• Rates re-pricing. Positive US GDP & jobless claims data has seen interest rate expectations adjust higher. US bond yields have moved up.

• USD firm. The repricing has supported the USD, although yesterday’s better than expected AU retail sales data has helped the AUD hold its ground.

• AUD events. Ahead of next week’s ‘line-ball’ RBA rate decision, the China PMIs, Eurozone CPI, and US PCE deflator are due today.

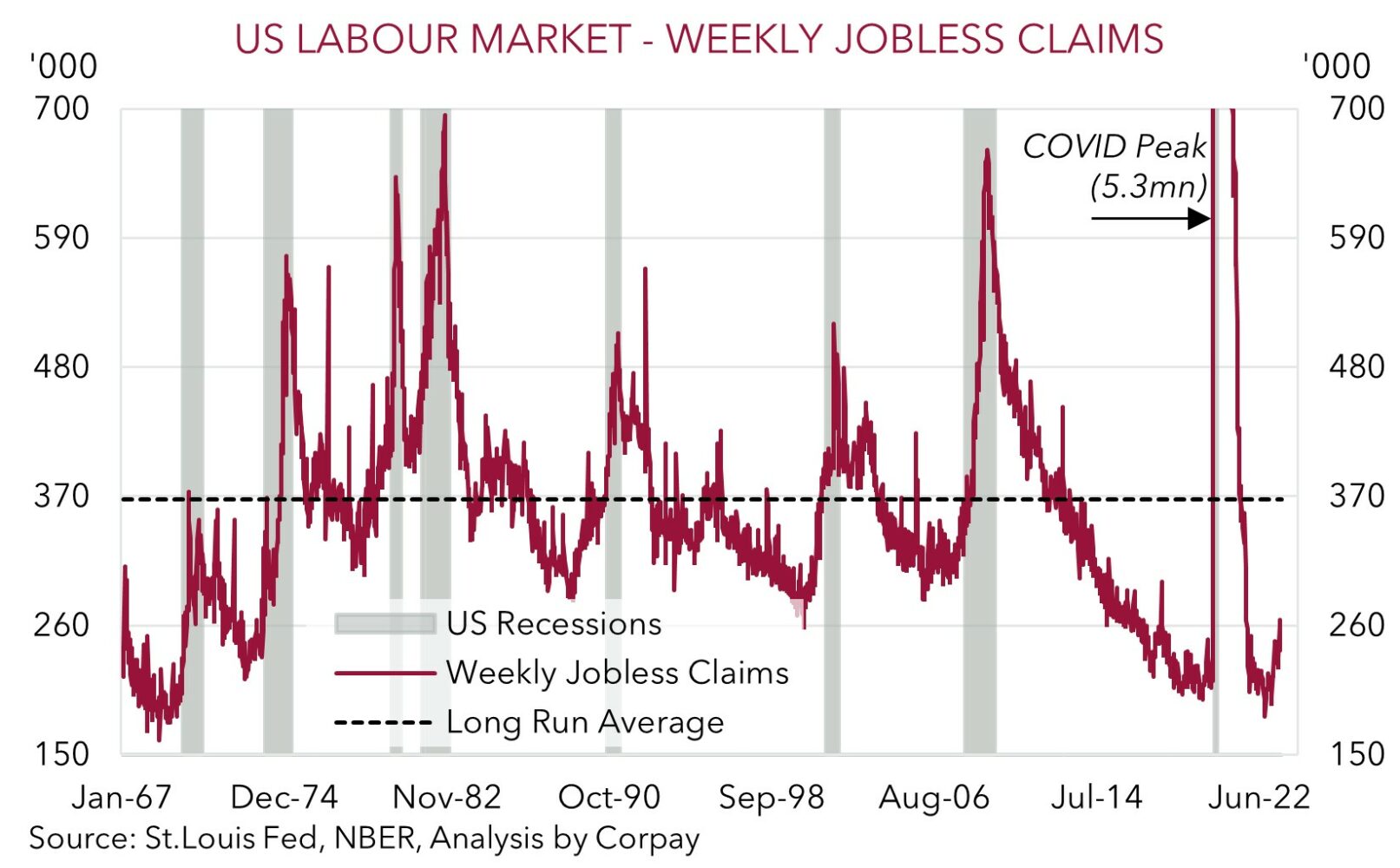

Bond markets came alive overnight, with yields spiking on the back of stronger than anticipated data. In the US, the run of positive surprises continued. Q1 US GDP growth was revised up, with the economy now estimated to have expanded at a 2% annualized pace thanks to stronger consumer spending and net exports. Added to that, initial jobless claims, one of the best real-time reads on the US economy and labour market, improved, with fewer people applying for unemployment benefits. At 239,000 jobless claims are down near last month’s lows. The tightness in the US labour market points to wages and services/core inflation remaining too high. And when combined with the upward revision to GDP there is little evidence to suggest the (needed) US economic slowdown is materializing.

The data triggered an upward re-pricing in US interest rate expectations. Another 25bp rate hike by the US Fed is now fully factored in by the September meeting, with markers assigning a ~40% chance another hike is delivered after that. The Fed has penciled in 2 more rate rises over the next 4 meetings, so there is still scope for markets to adjust higher. US bond yields rose, with the 2-year up ~15bps to 4.86%, a high since early-March. The US 10-year increased ~13bps (now 3.84%). As a result, the US 2s10s yield curve inversion has extended back through -100bps. European yields went along for the ride, with the German 2-year rising ~10bps. The re-acceleration in German inflation (from 6.3%pa to 6.8%pa) was another factor at play.

Elsewhere, US equity markets were unfazed by the shift in rates, with the stronger data an offset. The US S&P500 ticked up ~0.5%. Commodities were mixed with oil prices edging a little higher (WTI crude +0.4% to US$69.9/brl), while industrial metals lost ground (copper fell ~1.2%, the 8th fall in the past 9 trading days) as global growth concerns build. In FX, the USD index more than recouped some earlier weakness, tracking the lift in US yields. EUR (now ~$1.0865) is at a 1-week low and USD/JPY is fast approaching ~145, a level it hasn’t been at since early-November. AUD (now $0.6615) has consolidated around its lows, with yesterday’s stronger Australian retail sales helping the currency hold its ground.

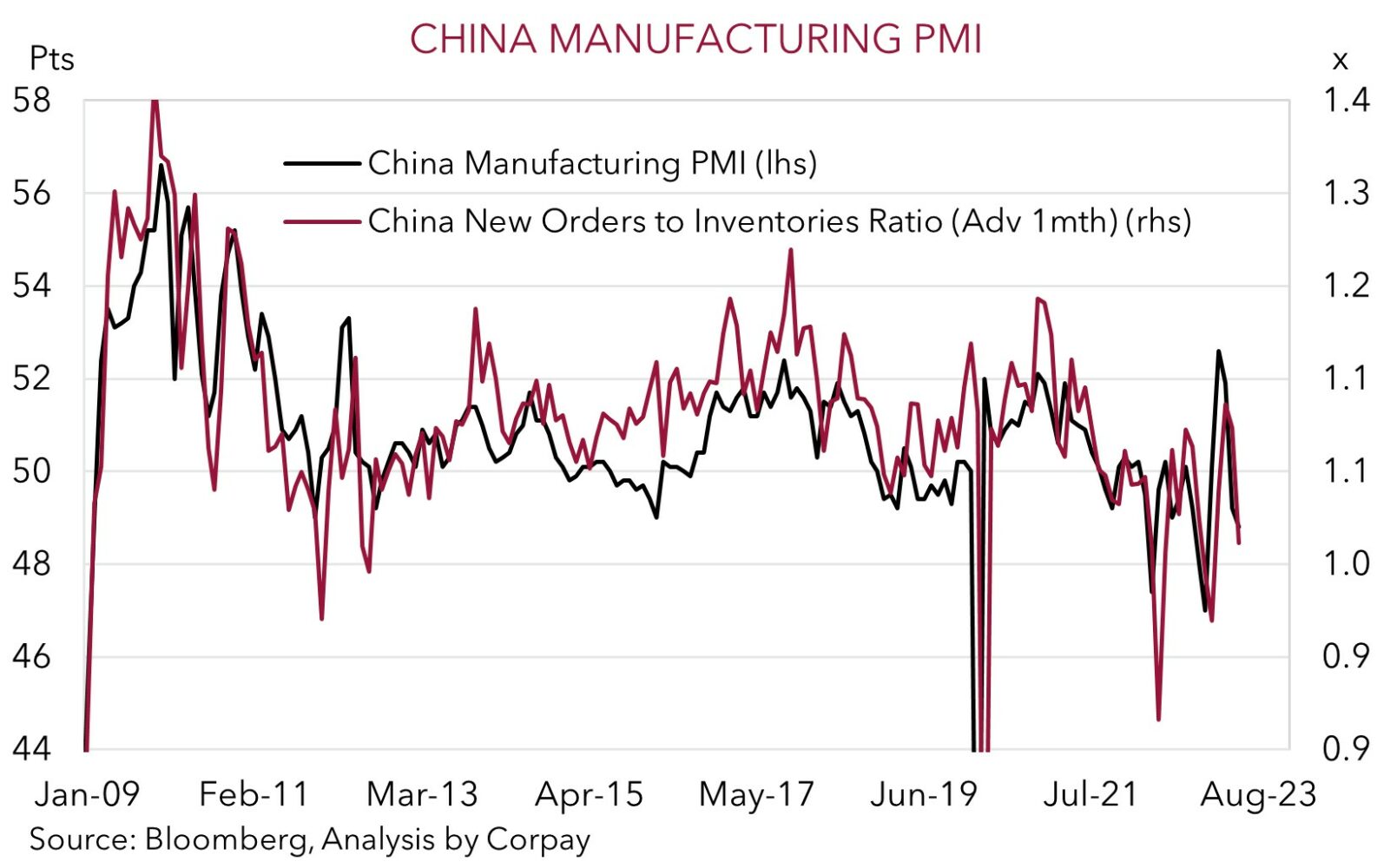

Today, the China PMIs (11:30am AEST), Eurozone CPI (7pm AEST), and US PCE deflator (the Fed’s preferred inflation gauge) (10:30pm AEST) are due. We think the China data risks underwhelming, while core inflation in Europe and the US is expected to stay uncomfortably high. In our opinion, this mix could rattle (seemingly complacent) risk markets and provide the USD with some further support.

Global event radar: China PMIs (Today), Eurozone CPI (Today), US PCE Deflator (Today), US ISM (4th July), RBA Meeting (4th July), US Jobs (7th July), China CPI (10th July), RBNZ Meeting (12th July), US CPI (12th July), Bank of Canada Meeting (13th July), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

AUD corner

The AUD has held its ground in the face of higher US yields and a firmer USD (see above), with the currency oscillating around ~$0.6615. Some relative outperformance on the crosses gave the AUD a helping hand. AUD/EUR has drifted up towards ~0.61, AUD/GBP is near ~0.5250, AUD/JPY is hovering around ~95.80, and AUD/NZD has poked its head back above ~1.09.

The better-than-expected Australian retail sales report and still high job vacancies has kept the debate about whether the RBA could raise rates again next week alive. Retail trade rose 0.7% in May (mkt 0.1%), with an early start to end of financial year sales and ongoing strength in services areas like eating out propping up spending. That said, if you step back from the monthly volatility, retail turnover is effectively running where it was last October, so there has been little change in momentum. And when you consider that retail sales are a nominal figure, and prices have been rising over this period, volumes (a better guide to underlying demand) are falling. For the labour market, while vacancies eased, conditions remain tight. There are still around 1.2 unemployed persons for each job vacancy. This can flow through to wages and inflation over time.

All up, we believe the data supports the case for the RBA to tighten policy further over the next few months. While we think the RBA are more likely to ‘skip’ next week’s meeting, it should be considered ‘live’ for a change. Based on current market pricing (there is a ~32% probability of a hike in July), as was the case in early-June, the bigger short-term reaction in the AUD is likely to be generated by a hike.

Ahead of the RBA, the AUD will need to navigate today’s China PMI (11:30am AEST), Eurozone CPI (7pm AEST), and US PCE deflator (10:30pm AEST) data. We judge that the data could see the downward pressure on the AUD return. In our opinion, forward-looking components and weakness in other PMIs suggests the China manufacturing data could undershoot. If realised, this could dampen risk sentiment and the AUD. Similarly, elevated core inflation in the Eurozone and US may see rate expectations adjust even higher, which could be USD and EUR supportive against cyclical currencies like the AUD.

That said, although we see a bit more downside in AUD/USD we also don’t want to be overly bearish down around current levels. As we have seen repeatedly over recent years, the AUD has tended to find solid support near current levels because of Australia’s current account surplus (now ~1.4% of GDP) and high level of the terms-of-trade. Since 2015 the AUD has only traded sub-$0.66 ~5% of the time.

AUD event radar: China PMIs (Today), Eurozone CPI (Today), US PCE Deflator (Today), US ISM (4th July), RBA Meeting (4th July), US Jobs (7th July), China CPI (10th July), RBA Gov. Lowe Speaks (12th July), RBNZ Meeting (12th July), US CPI (12th July), Bank of Canada Meeting (13th July), China GDP (17th July), US Retail Sales (18th July), NZ CPI (19th July), UK CPI (19th July), AU Jobs (20th July), Japan CPI (21st July).

AUD levels to watch (support / resistance): 0.6547, 0.6581 / 0.6664, 0.6692

SGD corner

USD/SGD has continued to press higher, with the rise in US bond yields and firmer USD pushing the pair above its 200-day moving average (~$1.3551) for the first time since mid-November (see above). On the crosses, EUR/SGD (now ~1.4735) has eased back slightly, but it remains within touching distance of its April highs, while SGD/JPY continues to track up around historic levels. As discussed before, based on the weakness in the JPY we believe there are uneven medium-term risks from here, with more scope for the JPY to re-strengthen sharply rather than continue on its downward run.

Today, the China PMIs, Eurozone CPI, and US PCE deflator (the Fed’s preferred inflation gauge) are in focus. In our opinion, the China PMIs, particularly the manufacturing measure, are at risk of underwhelming consensus forecasts, while core Eurozone and US inflation are likely to remain at uncomfortably high rates. This combination could, in our view, weigh on risk sentiment and support currencies like the EUR and USD against growth-linked ones such as Asian FX and the SGD.

SGD event radar: China PMIs (Today), Eurozone CPI (Today), US PCE Deflator (Today), US ISM (4th July), RBA Meeting (4th July), US Jobs (7th July), China CPI (10th July), Singapore GDP (10th-14th July), US CPI (12th July), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

SGD levels to watch (support / resistance): 1.3395, 1.3419 / 1.3590, 1.3650