• Solid US labour report. The March US labour market data showed that while momentum is slowing, conditions are still tight. US unemployment is 3.5%.

• USD rebound. The US data bolstered expectations the Fed will hike rates again in May. This has boosted the USD. US CPI inflation released this week.

• AUD lower. The shift in relative interest rate expectations in favour of the US has weighed on the AUD. Australian labour market data due on Thursday.

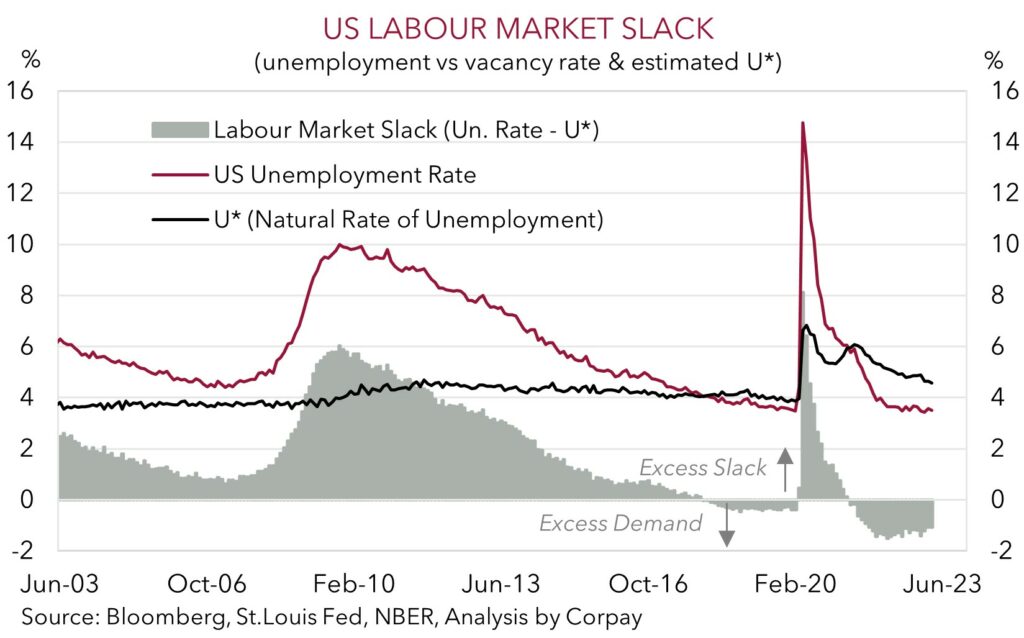

The US economic data continued to roll in over the Easter Holidays. On Friday the important US labour market report was released. While momentum has cooled, and the leading indicators point to softer results down the track as tighter monetary and credit conditions work their way through the economy, as at March the US labour market was still on solid footing. Non-farm payrolls rose 236,000, average hourly earnings (a wages measure) slowed but at 4.2%pa remains at a run-rate inconsistent with the US Fed’s 2%pa inflation target, and the unemployment rate ticked down to 3.5%. As our chart shows, given the very low unemployment rate, the US labour market remains in a state of ‘excess demand’. To bring down inflation, particularly services-driven inflation like it is in the US, ‘excess slack’ is needed. And for that to happen US monetary policy needs to remain in ‘restrictive’ territory for an extended period to materially slow down growth and push up unemployment.

In response to the US labour market data, and more signs that the acute phase of the US bank liquidity crisis is over (borrowings by US banks from the US Fed’s backstop facilities fell again last week), US and European equities edged up modestly, while US bond yields rose. The US 2yr yield is ~17bps higher compared to where it closed on Thursday (now ~4%) as the data bolstered expectations that the US Fed will deliver another rate hike at the 4 May meeting. The probability that the US Fed will raise rates by 25bps in May has risen to ~70%. In FX, the shift up in US rate expectations has boosted the USD. EUR has slipped back to ~$1.0860, USD/JPY has jumped back above 133.50 (~2.3% above last Wednesday’s low point), and the AUD has drifted down to ~$0.6640.

Globally, market focus this week will be on the US CPI inflation (Wednesday) and retail sales (Friday) data, and the start of US equity earnings season. In terms of the US CPI, importantly, although annual headline inflation should step down towards 5%pa as last year’s large increases in things like oil roll out of calculations, core (excluding food and energy) and services inflation are predicted to remain well above the Fed’s target and show few signs of slowing. In our view, another month of sticky/high core inflation should solidify the case for another Fed rate hike in May, and this can help the USD continue to claw back lost ground.

Global event radar: US CPI (Weds), Bank of Canada Meeting (Thurs), US Retail Sales (Fri), China GDP (18th Apr), Eurozone PMIs (21st Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May).

AUD corner

The AUD has remained on the backfoot, falling towards ~$0.6640 over the Easter Holiday period. This is ~2.3% below last Monday’s oil price spike induced high. As discussed, another solid US labour market report has given US interest rate expectations and the USD a lift with the market probability of another rate hike by the US Fed at the early-May meeting rising to ~70%. And when compared with thoughts that the RBA is at the end of its tightening phase, a range of relative interest differentials have moved in favour of the USD.

This week the US CPI report (Weds) is the main global release, while locally the March employment report is due (Thurs). As outlined above, while we think US headline inflation should decelerate as negative base-effects kick in as last year’s large jump in things like oil fall out of the numbers, core inflation should remain elevated. Indications US core inflation is still not responding to tighter monetary conditions should, in our view, see expectations for another US Fed rate hike in May continue to bounce back. If realised, we expect this to be USD supportive. At the same time, we see risks that the Australian unemployment rate (now 3.5%) ticks up more than consensus predicts. Slower labour demand as higher rates constrain activity, mixed with rising labour supply on the back of reopened international borders points to a higher unemployment rate over the next year, in our opinion. A soft March Australian labour market report should solidify views that the RBA hiking cycle is complete.

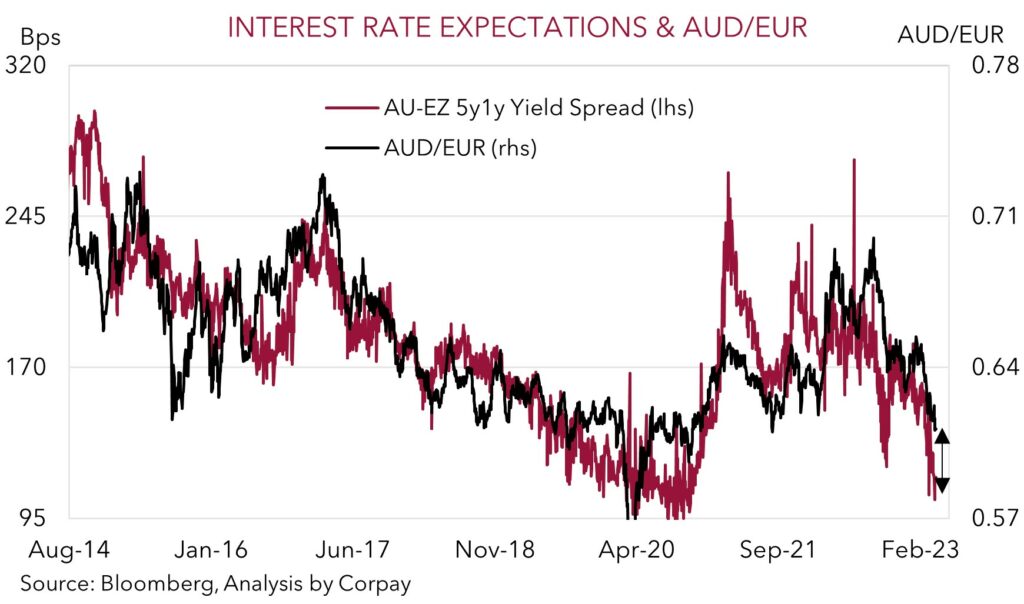

We continue to think that the AUD faces an uphill battle over Q2 as the impacts of abrupt tightening cycles continue to show up in markets and the global economy. Bouts of volatility and slower growth is an environment where currencies like the AUD, which are leveraged to the global economic cycle, typically underperform. Added to that, the diverging policy outlooks between the RBA and other central banks such as the ECB, BoE, and US Fed which we think still have more work to do to get on top of inflation should also keep the AUD on the backfoot. As our chart shows, relative interest rate differentials continue to point to a lower AUD/EUR.

AUD event radar: US CPI (Weds), Bank of Canada Meeting (Thurs), AU Jobs Report (Thurs), US Retail Sales (Fri), China GDP (18th Apr), NZ CPI (20th Apr), Eurozone PMIs (21st Apr), AU CPI Inflation (26th Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), AU Retail Sales (3rd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May).

AUD levels to watch (support / resistance): 0.6560, 0.6600 / 0.6746, 0.6800

SGD corner

USD/SGD has rebounded over the past few trading days, with the pair back up near ~$1.3330. This is ~0.7% above last week’s low. The firmer USD stemming from the solid US labour market report and bounce back in US rate hike expectations has been the catalyst (see above).

We continue to believe that USD/SGD can push a little higher over the near-term, though volatility is likely to pick up this week. On the USD side of the equation, while we see headline US inflation mathematically decelerating, core inflation looks set to remain elevated due to sticky services prices (data released Wednesday). In our view, another high core inflation print should support the case for further policy tightening by the US Fed in May, supporting the USD (and USD/SGD). On the SGD side of the story, the MAS’ policy review (Friday) is the main focal point. Despite slowing global growth, inflation in Singapore is still high. In an effort to keep inflation expectations anchored we expect the MAS to tighten conditions a bit further by slightly increasing the slope of the SGD NEER. If realised, this may give SGD some support at the end of the week.

SGD event radar: US CPI (Weds), MAS Review (Fri), US Retail Sales (Fri), China GDP (18th Apr), Eurozone PMIs (21st Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May).

SGD levels to watch (support / resistance): 1.3200, 1.3220 / 1.3353, 1.3397