• USD lower. Weaker US jobless claims and PPI data has reinforced thinking the US Fed is nearing the end of its hiking phase. This has weighed on the USD.

• AUD rebound. The weaker USD, positive risk sentiment, and repricing in RBA rate hike expectations following the stronger labour force report have boosted the AUD.

• US retail sales in focus. US retail sales are released tonight. Leading indicators point to a softer result.

A positive night for risk sentiment, with softer US data supporting expectations the US Fed could be nearing the end of its rate hiking phase. Equities were higher. The US S&P500 rose 1.3%, with the tech-focused NASDAQ up ~2%. The move puts the S&P500 at its highest level since mid-February. Notably, the easing of banking concerns and thoughts of ‘peak’ interest rates has seen the VIX Index (the volatility gauge for the S&P500) fall towards the bottom of its 2023 range.

US bond yields ticked up, with the curve steepening in a ‘risk-on’ fashion. US 10yr yields increased by 5bps to 3.44%. Expectations for another Fed rate hike at the early-May meeting remain (the markets are assigning a ~70% probability of a move), but beyond that markets continue to think rate cuts could start from Q3 2023. We continue to think this is unlikely, but the upcoming data doesn’t look like it will change the market’s views. In FX, the USD Index has continued to slip back, with the theme of the end of the Fed tightening cycle and weaker US economy weighing on the currency. EUR touched its highest level (~1.1068) since April 2022 and GBP hit a ~10-month high (~1.2537), with policy divergence between the US Fed and ECB/Bank of England a driver. AUD and NZD were boosted by the weaker USD and positive risk environment, with yesterday’s stronger than expected Australian labour report an added jolt for the AUD. AUD (now ~$0.6783) has moved back above its 50-day moving average for the first time since late-February.

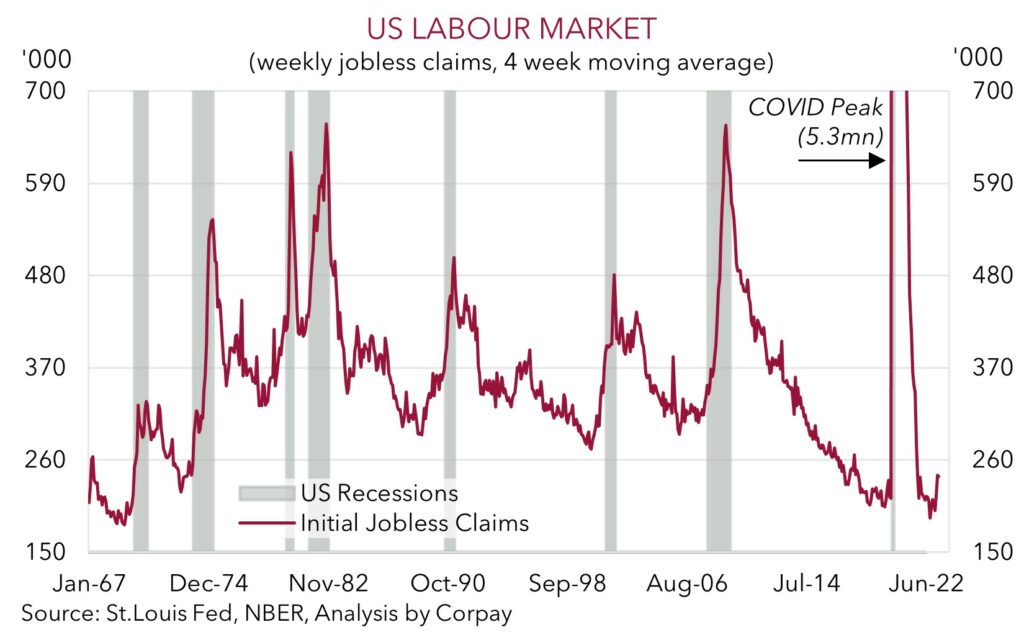

In terms of the US data, following on from the softer headline CPI inflation, Producer Price Inflation was also lower than forecast. The headline PPI slowed to 2.7%pa, the smallest rise in over two years. A sharp drop in petrol and falls across other goods prices drove the result. The PPI slowdown points to a further deceleration in headline CPI inflation over the coming months. Added to that, initial jobless claims (the weekly gauge of how many people are filing for unemployment benefits) rose a bit more than predicted. At ~240,000 the 4-week moving average is around the highest in a few years. Another sign the red-hot US labour market is slowly changing course.

In the short-term we think the weaker USD run stemming from the ‘peak’ Fed rate theme can extend a bit further. US retail sales data for March is released tonight (10:30pm) and we believe it could underwhelm. In our view, lower consumer confidence, a decline in auto sales, less demand for goods following the COVID overbuying, and a fall in credit card transactions point to downside risks to consensus expectations (mkt -0.4%).

Global event radar: US Retail Sales (Tonight), China GDP (18th Apr), Eurozone PMIs (21st Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May).

AUD corner

The AUD has added to its recent modest gains, rising by ~1.3% from this time yesterday to ~$0.6783. The AUD is back up near the highs it reached at the start of April following the spike in oil prices following the surprise OPEC+ production cuts. As discussed above, the weaker than predicted US PPI inflation and jobless claims data has reinforced market expectations that the US Fed could be nearing the end of its rate hiking phase. This has boosted risk assets, which the AUD has a high correlation too, and weighed on the USD. At the same time, the stronger than forecast Australian labour report has seen markets add in some chance the RBA hikes again in May.

In the short term, we think the AUD can bounce back a bit further. US retail sales is the next major USD-centric event, and as outlined above, we believe the data risks undershooting consensus thinking. If realised, this would reinforce the ‘peak’ Fed rate theme and add to the downward pressure on the USD. However, we remain sceptical that the AUD rebound will be sustained. Ultimately, we continue to think that over the next few months the AUD should face a challenging backdrop as the aftershocks from the very fast global tightening cycle continue to show up across economies and markets. Increased volatility and slower global growth have historically favoured currencies like the USD, EUR and JPY over ones like the AUD. And from a local economic perspective, while the March labour market data was strong, we think conditions should weaken over time and the RBA is unlikely to raise rates further.

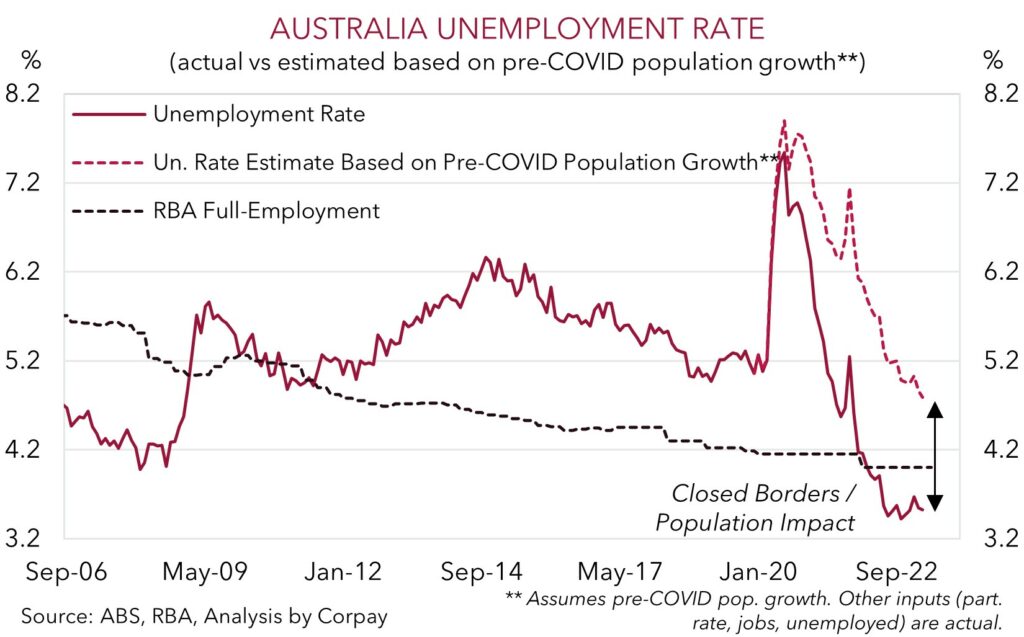

In terms of the data, another 53,000 jobs were added in March, helping the unemployment rate stay at 3.5%, near the lowest level since the early-1970’s. While the data raises the odds of another RBA hike, we continue to think that the broader domestic and global trends will see the RBA hold fire. A lot will depend on the upcoming CPI report (released 26 April), how much weight the RBA places on the large amount of tightening in the system that still hasn’t had its full effect, and the forecast for the labour market. From our perspective, the underlying dynamics point to unemployment rising from here. Labour demand is softening, and labour supply is rising because of reopened international borders. It is often overlooked how helpful the closed borders were in lowering unemployment. On our figuring had the population grown at the same rate over the past few years as it did pre-COVID, all else equal, the unemployment rate would now be just under 5% not 3.5%. For more see Market Wire: Australian labour market: As good as it gets.

AUD event radar: US Retail Sales (Tonight), China GDP (18th Apr), NZ CPI (20th Apr), Eurozone PMIs (21st Apr), AU CPI Inflation (26th Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), AU Retail Sales (3rd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May).

AUD levels to watch (support / resistance): 0.6700, 0.6745 / 0.6800, 0.6820

SGD corner

USD/SGD has remained on the backfoot, with the pair touching its lowest level (~$1.3210) since mid-February. The softer USD, on the back of the weaker than forecast US jobless claims and PPI inflation data, combined with the stronger EUR and GBP (see above) have been the catalysts. As discussed above, from the USD side of the equation, the USD/SGD run may extend a little further over the near-term. US retail sales are released tonight, and based on our reading of various indicators, risks are tilted to the data coming in below consensus forecasts.

Ahead of the US data, today’s MAS review will also influence the SGD. While global growth is slowing, and this is a drag on activity in Singapore due to its heavy linkages to trade and production, inflation in Singapore is still uncomfortably high. Core inflation is running at ~5.5%pa. To bring down inflation and keep inflation expectations anchored, we expect the MAS to tighten conditions a bit more by increasing the slope of the SGD NEER by ~0.5%. Alternatively, the MAS may look to re-center its currency band to the prevailing level of the SGD NEER. This would give scope for more SGD appreciation against its trading partners over time. Another round of MAS policy tightening can give the SGD some short-term support, in our opinion.

SGD event radar: MAS Review (Today), US Retail Sales (Tonight), China GDP (18th Apr), Eurozone PMIs (21st Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May).

SGD levels to watch (support / resistance): 1.3150, 1.3200 / 1.3320, 1.3360