• Calm markets. Focus is on tonight’s US CPI. Headline inflation should mechanically slow, but core inflation could remain high. This can support the case for further tightening by the US Fed.

• AUD mixed. AUD slightly higher against the USD, but remains under pressure against EUR and GBP as monetary policy outlooks diverge.

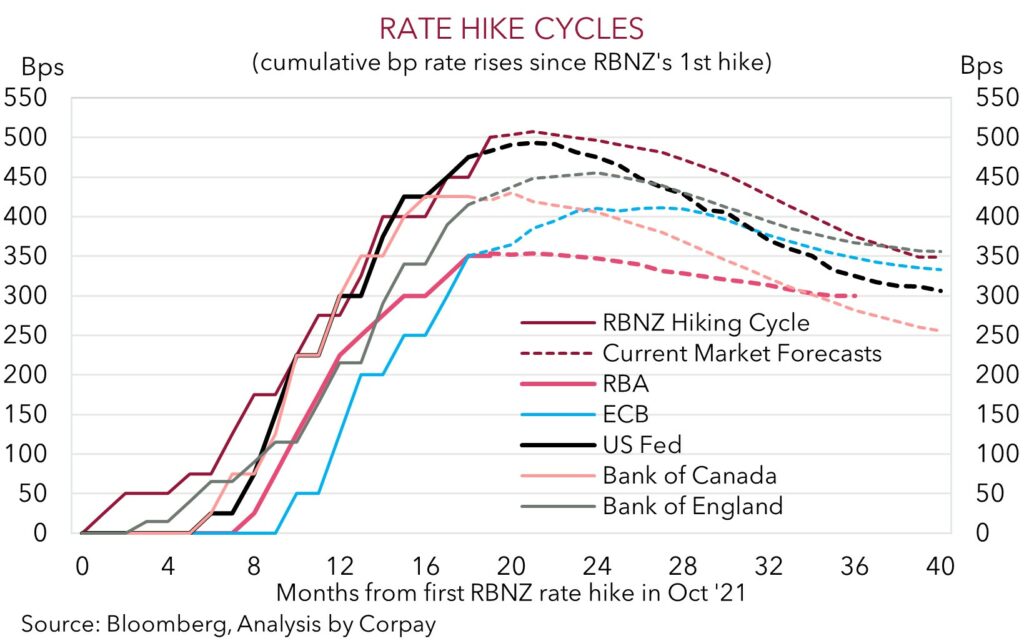

• NZD underperformer. Despite last week’s larger RBNZ rate hike, NZD has fallen back. Markets are starting to factor in a RBNZ ‘policy mistake’.

Markets were relatively calm overnight, with tonight’s US CPI in focus (10:30pm AEST). The US S&P500 ended the day flat, with the tech-focused NASDAQ easing back (-0.4%), while European equities rose (+0.6%). US bonds consolidated, with the policy-driven 2yr yield hovering near 4.02%. Markets continue to discount a ~70% chance the US Fed will deliver another 25bp rate hike at the early-May meeting. In Europe rates jumped (10yr yields rose 11-13bps across the region) as markets played catch-up following the Easter break. Across FX, the USD index slipped back with EUR, GBP and CAD recording modest gains. AUD has ticked up from Monday’s low point, but at ~$0.6650 it remains over 2% below last week’s peak. NZD has been a notable underperformer (AUD/NZD has bounced back towards ~1.0750). NZD is now nearly 3% below the levels reached last week after the RBNZ delivered another larger than expected 50bp rate hike. Our take is that markets are starting to factor in a RBNZ ‘policy mistake’, with the aggressive actions being taken to bring down inflation set to generate significant negative impacts across the NZ economy which is already on the verge of another recession.

In terms of economic events, the IMF pared back its global growth forecasts made only three months ago. The world economy is now projected to grow by 2.8% in 2023 and 3% next year. This is well below the 3.8% pace averaged in the 20yrs before COVID. We think the IMF’s figures still look optimistic, with the world economy having entered a challenging phase. The large jump up in interest rates and tighter credit conditions look set to significantly constrain activity across most economies. Indeed, the IMF stresses that the risks to its outlook “are weighted heavily to the downside, in part because of the financial turmoil of the last month and a half”. We continue to expect the most abrupt policy tightening cycle in several decades to generate further bouts of market volatility over the coming months as aftershocks continue to show up (see Market Musings: Buckle up, volatility should continue).

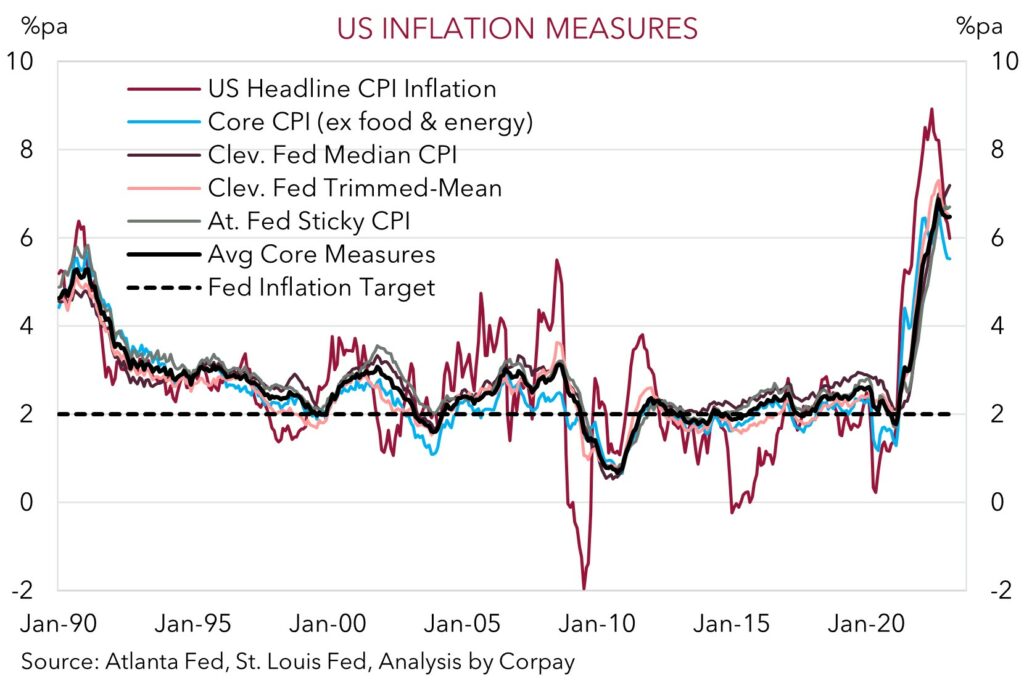

With respect to tonight’s US CPI, we would note that we are now at the point where there are several moving parts to consider. Annual headline inflation should mathematically step down towards 5%pa as last year’s large increases in things like oil roll out of calculations. However, core (excluding food and energy) and services inflation, which are underpinned by a tight US labour market and robust wage growth, look set to remain well above the Fed’s target and show few signs of slowing. In our opinion, the core measures, which gauge inflation persistence, are what policymakers are watching. We believe another month of sticky/high core inflation should solidify the case for another Fed rate hike in May, and this can support the USD.

Global event radar: US CPI (Tonight), Bank of Canada Meeting (Tonight), US Retail Sales (Fri), China GDP (18th Apr), Eurozone PMIs (21st Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May).

AUD corner

AUD has clawed back a bit of ground, but at ~$0.6650 it remains ~2% below last week’s peak. Indeed, while the AUD has ticked up against the softer USD, it has remained on the backfoot on other crosses. AUD/EUR and AUD/GBP touched fresh 2023 lows as the diverging policy outlooks between the RBA and the ECB and Bank of England shifted relative interest rate differentials against the AUD. AUD/CAD also hit a year-to-date low, with the CAD boosted by the upturn in energy prices and run of better than anticipated Canadian economic data. The Bank of Canada meets tonight (midnight AEST). The BoC is widely expected to keep rates on hold, but officials could maintain a relatively hawkish bias given the domestic data. This could keep AUD/CAD under pressure.

Tonight’s US CPI (10:30pm AEST) and tomorrow’s Australian labour force report are the key upcoming AUD events. As discussed above, while we expect US headline inflation to slow as negative base-effects kick in, the more policy-relevant core measures could remain uncomfortably high. Signs US core inflation is still not responding to tighter monetary conditions should, in our view, see expectations for another US Fed rate hike lift, with pricing for rate cuts later this year also at risk of being wound back. If realised, this could support the USD. At the same time, we see risks Australian unemployment (now 3.5%) lifts more than consensus expects (mkt 3.6%). Slowing labour demand as higher rates constrain activity, mixed with rising labour supply on the back of reopened international borders points to higher unemployment over 2023, in our view. We think a soft labour market report could solidify views that the RBA hiking cycle is complete.

AUD/NZD, which has rebounded from last week’s post-RBNZ rate hike lows, should also endure some volatility over the next 24hrs. Over the medium-term we continue to project AUD/NZD to push higher. With the policy tightening phase coming to an end, markets look to be starting to focus more on other differentials such as growth, labour market trends, and commodity prices. And on these metrics, we judge that the AUD should outperform the NZD. Growth-wise, the RBNZ moved earlier and has been far more aggressive than the RBA. As such we expect the NZ economy to underperform, particularly with the RBA trying to thread the needle and achieve a ‘soft landing’ (see Market Musings: Cross-Check: AUD/NZD – RBNZ Shock & Orr).

AUD event radar: US CPI (Tonight), Bank of Canada Meeting (Tonight), AU Jobs Report (Thurs), US Retail Sales (Fri), China GDP (18th Apr), NZ CPI (20th Apr), Eurozone PMIs (21st Apr), AU CPI Inflation (26th Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), AU Retail Sales (3rd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May).

AUD levels to watch (support / resistance): 0.6560, 0.6600 / 0.6745, 0.6800

SGD corner

USD/SGD consolidated overnight, with the pair hovering around ~$1.3325. This is ~0.6% above last week’s low, with the rebound in US interest rates expectations supporting the USD over the past few days (see above).

We continue to think that USD/SGD can push a little higher over the near-term, though volatility is likely to pick up over the next few sessions. On the USD side of the equation tonight’s US CPI data is the next focal point. As mentioned above, although we see headline US inflation decelerating, this mainly reflects the mathematical impact from last year’s large price rises in things like oil washing out of the numbers. By contrast, core inflation looks set to remain elevated due to sticky services prices and high wage growth. In our opinion, another high core inflation print should bolster the case for further policy tightening by the US Fed in early-May, supporting the USD (and USD/SGD). On the SGD side of the story, the MAS’ policy review (Friday) is the main domestic event. Despite slowing global growth, inflation in Singapore is still high. To keep inflation expectations anchored we think the MAS will tighten conditions a bit further by slightly increasing the slope of the SGD NEER.

SGD event radar: US CPI (Tonight), MAS Review (Fri), US Retail Sales (Fri), China GDP (18th Apr), Eurozone PMIs (21st Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May).

SGD levels to watch (support / resistance): 1.3200, 1.3220 / 1.3357, 1.3393