• Fed volatility. Fed delivered a ‘hawkish hold’. No policy change, but the projected 2024 easing cycle was pared back. US yields & USD rebounded.

• Higher for longer. Markets already look to be factoring in a ‘higher for longer’ view. Interest rate pricing remains above the Fed’s updated dots.

• AUD round trip. A bit of volatility, but on net the AUD is little changed. AUD has picked up against GBP ahead of tonight’s BoE meeting.

Markets endured some volatility overnight with moves in the lead up to the US Fed meeting reversing after the fact. Heading into the announcement, US bond yields and the USD were lower, with weaker than expected UK CPI inflation earlier in the day a drag on global rates as pricing for the remainder of the Bank of England hiking cycle was reduced. UK core inflation slowed to 6.2%pa, its slowest pace in 5-months. The UK data raises the odds the BoE holds rates steady at tonight’s meeting (9pm AEST). Markets are now discounting less than a 50% chance of a move. Even if the BoE hikes, we think it could give strong signals that the ‘peak’ has been reached. GBP has underperformed, and at ~$1.2345 it is near the bottom of its ~6-month range.

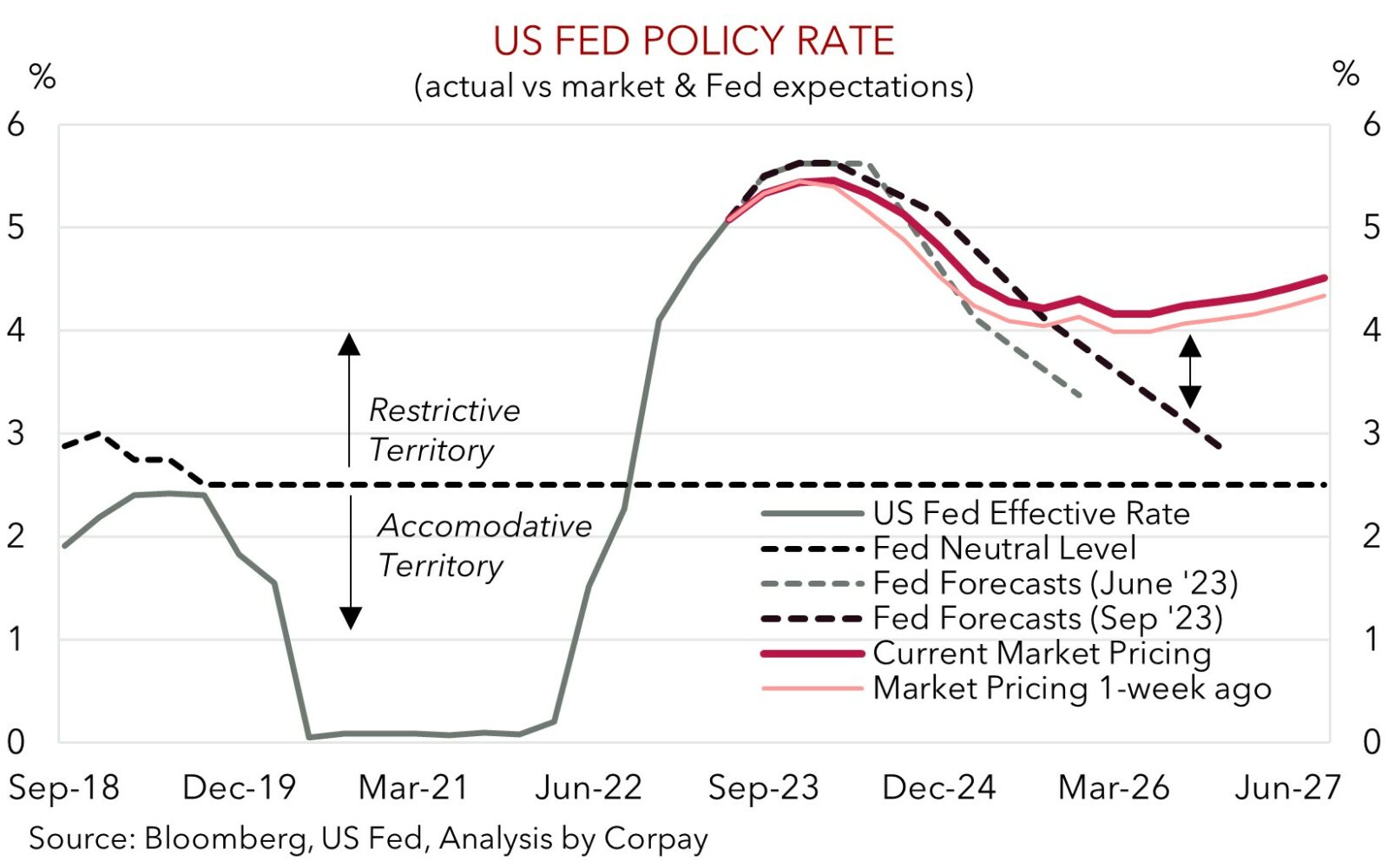

Market moves unwound in the wake of the US Fed, with the central bank delivering a ‘hawkish hold’. This was the expectation ahead of the event. Policy rates were kept steady, but the ‘higher for longer’ message was hammered home. On the back of upgrades to its US GDP forecasts, and only a gradual anticipated loosening in the labour market, the Fed’s ‘dotplot’ (i.e. its interest rate projections) was revised up. Another rate hike over the remaining two meetings of 2023 remains in its profile, but the forecasted easing cycle over 2024 was pared back. The Fed is now only penciling in ~50bps worth of rate cuts in 2024, compared to ~100bps previously. According to Chair Powell the Fed is “fairly close” to where they need to get to, the data will guide future decisions, and the risks are becoming more two-sided with the odds of over or under tightening becoming more equal given where policy now is.

In response to the Fed market volatility picked up. The US 2yr yield rose ~8bps, and at 5.18% it is at a cyclical high. The US 10yr increased ~5bps to 4.41%. US equity markets retreated (S&P500 -0.9%, NASDAQ -1.5%) and the USD index recovered. After moving up to ~$1.0740 pre the Fed, the EUR is back down at ~$1.0660 (where it was trading ~2-days ago). Similarly, USD/JPY rebounded (now ~148.20), and the AUD completed a round trip. After rising by ~0.9% earlier on, the AUD has fallen back to be little changed from this time yesterday (now ~$0.6450).

Interestingly, as our chart shows, the markets US Fed pricing has only changed slightly over the past week. This looks to have been more of a case of the Fed moving towards the market’s thinking, rather than the other way around. Notably, the markets longer-term outlook is still more ‘hawkish’ than the Fed with not as much easing priced in over the next ~2-years. This suggests that there is already a lot baked into the USD, and if the incoming data softens and longer-dated US rates turn down, it could lose ground.

AUD corner

The AUD has whipped around over the past 24hrs, trading in a ~1.1% range. But on net, at ~$0.6450 the AUD is little different from where it was a day ago with earlier gains unwound on the back of the US Fed driven recovery in the USD and dip in equities (see above). As outlined, while the US Fed delivered a ‘hawkish hold’ and trimmed back its future projected rate cutting cycle, interest rate pricing already reflects that. Indeed, as mentioned, the markets outlook remains more hawkish than the Fed, which in our view suggests a ‘higher for longer’ outlook should already be largely reflected in the USD, and in turn the AUD down at current low levels. Should the US economic data begin to underwhelm, which is where we think the risks reside based on the recent strong run and tighter conditions, we would expect US longer-dated interest rate expectations and the USD to give back some ground. This fits into our thoughts that the AUD should edge higher over the back end of this year and early 2024. Outside of the US, signs that growth momentum in China is stabilising and that the outlook is improving given the stimulus support being rolled out should be a positive impulse on the AUD over time. As should Australia’s relatively better growth prospects on the back of the population upswing, and likelihood the RBA lags the eventual global easing cycle due to the stickiness in domestic inflation and Australia’s slow moving wage dynamics (see Market Musings: AUD: Always darkest before the dawn).

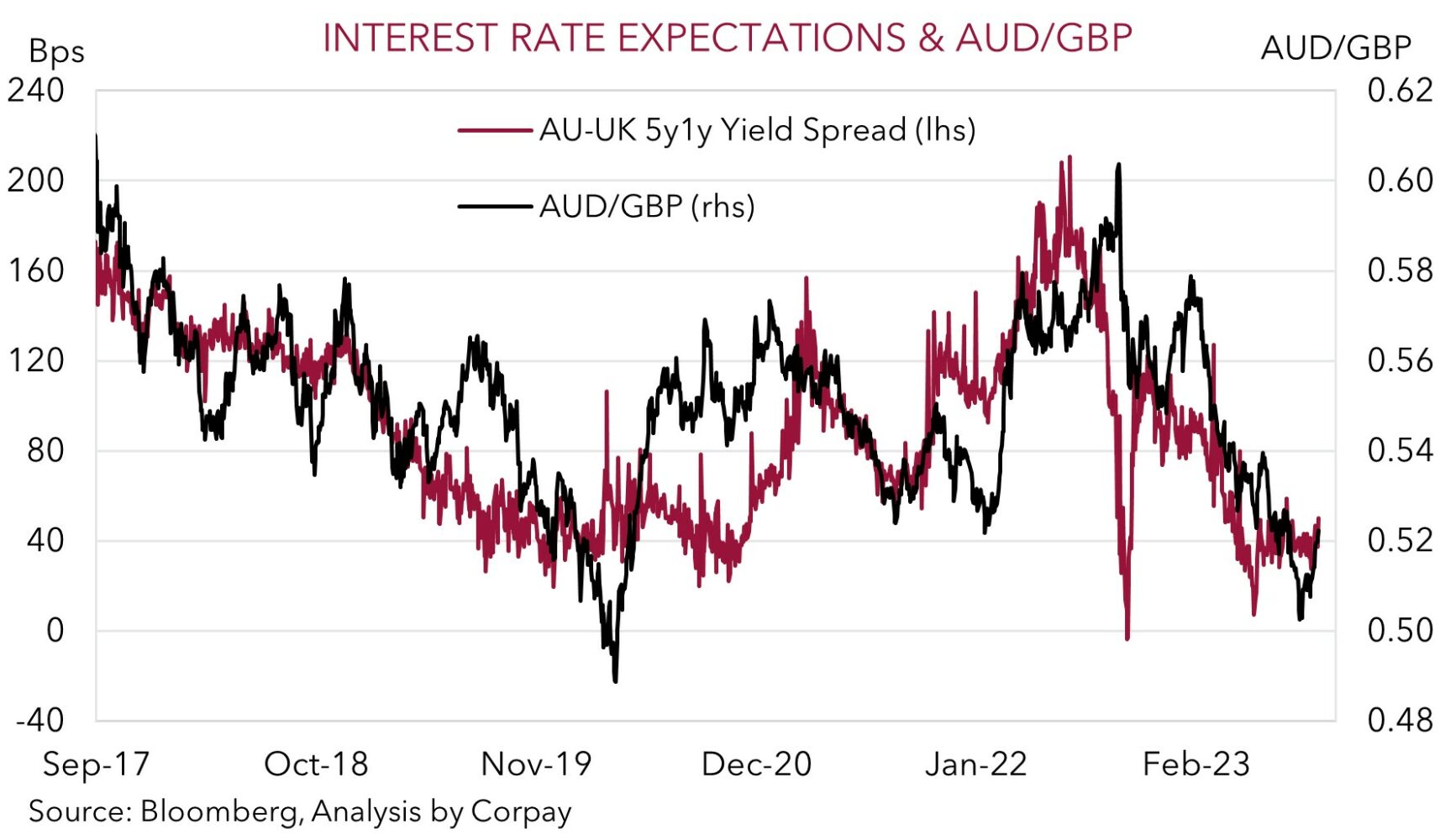

On the crosses, the AUD has ticked up further against the weaker GBP. Ahead of tonight’s BoE meeting (9pm AEST), where there is a risk the central bank keeps rates on hold, AUD/GBP is up near its 100-day moving average (~0.5225). The adjustment in relative interest rate expectations has supporting the pair over the past few weeks. Our medium-term view is for AUD/GBP to continue to edge higher as the UK economy underperforms on the back of aggressive BoE tightening that has been put through.

AUD/NZD has eased down towards 1.0850. Data released this morning showed NZ GDP was much stronger than predicted in Q2. The NZ economy returned to growth expanding by 0.9%qoq (mkt 0.4%). We had been flagging the risk of an upside surprise over the past few days given the payback for the capacity-constrained and Cyclone restricted growth at the turn of the year, and because of the volume boost from the sharp increase in NZ’s population. The positive result could see markets pare back their expectations looking for RBNZ rate cuts next year. AUD/NZD, which already looks to be tracking a bit too high compared to the AU-NZ two-year swap spread, may fall back further near-term with the 200-day moving average (~1.0820) in its sights.

AUD levels to watch (support / resistance): 0.6320, 0.6360 / 0.6541, 0.6611

SGD corner

As per the other major currencies and the swings in the USD, USD/SGD experienced a bout of volatility over the past 24hrs, with the US Fed announcement the key driver (see above). But on net, at ~1.3653 USD/SGD is only slightly up from where it was trading this time yesterday. On the crosses, EUR/SGD has eased back slightly to be down around where it was trading on Monday (now ~1.4550), while SGD/JPY (now ~108.59) is hovering near historic highs.

As discussed above, the US Fed delivered a ‘hawkish hold’. Interest rates were kept steady but the Fed’s projections were revised to show less policy easing over 2024 given the upgrades to US growth and less expected deterioration in the labour market. That said, a ‘higher for longer’ view is already reflected in the markets interest rate outlook. As such, we think the USD (and USD/SGD) could struggle to add to their gains. The USD remains at risk of a softening in the US economic data, in our view, and we believe it could also weaken if the BoJ begins to suggest a policy tweak may soon be up for discussion and/or the European PMIs improve (both due Friday).

SGD levels to watch (support / resistance): 1.3404, 1.3477 / 1.3690, 1.3711