• Shaky sentiment. Growth concerns dampened risk sentiment. Bond yields slipped back, oil fell, & the AUD lost some ground after a strong few days.

• Job trends. Signs the US labour market is cracking are increasing. In Australia employment positively surprised. Unemployment ticked up, but it is still low.

• RBA rhetoric. Next week in addition to the meeting minutes (Tues), Governor Bullock is appearing on a panel (Tues) & giving a speech on the outlook (Weds).

A slightly more negative tone across markets overnight with the run of soft US economic data supporting views growth momentum is slowing, and that the Fed’s tightening phase has run its course. Reports US President Biden labelled China’s President Xi a “dictator” at their summit also didn’t help matters, though there does look to have been some constructive progress made on things like AI regulation and high-level military contact.

After the recent rebound equities paused for breath. The S&P500 was flat, while the major European indices dipped ~0.5-1%. Volatility in bonds continued with yields lower. The US 10yr rate fell ~7bps, largely unwinding yesterday’s lift, to be back down near 4.45% (a multi-week low). The US 2yr yield shed 6bps (now 4.85%, the bottom of its recent range). Oil prices slumped with WTI crude falling ~4.7%. At ~US$73/brl WTI is at its lowest since early-July and ~23% below its recent peak. Data showing US stockpiles are rising looks to have unnerved investors given it is coming at a time demand is weakening. Notably, despite the pockets of volatility elsewhere, FX markets were pretty contained. The USD index was range bound with EUR hovering around ~$1.0850 (the top end of the range occupied since September), while USD/JPY slipped back slightly to ~150.70. USD/SGD is tracking just above its 200-day moving average (~1.3471), and the AUD has drifted lower on the back of the souring in risk appetite (now ~$0.6464).

In terms of the US data, initial jobless claims (one of the best real time reads on the US labour market) rose to a 12-week high, and continuing claims (a gauge of recurring applications for unemployment benefits) hit their highest level in nearly 2-years. The data is consistent with softening conditions and rising US unemployment, with layoffs picking up and it is becoming more challenging to be re-employed. US industrial production fell by a larger than anticipated 0.6% in October, with the autoworkers strike driving a 10% drop in vehicle production. The NAHB homebuilder sentiment index underwhelmed, touching its lowest point this year as poor affordability and tighter credit conditions dampen confidence across construction.

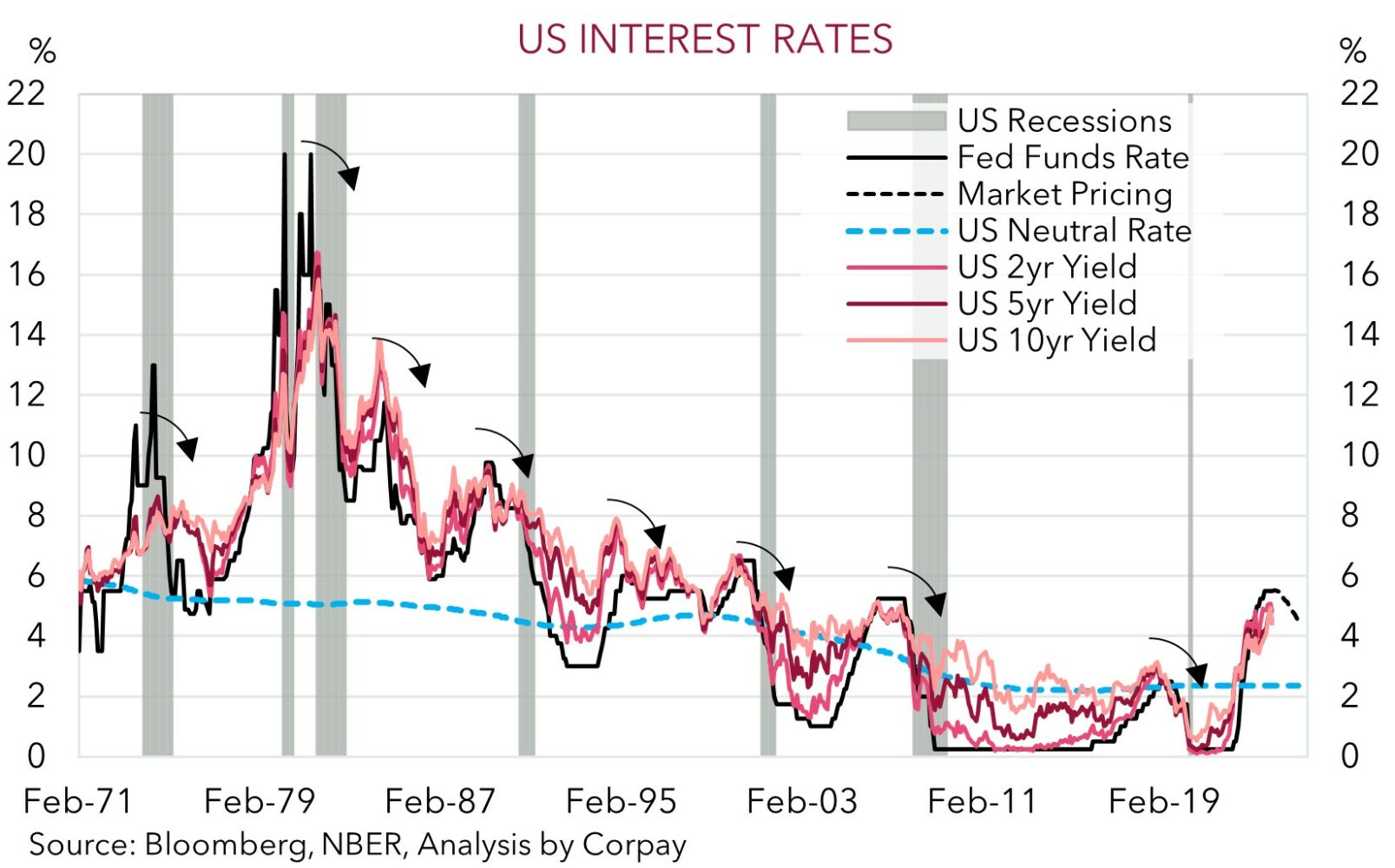

As the charts shows, markets are now expecting the next move by the US Fed to be a rate cut, with a series of moves anticipated over H2 2024. While the amount of easing factored in appears aggressive, the direction of travel looks right, in our opinion. The US’ inflation pulse has turned, and the negative consequences of past policy tightening is starting to manifest. History shows that bond markets shift ahead of time as the next policy trend is discounted. Things won’t move in a straight line. Twists and turns in risk sentiment will generate volatility. But fundamentally, as the next Fed easing cycle comes into view, US yields move lower, and US growth comes back to the pack, we are looking for the USD to gradually deflate over the next few quarters.

AUD corner

After a strong few sessions, the AUD has lost some ground as weaker risk sentiment weighed on growth-linked assets (see above). After rising by more than 3% over a few days it isn’t unusual for the AUD to drift back. And although it has slipped from this week’s peak, at ~$0.6464 the AUD is still near the upper end of its ~3-month range. The AUD also softened on the crosses, falling by ~0.7% against the EUR and GBP, ~0.8% versus the CNH, and ~1.1% vis-à-vis the JPY compared to 24hrs ago. Despite what looks like a sharp fall AUD/JPY is still historically high (now ~97.41). Since 1995 AUD/JPY has only been above current levels ~5% of the time.

Locally, the monthly labour force lottery was released yesterday. On net the data was again better than expected. Employment was positive (+55,000) in October, with full-time rebounding (+17,000) and part-time rising strongly (+37,900), though jobs related to ‘The Voice’ referendum could have played a role here. Unemployment ticked up a touch to 3.7%, but that reflected increased labour supply rather than job losses. The labour force participation rate hit a series high 67%.

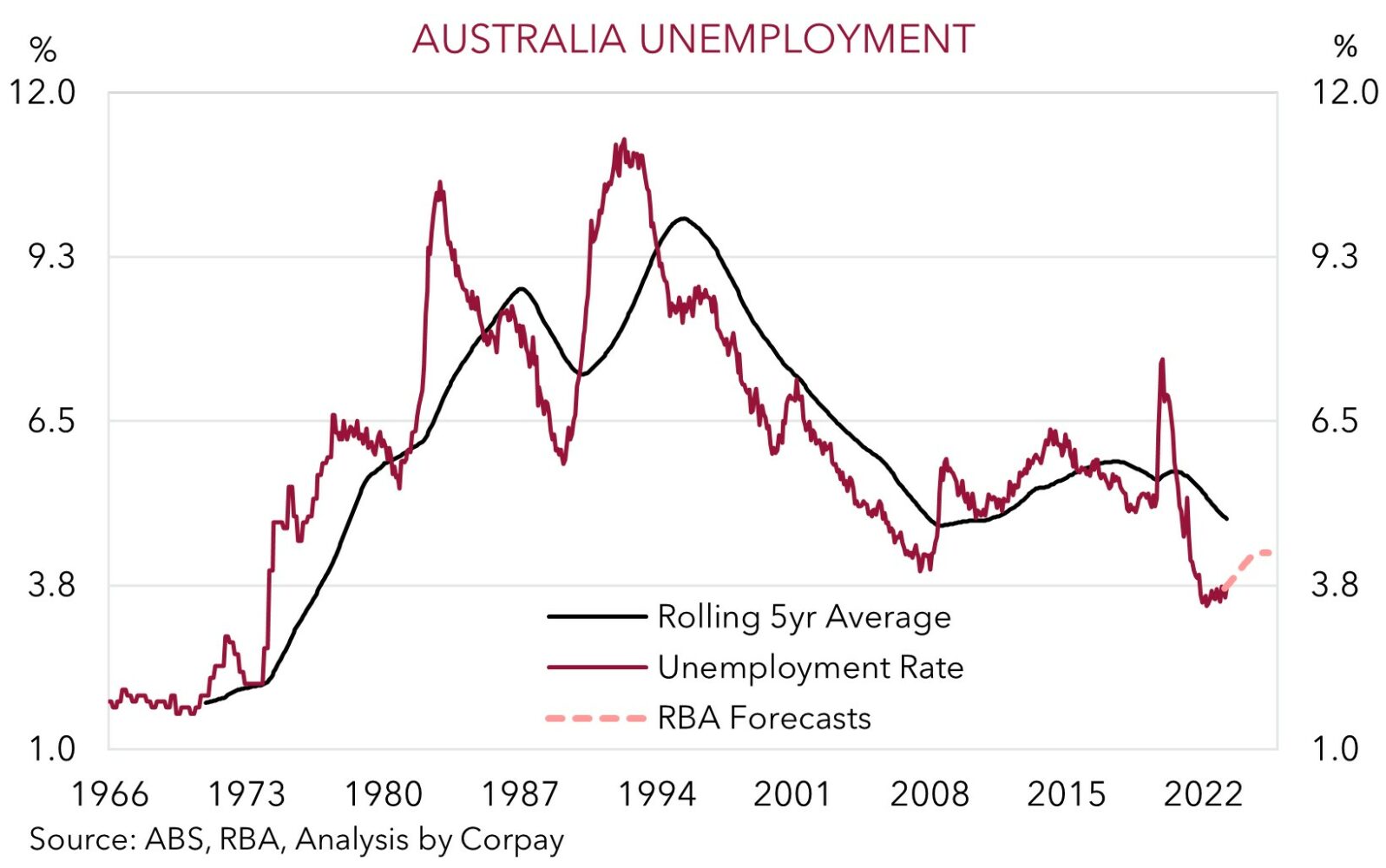

Under the surface there are signs the ‘excessive’ heat is coming out of the jobs market. Growth in hours work is slowing, there are more part-time rather than full-time jobs being added, and the cyclical youth unemployment rate has started to rise. That said, in the main, the labour market remains quite resilient, particularly considering the amount of tightening delivered by the RBA. As our chart shows, unemployment is still historically low with the RBA only forecasting a relatively modest lift over the next few years. In our mind, until the labour market cracks, the tightness should continue to feed through to wages and inflation, which in turn should keep the pressure on the RBA to do a bit more. There is a large amount of RBA communication next week which may shift market pricing. In addition to the November Board Minutes (Tues), RBA Governor Bullock will be appearing on a panel at an ASIC forum on the State of the Economy (Tues), and she will also be also delivering a speech titled “the economic outlook and monetary policy” (Weds night).

While the RBA may be reluctant to hike again, we believe the domestic backdrop is likely to mean it could lag its peers when it comes to the next policy easing cycle. Divergence between the RBA and others points to bond yield differentials becoming incrementally more favourable for the AUD over the next few quarters, in our opinion. This, the pickup in China as stimulus measures gain traction, and expectations for a further softening in the USD underpin our longstanding forecasts for the AUD to edge up to $0.66 by year-end, onto ~$0.68 in Q1, and up to ~$0.70 by late 2024.

AUD levels to watch (support / resistance): 0.6390, 0.6450 / 0.6520, 0.6580