverse course early next week.

In FX, the USD has remained on the backfoot. EUR has edged up to ~$1.0945 (its highest since mid-August). ECB Governing Council member Wunsch stated that rates could be hiked again if the shift in market pricing looking for policy easing next year begins to undermine the central banks ‘restrictive’ stance. GBP also edged higher (now ~$1.2511). Bank of England Governor Bailey made similar comments noting that it is ‘far too early’ to think about rate cuts and that inflation risks may require further action. USD/JPY has slipped below ~148.40 and is now ~2.3% under its recent peak. USD/SGD also lost more ground (now ~1.3376, its lowest since August), while the AUD’s revival has continued. At ~$0.6563 the AUD is at a ~3-month high.

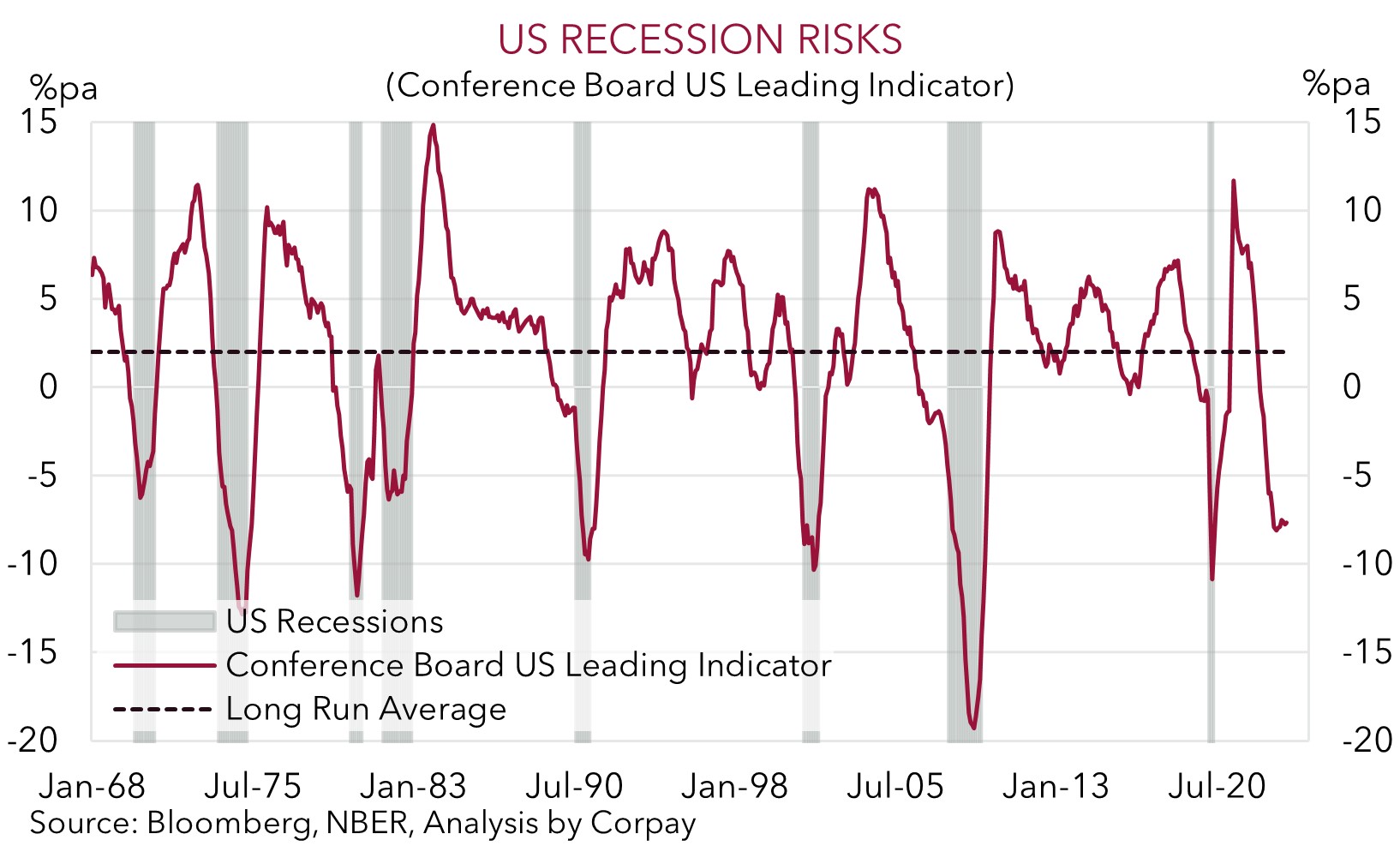

Data wise, the US Conference Board Leading Economic Index remained in a downtrend, falling again in October. The LEI is a composite gauge with a long history that provides a guide to significant turning points in the business cycle. As our chart shows, the LEI’s pulse rate is pointing to a sharp slowdown in US economic activity and increasing recession risks over the period ahead. The minutes of the last US Fed meeting are released tomorrow (6am AEDT), ahead of the US Thanksgiving holiday period later this week. While the minutes may generate some USD volatility if the Fed pushes back on the loosening in financial conditions that has flowed through recently, overall, we continue to think that as the US’ relative economic strength continues to fade, as per the signal from the LEI, the USD should gradually deflate over the next few quarters.

AUD corner

The AUD has continued to tick higher. On the back of the positive risk sentiment and USD weakness the AUD has risen to ~$0.6563, its highest level in around 3-months (see above). Given the tight correlation between the pairs the revival in CNH has also been supportive. On the back of not only the reversal in the USD but also the more positive outlook for China’s economy given the policy support being injected USD/CNH has fallen to a multi-month low (now ~7.1640). On the crosses, AUD/JPY remains historically high (now ~97.37). As flagged previously, since 1995 AUD/JPY has only traded above current levels ~5% of the time. Elsewhere, AUD/EUR has ticked up over the past 24hrs (+0.5% to ~0.60), as has AUD/GBP (+0.3% to ~0.5246), while AUD/NZD is treading water just above its ~6-month average (now ~1.0872).

As discussed yesterday, the holiday-shortened week in the US and limited global economic calendar is likely to mean that market volatility is somewhat subdued, particularly over Thursday and Friday. A lower vol. backdrop is normally helpful for the AUD. Locally, RBA communications are on the agenda over the next few sessions. Today, RBA Governor Bullock will be appearing on a panel at an ASIC forum (10am AEDT) and the minutes of the November meeting (11:30am AEDT) are released. Tomorrow, Governor Bullock is delivering a speech on “A Monetary Policy Fit for the Future” (Weds 7:35pm AEDT).

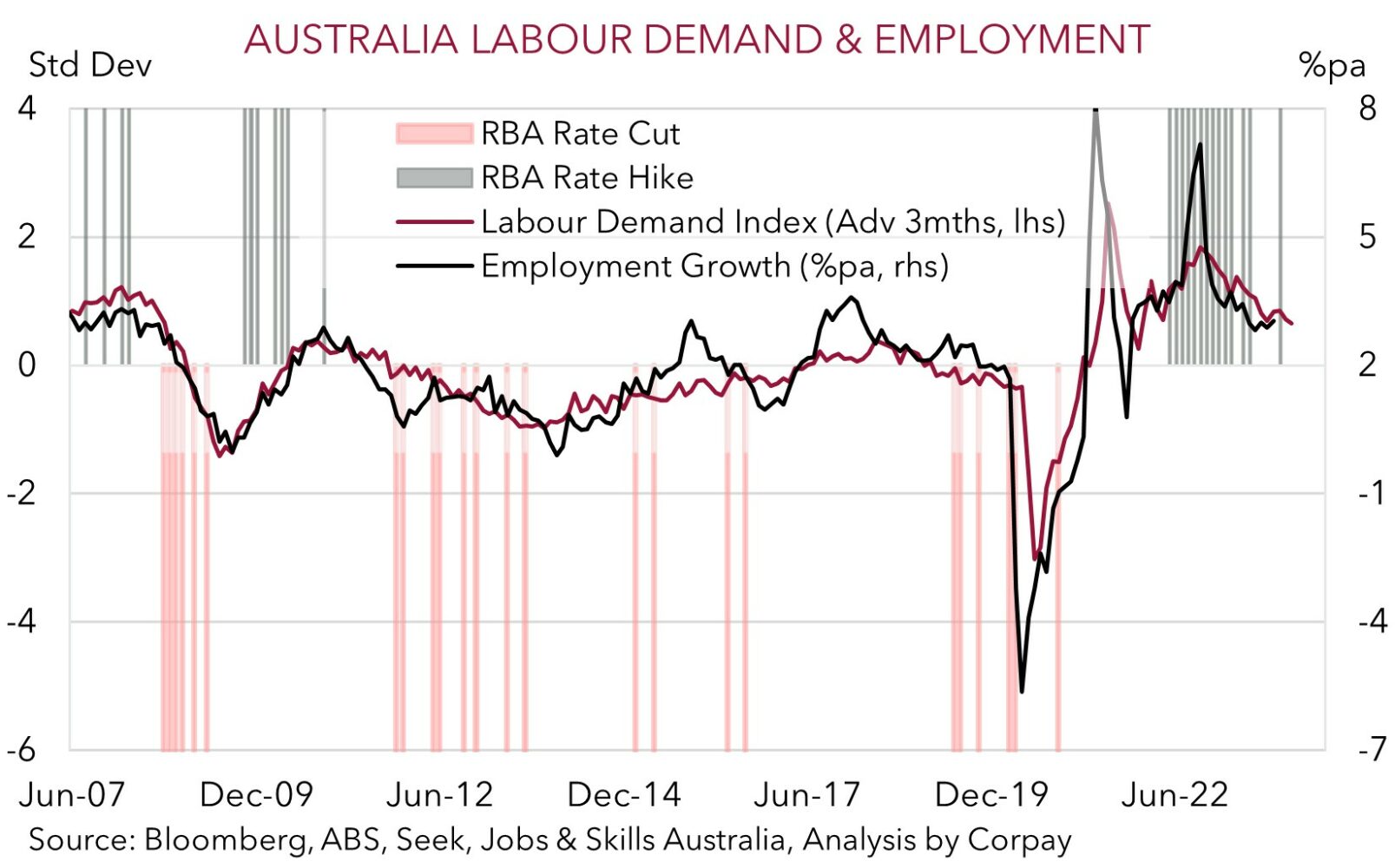

In our view, based on the resilience in the Australian labour market, firmer wages, stickiness across services inflation, and support to aggregate demand from the population surge, the risks reside with the RBA having to tighten policy a bit further with rate cuts looking a long way off. As our chart shows, while forward-looking indicators like job ads, vacancies and hiring intentions have declined from their respective peaks, our composite labour demand index is still at levels consistent with 20-25,000 jobs growth per month. This type of run-rate may mean robust wages and in turn inflation persist for longer than the RBA predicts. Given these pressures we think RBA Governor Bullock is likely to reiterate that if the data warrants it, the door to further tightening remains open.

At the very least, we believe the domestic backdrop could mean the RBA lags its peers when the next global policy easing cycle kicks off. The diverging policy expectations for the RBA and US Fed has seen the Australia-US two-year yield spread narrow. At -71bps, the yield differential is where it was in late-June and back then the AUD was closer to ~$0.67. The narrower yield spread, coupled with an improvement in China’s economic fortunes as stimulus measures gain traction, and a further softening in the USD underpin our forecasts looking for the AUD to nudge up to ~$0.66 over coming weeks, before grinding up to ~$0.68 in Q1, and rising to ~$0.70 by late 2024.

AUD levels to watch (support / resistance): 0.6480, 0.6520 / 0.6590, 0.6610