• Consolidation. Positive momentum in equites stalled & bond yields slipped back. USD ticked up a bit, but the AUD remains near the top end of its 3-month range.

• US macro. US home sales fell again as tighter conditions bite. FOMC meeting minutes reiterated that they are now in a position to “proceed carefully”

• RBA speak. Comments yesterday by Gov. Bullock & the November meeting minutes struck a slightly more ‘hawkish’ tone. Gov. Bullock gives a speech tonight.

It has been a rather uneventful night with market moves modest. Positive momentum in US and European equities stalled (S&P500 -0.2%) and bond yields slipped back. The US 2yr yield declined ~3bps to 4.88%, while the benchmark 10yr rate consolidated near the bottom of its ~2-month range (now 4.41%). Oil prices held up with WTI crude hovering at US$77.80/brl ahead of this weekends OPEC+ meeting where an extension of the production cuts to help rebalance global demand and supply is anticipated. Across FX, the USD edged up a bit, though the index remains ~3.5% below its early-October peak. EUR eased towards ~$1.0920, while USD/JPY ticked up after trading at its lowest level since early-September in yesterday’s session. GBP is hovering above its 100-day moving average (~$1.2505) with BoE Governor Bailey again pushing back on market pricing factoring in rate cuts next year. USD/SGD is tracking sub ~1.34. AUD has drifted a touch lower but at ~$0.6558 it is still around a multi-month high.

US existing home sales fell by a larger than forecast 4.1% in October. This puts sales of existing homes at their lowest since 2010. Higher new mortgage rates and tighter credit conditions, combined with low inventory levels are depressing housing activity, and over time this should further slow US consumer spending and push up unemployment. The minutes of the last US Fed meeting were also released, and they didn’t really break any new ground. Given where interest rates have been lifted to “all” members of the FOMC agreed they were “in a position to proceed carefully” and they will be monitoring the incoming data to determine the next step. Risks of another rate hike remain if inflation re-accelerates but given how things are evolving we believe the Fed has reached its peak.

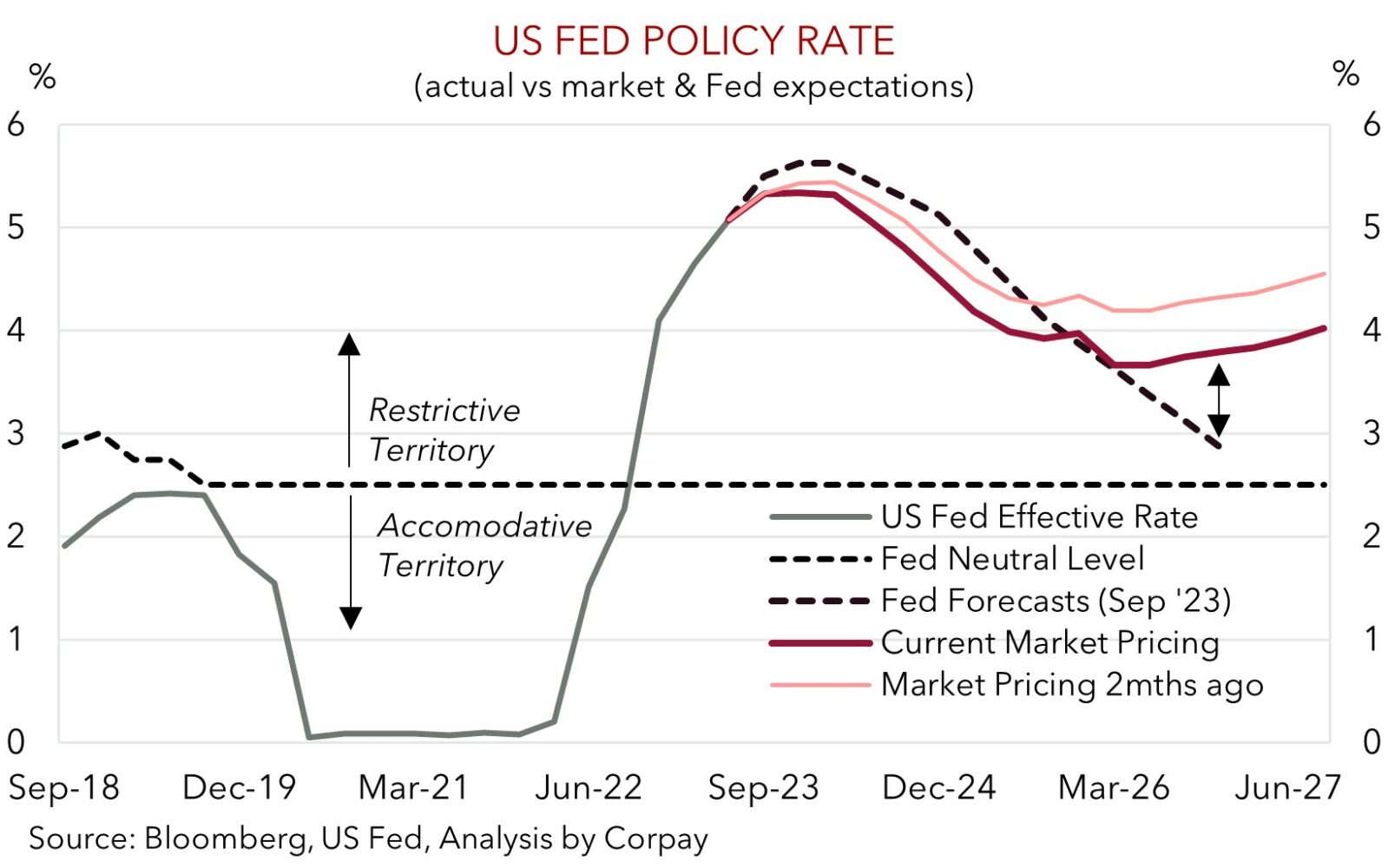

Fed officials also continue to stress that policy will need to be kept ‘restrictive’ for “some time until inflation is clearly moving down sustainably”. This doesn’t mean interest rates need to stay as high as they now are. Central bankers look at the level of interest rates compared to the equilibrium ‘neutral’ rate to determine if policy is ‘loose’ or ‘restrictive’. As our chart shows, both the market and the FOMC are assuming US interest rates will be lowered next year, however settings will continue to be ‘restrictive’. And although the market looks to be factoring in slightly more of a reversal in 2024, we would also flag that markets are also assuming US rates bottom out above where the US Fed projects they could reach. As such we think there is scope for longer-dated market pricing to move even lower over time as US economic growth slows, the labour market cracks, and/or inflation pressures recede. A further pull-back in US bond yields as the next Fed easing cycle comes into view is a factor underpinning our thoughts that the USD should gradually deflate over the next few quarters.

AUD corner

The AUD has consolidated over the past 24hrs, trading in a ~0.7% range centered on $0.6565. This is near the top end of the range occupied since early-August. The slight softening in risk sentiment, with the upswing in equities stalling overnight, and modest lift in the USD has counteracted domestic and regional supportive factors.

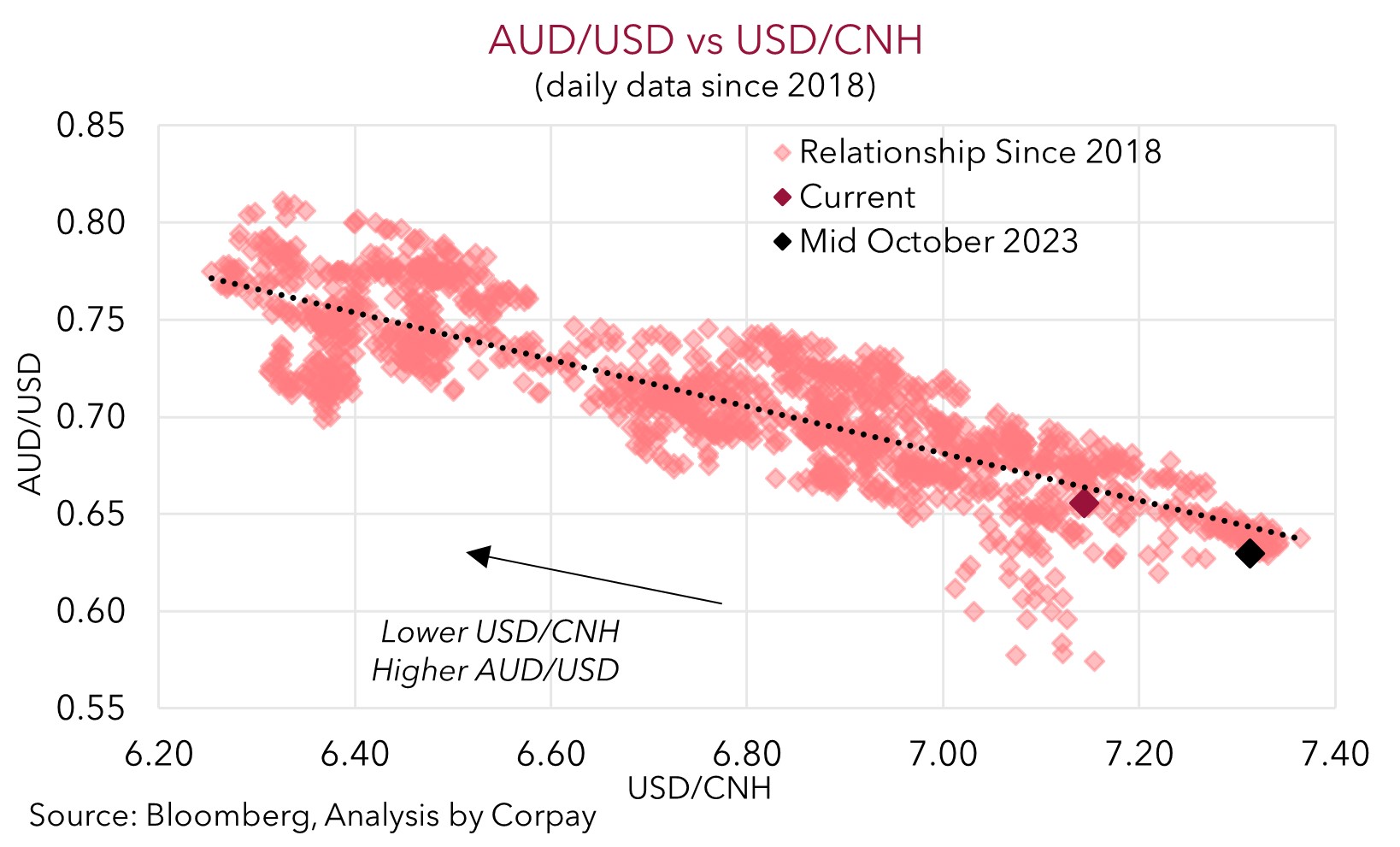

Regionally, USD/CNH has touched its lowest level in ~4-months. On top of the reversal in the USD, improving momentum in China’s economy as policy support measures gain traction, and thoughts further steps could be taken to reinforce the unfolding upswing have reinvigorated the CNH. Reports that Chinese regulators were drafting a list of 50 private and state-owned developers eligible for a range of financing has also aided CNH as it is easing concerns about conditions in the property sector. Trends in CNH are important for the AUD. As our chart shows, the correlation between the pairs remains intact with the rebound in the CNH a positive impulse for the AUD.

Domestically, comments yesterday by RBA Governor Bullock and the minutes of the early-November meeting struck a slightly more ‘hawkish’ tone. Australia’s lackluster productivity is running the risk faster wages growth makes inflation more persistent than expected. The RBA Board also looks to be becoming more concerned about the prospect of higher inflation expectations becoming embedded in business behaviour. Tonight, Governor Bullock is delivering a speech on “A Monetary Policy Fit for the Future” (7:35pm AEDT). We expect some of these themes to be repeated, and for the Governor to continue to stress that if the data warrants it, the door to further policy tightening remains open and/or rate cuts look to be a long way off. Markets are pricing in a ~40% chance of another RBA rate hike by next March. This contrasts the outlook for other central banks where the next move is generally expected to be a cut.

While the RBA may not raise rates again, we continue to think that the domestic growth, labour market, and inflation backdrop could mean it lags its peers when the next global policy easing cycle kicks off. The diverging policy expectations and narrower bond yield differentials should be AUD supportive over the medium-term, in our opinion. This shift, coupled with an improvement in China’s economy, and a further softening in the USD are pillars behind our longstanding forecasts looking for the AUD to tick up to ~$0.66 by year-end, on to ~$0.68 in Q1, and up to ~$0.70 by late 2024.

AUD levels to watch (support / resistance): 0.6480, 0.6520 / 0.6590, 0.6610