• Quiet markets. US equities flat, bond yields mixed. AUD consolidates. Markets in a holding pattern ahead of this weeks offshore central bank meetings.

• ECB signals. EUR a bit firmer following reports the ECB is looking at ways to mop up the QE driven excess liquidity in the banking system.

• Local trends. RBA minutes today. Population growth is booming. GDP is a volume measure. This can partially offset the drag from higher rates.

It has been a quiet start to what could be a busy week given the upcoming central bank meetings. European equities played a bit of catch up following the falls in the US on Friday and some major Asian markets yesterday. The EuroStoxx50 declined by 1.2%, while the US S&P500 ended the overnight session little changed. In bonds European yields ticked up ~3-4bps with media reports the European Central Bank may soon start to discuss how to mop up the trillions of euros worth of excess liquidity sloshing around in the banking system after years of quantitative easing a factor as this is another way of tightening monetary conditions. In the US it was more mixed with the yield curve flattening after the 2yr rate rose (+2bps to 5.05%) and the 10yr dipped (-3bps to 4.30%). Nevertheless, the US 10yr yield remains elevated and is within striking distance of its cyclical peak.

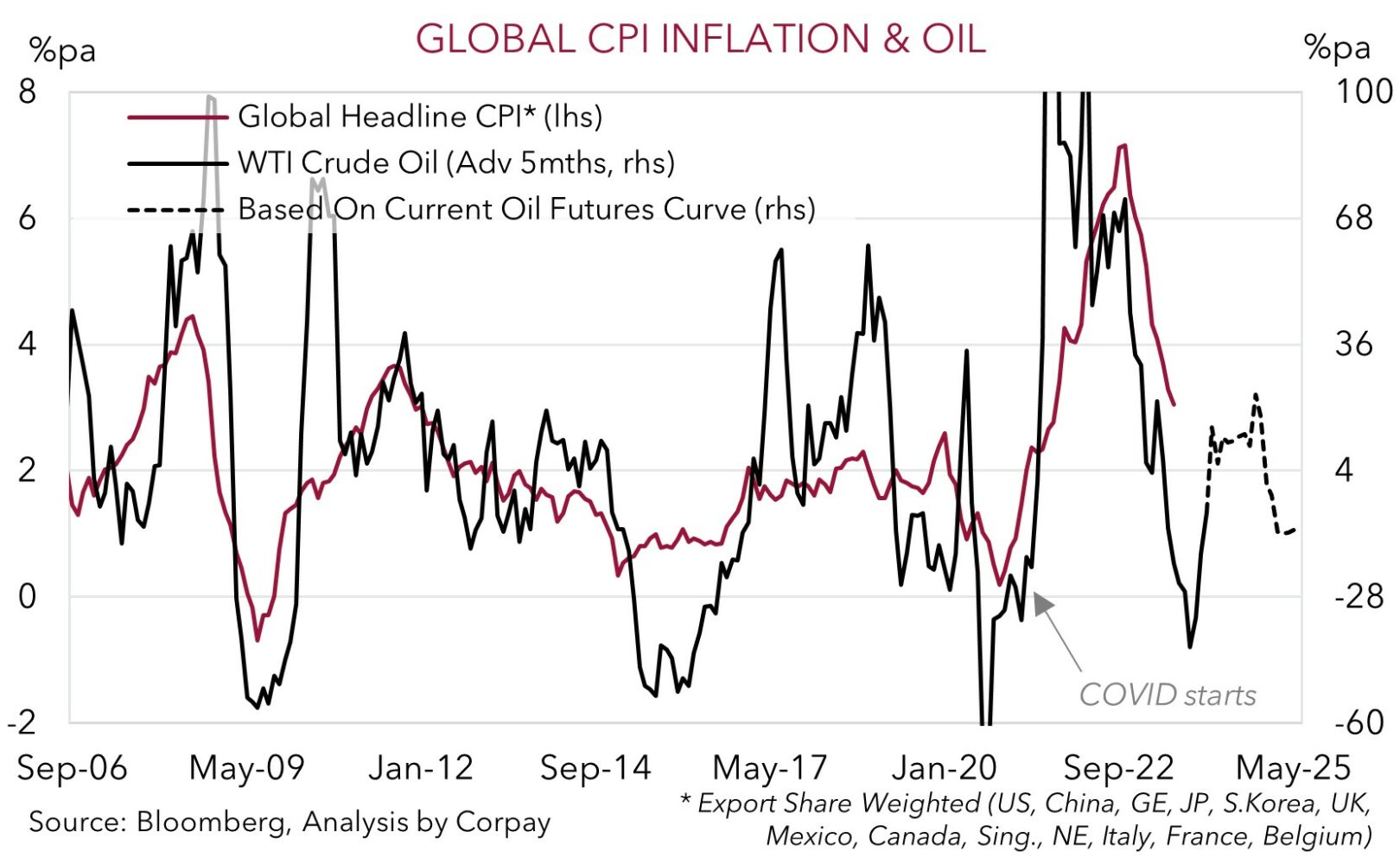

Across commodities, the upswing in oil has continued. Brent crude is now just under US$95/brl, nearly 33% above where it was tracking in mid-June. As stated previously (and shown below), this will be a mechanical boost to global headline inflation over the next few months. And although it should be a ‘known known’ it may lead to bouts of volatility as markets are caught by surprise. In FX, the USD index softened slightly with EUR edging back up towards ~$1.07 and USD/JPY a touch lower (-0.1% to ~147.60). AUD (now ~$0.6437) and NZD (now ~$0.5915) have consolidated.

The US Fed announcement and press conference (Thurs 4am and 4:30am AEST), and the Bank of England (Thurs 9pm AEST) and Bank of Japan (Friday AEST) decisions are in the spotlight this week. Only the BoE is likely to move, though this is well discounted with markets assigning a ~80% chance of another increase this week and nearly 40bps of hikes factored in by early-2024. Given market pricing we think GBP may underperform if the BoE delivers a ‘dovish’ hike by signaling it is becoming more data dependent. In the US, the Fed is broadly expected to keep rates steady. The Fed’s guidance and forecasts will be in focus. Upgrades to near-term US growth should flow through to the Fed reiterating that rates could rise again near-term, but this will be driven by the data, and that policy will need to stay ‘restrictive’ for some time. That said, in our view, the ‘higher for longer’ view is somewhat baked in given 2024 rate expectations are already above the Fed’s projections. We believe the USD could lose ground if the Fed rehashes its messaging, especially if the BoJ begins to open the door to tweaks at future meetings and/or the European data improves.

Global event radar: US Fed Meeting (Thurs), Bank of England Meeting (Thurs), Bank of Japan Meeting (Fri), Eurozone/US PMIs (Fri), Eurozone CPI (29th Sep), China PMIs (30th Sep).

AUD corner

The AUD has remained range bound over the past 24hrs and is little different from where it was tracking this time yesterday (now ~$0.6437). On the crosses, the AUD has given back a bit of ground. A slightly firmer EUR following the uptick in European bond yields has pushed AUD/EUR a little lower (-0.3% to ~0.6019). AUD/NZD has also slipped back under ~1.09. We think AUD/NZD risks falling further over the near-term given we see up upside risks to consensus forecasts for NZ Q2 GDP (mkt +0.4%qoq, released Thursday).

The minutes of the early-September ‘on hold’ RBA meeting are released today (11:30am AEST). We expect the minutes to repeat the RBA’s mild conditional tightening bias, hence they are unlikely to impact the AUD. Rather the upcoming offshore central bank meetings (US Fed (Thurs morning AEST), BoE (Thursday night AEST), and BoJ (Friday AEST)) may be more influential. As outlined, with the US Fed set to remain on hold this week, its forward guidance and updated macro projections will be in the spotlight. Outcomes relative to expectations drive markets. Hence, if the US Fed repeats its current stance that rates may rise again by year-end and only fall back slowly next year, we think the USD could soften as markets have already priced this in. This in turn may give the AUD some support, in our view.

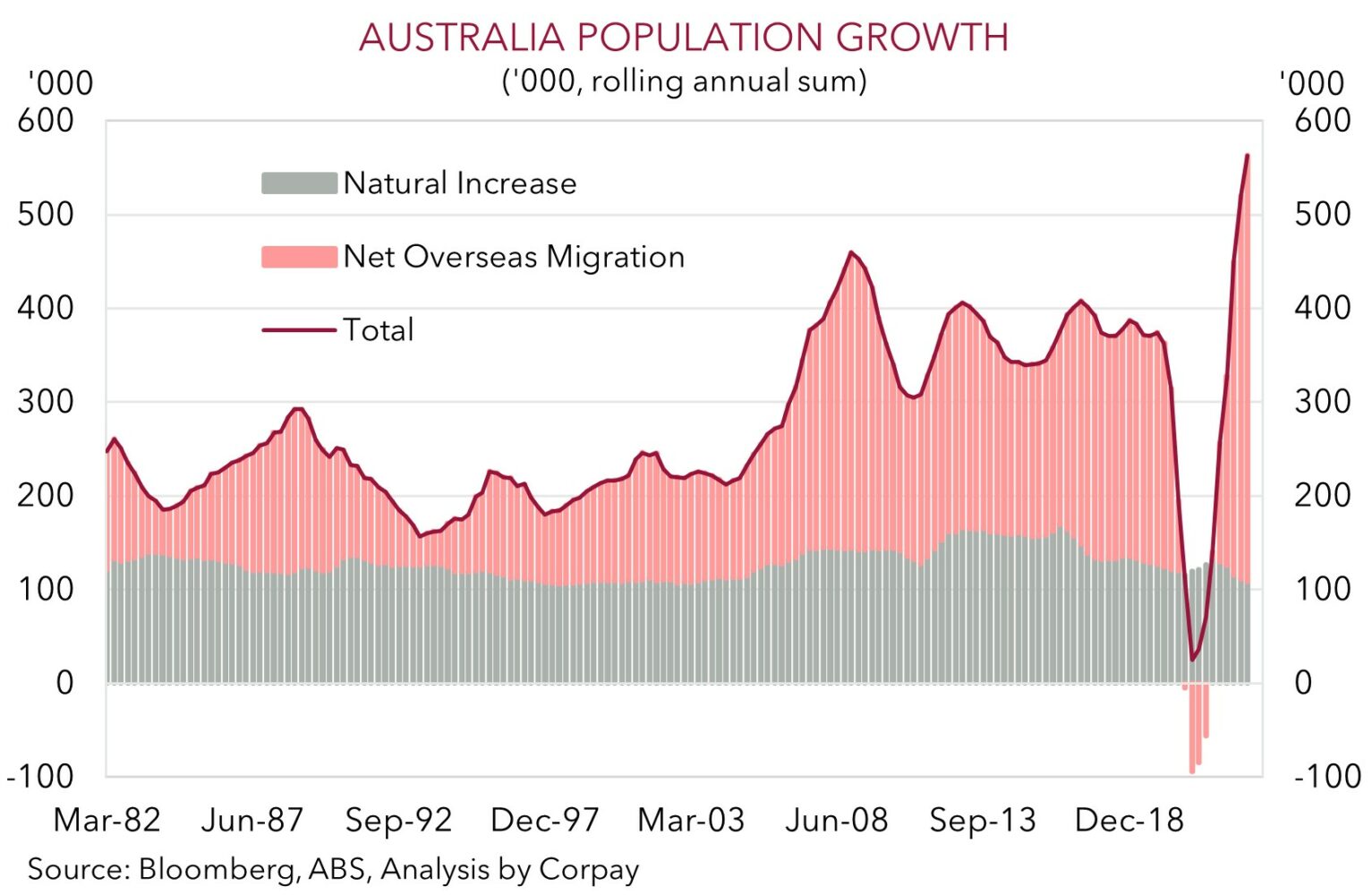

Over the medium-term we continue to see the AUD edging higher from its current low levels. Signs that growth momentum in China may be bottoming out, especially with policymakers continuing to push through stimulus measures, should underpin commodity demand, regional growth, and the AUD, in our opinion. Added to that, while many Australian households and business are feeling the pinch from higher borrowing costs, the population boom is an offsetting force for aggregate demand. As our chart shows, following the reopening of international borders, net overseas migration has snapped back. Over the past year the population has, on average, grown by ~47,000 per month. This is a double-edged sword. Although more supply can help lessen the shortages in the labour market, more people also adds to strains in other areas such as housing. Rents are rising briskly, and this is a sticky part of the inflation basket. This suggests that the door to another RBA rate rise can’t be completely closed. We believe this pricing, combined with relatively more favourable growth expectations for Australia over 2024, should be AUD supportive (see Market Musings: AUD: Always darkest before the dawn).

AUD event radar: US Fed Meeting (Thurs), Bank of England Meeting (Thurs), Bank of Japan Meeting (Fri), Eurozone/US PMIs (Fri), AU CPI (27th Sep), AU Retail Sales (28th Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

AUD levels to watch (support / resistance): 0.6320, 0.6360 / 0.6547, 0.6615

SGD corner

USD/SGD has held steady over the start of the new week with the pair hovering near ~1.3635. This is inline with the limited moves across the major currencies overnight (see above). On the crosses, the uptick in European bond yields on the back of reports the ECB is starting to think about steps to reduce excess liquidity in the banking system has seen EUR/SGD nudge higher (now ~1.4576). By contrast, ahead of this Friday’s BoJ meeting, SGD/JPY (now ~108.26) remains historically high.

As discussed above and yesterday, central banks decisions and commentary will be in focus later this week with the US Fed (Thursday morning), BoE (Thursday night), and BoJ (Friday) meetings on the radar. The US Fed is expected to remain on hold, though most analysts see Chair Powell repeating the view that rates may need to rise again (if the data warrants it), and that policy may need to remain ‘restrictive’ for some time to tackle inflation. But, as this is well known and factored into rates markets, we believe a repeat of this message could see the USD (and USD/SGD) ease back, particularly if the BoJ begins to suggest a policy adjustment may soon be up for discussion and/or the European PMIs stabilise (released Friday).

SGD event radar: US Fed Meeting (Thurs), Bank of England Meeting (Thurs), Bank of Japan Meeting (Fri), Eurozone/US PMIs (Fri), Singapore CPI (25th Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

SGD levels to watch (support / resistance): 1.3402, 1.3466 / 1.3690, 1.3711