• Risk on. Softer US spending & PCE inflation data supported risk sentiment on Friday. Equities higher. US bond yields consolidated. USD lost some ground.

• RBA in focus. Will they hike or pause on Tuesday? Markets & the analyst community are evenly split. This points to a binary short-term AUD reaction.

• AUD forces. As shown last month, RBA actions aren’t the only thing that matter for the AUD. A solid US labour market report on Friday could boost the USD.

A positive end to last week for risk markets with equities rising on Friday, while bond yields consolidated, and the USD gave up some ground. The US S&P500 rose 1.2%, its largest one-day increase in ~2 weeks, with the big tech firms ending June strongly. In rates space markets slightly pared back the expected tightening from the US Fed over the next few meetings, though another 25bp hike continues to be discounted by September. A move at the late-July Fed meeting is assigned a ~80% chance. The US 2-year yield is up at 4.90%, near the top end of its cyclical range, with the 10-year tracking around 3.84%. As a result, the US 2s10s yield curve is approaching levels reached just ahead of the failure of Silicon Valley Bank in March. In FX, the slightly softer USD helped EUR edge back above ~$1.09, while USD/JPY has pulled back from ~145 with comments by Japanese Finance Minister Suzuki that authorities “will respond appropriately to excessive moves” also mildly JPY supportive. AUD has ticked up to $0.6660, where it was trading on Thursday.

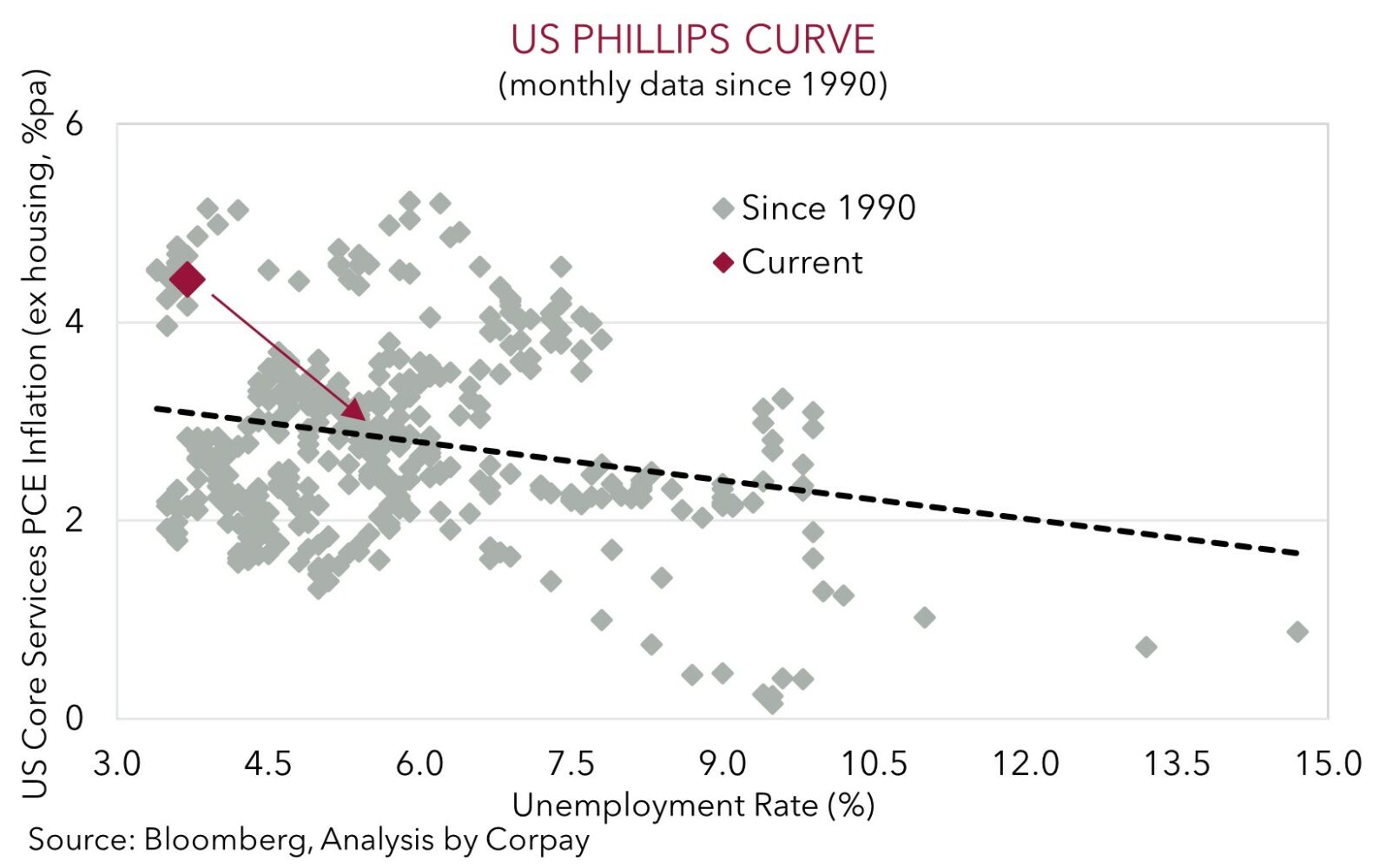

The US data was the catalyst for the moves. There was a plethora to absorb on Friday, but the main focal points for markets were the slowing in US personal spending (up just 0.1% in May) and deceleration in the US PCE deflator (the Fed’s preferred inflation gauge). The headline measure slowed to 3.8%pa, the lowest since April 2021, while the core rate nudged down to 4.6%pa with a bit of moderation coming through in services prices. However, as our chart shows, there is still a long way to go for services inflation to get back to where it needs to be. Services inflation, excluding housing, is still running at more than double its pre-COVID average. Increased labour market slack and slower wage growth is required for this measure to be consistent with the Fed’s inflation target. This will take time to unfold. These trends continue to support the case for rates remaining ‘restrictive’ for quite a while.

This week, the US 4 July holiday may mean trading conditions are lighter than usual early on. However, things could heat up later on with the minutes of the last Fed meeting (Thursday morning AEST), the ISM services measure (Friday morning AEST), and labour market report (Friday night AEST) due. Given the upgrade to the Fed’s interest rate projections, we believe the minutes could read ‘hawkish’. At the same time, the services ISM is expected to improve, and the labour report is likely to show still solid job creation and low unemployment. If realised, we think this mix could see US interest rate expectations shift back up, giving the USD some support.

Global event radar: US ISM (Tues), RBA Meeting (Tues), US Jobs (Fri), China CPI (10th July), RBNZ Meeting (12th July), US CPI (12th July), Bank of Canada Meeting (13th July), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

AUD corner

The AUD clawed back some lost territory on Friday, supported by the positive risk backdrop and softer USD following the weaker than predicted US spending and PCE inflation data (see above). However, at ~$0.6660 the AUD is only back where it was trading on Thursday. The AUD was mixed on the crosses. The AUD strengthened a bit against the EUR and JPY (+0.3% vs both) but underperformed the NZD. AUD/NZD has slipped back below its 200-day moving average (~1.0862).

Locally, all eyes will be on Tuesday’s RBA decision. As it was last month, it looks to be a ‘line-ball’ call. Some signs of moderation in headline inflation, dip in various forward indicators, slowing global growth, and the large amount of tightening still in the system that has yet to fully flow through support the case for a ‘pause’. While tight labour market conditions, rising unit labour costs, rebounding house prices, and offshore services inflation trends favour another hike.

All up, we think the RBA has more tightening in them over the next few months, but the uncertainty is around the timing. While we think the RBA are (just) more likely to ‘skip’ Tuesday’s meeting, it should be considered ‘live’ for a change. Indeed, illustrating how split views are for this week, rates markets are factoring in ~40% chance of a rise (with a full 25bp move priced in by August), while 13 of 27 analysts surveyed by Bloomberg have the RBA moving. As such short-term AUD reaction should be binary, with a RBA rate hike generating a lift as interest rate markets adjust higher, while no change is likely to generate a knee-jerk dip.

That said, as observed over the past month, even another rate rise by the RBA isn’t likely to be a driver for a sustained AUD upswing, in our view, given the slowing global growth pulse and actions of other global central banks in their fight against inflation. Later this week we think the risks are tilted to the US labour market report showing ongoing strength. This could support an upward repricing in US interest rate expectations and the USD. While at the same time, the AUD’s downside should continue to be supported by Australia’s current account surplus (now ~1.4% of GDP) and high level of the terms-of-trade. Since 2015, when these forces really kicked into gear, the AUD has only traded sub-$0.66 ~5% of the time.

AUD event radar: US ISM (Tues), RBA Meeting (Tues), US Jobs (Fri), China CPI (10th July), RBA Gov. Lowe Speaks (12th July), RBNZ Meeting (12th July), US CPI (12th July), Bank of Canada Meeting (13th July), China GDP (17th July), US Retail Sales (18th July), NZ CPI (19th July), UK CPI (19th July), AU Jobs (20th July), Japan CPI (21st July).

AUD levels to watch (support / resistance): 0.6547, 0.6581 / 0.6673, 0.6697

SGD corner

USD/SGD has drifted back a little, with the softer USD post the US PCE deflator and spending data exerting some downward pressure on Friday (see above). However at ~$1.3520 USD/SGD is just under its 200-day moving average. On the crosses, EUR/SGD (now ~1.4750) has consolidated up near its April highs, while SGD/JPY continues to track around historic levels. As discussed previously, based on the weakness in the JPY and quickening Japanese inflation we believe there are uneven medium-term risks from here, with more scope for the JPY to re-strengthen sharply rather than continue on its depreciation path.

This week the US will be a focal point for markets with the minutes of the last Fed meeting, the ISM services measure, and labour market report released over Thursday and Friday. As mentioned above, based on the upgrade to the Fed’s interest rate projections at the June meeting, we think the minutes could read ‘hawkish’. Concurrently, the services ISM is expected to improve, while we are looking for the labour report to show positive job creation and low unemployment. If this occurs we would expect US interest rate expectations to tick up, which in turn could give the USD (and USD/SGD) some support.

SGD event radar: US ISM (Tues), RBA Meeting (Tues), US Jobs (Fri), China CPI (10th July), Singapore GDP (10th-14th July), US CPI (12th July), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

SGD levels to watch (support / resistance): 1.3399, 1.3426 / 1.3546, 1.3590