• Negative sentiment. Fed’s ‘higher for longer’ forecasts have continued to wash through. Long-end bond yields rose again. Equities dipped. USD consolidated.

• BoE surprise. Following the weaker UK CPI the BoE surprised by keeping rates on hold. GBP weakened with markets starting to price in a rates ‘peak’.

• AUD softer. AUD slipped back over the past 24hrs. AUD/JPY has fallen by ~1%. The BoJ is today. Could it spring a ‘hawkish’ surprise?

Risk markets have generally remained on the defensive with long-end bond yields continuing to push higher as the US Fed’s ‘higher for longer’ mantra continues to sink in. Yield curves have steepened with 10yr bond yields approaching or touching fresh cyclical highs in many nations. The US 10yr rate rose another ~9bps to now be at 4.49%, the highest since Q4 2007. The German and UK 10yrs increased by 4bps and 8bps respectively, despite the BoE’s ‘dovish’ turn (see below). A surprising fall in US initial jobless claims, a real-time read on the state of the labour market, compounded the Fed’s hawkish vibes from a day earlier. Jobless claims fell to 201,000, the lowest since the start of the year, a sign job creation remains solid and that inflation could linger particularly with oil prices elevated. Although it is below recent highs at ~US$89.60/brl WTI crude is ~34% above its mid-June levels. This will be a mechanical boost to headline CPI over future months.

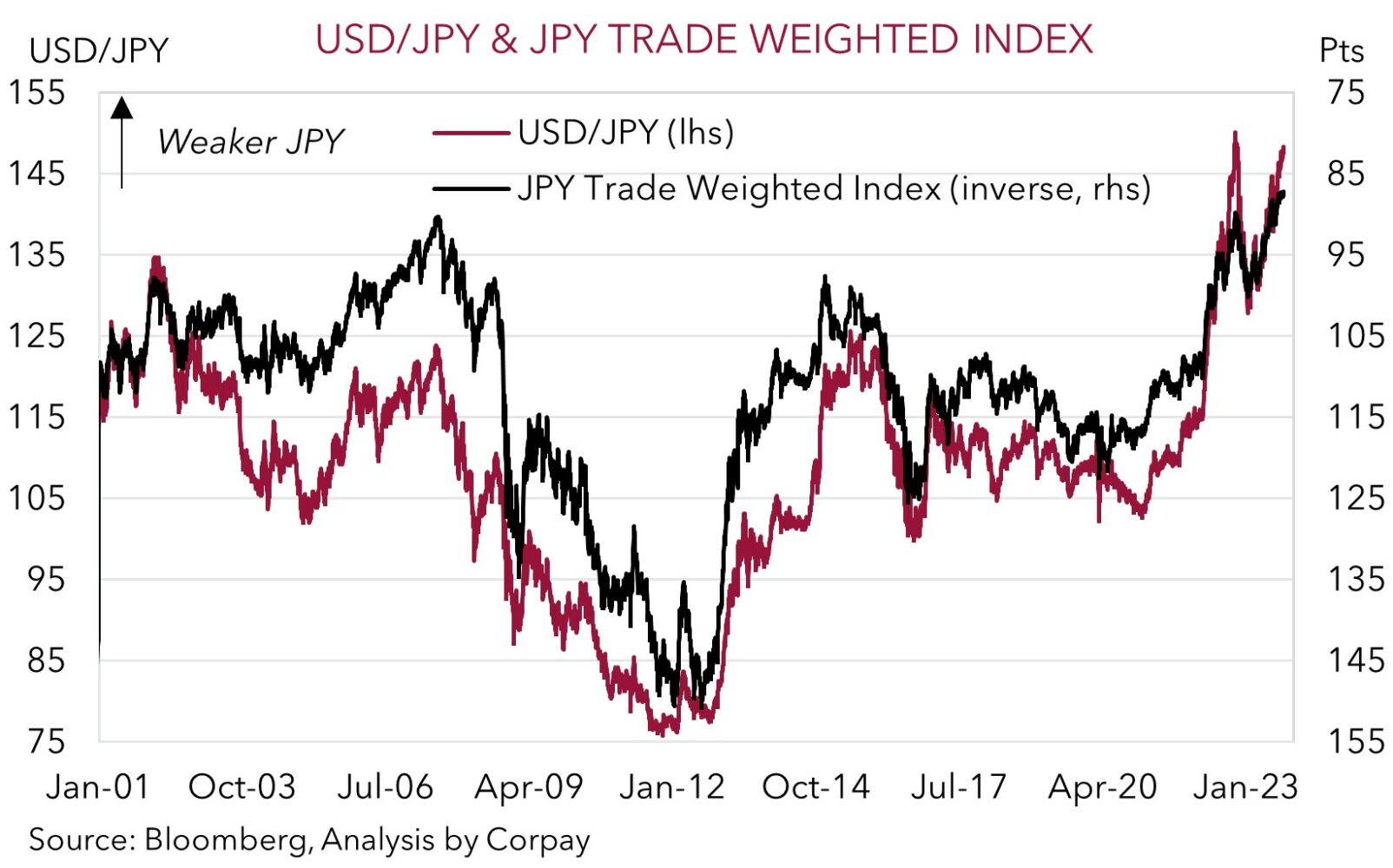

The rise in bond yields has weighed on equities with falls coming through across Europe and the US. The US S&P500 declined by 1.6%. Unless there is a turnaround the S&P500 is on track to record its second consecutive monthly decline, something that hasn’t happened since this time last year. Across FX markets there was a bit of volatility, but on net the USD index has consolidated with EUR stabilising (now ~$1.0660), AUD finding some support above yesterday’s lows (now ~$0.6413), and USD/JPY losing ground on the back of the shaky risk sentiment and ahead of today’s Bank of Japan meeting. No policy change is expected today, but we think the odds of a shift by the BoJ over coming meetings are growing. The BoJ’s ultra-accommodative policy stance looks untenable, in our view. Core inflation is running north of 4% (the highest since the early-80s), and the excessively weak JPY only adds to the challenge given it lifts imported prices. The yen real effective exchange rate fell to a record low in data going back to 1970. A tweak today or indications a change is looming could give the JPY a broad-based boost, and this could be a USD negative since USD/JPY is the second most traded pair.

Elsewhere, GBP has weakened with GBP/USD (now ~$1.2295) trading around its lowest since late-March. Not all central banks are created equal. Following on from the weaker than anticipated UK CPI the BoE surprised markets by keeping rates steady at 5.25%. The BoE had raised rates at the previous 14 meetings. Although it maintained a tightening bias, we believe the ‘pause’ could become a ‘full stop’ due to signs the UK economy is starting to buckle. With markets beginning to price in a ‘peak’ BoE rate GBP’s struggles may continue due to slowing UK growth and structural headwinds such as the wide current account deficit.

AUD corner

After losing some more ground yesterday in the aftermath of the US Fed’s ‘hawkish hold’ and firmer USD, the AUD consolidated overnight just above its lows (now ~$0.6413). That said, the negative risk sentiment, as illustrated by the dip in equities, exerted some downward pressure on the AUD crosses. AUD/EUR (-0.5%) has slipped back down towards ~0.60, AUD/CNH is sub-4.70, and AUD/NZD is back under its 200-day moving average (~1.0822) with yesterday’s stronger than expected Q2 NZ GDP raising some doubts the RBNZ’s tightening cycle is over. AUD/GBP has held up (now ~0.5216) with the BoE’s surprise move to keep rates on hold an offsetting factor. Our medium-term view is for AUD/GBP to edge higher as the UK economy underperforms on the back of the aggressive BoE tightening that has been put through.

AUD/JPY has also declined (-1% to ~94.60) with the risk backdrop JPY supportive ahead of today’s BoJ decision (no set time). As mentioned above, while we believe the BoJ isn’t likely to change policy today there is a growing chance it happens sooner than people think due to the upswing in Japanese inflation and very weak JPY. In our opinion it remains a matter of when, not if, the BoJ’s moves along the policy normalisation path. Signs from the BoJ that the door to an adjustment is opening would be JPY supportive. This would further drag on AUD/JPY, but the moves in USD/JPY could also wash through to a higher AUD/USD.

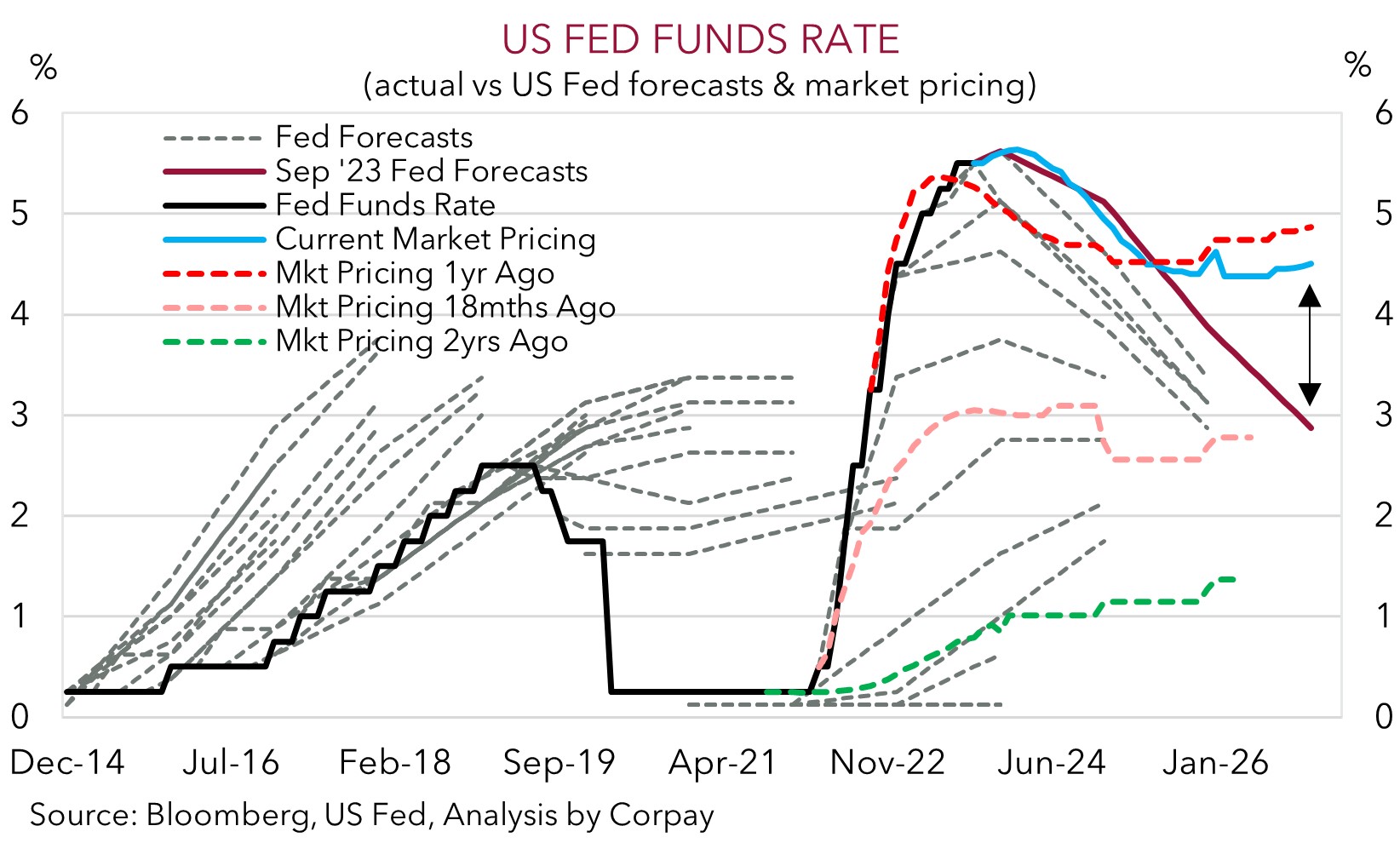

More broadly, as discussed yesterday, while the US Fed trimmed back its future projected rate cutting cycle, we feel markets may be overly focused on the updated guidance. As our chart shows, the Fed’s track record of forecasting where things could end up has been poor for some time. And on top of that the markets outlook is already more ‘hawkish’ than the Fed’s. As such a ‘higher for longer’ rates outlook should arguably already be largely reflected in the USD, and in turn the AUD down at current low levels. We continue to think that if the US economic data begins to undershoot predictions, which is where we think the risks reside based on the recent strong run, longer-dated US rate expectations and the USD may start to soften. In addition to the BoJ announcement, the Eurozone (6pm AEST), UK (6:30pm AEST) and US (11:45pm AEST) PMIs for September are also released today.

SGD corner

USD/SGD exhibited some volatility overnight, but on balance, at ~1.3673 the pair is only fractionally higher compared to this time yesterday. USD/SGD is tracking around its highest level since late-November. On the crosses, EUR/SGD has ticked up (now ~1.4570) to be back trading near where it was two days ago, while SGD/JPY (now ~107.96) has fallen with the bout of risk aversion supporting the JPY (see above).

As outlined above, the US Fed’s ‘hawkish hold’ has continued to flow through markets with long-end bond yields pushing higher across Europe and the US. That said, we think markets may be getting overexcited with the US Fed’s updated projections. Short-term rates markets already look to have more than factored in a ‘higher for longer’ view with rate expectations for 2024 and 2025 tracking above the Fed’s forecasts. As such, we think the USD (and USD/SGD) could struggle to add to its gains. In our opinion, the USD appears at risk of a softening in the US economic data, and we think it could also weaken if the BoJ begins to open the door to a policy change and/or the European PMIs improve (both due today).