• Diverging markets. US equities higher, supported by stronger data. Bond yields up with ‘hawkish’ rhetoric from ECB President Lagarde also at play.

• FX markets. USD mixed. EUR firmer, while USD/JPY edged up. The world’s key central bankers speak tonight. Could this rattle risk markets?

• AUD mixed. AUD unwound its CNY strength inspired gains. AUD/EUR lower. Australia’s monthly CPI indicator is released today.

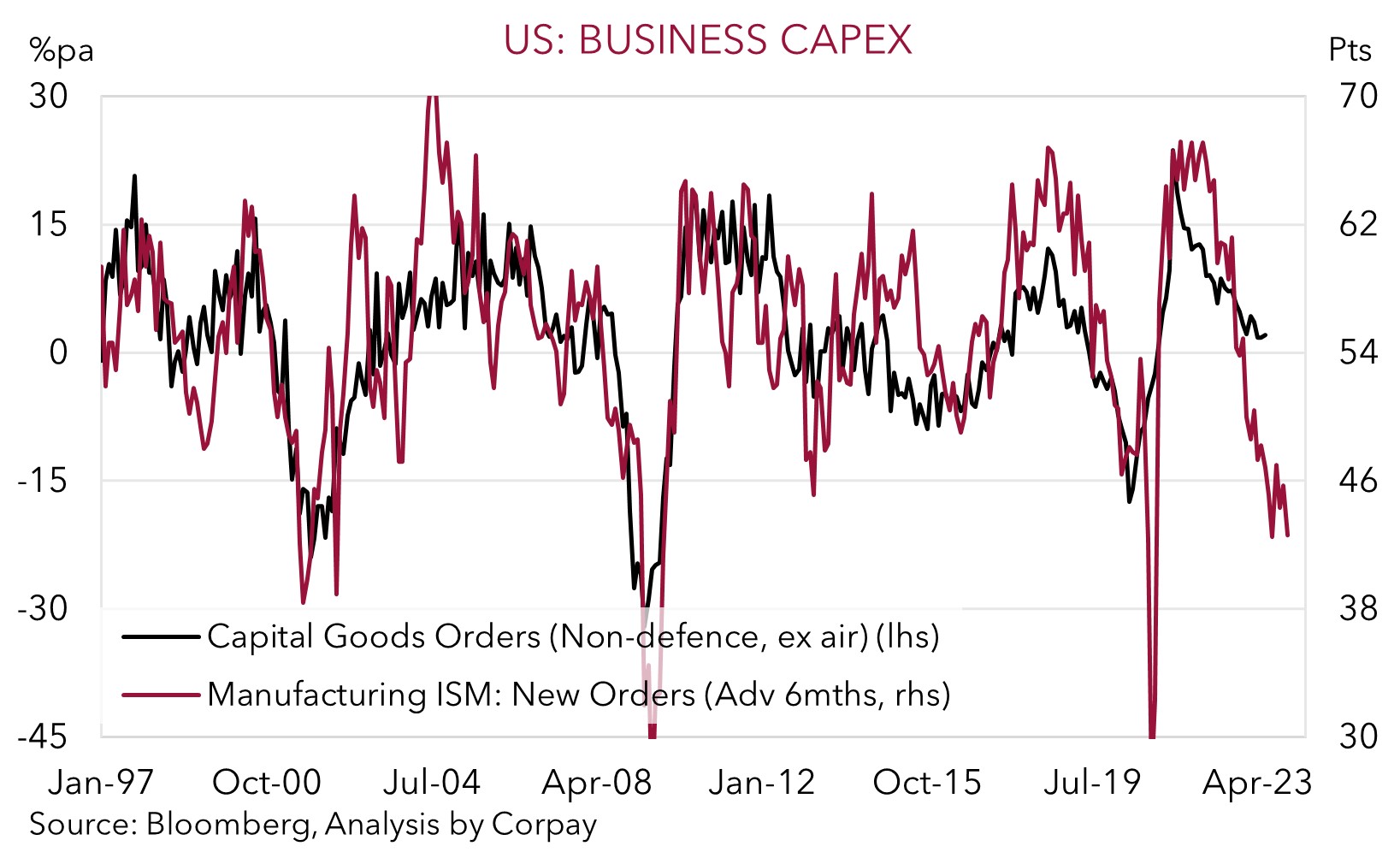

Mixed fortunes across markets overnight with stronger than expected US economic data and ‘hawkish’ messages from central bankers pulling asset classes in different directions. In terms of the data, US new home sales increased to their highest level since February 2022, and consumer confidence improved thanks to the still healthy labour market. Durable goods orders also rose more than predicted, with a large jump in transportation goods at play. The rotation by consumers from spending on ‘goods’ back to ‘services’ like travel has boosted demand for transportation equipment. Though as our chart shows this could be a false dawn as the slump in manufacturing new orders and tighter credit conditions is likely to restrain US firms’ ability to expand.

Equity markets were buoyed by the positive data as it calmed some fears of an impending recession. The S&P500 broke a 2-day losing streak (+1.2%) while the Nasdaq outperformed (+1.5%). In our view this is short-term thinking as economic resilience could compel central banks to tighten further and/or keep settings at ‘restrictive’ levels for some time. This appears to have been the reaction in bond markets with yields rising as a ‘higher for longer’ interest rate environment was factored in. Adding to the data, ECB President Lagarde was quite ‘hawkish’ when speaking, reiterating that another rate hike in July was anticipated and that policymakers won’t be able to declare the end of the cycle any time soon. European yields are higher with 10-year German Bunds up 5bps to 2.35% and 10-year UK Gilts rising 7bps to 4.37%. The US 2-year yield more than unwound earlier falls to end the day at 4.76%.

In FX, the USD was mixed. EUR (+0.5% to ~$1.0960) and GBP (+0.3% to ~$1.2750) drifted higher, while USD/JPY edged above ~144 for the first time since mid-November. Based on where the JPY is now tracking, we remain of the view that there are asymmetric risks from here (i.e. further JPY weakness could be limited with the odds of a large snapback increasing) (see Market Musings: JPY: Asymmetric risks building). USD/CAD lifted as oil prices slipped back (WTI crude -2.4%) and data showed Canadian inflation slowed in May. Headline CPI dipped to 3.4%pa, a low since mid-2021. AUD and NZD are little changed compared to 24hrs ago with yesterday’s Asian session gains, inspired by intra-day CNH strength, unwinding overnight.

Globally, market focus will be on tonight’s panel appearance by Fed Chair Powell, ECB President Lagarde, BoE Governor Bailey, and BoJ Governor Ueda (11:30pm AEST). We think central bankers should continue to stress that the fight against inflation still isn’t over and that policy needs to stay tight for some time, even in the face of slowing growth. In our opinion, this type of messaging could rattle risk sentiment and support currencies like the EUR and USD against cyclical ones such as the AUD and NZD.

Global event radar: ECB Sintra Conference (Today), Fed Chair Powell Speaks (Thurs), China PMIs (Fri), Eurozone CPI (Fri), US PCE Deflator (Fri), US ISM (4th July), RBA Meeting (4th July), US Jobs (7th July), China CPI (10th July), RBNZ Meeting (12th July), US CPI (12th July), Bank of Canada Meeting (13th July), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

AUD corner

The AUD has endured a bit of volatility over the past 24hrs, with yesterday’s gains stemming from a stronger CNY reversing overnight. At ~$0.6685 the AUD is tracking between its 50-day and 200-day moving averages. On the crosses, AUD/EUR has continued to fall back, with the hawkish ECB rhetoric supporting the EUR (see above). AUD/EUR has undergone a round trip with the pair now ~3.4% below its mid-June peak to be little changed compared to where it started the month. AUD/GBP is ~0.6% from its 2023 lows, while AUD/NZD is nearing its 100-day moving average (~1.0815).

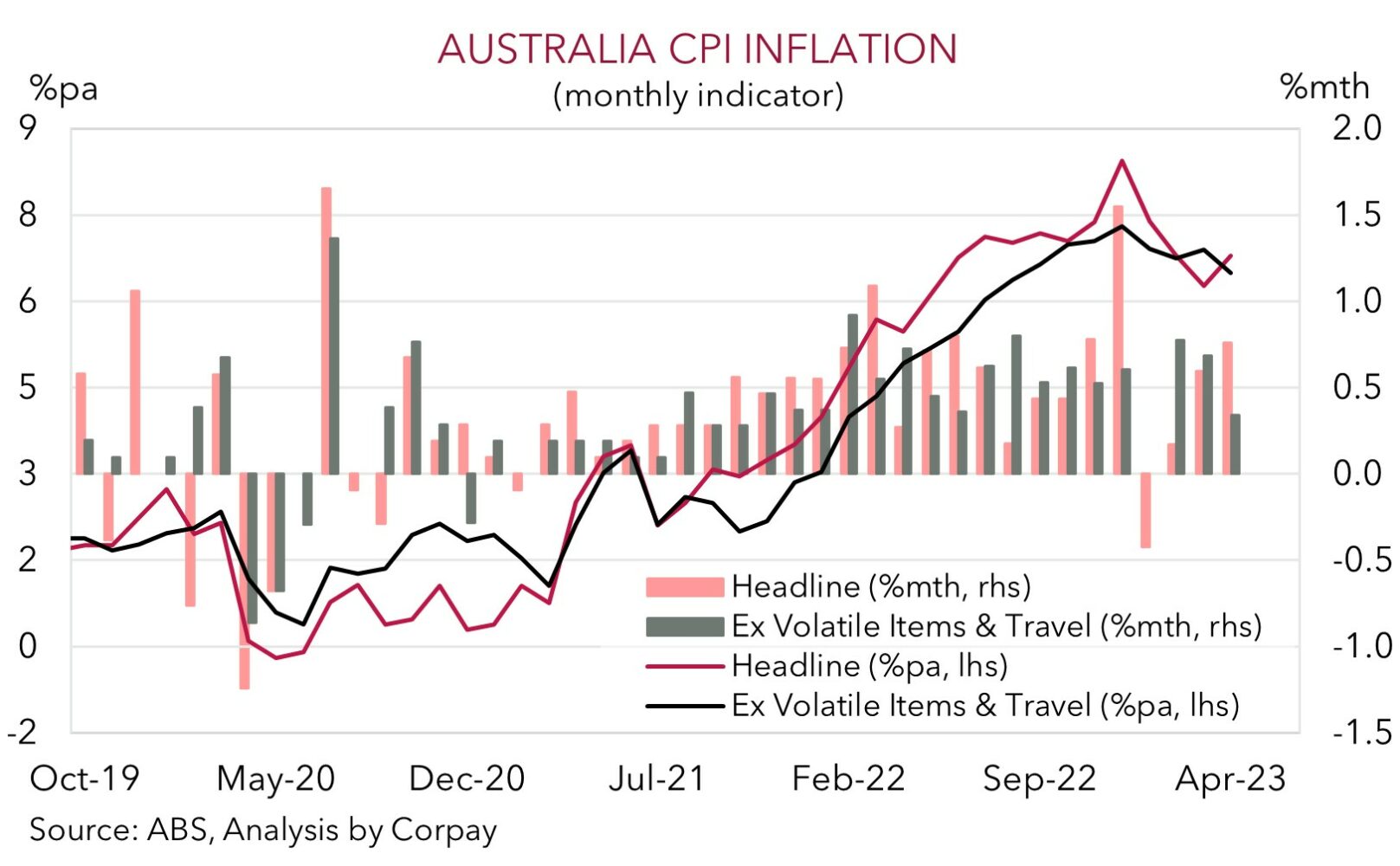

In today’s Asian session, Australia’s monthly CPI indicator will be in focus (11:30am AEST). Base-effects from the fall in fuel and holiday travel prices point to a deceleration in annual inflation (mkt 6.1%pa from 6.8%pa in April). If realised, we believe this type of result could see the market trim their RBA rate hike bets, which in turn could exert some downward pressure on the AUD. As could ‘hawkish’ rhetoric about the ongoing fight against inflation from the world’s key central bankers when they speak at the ECB Sintra Conference tonight (11:30pm AEST). In our opinion, this could dampen risk sentiment and growth-linked assets like the AUD. All up, we continue to think that the downward pressure on the AUD should remain in place over the near-term, particularly against currencies like the EUR, and GBP, and to a lesser extent the USD, while the case for a sharp pull-back in AUD/JPY is building (see Market Musings: AUD: break-out or bull-trap? and Market Musings: JPY: Asymmetric risks building).

However, while we see some more downside in AUD/USD (and underperformance on the crosses), we also don’t want to be overly bearish down around current levels. While we don’t see the AUD snapping back sharply, we also think that fundamentals such as Australia’s current account surplus (now ~1.4% of GDP) and the high level of the terms of trade should act as downside supports. As should signs that officials in China are become uncomfortable with the weakening CNY. Yesterday the PBoC set a stronger CNY fix for a second straight day. A further run of stronger fixings would, in our view, be a shot across the bow of FX markets. And given its tight/inverse correlation, a firmer CNY would be AUD supportive.

AUD event radar: AU Monthly CPI (Today), ECB Sintra Conference (Today), AU Retail Sales (Thurs), Fed Chair Powell Speaks (Thurs), China PMIs (Fri), Eurozone CPI (Fri), US PCE Deflator (Fri), US ISM (4th July), RBA Meeting (4th July), US Jobs (7th July), China CPI (10th July), RBA Gov. Lowe Speaks (12th July), RBNZ Meeting (12th July), US CPI (12th July), Bank of Canada Meeting (13th July), China GDP (17th July), US Retail Sales (18th July), NZ CPI (19th July), UK CPI (19th July), AU Jobs (20th July), Japan CPI (21st July).

AUD levels to watch (support / resistance): 0.6600, 0.6664 / 0.6707, 0.6781

SGD corner

USD/SGD lost a bit of ground overnight, but at ~$1.3490 the pair remains near the top end of its June range. On the crosses, EUR/SGD (now ~1.4785) is within a whisker of its April cyclical highs. The ‘hawkish’ rhetoric from ECB President Lagarde overnight has boosted the EUR (see above). SGD/JPY also continues to hover near its peak. As discussed previously, given the weakness in the JPY we believe there are uneven medium-term risks from here, with more scope for the JPY to re-strengthen sharply rather than continue on its weakening run (see Market Musings: JPY: Asymmetric risks building).

As outlined, over the near-term we think buoyant risk sentiment could be challenged by comments from central bankers that the battle against high inflation still isn’t won. Fed Chair Powell, ECB President Lagarde, BoE Governor Bailey, and BoJ Governor Ueda are speaking on a panel at the Sintra Conference tonight. In our judgement, a ‘higher for longer’ interest rate message could give the USD and EUR more support against cyclical currencies like the SGD.

SGD event radar: ECB Sintra Conference (Today), Fed Chair Powell Speaks (Thurs), China PMIs (Fri), Eurozone CPI (Fri), US PCE Deflator (Fri), US ISM (4th July), RBA Meeting (4th July), US Jobs (7th July), China CPI (10th July), Singapore GDP (10th-14th July), US CPI (12th July), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

SGD levels to watch (support / resistance): 1.3389, 1.3411 / 1.3561, 1.3590