• US holiday. Quiet night across markets. Oil prices rose, EUR weakened, & the AUD bounced back following yesterday’s post-RBA meeting dip.

• RBA holds firm. Cash rate held steady at 4.1%. We expect a 25bp hike in August when new inflation & labour market forecasts are produced.

• US data flow. US FOMC minutes, JOLTs job openings, ISM services measure, & US labour market report due over coming days.

With the US enjoying its 4 July holiday it was another quiet night across markets. The EuroStoxx50 eased (-0.2%), with cyclical sectors like industrials, materials, and financials underperforming. European bond yields were mixed with the German 10yr ~2bps higher (now 2.45%) and the 2-year falling by ~3bps (now 3.20%). Markets continue to price in further policy tightening by the US Fed, ECB, and Bank of England. There is now a ~90% chance of a 25bp rate hike by the ECB on 27 July discounted (~2 hikes are fully factored in by December), while the BoE is projected to deliver another ~127bps worth of hikes by year-end. This is the most ‘hawkish’ outlook across the major central banks. For the US Fed odds of another 25bp move in late-July currently sit at ~84%. In contrast to the Fed’s view, markets continue to struggle to pencil in another two rate rises over the remaining four meetings of the year.

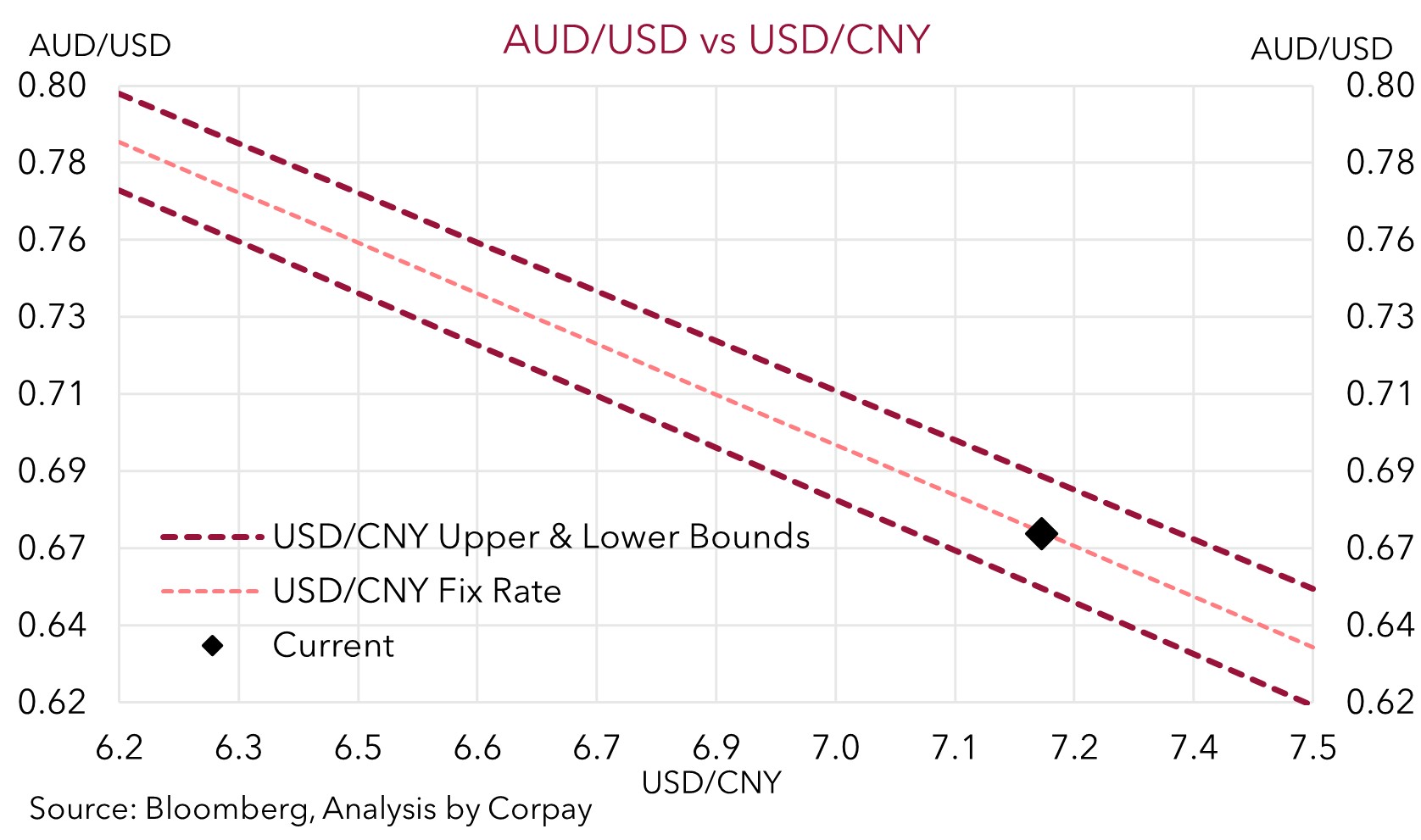

Across commodities, copper extended its mini recovery, rising by another 1%. However, this follows a weak run. Copper is still ~13% below its January highs. Brent crude oil prices rose by ~2%, somewhat of a delayed response to the announcement by Saudi Arabia that it would extend its 1m barrels per day production cuts. In FX, the USD index nudged up slightly with EUR (the major USD alternative) slipping back under ~$1.09. USD/JPY (now 144.45) remains near the top of its ~8-month range, and GBP (now ~$1.2710) is around 1% from its 1-year highs. The AUD more than recouped yesterday’s post RBA on hold dip to be near its 200-day moving average (~$0.6692). Given the tight correlations, the AUD and NZD received support from the rebound in CNH, with the higher energy/copper price also helpful. Yesterday, the PBoC continued with its policy of setting a stronger CNY reference rate, with the recent currency weakness clearly on the radar of officials. There were also reports that China’s biggest state banks have been providing Local Government Financing Vehicles ultra-long maturity loans and some interest rate relief.

Over the next few days the US economic calendar heats up. The minutes of the last US FOMC meeting (Thursday 4am AEST), JOLTS job openings, the ISM services measure (both Friday morning AEST), and US labour market report (Friday night AEST) are due. Based on the lift to the Fed’s interest rate forecasts, we believe the minutes could read ‘hawkish’. The services ISM is also expected to improve, while the labour data is likely to show unemployment remains low. We think this combination could see participants add to their US Fed rate hike bets giving the USD some support.

Global event radar: US Jobs (Fri), China CPI (10th July), RBNZ Meeting (12th July), US CPI (12th July), Bank of Canada Meeting (13th July), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

AUD corner

The AUD more than unwound its post-RBA dip in quiet overnight trade, with the lift in copper/energy prices and firmer CNH supportive factors (see above). At ~$0.6692 the AUD is sitting just below its 200-day moving average. On the crosses, the AUD outperformed the EUR, GBP, and JPY to differing degrees. AUD/EUR is near its 50-day moving average (~0.6146), while AUD/JPY has edged back above 96.60. By contrast, AUD/NZD has slipped down to its 100-day moving average (~1.0808).

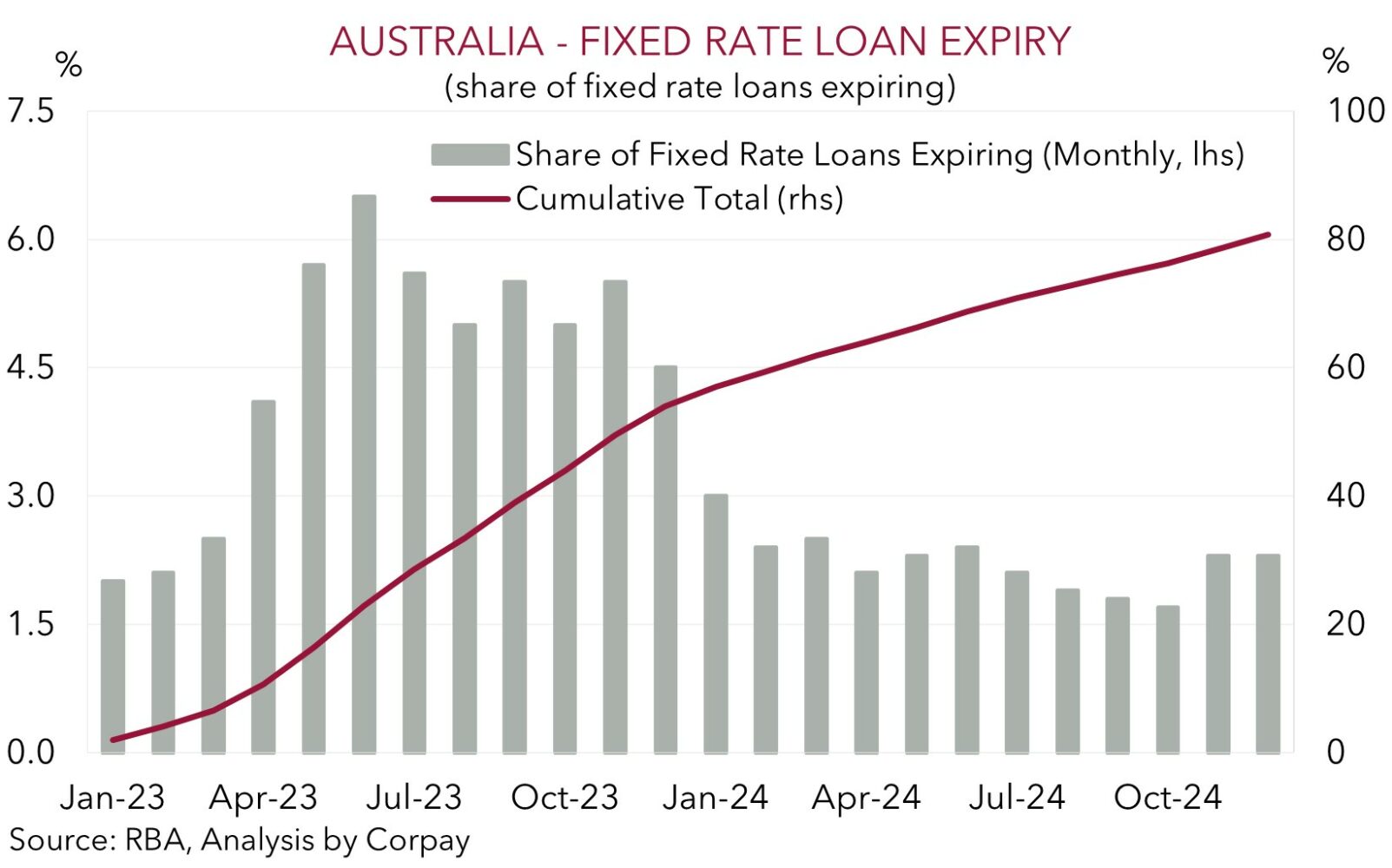

In terms of the RBA, we thought it would be a close call and that an on-hold decision was fractionally more likely, and that’s what occurred. The RBA held the cash rate steady at 4.1%, however, we doubt the ‘pause’ will extend too long. Inflation is still too high, and the RBA remains focused on getting it back down to target in a “reasonable timeframe”. For that to occur further policy tightening is needed, in our view. We are looking for the RBA to lift the cash rate to 4.35% in August. In our opinion, the repeated reference to “this month” in yesterday’s decision, and that “forecasts” for inflation and the labour market will be inputs in future moves suggests quite heavily that a hike next month is probable. However, such elevated interest rates isn’t going to be painless. As the substantial cashflow hit on the household sector builds we expect consumption and broader growth to slow considerably over H2 2023 and early-2024. As our chart shows, we are currently in the eye of the fixed rate refinancing storm, and this roll-off should generate a fair amount of ‘natural’ tightening over the coming months. For more see Market Wire: RBA: Skips a beat.

For the AUD, as highlighted previously, FX is a relative price and RBA decisions aren’t the be-all and end-all. We doubt the AUD’s overnight move will be sustained. We think the USD could lift over the next few days. The FOMC meeting minutes (Thursday 4am AEST) are likely to read ‘hawkish’, while we believe the US labour market data could show conditions remain tight (Friday AEST). If realised, this could see US interest rate expectations shift up.

That said, although we see some renewed near-term downside in AUD/USD we also don’t want to be overly bearish. While we don’t see the AUD snapping back sharply for a while yet given the sluggish global growth pulse, we also think that fundamentals such as Australia’s current account surplus (now ~1.4% of GDP) and the high level of the terms-of-trade may act as downside cushions. On our figuring, since 2015, when these forces kicked into gear, the AUD has only traded sub-$0.6650 ~6% of the time.

AUD event radar: US Jobs (Fri), China CPI (10th July), RBA Gov. Lowe Speaks (12th July), RBNZ Meeting (12th July), US CPI (12th July), Bank of Canada Meeting (13th July), China GDP (17th July), US Retail Sales (18th July), NZ CPI (19th July), UK CPI (19th July), AU Jobs (20th July), Japan CPI (21st July).

AUD levels to watch (support / resistance): 0.6600, 0.6640 / 0.6695, 0.6760

SGD corner

USD/SGD has consolidated just under ~$1.35 in quiet trade over the past 24hrs (see above). On the crosses, EUR/SGD (now ~1.4680) has given back a little ground, however, the pair remains within 1% of its 1-year highs. SGD/JPY continues to track at historically high levels (now ~107.05) due to the weakness in the JPY.

The US returns from holiday today, and the economic dataflow picks up. The minutes of the last US Fed meeting are released tomorrow morning, while JOLTs job openings, initial jobless claims, the ISM services measure, and the monthly labour market data are released over Thursday and Friday. As mentioned, based on the upgrade to the Fed’s interest rate forecasts in June, we think the minutes could read ‘hawkish’. Additionally, the services ISM is forecast to improve, while we think the labour market data should show that conditions remain tight with unemployment still at low levels. All up, we believe this type of mix could see US interest rate expectations edge higher, which in turn may give the USD (and USD/SGD) a bit of a boost.

SGD event radar: US Jobs (Fri), China CPI (10th July), Singapore GDP (10th-14th July), US CPI (12th July), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

SGD levels to watch (support / resistance): 1.3401, 1.3428 / 1.3542, 1.3590