• Quiet markets. US closed for Thanksgiving. European equities ticked up & bond yields rose. FX moves limited. AUD hovering near multi-month highs.

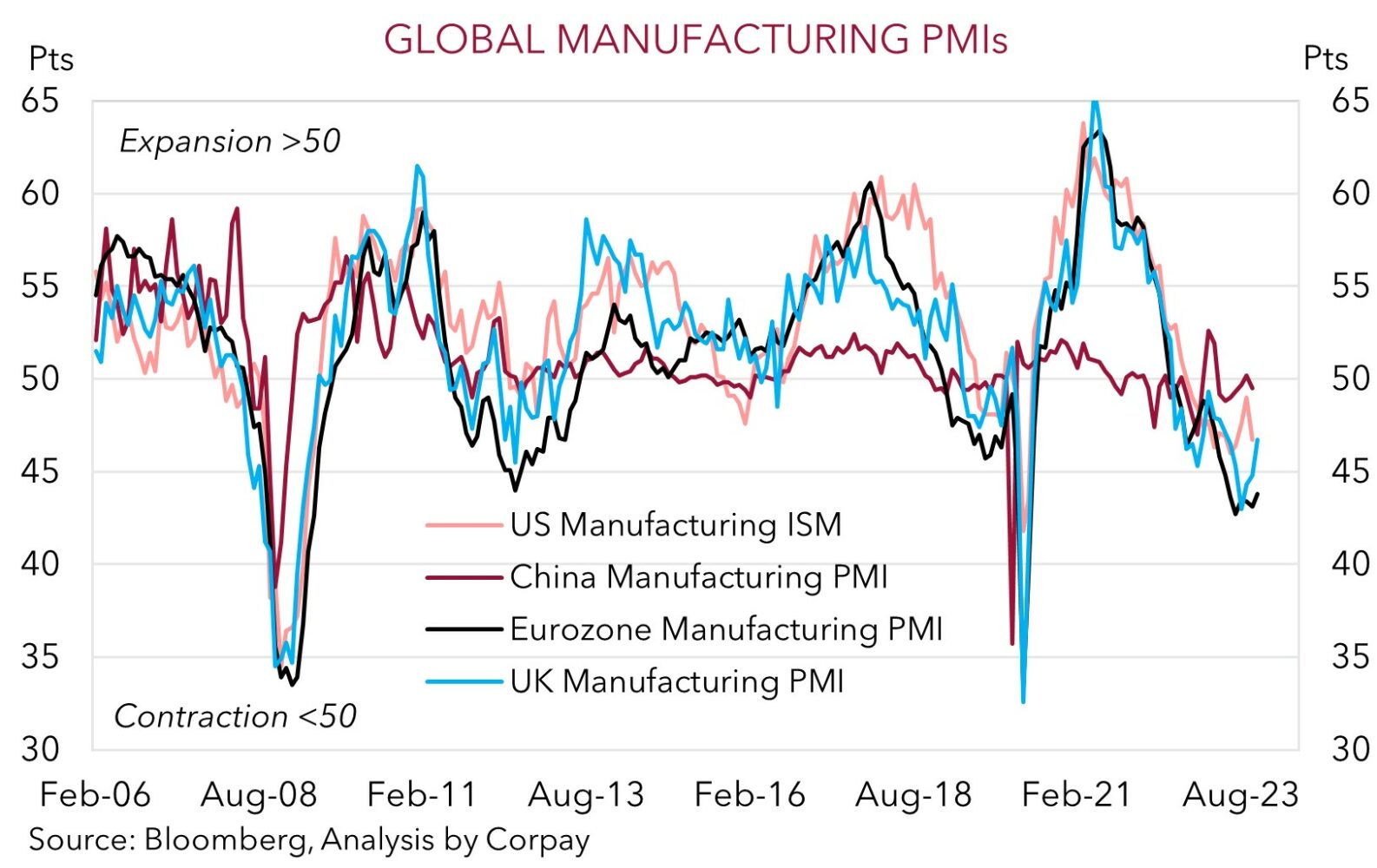

• PMIs. Eurozone & UK PMIs a bit better than expected. Eurozone still in the ‘contraction’ zone but momentum looks to be stabilising.

• Data quirks. Locally, retail sales & monthly CPI due next week. We think sales may fall & the CPI indicator may send a false signal. Near-term risks for the AUD.

With the US on holiday celebrating Thanksgiving markets have been fairly quiet. This is likely to remain the case today given reduced activity in the US due to early closes for various markets. In terms of the overnight moves European equities nudged up (EuroStoxx50 +0.2%), oil slipped back a bit more (WTI crude -1%), while there were relatively larger swings in European bonds. The German 10yr rate rose ~6bps (now 2.62%) and the UK 10yr lifted by ~10bps (now 4.25%). Some better than predicted data and hawkish ECB rhetoric (see below), coupled with signals from the German government that it would suspend the “debt brake” on government financing (and hence increase bond supply) following a court ruling last week have pressured yields.

Despite these adjustments currency moves have been modest. The USD index has consolidated. EUR is hovering near ~$1.09, GBP is back up around ~$1.2530, and USD/JPY is at ~149.60. Both EUR and USD/JPY are roughly inline with where they opened the week. USD/SGD is tracking just over ~1.34 with yesterday’s bigger than anticipated re-acceleration in Singapore CPI (from 4.1%pa to 4.7%pa) not generating much reaction. Policymakers were anticipating a pick up and volatility in inflation near-term because of utility prices. AUD is treading water at the upper end of its multi-month range (now ~$0.6559).

European bonds reacted to a few macro developments. The November readings of the Eurozone and UK business PMIs were a bit stronger than forecast. Although the level of the Eurozone composite PMI (now 47.1) remains in ‘contractionary’ territory, the uptick suggests growth momentum may be stabilising and that the unfolding recession could be ‘mild’. In the UK, the rebound in the composite PMI back above 50 for the first time in 4 months is a slightly more positive signal for growth, but also points to the Bank of England having to maintain a high level of interest rates for some time to ward off inflation. Elsewhere, the ‘higher for longer’ policy theme was also part of the communication from members of the European Central Bank. According to the ECB’s Villeroy, they “won’t raise rates again, excluding surprises”. However, several other members were also on the wires stressing rates will need to “stay where they are for a while”, and that its “too early to talk about” rate cuts.

Today, Japanese CPI inflation (10:30am AEDT), the German IFO survey (8pm AEDT), a speech by ECB President Lagarde (9pm AEDT) and the US PMIs (1:45am AEDT) are the macro highlights. We remain of the view that signs US growth is coming back to the pack, after a period of exceptional relative outperformance over Q3, should see the USD continue to gradually deflate over the period ahead.

AUD corner

The AUD held steady overnight during the US holiday impacted sessions. At ~$0.6559 the AUD remains at the upper end of its multi-month range and is just below its 200-day moving average (a technical indicator it hasn’t been above since late-July). The AUD has also held firm on the crosses. AUD/EUR has ticked up over its 100-day moving average (~0.6008), AUD/JPY (now ~98.10) is within 0.5% of its cyclical peak, and AUD/CNH (now ~4.6910) is just below its 1-year average.

We remain of the view that the AUD should continue to trend higher over the medium-term. Our longstanding forecasts are for the AUD to reach ~$0.68 in Q1, and ~$0.70 in a years-time. Underpinning our projections are our assessment that the still over-valued USD should continue to steadily lose its shine as the US Fed’s ‘restrictive’ policy stances slows the US economy, which in turn weighs on US bond yields as the next easing cycle comes closer into view. On top of that policy support measures should bolster China’s economic fortunes, and we think that domestic growth, labour market, and inflation dynamics could mean the RBA lags its peers when the next global rate cutting cycle kicks off. This should see bond yield differentials, which have been a drag on the AUD for the past few years, become more supportive over time.

However, markets don’t move in straight lines and after its recent run up, we think the AUD could face some short-term domestic economic challenges early next week. Quirks in the data may take some of the heat out of the built-up RBA rate hike pricing and the AUD, in our opinion. Australian retail sales (released Tues) and the monthly CPI indicator (released Weds) are due next week. We think both risk undershooting expectations. After a bumper September (retail turnover rose 0.9%, the strongest result since January), we believe financially squeezed households might have pared back their discretionary retail spending in October as they wait for the November ‘Black Friday’ sales.

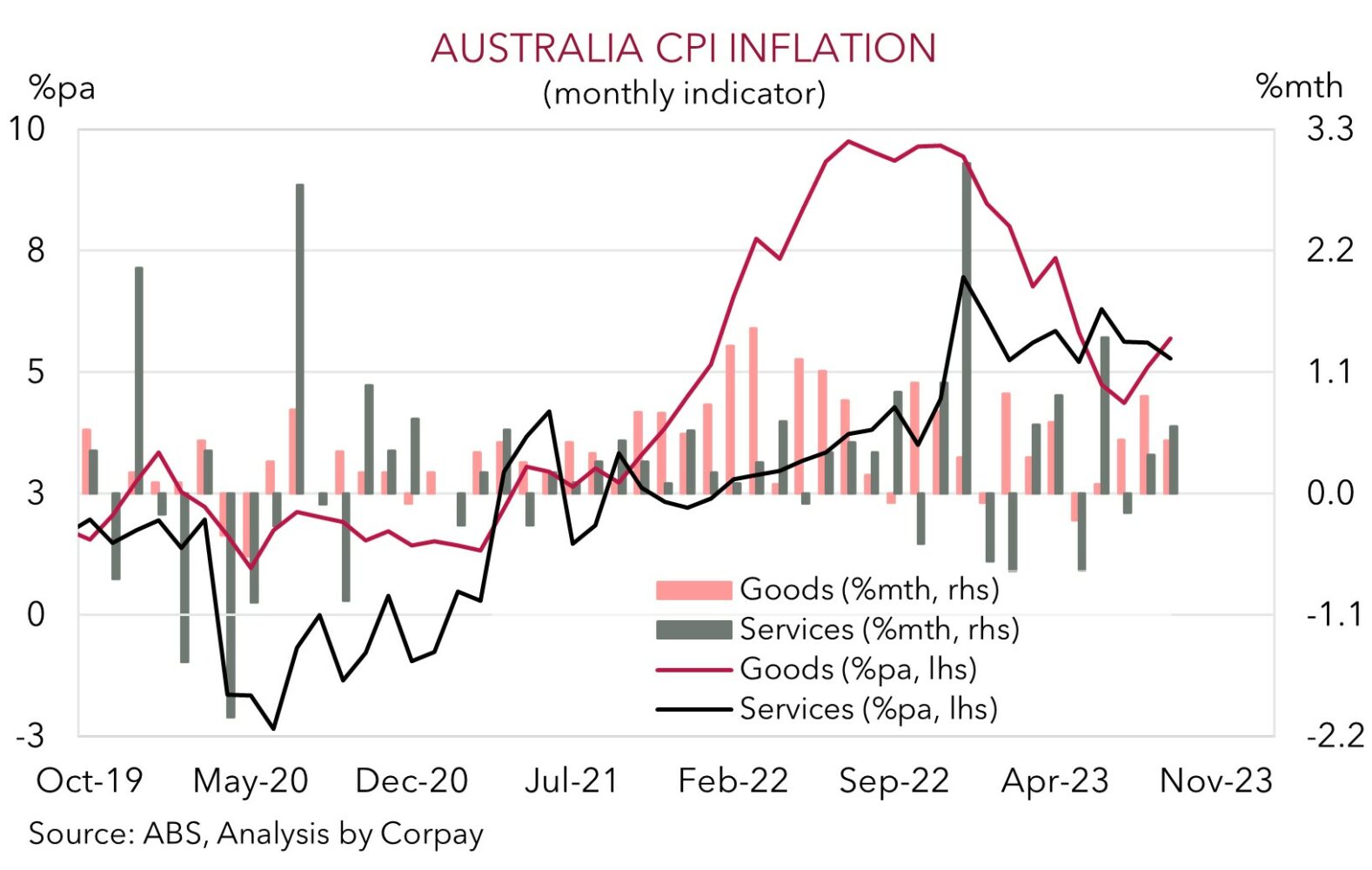

Added to that, as it captures the first month of the quarter, the October reading of the CPI indicator will be heavily skewed towards ‘goods’ (which are on a disinflation trend) and utilities prices, rather than sticky ‘services’ prices. Services prices, which are heavily intertwined with wages and labour market conditions, is the area that drove the upside surprise in the quarterly CPI report and is the focus of the RBA’s inflation concerns. This will be better captured in the November CPI reading. A similar thing happened a few months ago when the July CPI reading stepped down, triggering a drop in the AUD, only for inflation to re-accelerate meaningfully over August/September.

AUD levels to watch (support / resistance): 0.6480, 0.6520 / 0.6590, 0.6610