• USD rebound. The lift in US inflation expectations and hawkish Fed comments boosted US interest rate pricing and supported the USD.

• AUD falls back. The bounce back in the USD has weighed on the AUD. The China data batch is the main AUD event this week.

• AUD/NZD edging higher. NZ CPI inflation released later this week. A result close to consensus should reinforce thinking the RBNZ has reached a rate peak.

The USD bounced back on Friday, with Thursday’s losses unwound. US economic data and ‘hawkish’ comments from a key Federal Reserve official boosted US interest rate expectations and this flowed through to the USD. EUR has slipped back below 1.10, USD/JPY is back up near 134, and the AUD is down just above ~$0.67. The US 2yr yield rose ~13bps to 4.10%, a high since early-April, as near-term rate hike probabilities were bolstered and rate cut pricing for later this year was trimmed back. Another 25bp hike by the US Fed is fully factored in by the June meeting, with the market assigning a ~81% chance it happens in early-May. The lift in US yields exerted a bit of pressure on equities (S&P500 -0.2%), with falls in sectors like real estate and utilities outweighing the rise in financials following strong results from a few US banks.

In terms of the data, headline US retail sales were weaker than predicted, falling 1% in March. Core retail sales, which exclude auto and gasoline sales, also dipped (-0.3%), though not as much as expected. While the core result helped the USD at the margin, the rebound kicked into gear after the University of Michigan consumer sentiment gauge lifted more than anticipated, particularly the 1-year ahead inflation expectations measure which jumped up to a multi-month high on the back of higher petrol prices. Inflation expectations drive actual inflation given they feed people’s price setting behaviors. The data supports our thinking that the Fed’s work isn’t done, and that pricing looking for rate cuts later this year is misplaced. Indeed, this was the message from Fed Governor Waller who stressed that “because financial conditions have not significantly tightened, the labour market continues to be strong and quite tight, and inflation is far above target, so monetary policy needs to be tightened further”, and that settings will need to remain restrictive for “longer than markets anticipate”.

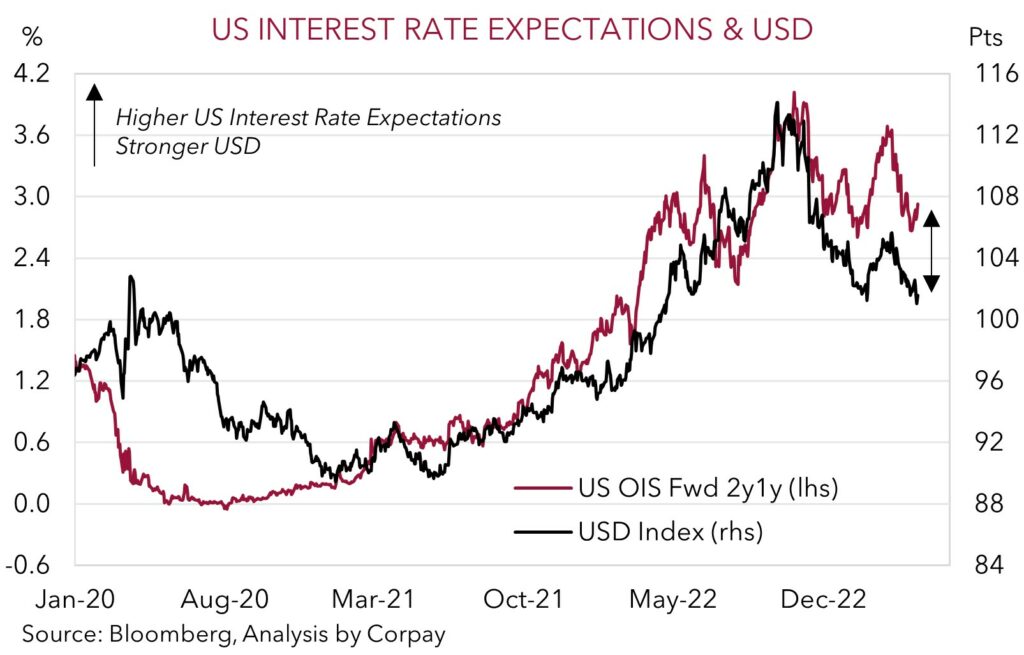

Globally, the focus this week will be on the China data batch which includes Q1 GDP (Tuesday), the global PMIs (Friday), and US Fed speakers. Indications that China’s economy isn’t snapping back as fast as people were hoping and/or a continued push back by Fed officials on the markets outlook for rate cuts later this year should, in our opinion, help the USD recover more lost ground. As our chart shows, the USD and US rate expectations have diverged, and this hasn’t tended to last over recent years.

Global event radar: China GDP (Tues), Eurozone PMIs (Fri), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), Eurozone CPI (2nd May), ECB Meeting (4th May), US Fed Meeting (4th May), Fed Chair Powell Speaks (4th May), US Jobs Report (5th May), US CPI (10th May), Bank of England Meeting (11th May).

AUD corner

AUD gave back a large share of last week’s gains on Friday. The resurgent USD stemming from the lift in US interest rate expectations following better than expected US data and hawkish Fed rhetoric pushed the AUD back down towards ~$0.67 (see above). AUD also underperformed the EUR. We continue to think that AUD/EUR (now ~0.61) should remain under pressure for a while yet due to diverging RBA and ECB policy expectations and unfolding slow down in global growth.

It is a quiet week on the domestic calendar with the minutes of the April RBA meeting (Tuesday) the main release. Given Governor Lowe’s speech following the decision to ‘pause’ we don’t think the minutes will be market moving. Rather, offshore developments will drive the AUD. The China data batch, which includes Q1 GDP, is released on Tuesday, the global PMIs are due Friday, and a few US Fed officials speak later in the week. While China’s GDP should mechanically lift following the move away from COVID zero, we think the growth pulse risks underwhelming. Given the global downturn, this is particularly the case for industrial activity. As our chart shows, the AUD looks to have factored in a decent pick up in this side of China’s economy. Any weakness, combined with US Fed members continuing to lean against pricing of rate cuts later this year, should weigh on the AUD, in our view. We continue to believe that over the next few months the AUD should face a challenging backdrop as the aftershocks from the very fast global tightening cycle continue to show up. Increased volatility and slower global activity have historically favoured currencies like the USD, EUR and JPY over cyclical ones like the AUD.

AUD/NZD has bucked the trend, with the pair hovering just below the 50-day moving average (~1.0819). We think the NZD’s weakness reflects the shift in thinking towards a view the RBNZ’s very aggressive policy tightening will generate a sharper and longer economic downturn. This week, NZ Q1 CPI inflation is released (Thursday). The market is looking for inflation to come in below the RBNZ’s very high forecast (mkt 6.9%pa, RBNZ 7.3%pa). A result close to consensus should add to the belief the RBNZ has reached a rate peak, and we think this can give AUD/NZD further support.

AUD event radar: China GDP (Tues), NZ CPI (Thurs), Eurozone PMIs (Fri), AU CPI Inflation (26th Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), AU Retail Sales (3rd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May), US CPI (10th May), Bank of England Meeting (11th May), AU Wages (17th May), AU Jobs Report (18th May), RBNZ Meeting (24th May).

AUD levels to watch (support / resistance): 0.6620, 0.6662 / 0.6744, 0.6800

SGD corner

USD/SGD has edged back up above ~$1.33 with the rebound in the USD due to the lift in US interest rate expectations (see above) compounding Friday’s dovish MAS surprise. In contrast to many analysts forecasts, the MAS maintained “the prevailing rate of appreciation” of the SGD NEER. The MAS also held the width and center of the currency band steady. This reflected the MAS’ relatively more downbeat view of global and domestic growth, and expectations inflation will slow materially over 2023. For more detail on the MAS’ updated macro thinking see Market Wire: MAS assuming the brace position.

In our opinion, the pick up in the USD could extend a bit further if, as we expect, US Fed officials speaking later this week continue to push back on market pricing looking for interest rate cuts later this year. Similarly, a softer China data batch (released Tuesday) may also raise concerns about the global economy, and if realised, this can dampen cyclical currencies like the SGD and broader Asian FX. This mix may see USD/SGD tick up towards the top of its recent $1.3150-1.3450 range. Elsewhere, we think the weaker global growth backdrop, combined with our thoughts that the ECB still has more work to do to bring down Eurozone inflation, that the Bank of Japan could be about to embark on a long overdue policy normalisation path, and the rising odds the next move by the MAS could be to ease policy, should see EUR and JPY outperform the SGD over coming months.

SGD event radar: China GDP (Tues), Eurozone PMIs (Fri), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), Eurozone CPI (2nd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May), US CPI (10th May), Bank of England Meeting (11th May).

SGD levels to watch (support / resistance): 1.3200, 1.3245 / 1.3365, 1.3400