• Positive tone. Risk sentiment improved on Friday. Equities were firmer, oil & copper rose, & the USD lost ground. The AUD rebounded.

• Holiday markets. It looks set to be a quieter week due to US Thanksgiving (Thurs), reduced US trade on Friday, & with few global events scheduled.

• RBA speak. November meeting minutes are released (Tues), while Governor Bullock is appearing on a panel (Tues), & delivering a speech (Weds).

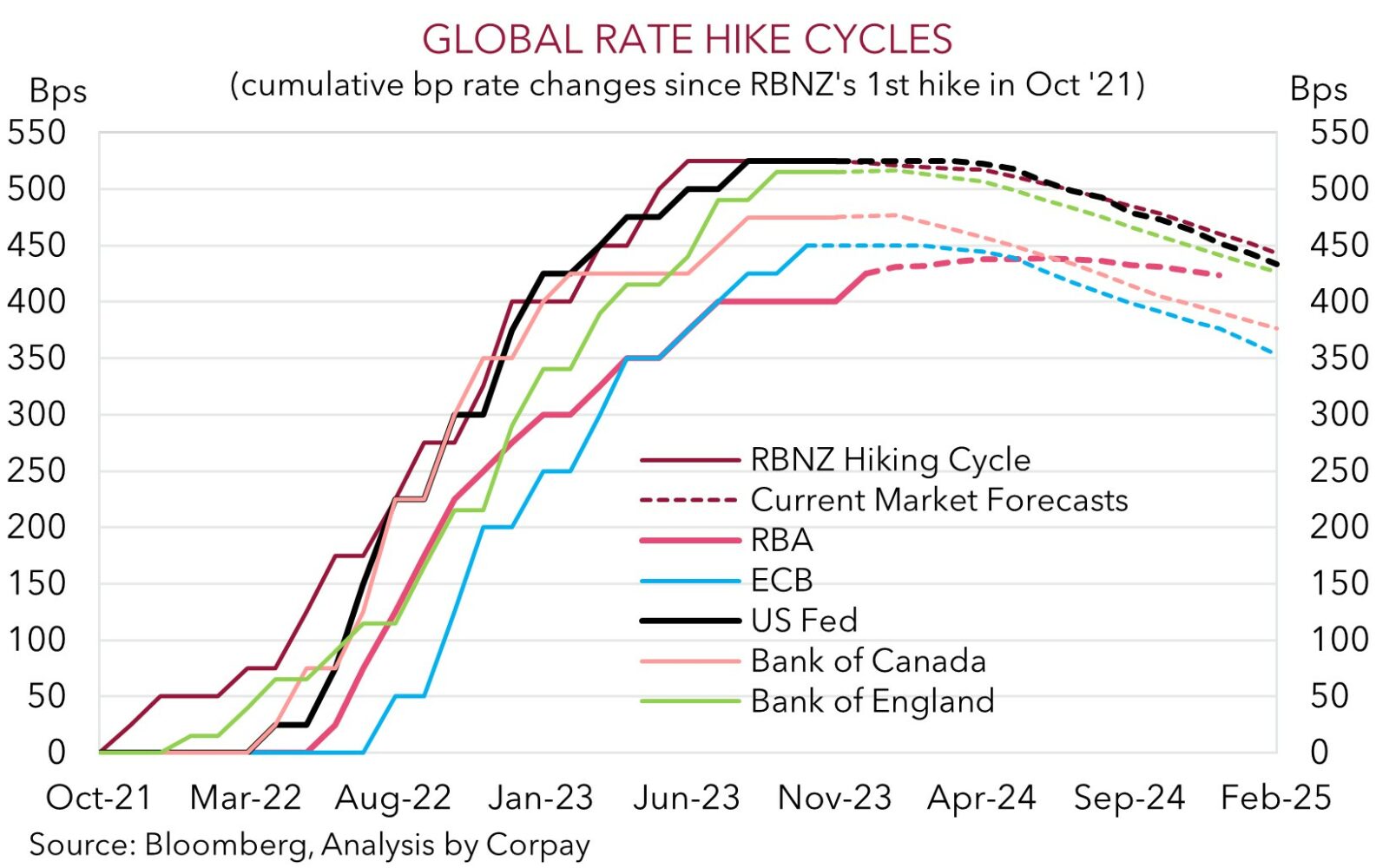

Twists and turns continued on Friday with markets ending the week on a more positive note following Thursday’s negative tone. European equities rose (EuroStoxx50 +0.9%) and the US S&P500 ticked up (+0.1%) with the index hovering at the top-end of its 6-month range. US bond yields consolidated with the 10yr rate flat (now 4.43%, near ~2-month lows) and the US 2yr rate nudging up slightly (+4bps to 4.88%). Some better than expected US housing starts and building permits data helped support sentiment and shorter-dated US bond yields as it counteracted fears of a sharper US economic slowdown. That said, markets continue to price in no further rate hikes by the US Fed this cycle, with more than 3 rate cuts factored in over H2 2024.

Across commodities oil lifted by ~4% with WTI crude rebounding towards ~US$76/brl. Reports Saudi Arabia may extend its production cuts into next year alongside potential supply reductions by other OPEC+ members to offset weaker demand drove the price revival. Copper also increased by ~1%. The move means copper is now over 6% above its recent lows and back in line with its ~6-month average.

In FX, this mix exerted renewed downward pressure on the USD. EUR has poked its head back over ~$1.09 for the first time in a few months, while USD/JPY has slipped below ~150. The USD weakness helped GBP brush off another disappointing UK retail sales report (now $1.2455). The cost of living squeeze, jump up in UK mortgage rates, and deteriorating labour market conditions is constraining consumer spending. UK retail sales volumes have fallen in 3 of the past 4 months. The broader backdrop helped the AUD recover. At ~$0.6513 the AUD is ~2.4% higher than this time a week ago, and around the upper end of the range occupied since mid-August.

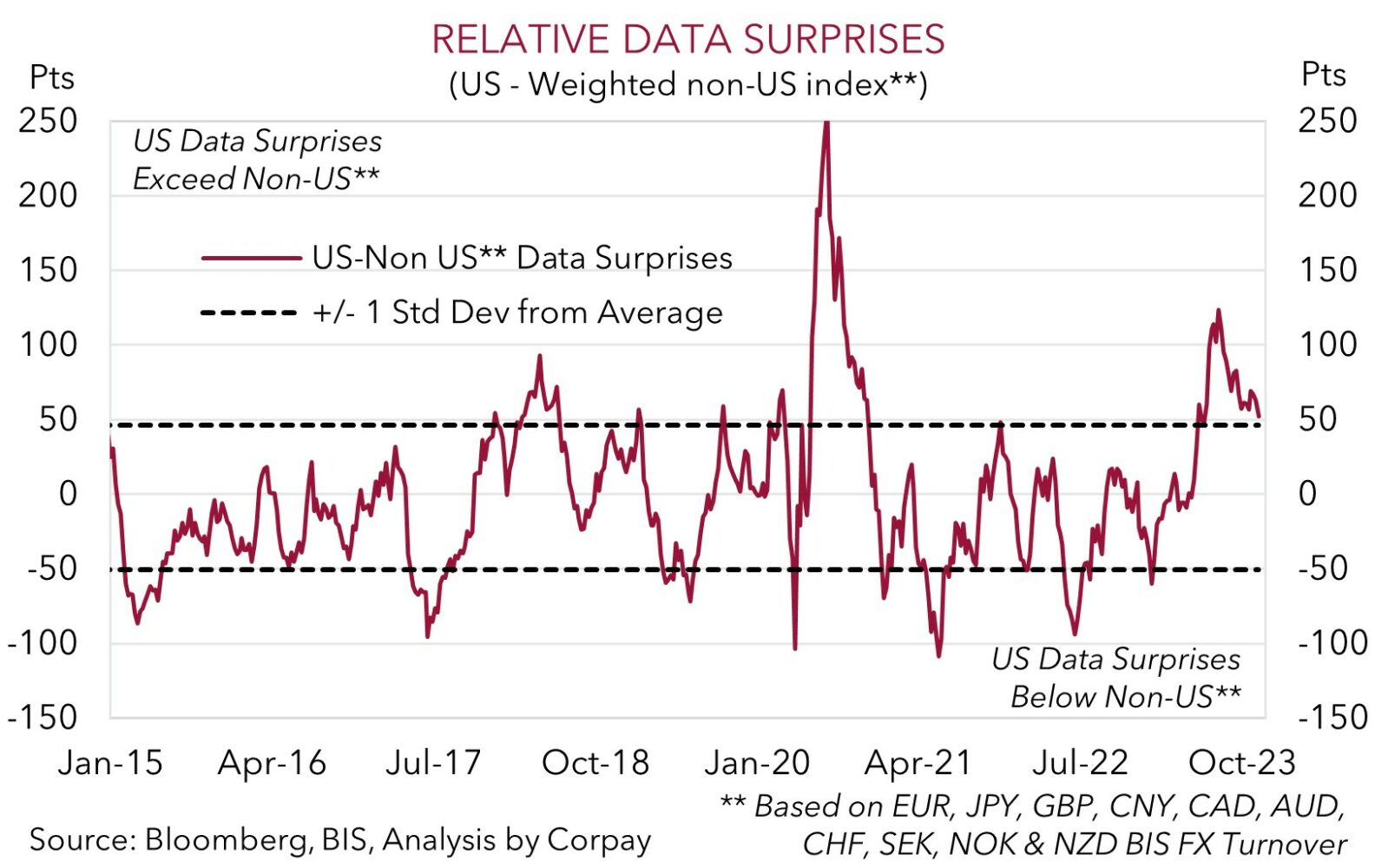

Globally, it looks set to be a quieter week due to the Thanksgiving holiday on Thursday in the US and Japan, reduced trade in the US on Friday given early closes for various markets, and with few top tier economic events scheduled. The minutes of the last US Fed meeting (released Weds AEDT) are likely to be somewhat stale because of the number of policymakers that have spoken recently, so we think market impact may be limited. However, we believe the softening in the USD can continue if the incoming US durable goods orders (Fri AEDT), jobless claims (Fri AEDT) and/or business PMIs (Sat AEDT) underwhelm, and the Eurozone PMIs (Thurs AEDT) and German IFO (Fri AEDT) stabilise. The US’ relative economic strength underpinned the USD’s resurgence over the past few months. In our opinion, further indications US growth is coming back to the pack and the pricing in of the next Fed easing cycle should see the USD continue to gradually deflate over the period ahead.

AUD corner

The AUD recovered lost ground on Friday, with Thursday’s dip unwinding. More upbeat risk sentiment (as illustrated by the lift in European/US equities), coupled with the firmer oil and copper prices helped the AUD edge back up towards the top of its multi-month range (now ~$0.6513) (see above). The backdrop also helped the AUD modestly outperform on the crosses. The AUD has appreciated by ~0.4-0.5% against GBP, NZD, CAD, and CNH relative to where it was this time on Friday. AUD/JPY has ticked up by 0.1%, and at ~97.48 it remains historically high. As pointed out before since 1995 AUD/JPY has only traded above current levels ~5% of the time.

As mentioned above, the holiday-shortened economic calendar in the US could mean that market volatility is more subdued, particularly later in the week. Locally, attention will be on RBA communications. In addition to the November Board Minutes (Tues 11:30am AEDT), RBA Governor Bullock will be appearing on a panel at an ASIC forum on the State of the Economy (Tues 10am AEDT), and she will also be also delivering a speech on “the economic outlook and monetary policy” (Weds 7:35pm AEDT). In our opinion, given the ongoing resilience in the Australian labour market, firmer wages pulse, stickiness across services inflation, and support to aggregate demand from the population surge, Governor Bullock is likely to reiterate that if the data continues to warrant it, the door to further policy tightening remains open, and/or that any thoughts of rate cuts are a long way off.

As our chart shows, policy expectations between the RBA and other major central banks are diverging once again. Rate cutting cycles are being factored in outside of Australia, while at the same markets think the RBA may still have a bit more work to do. At the very least, we remain of the view that the RBA could lag its peers when the next global policy easing cycle kicks off. This should see bond yield differentials, which have been a drag on the AUD over the past few years, become more supportive over the period ahead. We believe, this, combined with an improvement in China’s economic fortunes as stimulus measures gain traction, and a further softening in the USD should help the AUD continue to edge up gradually. Our longstanding forecasts have been for the AUD to end the year near $0.66, before grinding up to ~$0.68 in Q1, and on to ~$0.70 by late 2024.

AUD levels to watch (support / resistance): 0.6400, 0.6450 / 0.6540, 0.6580

SGD corner

USD/SGD has fallen over the past week with the pair tracking around its lowest level in ~3-months (now ~1.3442). The downward repricing in US interest rate expectations following the run of softer US economic data and step down in US inflation has weighed on the USD. On the crosses, EUR/SGD (now ~1.4661) has risen, with the EUR a major outlet for the USD weakness. SGD/JPY has also lost some ground, though at ~111.35 it remains historically high.

As flagged above, the global economic calendar is quiet this week with market volatility also likely to be more subdued later on given the US Thanksgiving holiday period (Thursday and Friday). That said, there are a few data points such as US durable goods orders, US jobless claims, and the Eurozone PMIs which we think are worth calling out. In our judgement further signs US growth is slowing, and/or activity outside of the US is stalising should see the USD (and USD/SGD) remain on the backfoot. The US’ relative economic strength was a reason behind the USD upswing over Q3 and we believe that this theme has now largely run its course.

SGD levels to watch (support / resistance): 1.3380, 1.3420 / 1.3470, 1.3520