• Some jitters. Rising oil prices & higher Canadian inflation boosted bond yields. Equities were flat. The USD consolidated & AUD ticked up.

• US Fed. No policy change is anticipated tomorrow. Focus will be on the Fed’s guidance & forecasts. Markets are already pricing a ‘higher for longer’ view.

• Event radar. In addition to the US Fed over the next few days UK CPI (today) is released & the BoE meets (tomorrow). The BoJ meeting is on Friday.

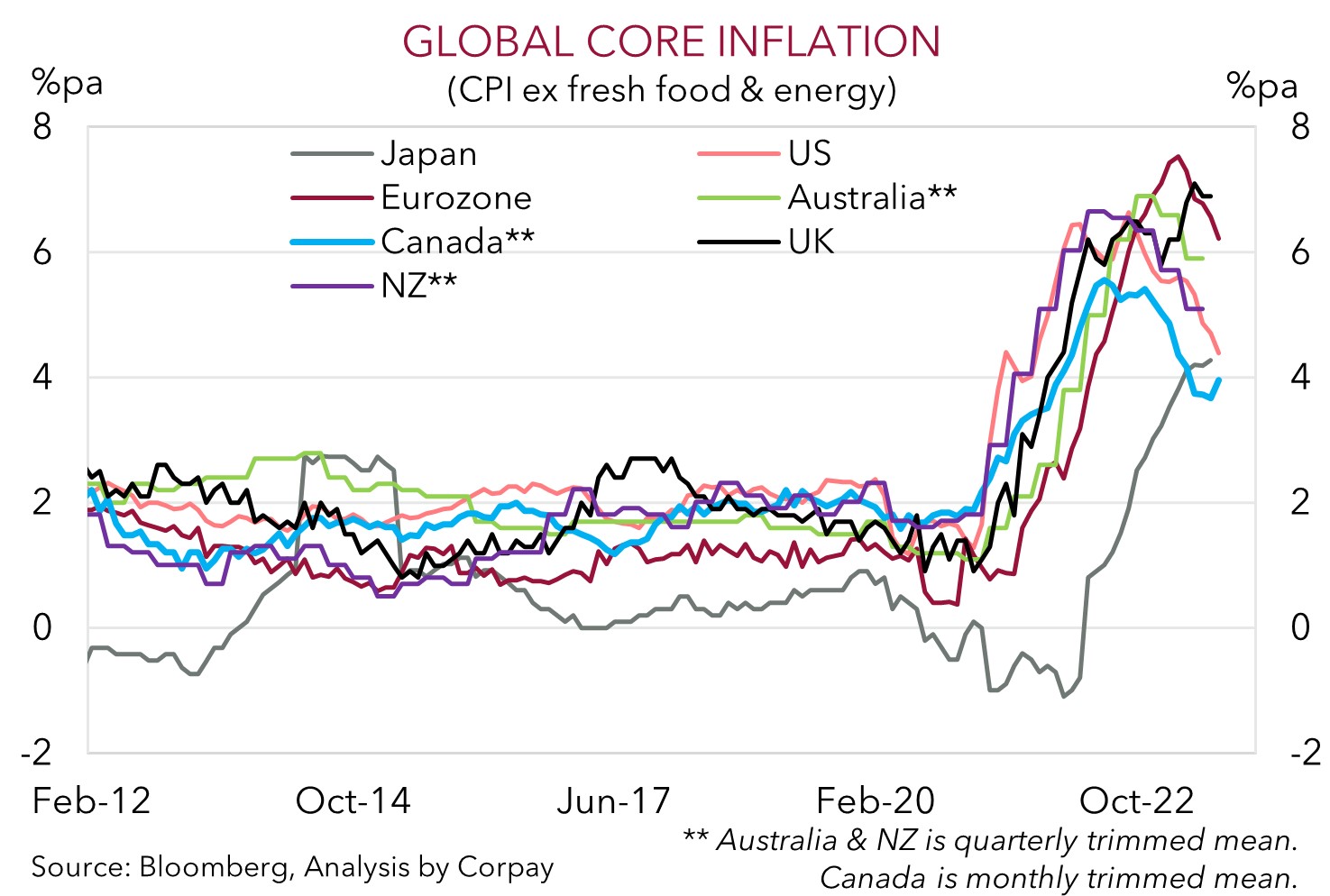

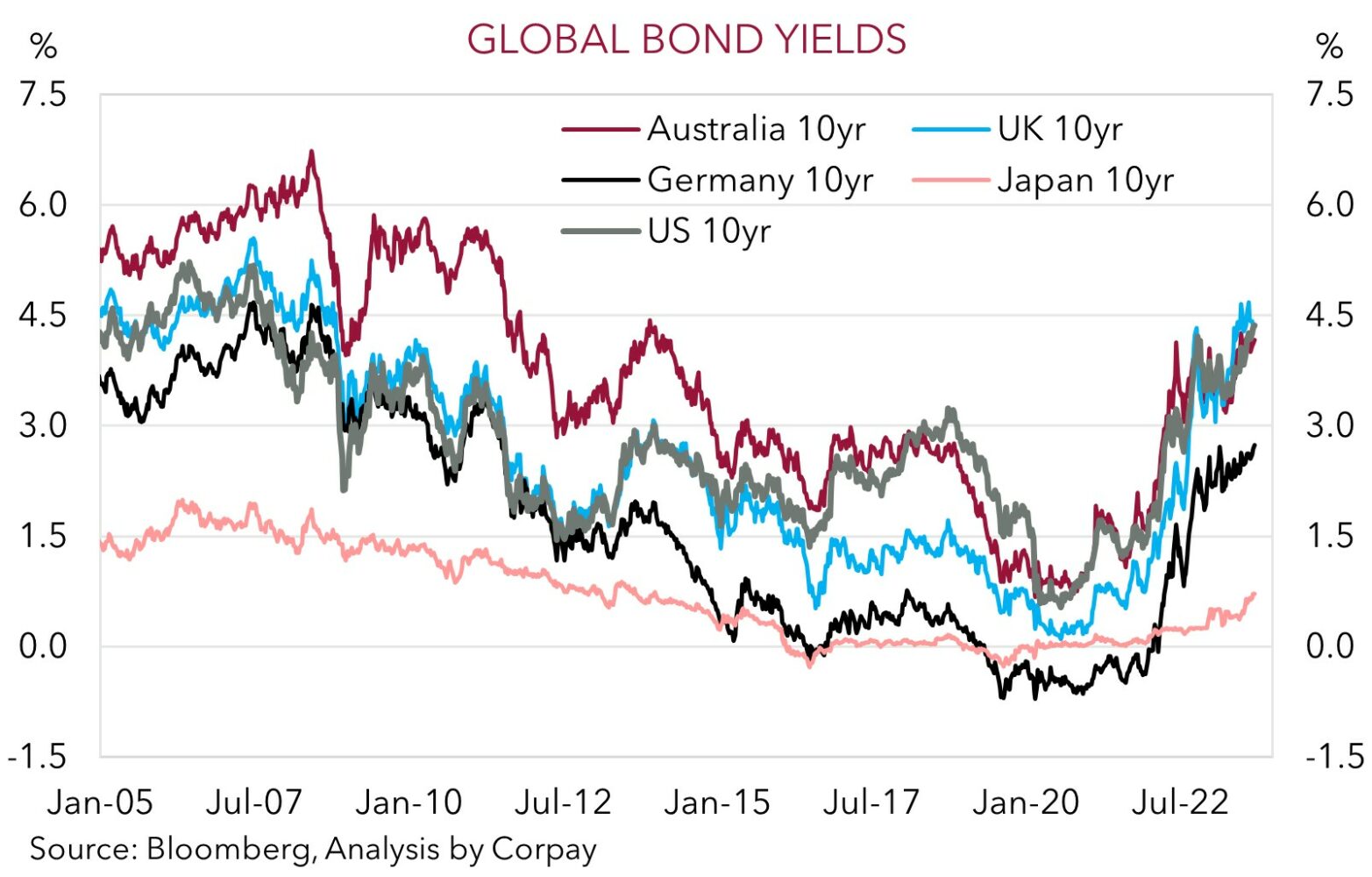

A few jitters across markets overnight ahead of tomorrows US Fed decision and press conference (4am and 4:30am AEST). Equities were flat to slightly lower (S&P500 -0.2%), with bond yields rising across the Eurozone and US. German yields rose ~3bps with the 10yr rate now up at 2.73%, the top of its multi-year range. In the US the 10yr yield increased by ~6bps to 4.36%, its highest level since late-2007. The upswing in oil prices and what this could mean for inflation over coming months remains front-of-mind. WTI crude (now ~US$91.20/brl) touched a ~10-month high before drifting back. As pointed out over recent days, the jump up in oil should generate a mechanical boost to global headline inflation over the near-term (WTI crude is up over ~36% from where it was tracking in mid-June). And at the same time, the added squeeze on budgets could further slow activity. Higher oil/petrol prices act like a tax by reducing the amount of disposable income available to spend.

Also adding to nerves and supporting the lift in bond yields was the higher-than-expected inflation data in Canada. Headline inflation accelerated to 4%pa, with the core measures also rebounding. Much of the strength was due to rising energy prices, but the stickiness in core inflation shows there is more to it and central banks still can’t let their guard down. Markets have moved to price in a 50/50 chance of another rate rise by the BoC at the next meeting in late-October, with a full hike now discounted by January. This shift gave the CAD some support. Elsewhere in FX, the USD index consolidated with the EUR (now ~$1.0680) range trading, USD/JPY ticking up slightly, and GBP hovering near its recent lows ahead of todays UK CPI data (4pm AEST) and tomorrow nights BoE announcement. AUD has nudged up modestly (now ~$0.6455) with firm energy prices helpful.

Attention now turns to the US Fed. Markets aren’t expecting a change with next to nothing factored into the rates curve, as such the Fed’s guidance and forecasts will be in focus. Upgrades to near-term US growth should flow through to the Fed reiterating that rates could rise again by year-end, but this will be driven by the data, and that policy will need to stay ‘restrictive’ for some time with the ‘dotplot’ projections possibly showing one less rate cut next year. This appears to be what consensus is anticipating and is what the interest rate market is already pricing in, hence it should be reflected in the USD and any knee-jerk strength is likely to be short-lived, in our view. The Fed could be moving to the markets view rather than the other way around.

AUD corner

The AUD has nudged up compared to this time yesterday (+0.3% to ~$0.6455) with firmer energy prices and some outperformance on the crosses generating some support. AUD/EUR (+0.4%) is tracking just under its 100-day moving average (~0.6073). As is AUD/GBP (its 100-day moving average sits at ~0.5226) ahead of today’s UK CPI data (4pm AEST) and tomorrow nights BoE decision (Thursday 9pm AEST). We think the BoE will deliver another 25bp rate rise, but based on the weakening UK growth pulse its forward guidance could be toned down suggesting the ‘peak’ in rates may have been reached. AUD/NZD is still sub ~1.09. We think AUD/NZD could dip back a bit further over the near-term given we see up upside risks to forecasts for NZ Q2 GDP (mkt +0.4%qoq, released Thursday 8:45am AEST).

The minutes of the early-September RBA meeting were released yesterday and didn’t move the interest rate expectations needle. According to the RBA’s updated language “some further tightening may be required should inflation prove more persistent than expected”. This suggests that upside surprises on inflation and ongoing labour market strength may be needed for the RBA to move again. The August monthly CPI is due next week, and the broader Q3 CPI is released on 25 October. The data could shift RBA interest rate expectations (and impact the AUD). Markets are assigning about a 50% chance of another RBA rate rise by February.

As discussed above, tomorrow’s US Fed decision and press conference is the next event risk. With the US Fed set to remain on hold, its forward guidance, updated forecasts, and comments by Chair Powell will be in focus. If the Fed repeats its current stance that rates may rise again by year-end and only fall back slowly next year, we think the USD could soften as markets have already priced this in. This in turn may give the AUD some support, in our opinion, particularly as the Fed’s growth and labour market projections are likely to show a ‘soft landing’.

Beyond the near-term gyrations, we continue to see the AUD edging higher from its current low levels over the medium-term. Indications that growth momentum in China is stabilising and that the outlook is improving given the stimulus support being rolled out should be a positive impulse on the AUD over time. As should Australia’s relatively better growth prospects next year on the back of the swelling population, and likelihood that the RBA lags the eventual global policy easing cycle due to the stickiness in key domestic inflation components and Australia’s slow moving wage dynamics (see Market Musings: AUD: Always darkest before the dawn).

AUD levels to watch (support / resistance): 0.6320, 0.6360 / 0.6541, 0.6611

SGD corner

USD/SGD has continued to consolidate with the pair tracking around ~1.3644. This is inline with the modest movement observed across the major currencies over the past few sessions (see above). On the crosses, EUR/SGD has held onto the gains that came through over the last two days (now ~1.4574), while SGD/JPY (now ~108.29) is still around the top of its long-term range.

As mentioned above, the market focus will be on tomorrow morning’s US Fed decision and press conference. The US Fed isn’t expected to make a policy change at this meeting with most anticipating Fed Chair Powell (and the updated forecasts) to reiterate that rates may rise again if the data warrants it and that settings will need to stay at ‘restrictive’ levels for an extended time for inflation to sustainably return to target. However, as this is largely already priced into rates markets, we believe the USD (and USD/SGD) may lose ground, particularly if the BoJ begins to suggest a policy tweak may soon be up for discussion and/or the European PMIs stabilise (both due Friday).

SGD levels to watch (support / resistance): 1.3403, 1.3477 / 1.3690, 1.3711