• US CPI. Headline inflation slowed a bit more than expected, but core inflation remains high. The conflicting signals generated intra-day volatility.

• Softer USD. The USD lost some ground. But will it last? Sticky US core inflation points to another Fed rate hike. Rate cut pricing for later this year looks misplaced.

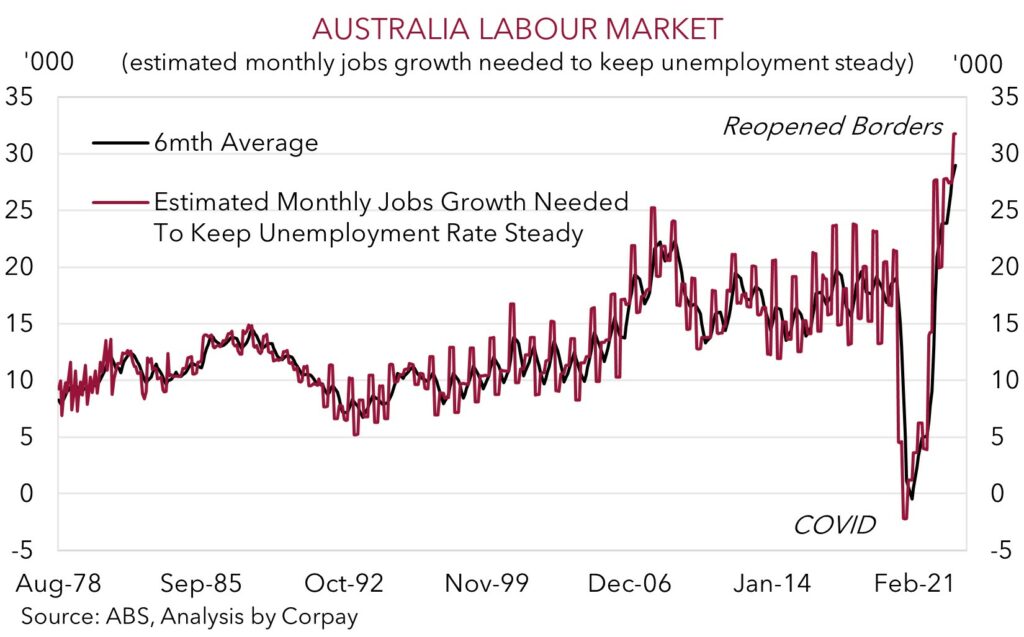

• AUD mixed. AUD focus today will be on the Australian labour market data. Reopened borders mean the hurdle to keep unemployment steady has risen.

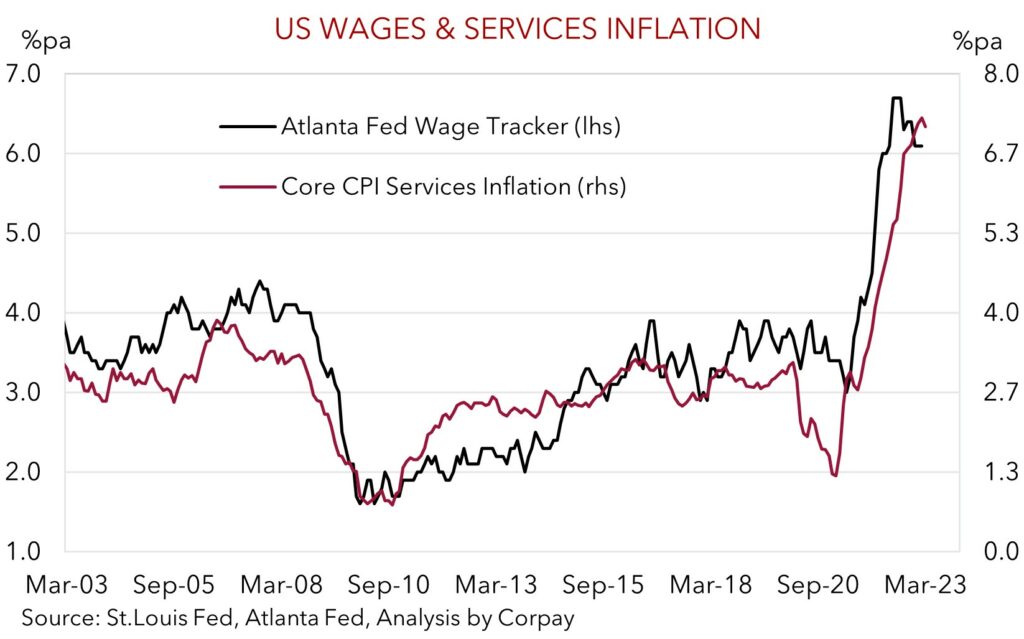

The latest read on US CPI inflation was the focus overnight. There was something for everyone in the data, and this generated divergence across markets and intra-day volatility. In terms of the numbers, headline inflation slowed a bit more than expected with the annual rate falling to 5%pa, the slowest since May 2021. However, a look under the hood shows that this was primarily due to the mechanical impacts from lower oil prices. Core inflation, which excludes food and energy, ticked up slightly to 5.6%pa, while other measures of underlying inflation also remain uncomfortably high. This shows inflation in the US remains quite sticky, with tighter monetary conditions yet to generate much impact. Indeed, we would call out the still strong US services inflation, which is linked to the tight labour market and robust wage growth, as a sign the US Fed still has more work to do. As our chart shows, US services inflation is still running over 7%pa. For this to be consistent with the Fed’s inflation target wages need to slow materially, and for that to happen an extended period of weak growth and higher unemployment are needed. In line with this thinking, the minutes of the last Fed meeting, also released overnight, indicate that the staff are now anticipating a “mild recession later in 2023”.

Market wise, US bond yields fell sharply after the CPI release, but the move wasn’t sustained. The US 2yr yield initially slumped ~20bps to 3.87%, but has since rebounded to be near 3.96%, with the stubborn core inflation pulse maintaining expectations the Fed will deliver another 25bp rate rise in early-May meeting. Markets are assigning a ~73% probability the Fed hikes again. Similarly, US equities opened higher before reversing course as the session rolled on as the prospect of additional near-term Fed action sunk in. The S&P500 ended the day in negative territory (-0.4%). In FX, the USD Index lost some ground, with EUR rising back up to ~1.10 (a high since early-February). USD/CAD also continued to edge lower. As expected, the Bank of Canada held rates steady, however, it retained a conditional tightening bias and pushed back on market pricing looking for cuts later this year. AUD ticked up modestly and at ~$0.6690 it is trading where it was a week ago.

In our view, the still tight US labour market and elevated core/services inflation supports the case for the Fed to raise rates further. We also think that pricing looking for rate cuts by the Fed over H2 2023 looks misplaced. Push back by the Fed on the markets view and/or some positive US data could see longer-dated US interest rate expectations adjust towards a ‘higher for longer’ outlook. We think this, coupled with further bouts of volatility, could generate some renewed USD strength down the track.

Global event radar: US Retail Sales (Fri), China GDP (18th Apr), Eurozone PMIs (21st Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May).

AUD corner

On the back of the softer USD in the wake of the US CPI report (see above), AUD has nudged up towards ~$0.6690. However, the move has been far from convincing with the AUD’s continued sluggish performance on some key cross-rates and shifting interest rate differentials generating headwinds. Specifically, AUD/EUR and AUD/GBP remain under pressure, with the diverging policy expectations between the more patient RBA and the still hiking ECB and Bank of England firmly entrenched.

Today, the AUD-focus will be on the March Australian labour force report (11:30am AEST). Following on from the February rebound, consensus expectations are centered on job gains of ~20,000 and for the unemployment rate to tick up slightly to 3.6%. We believe the Australian labour market has past its peak, and risks are tilted to softer prints over the coming months. Forward-looking labour demand indicators like job ads and hiring intentions topped out last year, and business confidence has fallen. Slower economic activity on the back of the jump up in interest rates should see less job creation down the line. Importantly, this is occurring at a time population growth has re-accelerated due to reopened international borders. As our chart shows, increased labour supply means the hurdle rate to keep the unemployment rate steady is now higher than it was during COVID (we estimate that ~30,000 jobs now need to be created each month to prevent the unemployment rate from rising). This should be an increasingly difficult task over the period ahead as higher interest rates bite and growth slows. We see the unemployment rate moving up over 2023. In our view, a softer than predicted Australian labour market report/higher unemployment should solidify views that the RBA hiking cycle is complete. If realised, this can see AUD/USD unwind some of its recent gains and should keep the AUD on the backfoot against EUR and GBP.

AUD event radar: AU Jobs Report (Today), US Retail Sales (Fri), China GDP (18th Apr), NZ CPI (20th Apr), Eurozone PMIs (21st Apr), AU CPI Inflation (26th Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), AU Retail Sales (3rd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May).

AUD levels to watch (support / resistance): 0.6560, 0.6600 / 0.6745, 0.6800

SGD corner

USD/SGD has given back some ground, with the softer USD post the US CPI report the driver (see above). At ~$1.3280 USD/SGD is back near where it was tracking a week ago. As discussed above, we think that the still high US core/services inflation points to further policy tightening by the US Fed, and believe market pricing looking for rate cuts later this year is unlikely to materialise. An upward repricing in longer-dated US interest rate expectations towards a ‘higher for longer’ Fed view could spark further market volatility and a firmer USD over the period ahead, in our view.

More near-term, the SGD focus now switches to tomorrows MAS policy review. Despite slowing global growth and Singapore’s linkages to the global industrial activity, inflation in Singapore is still uncomfortably high. Core inflation is running at ~5.5%pa. To bring down inflation and keep inflation expectations anchored, we expect the MAS to tighten conditions a little more by increasing the slope of the SGD NEER by ~0.5%. This can give the SGD some short-term support, in our opinion, though with SGD NEER looking like it is already tracking above the mid-point of the band, the direct impacts may not be that large.

SGD event radar: MAS Review (Fri), US Retail Sales (Fri), China GDP (18th Apr), Eurozone PMIs (21st Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May).

SGD levels to watch (support / resistance): 1.3200, 1.3220 / 1.3361, 1.3388