• Central bankers. Fed Chair Powell, ECB President Lagarde & BoE Governor Bailey maintained a ‘hawkish’ message. The BoJ remains an outlier.

• AUD slides. AUD has continued to fall (now 4.3% below its mid-June highs). A firmer USD compounded the slowdown in Australian headline inflation.

• AU events. Retail sales & job vacancies due today. A soft retail sales print is likely to add to the AUD’s woes. RBA meets next week.

Central bank speak was in focus overnight with Fed Chair Powell, ECB President Lagarde, BoE Governor Bailey, and BoJ Governor Ueda appearing on a panel. On net, a ‘hawkish’ message was again expressed, though the BoJ remains an outlier. According to Chair Powell, “although policy is restrictive, it may not be restrictive enough and it has not been restrictive for long enough”, keeping alive the chance of two more rate hikes over the remaining four meetings of the year. Indeed, Powell wouldn’t rule out consecutive hikes after the ‘skip’ at the June meeting. President Lagarde signaled that a hike at the late-July ECB meeting was a virtual certainty, while BoE Governor Bailey vowed to do what is needed to get inflation down to target.

By contrast, BoJ Governor Ueda continues to keep his head in the sand when it comes to the upswing in Japanese inflation, claiming the bank needs to be confident that price gains will be sustained over 2024 to bring about a policy shift. This is despite Japanese core inflation (i.e. ex fresh food and energy) already running north of 4%pa, a high since the early 1980’s. The longer the BoJ holds out the bigger the market and JPY impact could be when they turn course. This is why we are of the view that there are uneven medium-term risks around the weak JPY from here (see Market Musings: JPY: Asymmetric risks building).

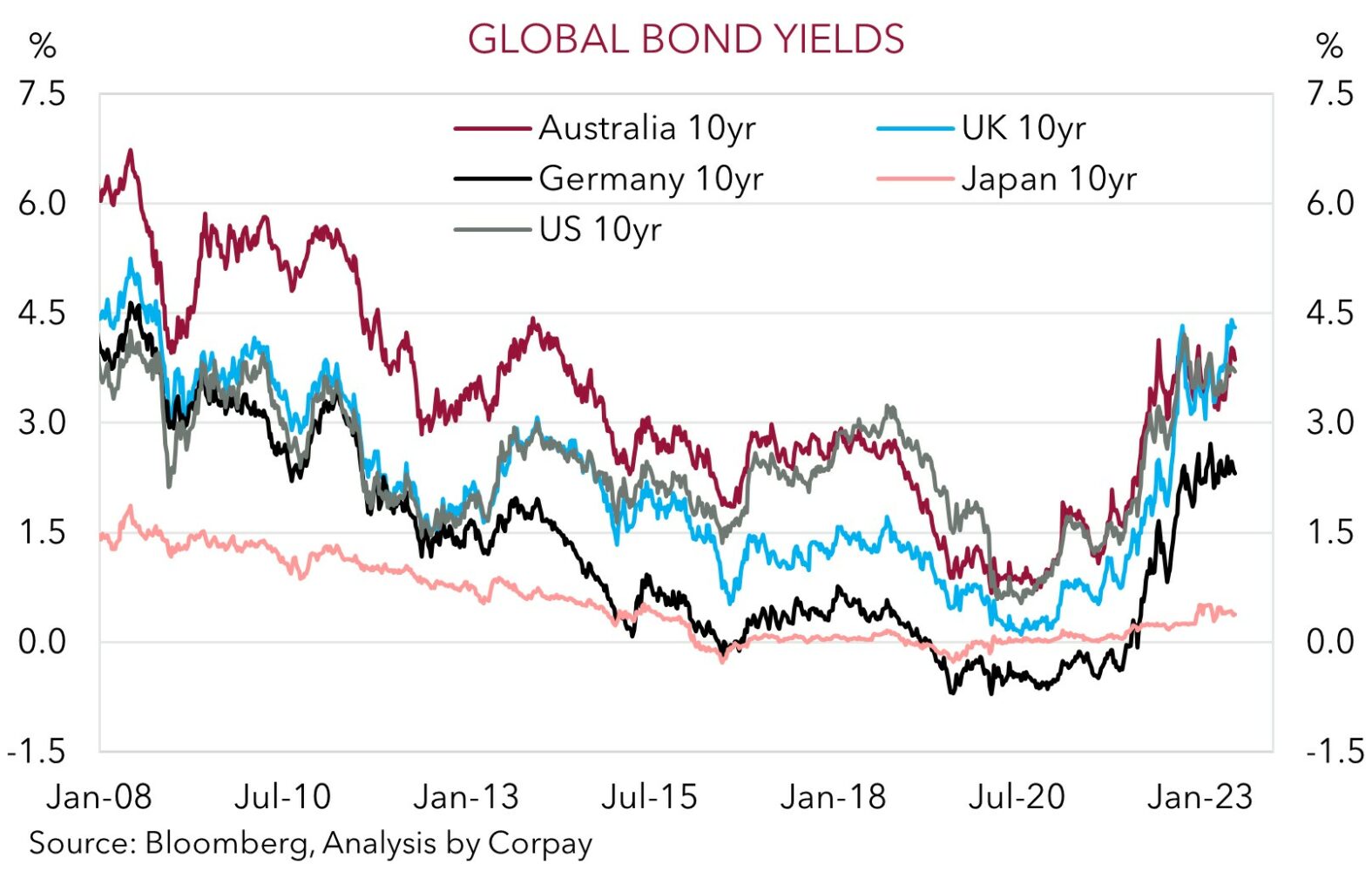

Most markets took the central bank comments in stride. European equities rose (EuroStoxx50 +0.9%), while US stocks consolidated (S&P500 flat, NASDAQ +0.3%). Bond yields ended trade a little lower. 10-year yields in Germany, the UK, and the US slipped by 4-6bps, but as our chart shows yields remain near the top end of their respective ~3-month ranges. In FX, the USD was firmer. EUR has drifted down towards $1.0915, while USD/JPY has pushed up to~144.40, a high since mid-November. AUD and NZD have weakened, with the former ~1.3% lower compared to this time yesterday, while the latter has fallen by ~1.5%. Some renewed CNH weakness and the sharp deceleration in the Australian CPI indicator were catalysts.

Offshore, Fed Chair Powell speaks again (4:30pm AEST), while on the data-front German CPI (10pm AEST) and US initial jobless claims (10:30pm AEST) are in focus. German inflation is forecast to re-accelerate as public transport discounts implemented last year roll out of calculations. In our view, a lift in German inflation and solid US jobless claims would reinforce expectations for further policy tightening by the US Fed and ECB over coming months. We think this could rattle risk sentiment and support currencies like the EUR and USD against cyclical ones such as the AUD and NZD.

Global event radar: Fed Chair Powell Speaks (Today), China PMIs (Fri), Eurozone CPI (Fri), US PCE Deflator (Fri), US ISM (4th July), RBA Meeting (4th July), US Jobs (7th July), China CPI (10th July), RBNZ Meeting (12th July), US CPI (12th July), Bank of Canada Meeting (13th July), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

AUD corner

The AUD has continued to fall back down to earth with yesterday’s sharp slowdown in Australia’s monthly CPI indicator and adjustment in near-term RBA rate hike pricing compounded by a firmer USD (see above). At ~$0.66 the AUD is ~4.3% below its mid-June highs. The pull-back has been in-line with our thinking, given we believed the AUD had run too far too fast earlier this month (see Market Musings: AUD: break-out or bull-trap?). The AUD has also lost more ground on the crosses. AUD/EUR has dipped down towards ~0.6050 to now be ~1.5% from its late-April lows. AUD/GBP hit a fresh 2023 low and AUD/JPY is hovering just above ~95 (~2.5% below its recent peak). AUD/NZD bucked the trend, having ticked above its 200-day moving average (~1.0867) on the back of NZD underperformance.

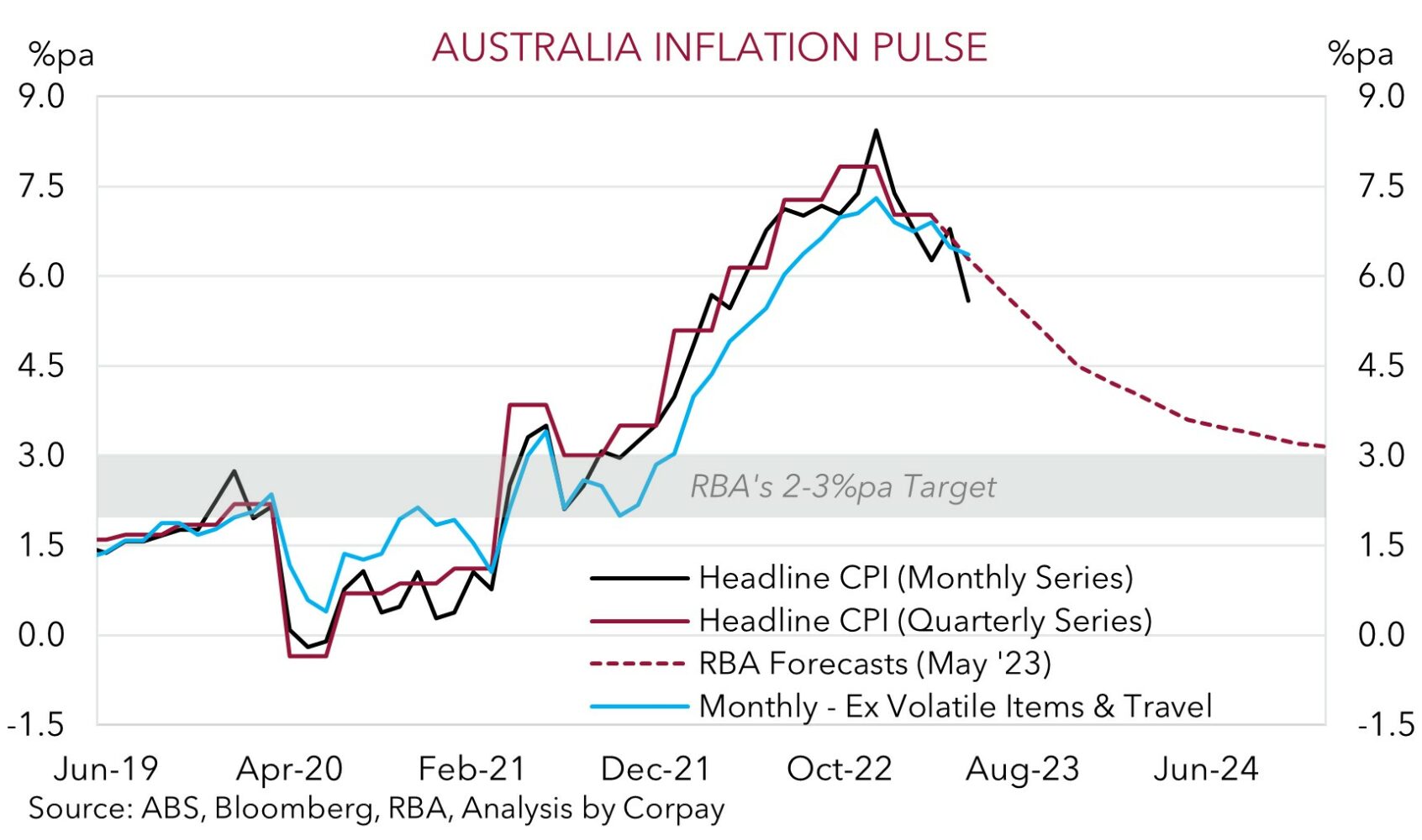

Data wise, the monthly headline inflation measure slowed from 6.8%pa to 5.6%pa in May (mkt 6.1%pa). This is the slowest annual run rate in headline inflation since April 2022. A closer look shows that base-effects from lower petrol prices and an unwind of the spike in holiday travel prices over Easter played a role. However, core inflation is improving far more slowly. The gauge that excludes volatile items and holiday travel, which the RBA has been paying attention to, only eased from 6.5%pa to 6.4%pa. From a policy perspective, the stickiness in some of the less volatile sub-components, still tight labour market, Australia’s lacklustre productivity, and stickiness in offshore services inflation suggests the RBA has more work to do. But the question is around the timing. While we think the RBA is more likely to hold firm at 4.1% next week, it should still be considered ‘live’ for a change. Over the past few months the RBA has shown a willingness to surprise (see Market Wire: CPI adds to the AUD’s woes).

Locally, retail sales for May and the latest read on job vacancies are released today (both 11:30am AEST). A soft retail sales print given the squeeze on household budgets from higher mortgage costs and below average confidence is where we think the risks reside (mkt +0.1%). If realised, we expect this to maintain the downside pressure on the AUD, particularly against the EUR and GBP, and to a lesser extent the USD. More generally, we think the case for a extended pull-back in AUD/JPY is building.

That said, while we see a bit more downside in AUD/USD we also don’t want to be overly bearish down around current levels. Fundamentals such as Australia’s current account surplus (now ~1.4% of GDP) and the high level of the terms-of-trade should act as downside cushions. As we have seen repeatedly over the past few years, the AUD has tended to find solid support near current levels because of these factors. Since 2015 the AUD has only traded sub-$0.66 ~5% of the time.

AUD event radar: AU Retail Sales (Today), Fed Chair Powell Speaks (Today), China PMIs (Fri), Eurozone CPI (Fri), US PCE Deflator (Fri), US ISM (4th July), RBA Meeting (4th July), US Jobs (7th July), China CPI (10th July), RBA Gov. Lowe Speaks (12th July), RBNZ Meeting (12th July), US CPI (12th July), Bank of Canada Meeting (13th July), China GDP (17th July), US Retail Sales (18th July), NZ CPI (19th July), UK CPI (19th July), AU Jobs (20th July), Japan CPI (21st July).

AUD levels to watch (support / resistance): 0.6547, 0.6581 / 0.6664, 0.6692

SGD corner

USD/SGD rebounded overnight to be near the top of its recent range (now ~$1.3525) on the back of the firmer USD (see above). USD/SGD is now sitting just below its 200-day moving average. On the crosses, EUR/SGD (now ~1.4765) remains within striking distance of its April cyclical highs, while SGD/JPY continues to track up around historic levels. As outlined above, BoJ Governor Ueda maintained a relatively ‘dovish’ stance when speaking overnight, however we think the upswing in Japanese inflation could see the bank shift course sooner than markets anticipate. Based on the weakness in the JPY we believe there are uneven medium-term risks from here, with more scope for the JPY to re-strengthen sharply rather than continue on its downward run (see Market Musings: JPY: Asymmetric risks building).

Today, Fed Chair Powell speaks and German CPI and US initial jobless claims data is released. In our opinion, a re-acceleration in German inflation and solid US jobless claims could reinforce expectations for further tightening by the US Fed and ECB over coming months. We think this could dampen risk sentiment and support currencies like the EUR and USD against cyclical ones such as Asian FX and the SGD.

SGD event radar: Fed Chair Powell Speaks (Today), China PMIs (Fri), Eurozone CPI (Fri), US PCE Deflator (Fri), US ISM (4th July), RBA Meeting (4th July), US Jobs (7th July), China CPI (10th July), Singapore GDP (10th-14th July), US CPI (12th July), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

SGD levels to watch (support / resistance): 1.3392, 1.3414 / 1.3557, 1.3590