• Quiet trade. Minimal moves ahead of today’s US holiday. Yields tick up, with markets shrugging off the deterioration in the US manufacturing ISM.

• RBA today. Will they hike or hold? Expectations are split. Markets have a ~32% chance of a hike, while 13 of 27 analysts surveyed have the RBA moving.

• AUD reaction. Based on market pricing short-term AUD reaction could be uneven. But as seen in June a RBA rate rise isn’t the be-all & end-all for the AUD.

Markets were quiet overnight with US trading sessions shortened due to today’s 4 July holiday. US equities inched higher (S&P500 +0.1%), while the major European indices were flat to slightly lower. Bond yields ticked up, with the German 10-year rising ~4bps to 2.43% and the US 10-year up ~2bps to 3.86%. Moves at the front end were slightly bigger (~4-6bps), pushing yield curves further into negative territory. The US 2s10s yield curve (now -108bps) is on the cusp of pushing through levels reached just ahead of the failure of Silicon Valley Bank in March.

In commodities, industrial metals like copper rose (+1%), but this follows a negative run. Copper is ~13% below its 2023 high. Oil prices eased back (WTI crude -1.2%, at ~$69.80/brl WTI is ~34% below where it was a year ago). The dip in oil came about even though Saudi Arabia said that it would extend its 1m barrels a day production cut for another month, and with Russia adding that it would reduce oil exports by 500,000 barrels per day in August. Markets remain more concerned about the weakening demand outlook rather than the supply side. In FX, there was minimal net movement. The USD index remained range bound, with EUR oscillating around ~$1.09 and USD/JPY tracking near 144.60 (the top-end of its ~8-month range). Ahead of today’s RBA decision (2:30pm AEST), the AUD is hovering just below its 50-day moving average (~$0.6674).

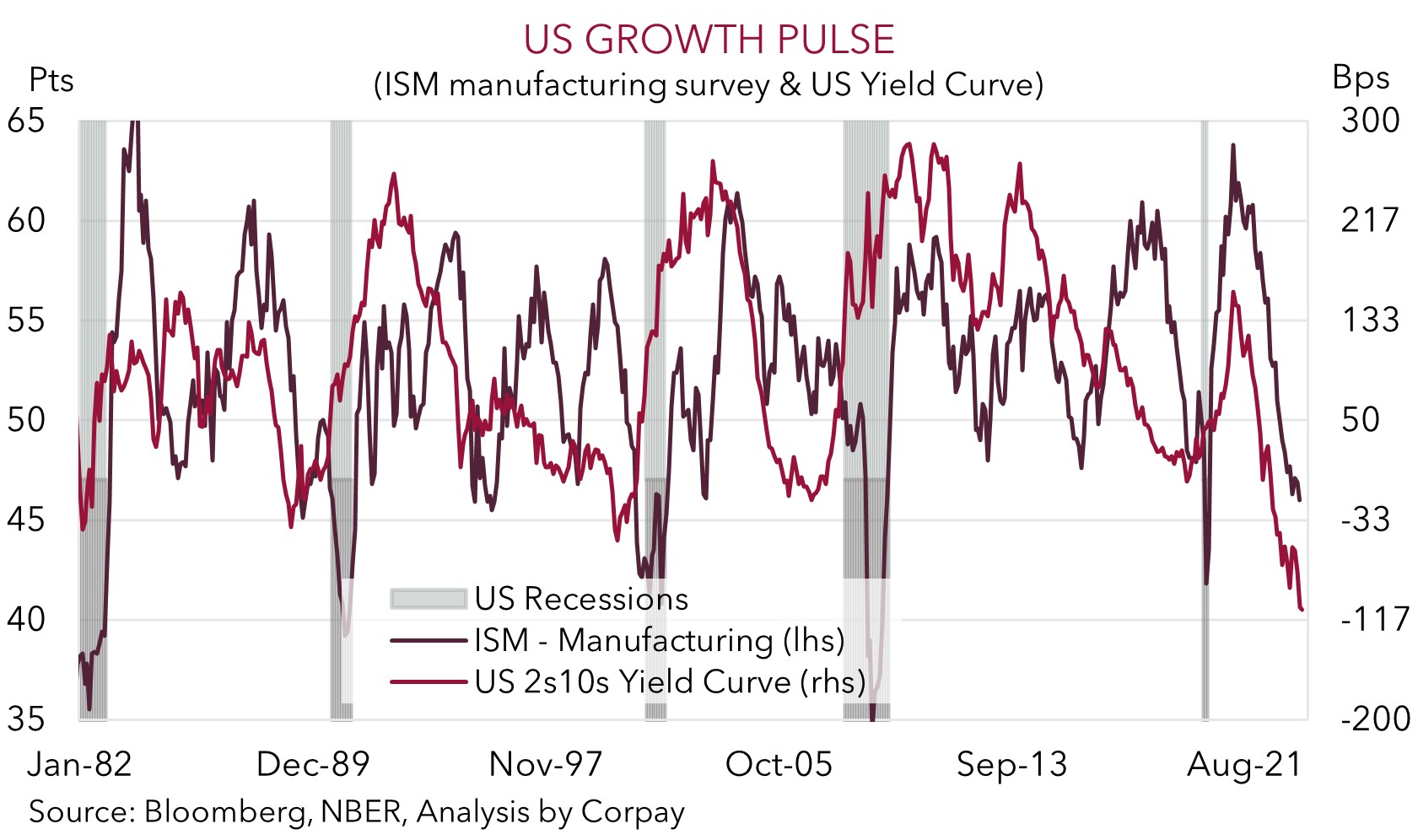

The limited market action occurred despite the US ISM manufacturing survey deteriorating further. The ISM fell to 46 in June, the lowest since May 2020 and the 8th straight month manufacturing has been in ‘contractionary’ territory. As our chart shows, the ISM, along with the US yield curve, have long track records of foreshadowing a US economic slowdown and recession. Globally, the shift in consumer spending from ‘goods’ to ‘services’, high level of inventories, and jump up in interest rates which is a drag on demand, points to further weakness in industrial activity. This is typically a headwind for cyclical currencies like the AUD, NZD, and Asian FX.

Later this week the minutes of the last US Fed meeting (Thursday morning AEST), the ISM services measure (Friday morning AEST), and US labour market report (Friday night AEST) are due. Based on the upgrade to the Fed’s interest rate forecasts, we think the minutes could read ‘hawkish’. The services ISM is also expected to hold up, while the labour data is likely to show solid job creation and low unemployment. If realised, we believe this combination could see US interest rate expectations lift, giving the USD some support.

Global event radar: RBA Meeting (Today), US Jobs (Fri), China CPI (10th July), RBNZ Meeting (12th July), US CPI (12th July), Bank of Canada Meeting (13th July), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

AUD corner

In quiet trade the AUD has drifted slightly higher at the start of this week (see above). At ~$0.6670, the AUD is tracking just below its 50-day moving average, while on the crosses AUD/EUR is hovering a bit above 0.61 and AUD/JPY is a little north of ~96. Elsewhere, AUD/NZD remains under its 200-day moving average (~1.0859), and AUD/CNH (now ~4.84) is ~1.7% below its mid-June high.

Today’s RBA decision is an AUD focal point (2:30pm AEST). As it was last month, it looks to be another finely balanced call. Still tight labour market conditions, rising unit labour costs, upturn in house prices, and offshore services inflation surprises support another hike. By contrast, some signs of moderation in headline inflation, cooling in forward-looking activity indicators, the global slowdown, and the large amount of tightening that has yet to fully flow through to households and businesses support the case for a ‘pause’.

All up, we believe the RBA has more tightening in them over the next few months, but the uncertainty is around the timing given the added focus on navigating a ‘soft landing’. While we think the RBA are fractionally more likely to ‘skip’ today’s meeting, it is clearly ‘live’ for a change. Indeed, indicative of how evenly poised expectations are, rates markets are factoring in a ~32% chance of a hike (with a full 25bp move priced in by September), while 13 of 27 analysts surveyed by Bloomberg have the RBA moving today. Based on market pricing, we think the short-term AUD reaction could be a bit uneven, with an RBA hike generating a slightly larger knee-jerk lift as interest rates adjust, while no change could generate a smaller dip due to the outlook for higher rates down the track.

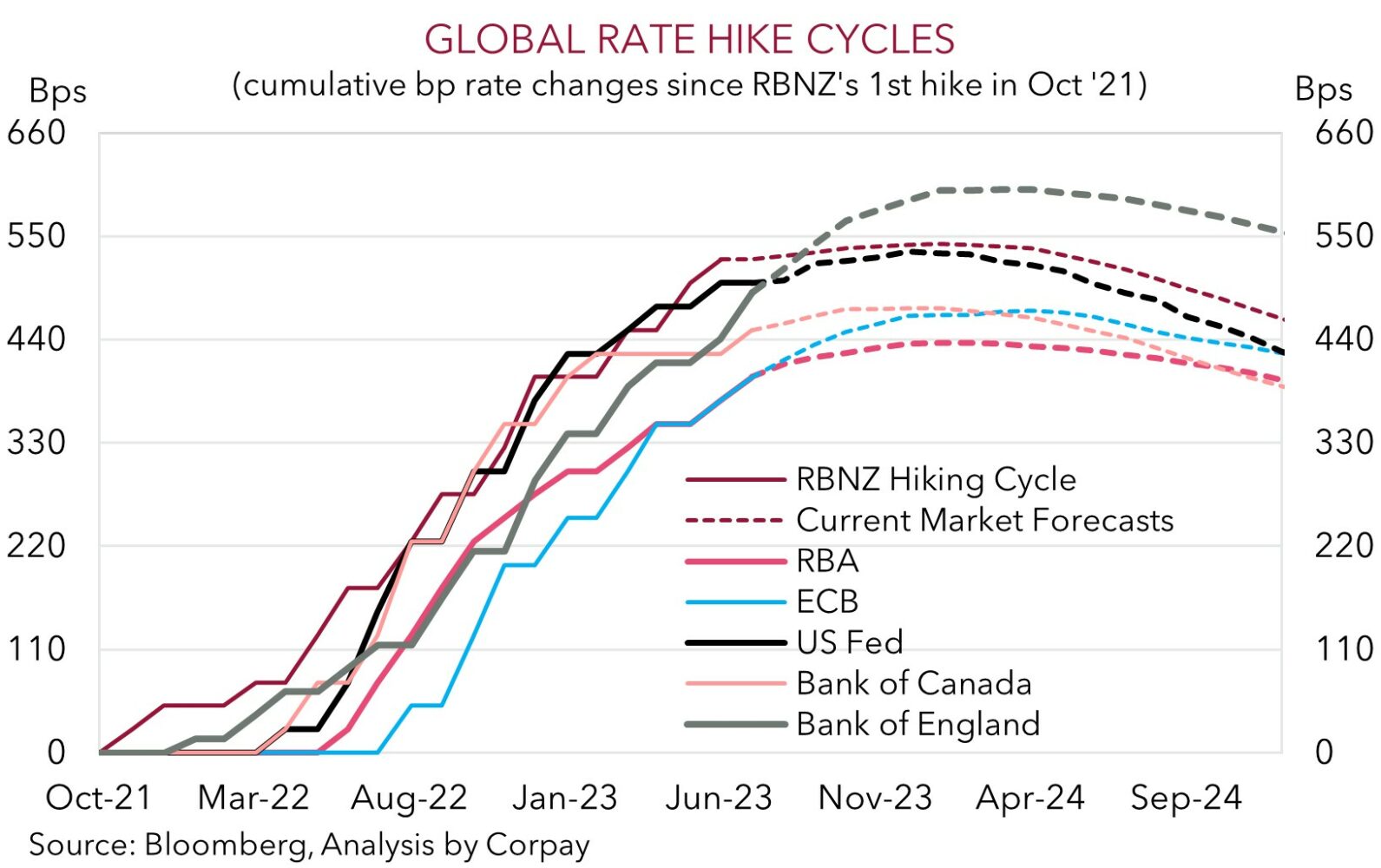

That said, as seen over June a ‘surprise’ RBA rate rise isn’t the be-all and end-all for the AUD, and in our view it shouldn’t be a driver of a sustained upswing given the slowing global growth pulse, actions of other global central banks in their fight against inflation, and expectations already penciling in ~2 more RBA rate hikes over coming months. Indeed, later this week we think the risks are tilted to the US labour market report showing ongoing strength. This could support an upward shift in US interest rate expectations and be USD supportive. While at the same time, the AUD’s downside should continue to be cushioned by Australia’s current account surplus (now ~1.4% of GDP) and high level of the terms-of-trade. As we have highlighted before, since 2015 the AUD has only traded sub-$0.66 ~5% of the time.

AUD event radar: RBA Meeting (Today), US Jobs (Fri), China CPI (10th July), RBA Gov. Lowe Speaks (12th July), RBNZ Meeting (12th July), US CPI (12th July), Bank of Canada Meeting (13th July), China GDP (17th July), US Retail Sales (18th July), NZ CPI (19th July), UK CPI (19th July), AU Jobs (20th July), Japan CPI (21st July).

AUD levels to watch (support / resistance): 0.6547, 0.6581 / 0.6673, 0.6697

SGD corner

USD/SGD has drifted a touch lower in quiet trade (see above). However at ~$1.3510 USD/SGD is holding just below its 200-day moving average. On the crosses, EUR/SGD (now ~1.4745) continues to consolidate near its April peak, while SGD/JPY hit a historic high (now ~107.08). As outlined before, given how weak the JPY now is, we see uneven medium-term possibilities from here, with more scope for the JPY to re-strengthen sharply rather than continue on its downward path.

The US is on holiday today. Later this week things should hot up with the minutes of the last US Fed meeting, the ISM services gauge, and US labour market data released over Thursday and Friday. As discussed, given the upgrade to the Fed’s interest rate forecasts at the June meeting, we think the minutes could read ‘hawkish’. Added to that, the services ISM is expected to hold up better than the manufacturing measure, while we are looking for the labour report to show positive job growth and low unemployment. If realised, we think this could see US interest rate expectations tick up, which in turn could give the USD (and USD/SGD) some support.

SGD event radar: RBA Meeting (Today), US Jobs (Fri), China CPI (10th July), Singapore GDP (10th-14th July), US CPI (12th July), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

SGD levels to watch (support / resistance): 1.3399, 1.3426 / 1.3546, 1.3590