• Fed thinking. Minutes of the last Fed meeting had a ‘hawkish’ tinge. “Almost all” think more tightening is needed. US yields higher & USD firm.

• AUD underperforms. AUD weighed down by the lift in US yields, shaky risk sentiment, & weaker CNH. AUD headwinds remain, in our view.

• US data. ADP employment, initial jobless claims, JOLTs job openings, & ISM services index released tonight. US non-farm payrolls due tomorrow.

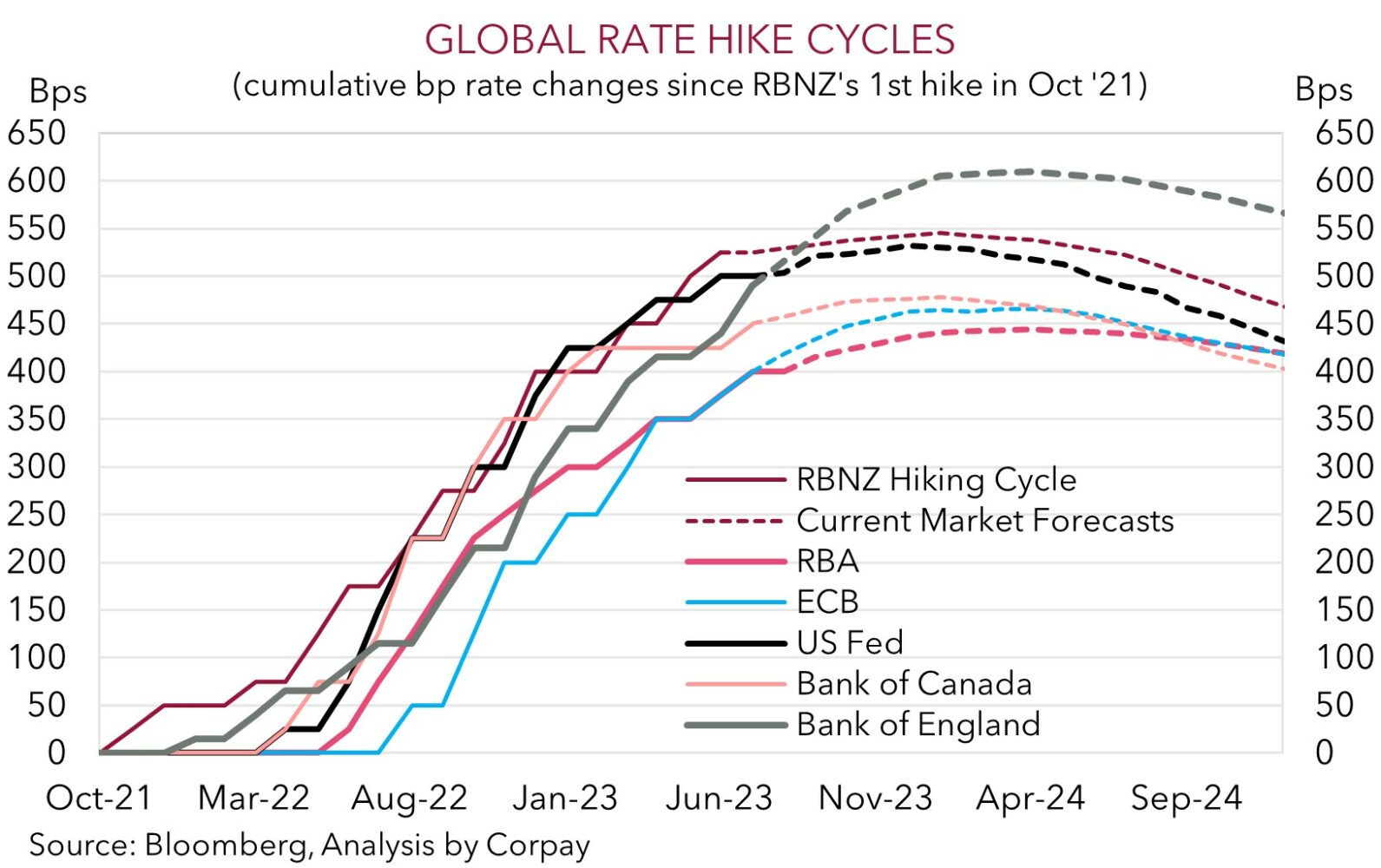

With the US back on deck markets were more lively overnight. The minutes of the last US FOMC meeting were in focus, and as we had expected there was a ‘hawkish’ tinge to them. The June on hold decision by the US Fed was clearly a ‘skip’ rather than the end of the line. Indeed, while the decision was reported as being unanimous, the minutes noted that “some” members had favoured a hike, and looking ahead “almost all” participants said that additional rate rises would be appropriate given the tightness in the labour market and high/sticky inflation. In its updated central view in June the Fed had penciled in another two rate rises over the remaining four meetings of the year. Odds of another hike at the late-July meeting are currently sitting at ~85%, with markets still not fully factoring in the Fed’s baseline assumption.

US bond yields rose, with the 10-year up ~8bps to 3.93% (highest since early-March). And with the US 2-year holding fairly steady near ~4.95%, the yield curve steepened. Equity markets eased back. The US S&P500 (-0.2%) relatively outperformed the major European indices (EuroStoxx50 -0.9%). The negative lead from Asia yesterday (Hang Seng -1.6%) following some more underwhelming economic news out of China dampened sentiment. China’s Caixin Services PMI fell more than predicted, declining to 53.9 (a low since January). This is more evidence that China’s recovery is faltering.

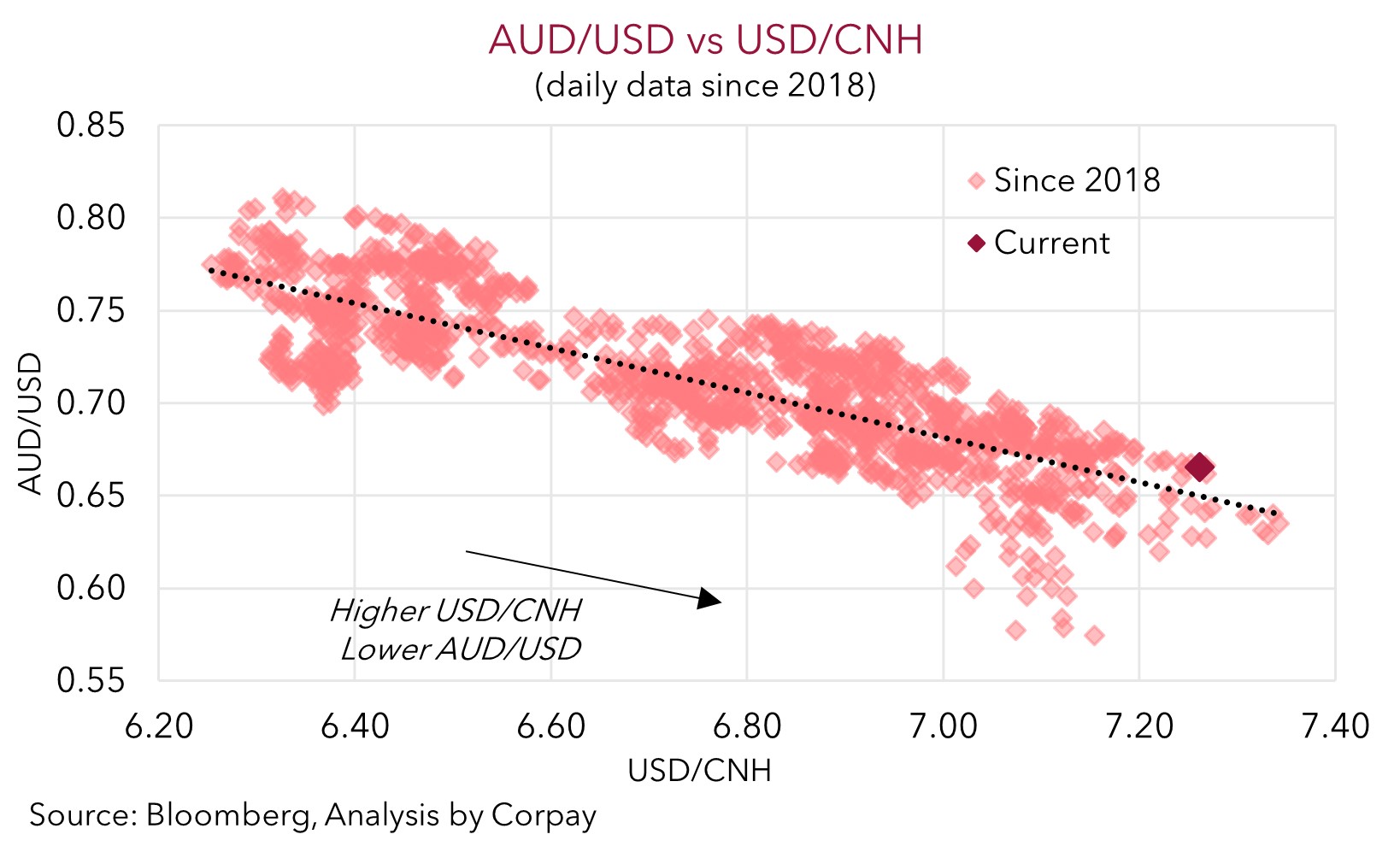

In FX, the USD Index edged higher, supported by the lift in US bond yields. EUR slipped down to ~$1.0850, while USD/JPY oscillated around 144.40 as widening interest rate differentials were counteracted by softer risk sentiment. AUD has drifted lower, and at ~$0.6660 is back near where it started the week. In addition to the shaky risk backdrop, AUD has also been weighed down by renewed weakness in CNH. USD/CNH has unwound its recent pullback (now ~7.2620) with the weaker China data bolstering expectations authorities could ease policy to reinvigorate the economy.

Macro focus will remain on the US over the rest of this week. ADP employment (10:15pm AEST), weekly initial jobless claims (10:30pm AEST), JOLTs job openings and the ISM services index (both 12am AEST) are released tonight, while the monthly jobs report is due tomorrow night. The US is a services-driven economy, and the ISM gauge is expected to improve in June. At the same time, while the labour market may show some modest cooling, conditions should still be quite tight. We think this mix could see US interest rate expectations and the USD tick up as an even higher for even longer Fed view is factored in.

Global event radar: US Jobs (Fri), China CPI (10th July), RBNZ Meeting (12th July), US CPI (12th July), Bank of Canada Meeting (13th July), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

AUD corner

The AUD has underperformed over the past 24hrs, with weaker data out of China compounded by the lift in US bond yields and firmer USD (see above). As noted yesterday, we didn’t expect the AUD’s surprising post RBA rebound to be sustained given the shaky underlying foundations. AUD/USD has dipped back down to ~$0.6660, roughly where it was trading at the start of the week. The AUD has also lost ground on the major crosses falling by ~0.3-0.5% against the EUR, JPY, GBP, and NZD. As a result, AUD/NZD touched its lowest level since late-May (now ~1.0770).

As discussed, the minutes of the last US Fed meeting highlighted that the central bank clearly thinks more work needs to be done to tame US inflation. And yet, markets continue to doubt the Fed’s resolve by still not factoring in the two further rate hikes it is penciling in over the remaining meetings of 2023. The US data flow picks up over the next few days with ADP employment (10:15pm AEST), weekly initial jobless claims (10:30pm AEST), JOLTs job openings and the ISM services index (both 12am AEST) released tonight, and the monthly jobs report due tomorrow night. We are looking for the services ISM to improve in June, while we think risks are tilted to the labour market data continuing to hold up. In our opinion, this could see US interest rate expectations adjust higher towards the Fed’s baseline thinking, supporting the USD and exerting a bit more pressure on the AUD.

At the same time, trends in USD/CNH are also important for the AUD. As our chart illustrates, USD/CNH and AUD/USD have a tight (inverse) correlation. Rising expectations that Chinese authorities will announce more monetary and fiscal measures to boost growth is weighing on CNH. This is a headwind for the AUD. Until USD/CNH stabilizes and begins to turn around, we doubt intermittent AUD rebounds can be sustained. However, as we have pointed out before, while we don’t see the AUD snapping back sharply for a while yet given the sluggish global backdrop, stronger USD, and developments in China, we also believe that fundamentals such as Australia’s current account surplus (now ~1.4% of GDP) and the high level of the terms-of-trade should continue to act as downside supports. Since 2015 the AUD has only traded sub-$0.6650 ~6% of the time.

AUD event radar: US Jobs (Fri), China CPI (10th July), RBA Gov. Lowe Speaks (12th July), RBNZ Meeting (12th July), US CPI (12th July), Bank of Canada Meeting (13th July), China GDP (17th July), US Retail Sales (18th July), NZ CPI (19th July), UK CPI (19th July), AU Jobs (20th July), Japan CPI (21st July).

AUD levels to watch (support / resistance): 0.6547, 0.6600 / 0.6695, 0.6760

SGD corner

USD/SGD has bounced back over the past 24hrs and is now sitting on its 200-day moving average (~$1.3534). The combination of higher US bond yields and negative risk sentiment has supported USD/SGD (see above). On the crosses, EUR/SGD (now ~1.4692) continues to consolidate, however, the pair remains within 0.8% of its one-year highs. SGD/JPY has eased back with the JPY clawing back some ground thanks to the dip in global equities. However, at ~106.81 SGD/JPY remains historically high.

As discussed above, in line with our thinking the minutes of the last US Fed meeting were ‘hawkish’ with further rate hikes still very much in the pipeline. There is a string of US labour market and services data released over the next two days (ADP employment, weekly initial jobless claims, JOLTs job openings, ISM services index, non-farm payrolls report). We are looking for the services ISM to improve in June, and while the labour market data may show some moderation, overall conditions should remain ‘tight’. If realised, we think this type of combination could see US interest rate expectations edge even higher, giving the USD (and USD/SGD) a bit more of a lift.

SGD event radar: US Jobs (Fri), China CPI (10th July), Singapore GDP (10th-14th July), US CPI (12th July), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

SGD levels to watch (support / resistance): 1.3403, 1.3432 / 1.3538, 1.3590