• Mixed markets. US equities rose & bond yields edged up slightly. Oil eased back. USD a bit firmer. RBA rhetoric an offset for the AUD.

• Volatile data. Weekly US jobless claims data a little better than expected. But some seasonal factors suggest it may not last. Eurozone PMIs due tonight.

• RBA speak. Gov. Bullock delivered another speech & comments around inflation sounded hawkish. Diverging policy expectations are AUD supportive.

Market volatility picked up slightly overnight as participants reacted to some partial US economic data and looked to lighten positions ahead of the Thanksgiving holiday period. The US and Japan will be offline over the next 24hrs and there is likely to be reduced activity on Friday night in the US given early closes for various markets.

Looking across markets US equities rose (S&P500 +0.5%), as did bond yields, albeit the moves only unwound a portion of the recent falls. US yields ended the day 2-3bps higher across the curve with the benchmark 10yr rate nudging up to 4.41%. UK yields lifted by more (+5bps across the curve) after some concerns crept in that the announced personal and business tax cuts in the latest Autumn Statement could fuel further inflation. Oil gave back ground (WTI crude -1.1%) after the upcoming OPEC+ meeting was delayed due to push back by African members on the proposed output cuts being pressed on them.

Across FX, the US yield bounce gave the USD a bit of support with EUR slipping back below ~$1.09 and GBP dipping under ~$1.25. The interest rate sensitive USD/JPY tracked the modest rebound in US yields (now ~149.59), and USD/SGD ticked up a touch (now ~1.3421). AUD (now ~$0.6540) held up better with a ‘hawkish’ speech by RBA Governor Bullock an offsetting factor (see below).

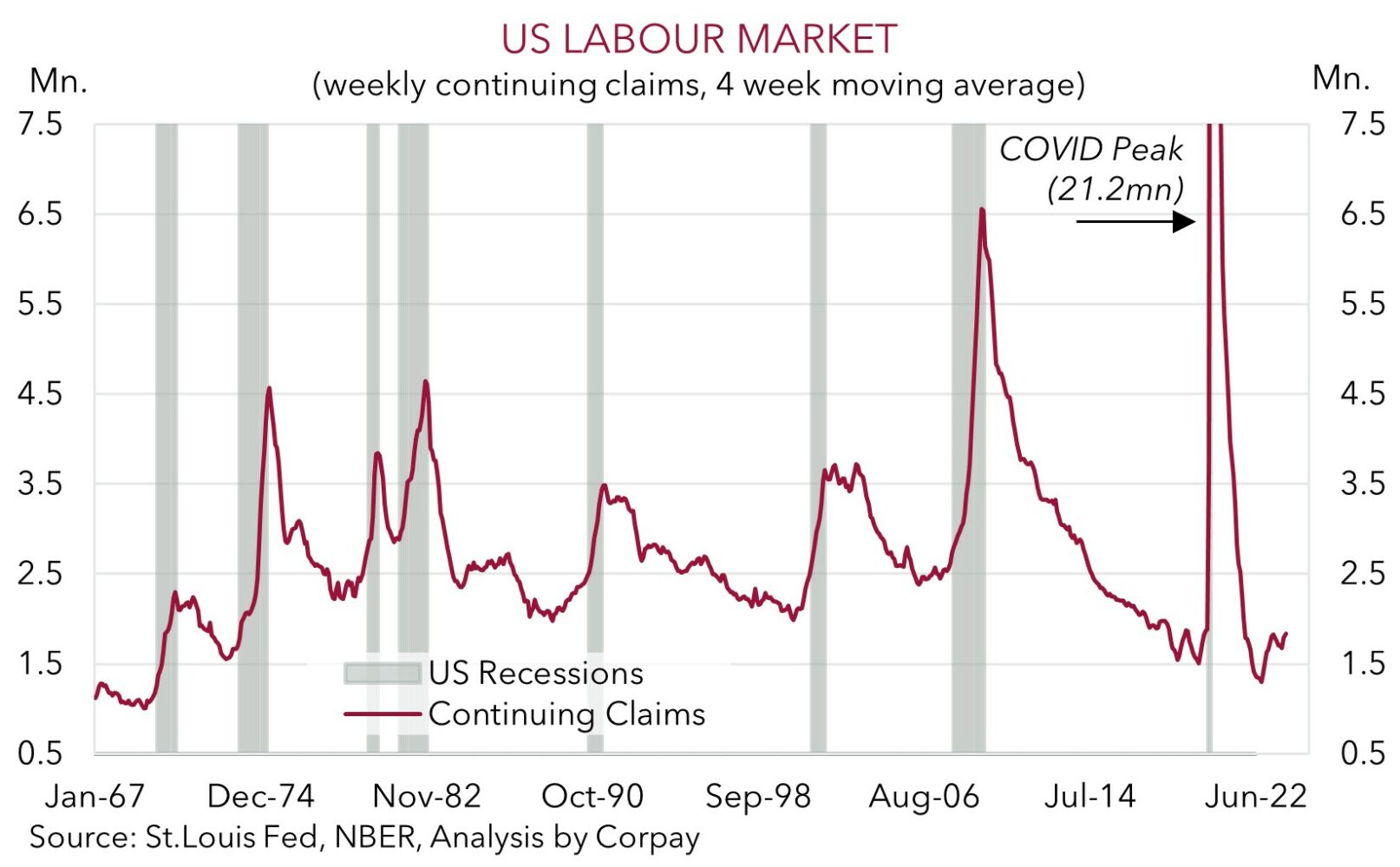

In terms of the US data, while durable goods orders fell back and shipments were weak (a sign business CAPEX is losing steam), weekly initial jobless claims and continuing claims were better than anticipated. Longer-term inflation expectations also held at a cyclical high 3.2%. The reaction to these volatile prints shows how sensitive markets still are to anything that may challenge the view the US Fed tightening cycle is over. From our perspective, jittery markets look to be jumping at shadows. While the claims data fell back over the week, a look under the hood finds that some seasonal factors in a few US states may have been a driver and the improvement shouldn’t last. As our chart shows, when you step back from the week-to-week swings, continuing claims (a gauge of recurring applications for unemployment benefits) look to be trending higher. And as US growth slows and tighter credit conditions bite we expect the developing cracks in the labour market to widen, supporting the view the next move by the US Fed will be to cut rates.

Today, the Eurozone (8pm AEDT) and UK (8:30pm AEDT) PMI data for November is due. In our judgement signs activity outside of the US is stabilising could see the downward pressure on the USD return. The US’ relative economic strength and upward repricing in US interest rate expectations were reasons behind the USD’s upswing over Q3, and we believe these impulses have now largely run their course.

AUD corner

The slightly firmer USD on the back of the modest rebound in US yields has exerted a bit of downward pressure on the AUD over the past 24hrs. However, at ~$0.6540 the AUD remains near the upper end of its multi-month range. Indeed, in a reflection of the USD-centric moves the AUD has held up or outperformed on the crosses. AUD/EUR is hovering near ~0.60, AUD/JPY has risen (+0.6% to ~97.84), and AUD/NZD is tracking above its 6-month average (now ~1.0863).

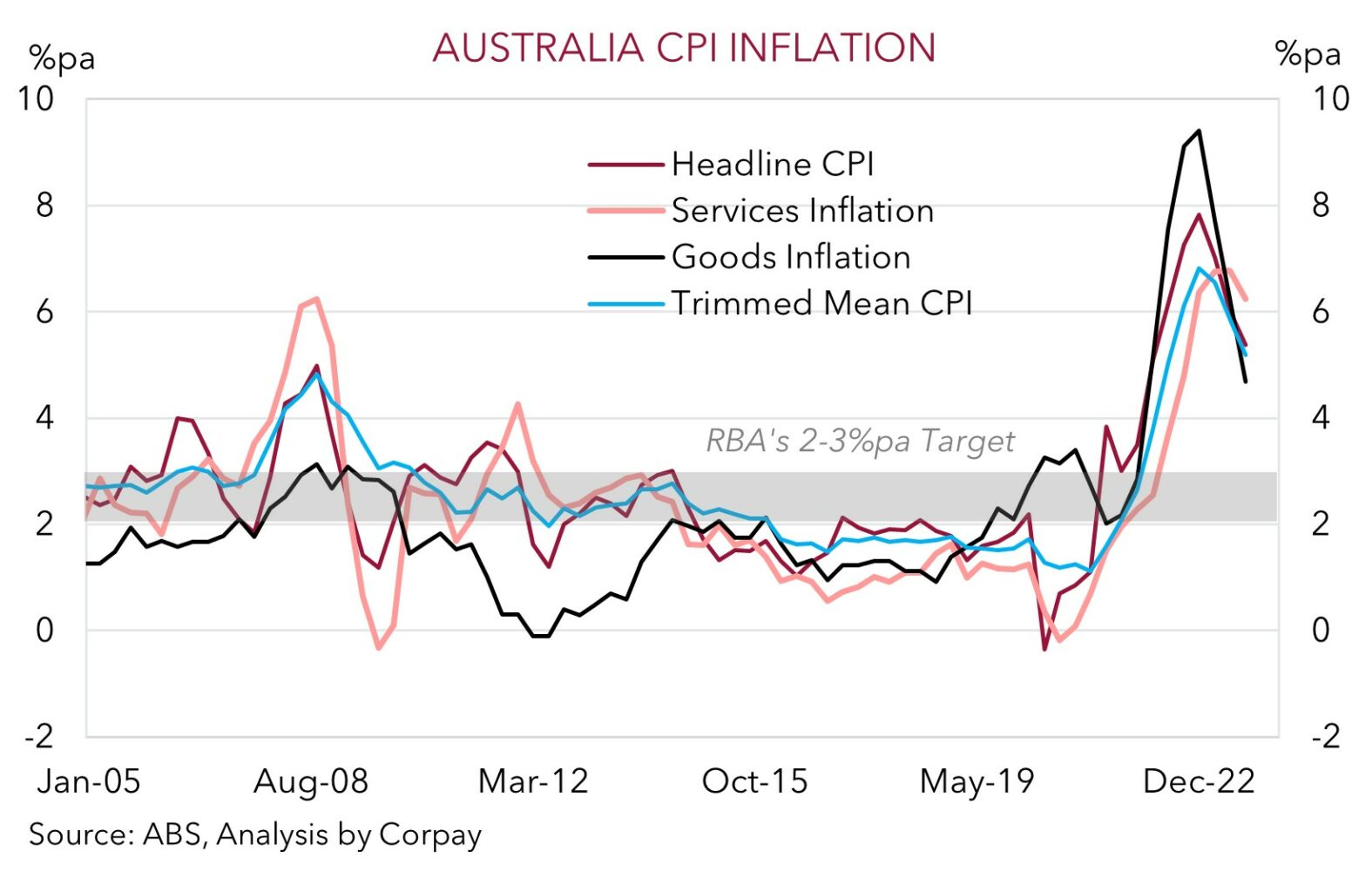

Diverging expectations between the outlook for the RBA’s stance and other major central banks (where the next move is generally viewed to be policy easing) remains AUD supportive. RBA Governor Bullock delivered another speech overnight, and the underlying tone was again quite ‘hawkish’, in our view. According to Governor Bullock the inflation challenge was now more home-grown and demand-driven, and the hardest part of the inflation fight was still ahead of us. As our chart shows, and as Governor Bullock stressed, sticky services prices are elevated, a reflection of the resilience in the domestic economy and tight labour market conditions. As we have noted previously, for services inflation to slow an extended period of ‘restrictive’ policy, sub-trend growth, and higher unemployment is needed.

On top of that, we would also flag that when asked about the RBA Review recommendation to target the midpoint of the 2-3% target Governor Bullock stated that “we are aiming to get to the midpoint” given that just getting back into the band “doesn’t give you much leeway to the upside”. When crossed with the RBA’s latest forecasts showing inflation is only projected to slow to 2.9%pa by end-2025 this in our mind would appear to highlight the risk of a further rate hike remains alive. It may not take much of a positive run in the activity or inflation data for the RBA to react once again.

Markets are pricing in a ~40% chance of another RBA rate rise by next February. While the RBA may be not raise rates again as it tries to navigate a ‘soft landing’, we continue to think that the domestic growth, labour market, and inflation dynamics could mean it lags its peers when the next global policy easing cycle kicks off. In our opinion, if this outlook holds, the narrowing in yield differentials should become incrementally more AUD supportive over the medium-term. The unfolding turn in relative yield spreads, combined with an improvement in China’s economy, and a softening in the USD underpin our longstanding forecasts looking for the AUD to nudge up to ~$0.66 by year-end, before moving up to ~$0.68 in Q1, and on to ~$0.70 by late 2024.

AUD levels to watch (support / resistance): 0.6480, 0.6520 / 0.6590, 0.6610