• Negative vibes. Bond yields eased back & US equities continued to lose steam. The global PMIs illustrated ongoing sluggish growth momentum.

• USD mixed. GBP remains on the backfoot as markets price in ‘peak’ rates. USD/JPY rose after the BoJ held steady. AUD ticked a bit higher.

• Event radar. Locally, monthly CPI & retail sales due this week. Offshore, EZ CPI & US PCE data released. Risk of another US government shutdown also rising.

The upswing in bond yields paused for breath on Friday and equity markets continued to lose steam. US and UK 10yr yields ended Friday ~6bps lower (now 4.44% and 4.25% respectively), while the German 10yr finished little changed (now 2.74%). US and European equities declined by ~0.1-0.2%. On the back of its weak run the US S&P500 fell 2.9% last week. This was its 3rd straight weekly loss, and means the index is now back where it was trading in late-June and just over 6% below its July peak. Growth concerns mixed with a ‘higher for longer’ interest rate outlook is dampening risk appetite. The latest batch of PMI reports illustrated still lackluster growth momentum with manufacturing stuck in ‘contractionary’ territory across the US, Eurozone, and UK. And in contrast to the slight improvement in the Eurozone measure, US and UK services activity softened in September. Added to that the rebound in UK retail sales following the sharp falls in July was less than expected as cost of living pressures continue to bite.

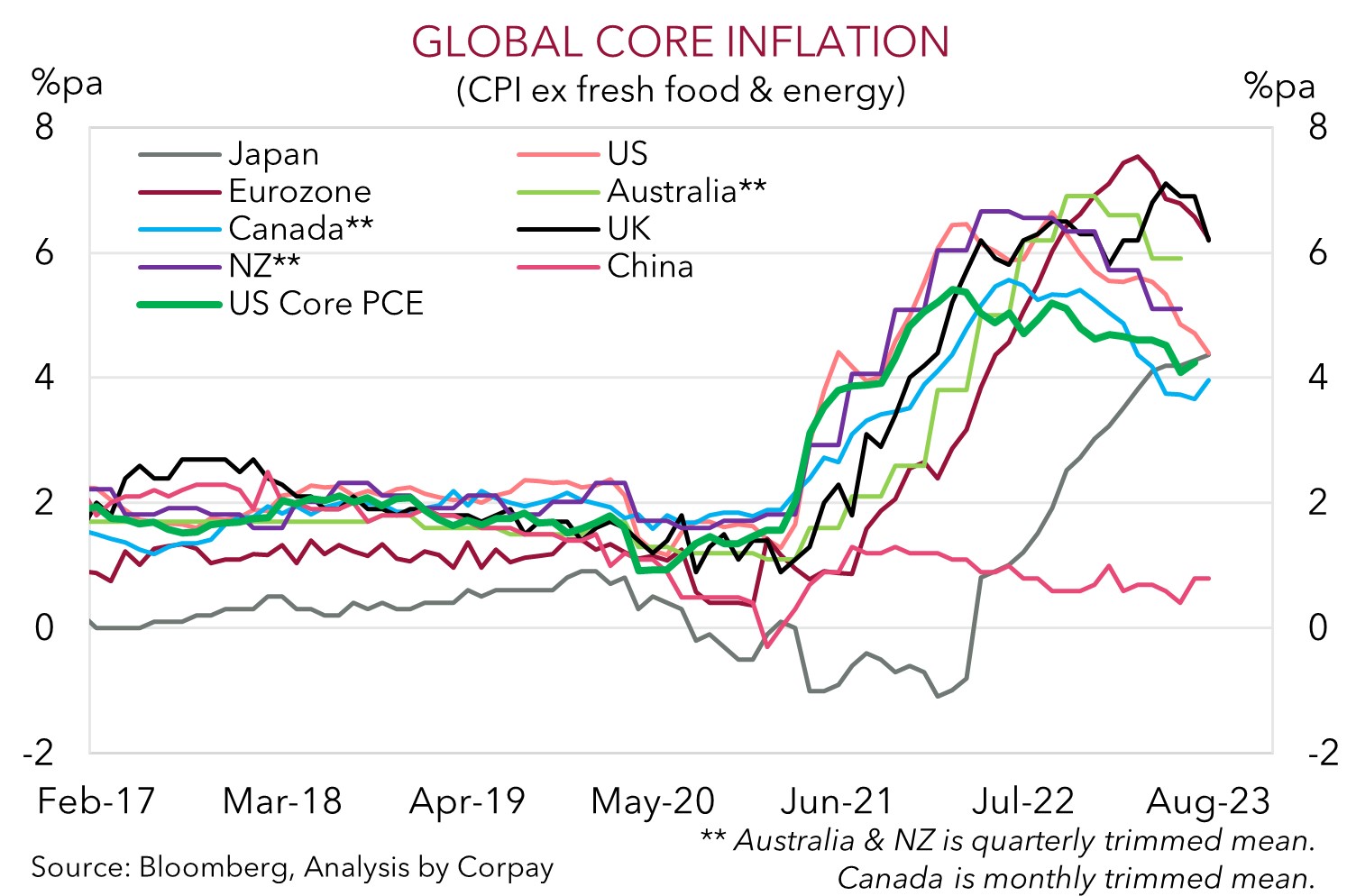

These trends were reflected in FX markets with GBP remaining on the backfoot as the weak data reinforced expectations UK interest rates may have ‘peaked’. At ~$1.2255 GBP/USD is near its lowest since late-March. EUR consolidated (now ~$1.0651), and USD/JPY rebounded back up to where it was trading on Thursday (now ~148.30) after the Bank of Japan maintained its ‘dovish’ policy stance at Friday’s meeting despite the stronger Japanese inflation pulse. As our chart shows Japanese core inflation (which is running north of 4%pa) is little different to its peers. In our mind the BoJ’s ultra-accommodative position looks untenable, and it is a matter of when, not if, incremental changes are made. The late-October BoJ meeting (where new macro forecasts will be available) could be a jumping off point. The crosscurrents helped the USD Index track sideways. AUD nudged up (now ~$0.6440), supported by strong gains in Chinese equities (CSI300 +1.8%) and a firmer CNH.

Globally, attention this week will be on the latest Eurozone CPI and US PCE deflator data (both Friday), comments by Fed Chair Powell (Friday morning AEST), and the risk of another US government shutdown. Current spending laws expire on 30th September, so without action the US government will shutdown on 1st October. If no deal is reached this week hundreds of thousands of US federal government workers are set to be furloughed until an agreement is struck. The political divide is making negotiations difficult. At current lofty heights, we believe a lot of positives are factored into the USD. Hence, we think another US shutdown could take some of the heat out of elevated US rate expectations and the USD given it would be a negative growth shock that compounds the drag stemming from the widening strike by auto workers, and with the US core PCE deflator set to slip below 4%pa for the first time since Q3 2021. The PCE deflator is the US Fed’s preferred inflation gauge.

AUD corner

The AUD clawed back some ground rising by ~0.4% against the USD (now ~$0.6440) on Friday and outperforming on most of the major crosses. The strong lift in Chinese equities and firmer CNH was AUD supportive, with softer data and policy developments negatives on the other side of the ledger (see above). AUD/EUR (+0.5% to ~0.6045) is hovering just below its 100-day moving average, while AUD/JPY (+0.9% to 95.48) is back up near its September highs following the BoJ’s decision to hold steady once again at Friday’s meeting. AUD/GBP has added to its gains (+0.7%) and at ~0.5255 is near a ~2-month high. Our medium-term view is for AUD/GBP to keep edging higher as the UK economy underperforms on the back of the aggressive BoE tightening that has been put through.

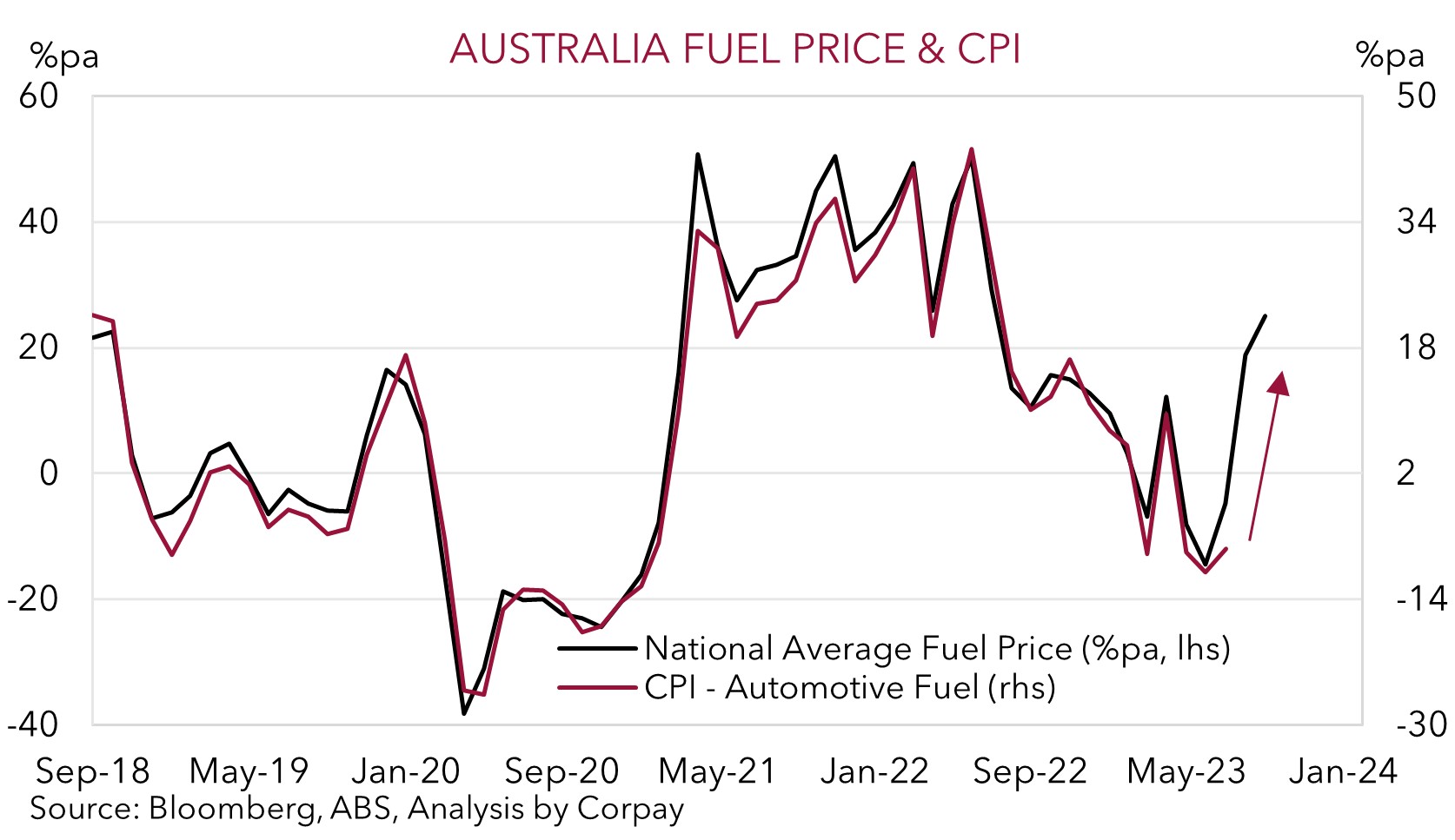

We think the AUD’s bounce back can extend this week, particularly on the crosses. Locally, the monthly CPI indicator for August is released (Weds) and the latest retail sales data is due (Thurs). The sharp lift in petrol over the past few months, the weaker AUD and its flow-through to imported prices, and stickiness across services inflation (which will be better captured in this month’s CPI data) points to a meaningful re-acceleration in annual inflation. We see upside risks to the market’s forecasts (mkt 5.2%pa from 4.9%pa in July). Added to that retail sales may post another positive result (mkt +0.3%) with the boost to spending on services related to the Women’s Football World Cup more than offsetting the impact from higher mortgage costs. In our opinion, solid spending data and/or a jump up in inflation could generate an AUD supportive jolt on near-term RBA rate hike expectations. Markets are only assigning a ~38% chance of another 25bp hike by November. Offshore, as outlined, we think the USD could soften if the political divide sees the US government shutdown once again, and the mix of a potential negative growth hit and slower US core PCE deflator exerts some downward pressure on longer-dated US interest rate pricing.

Overall, this fits into our thoughts that a lot of negatives are factored into the AUD down near current levels and that the AUD should drift higher over the back end of 2023 and early 2024. Outside of the US, signs growth momentum in China is turning the corner given the stimulus support being rolled out should be an AUD positive over time. As should Australia’s relatively better growth prospects due to the burgeoning population, and likelihood the RBA lags the eventual global easing cycle given domestic inflation pressures and Australia’s slow moving wage dynamics (see Market Musings: AUD: Always darkest before the dawn).

AUD levels to watch (support / resistance): 0.6320, 0.6360 / 0.6516, 0.6601

SGD corner

USD/SGD remained range bound on Friday, in line with the consolidation in the USD Index (see above). That said, at ~1.3660 USD/SGD remains near its highest level since late-November 2022. On the crosses, EUR/SGD (now ~1.4570) is tracking just above its 200-day moving average, while SGD/JPY (now ~108.62) rebounded to its historic highs on the back of the softer JPY following the ‘on hold’ BoJ meeting outcome (see above).

As mentioned above, the global focus this week will be on the Eurozone CPI and US PCE deflator data (Friday), comments by Fed Chair Powell (Friday), and the risk of another US government shutdown (from 1st Oct). In our opinion, another US government shutdown coupled with the ongoing auto workers strike poses a near-term growth challenge for the US economy. These risks, in conjunction with a projected slowdown in the US core PCE deflator could see markets reduce their now elevated longer-term US interest rate expectations. If realised, we believe this could generate some downward pressure on the USD (and USD/SGD) over the period ahead.

SGD levels to watch (support / resistance): 1.3471, 1.3504 / 1.3690, 1.3711