• Growth concerns. Weaker German IFO data is another sign the global economy is losing steam. Risk sentiment remains cautious.

• Central bankers. The major global central bankers speak tomorrow night. An inflation fighting message could keep the USD firm, in our view.

• AUD sluggish. Global backdrop is weighing on the AUD. We see a bit more downside. Locally, CPI indicator & retail sales are due over coming days.

Choppy trade to start the new week, but on net risk sentiment remains cautious with growth concerns front of mind. The dramatic weekend events in Russia haven’t generated a meaningful market impact. Economically, the German IFO survey, another forward looking business sentiment gauge, showed a further deterioration in confidence. The IFO’s expectations measure fell to its lowest level of the year with manufacturing particularly weak. This is inline with the recent PMI data and is another signpost indicating that recession risks are rising.

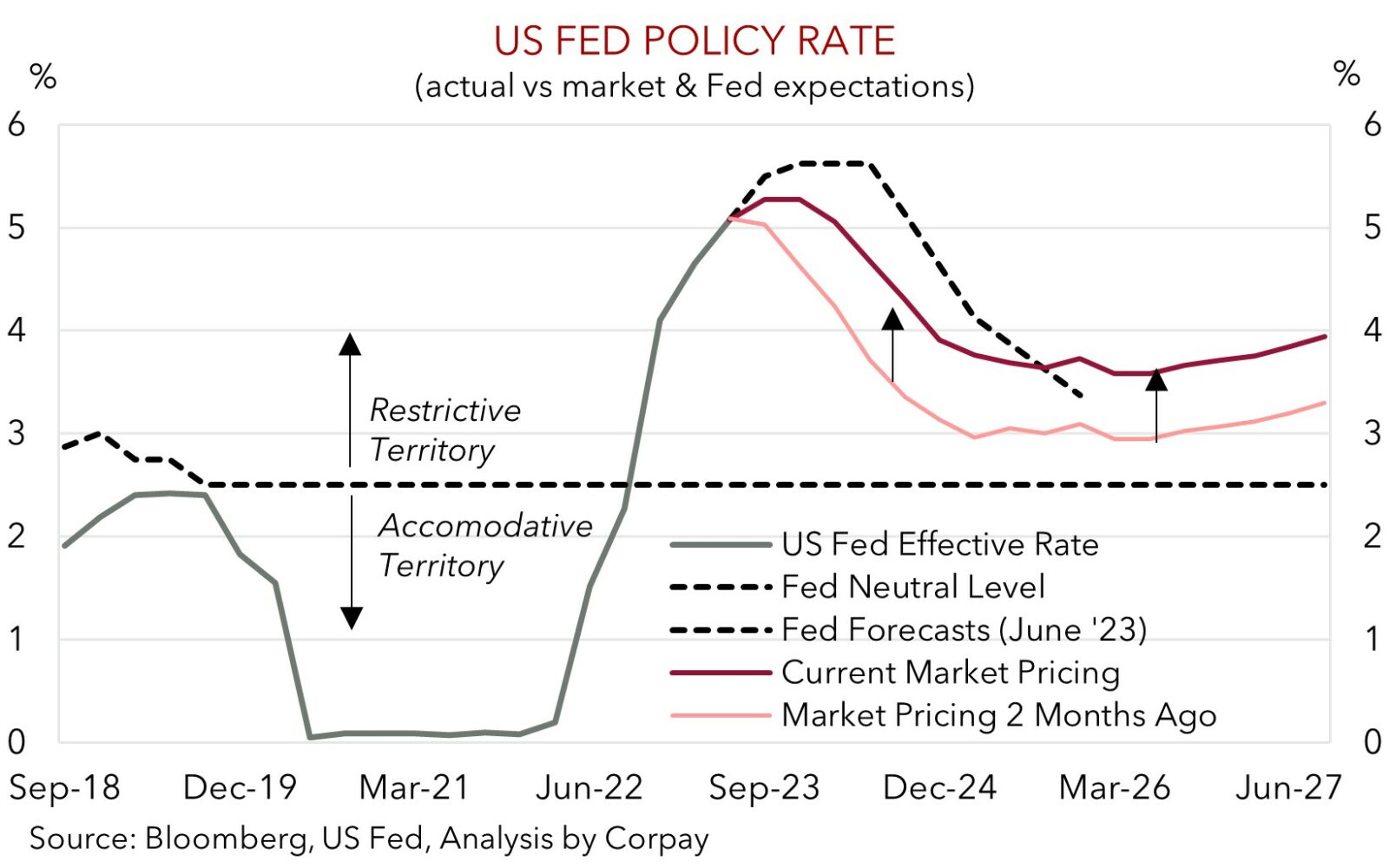

US equities ended overnight trade lower, with the tech-focused NASDAQ underperforming (S&P500 -0.5%, NASDAQ -1.2%). Long-end bond yields were also lower, with 10-year yields in the US and across Europe falling by 1-4bps. It was a slightly different at the front-end of the curve, with policy tightening expectations holding things up. At ~4.74%, the US 2-year yield remains near its highest since mid-March. As our chart shows, over the past two months there has been an upward repricing in US Fed rate hike expectations, however, despite the shift there continues to be a disconnect between the markets thinking and the Fed’s views. In contrast to the Fed, which has penciled in ~2 more hikes over the remaining four meetings of 2023, markets are only discounting ~1 more move.

In FX, the USD index consolidated, with EUR shrugging off the soft IFO data to trade around ~$1.09. USD/JPY (now ~143.50) experienced a bit of volatility with Japanese Vice Minister Kanda firing a warning shot across the bow of FX markets by noting that recent moves appear rapid and one-sided, and that he “won’t rule out any options”. Given where the JPY is trading, we think the distribution of medium-term outcomes is becoming increasingly uneven. We see more upside than downside risks to the JPY from current low levels. For more see Market Musings: JPY: Asymmetric risks building. AUD remains heavy and is still tracking under its 200-day moving average (~$0.6692) with the negative risk backdrop a downward force. As is the weakness in CNH given the tight/inverse correlation between the two. USD/CNH has pushed above 7.24 for the first time since late-November as expectations that China will announce further easing steps to support its faltering recovery build.

Globally, macro eyes are on the ECB’s Sintra Conference. Fed Chair Powell, ECB President Lagarde, BoE Governor Bailey, and BoJ Governor Ueda are speaking on a panel on Wednesday night. We think central bankers are likely to stress that the fight against inflation still isn’t over, policy needs to stay tight for some time, and that weaker growth/higher unemployment is the price that needs to be paid to ensure inflation gets back to target. In our opinion, this type of messaging is likely to keep risk sentiment on the backfoot and the USD firm.

Global event radar: ECB Sintra Conference (Weds), Fed Chair Powell Speaks (Thurs), China PMIs (Fri), Eurozone CPI (Fri), US PCE Deflator (Fri), US ISM (4th July), RBA Meeting (4th July), US Jobs (7th July), China CPI (10th July), RBNZ Meeting (12th July), US CPI (12th July), Bank of Canada Meeting (13th July), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

AUD corner

The AUD remains on the backfoot with global growth concerns continuing to exert pressure on risk sentiment (see above). The AUD continues to trade below its 200-day moving average (~$0.6692). The AUD has eased back a bit further on the crosses. AUD/EUR has drifted down towards ~0.6120, AUD/JPY is below ~96 (~2% below its recent highs), AUD/NZD is just above its 100-day moving average (~1.0816), and AUD/GBP is only ~0.7% from its 2023 lows.

As discussed previously, we believe the global economic downturn should gather pace and broaden out over the period ahead as tighter monetary policy restrains consumer spending and this flows through to other areas like production and labour markets. Slower global growth is typically a headwind for cyclical currencies like the AUD. Added to that we expect the major central bankers to reiterate their inflation fighting message when speaking at the ECB Sintra Conference (Weds AEST). If realised, this could further dampen risk appetite and the AUD based on its positive correlation with growth-linked assets like equities and commodities.

Closer to home, the monthly CPI indicator (Weds) and retail sales (Thurs) are due over the next few days. Base-effects from the fall in fuel and holiday travel prices point to a deceleration in annual inflation (mkt 6.1%pa from 6.8%pa in April), while the squeeze on household budgets from higher mortgage costs suggests retail sales may underwhelm. In our judgement, softer data may see the market trim their RBA rate hike bets, which in turn could weigh on the AUD. Overall, we continue to think that the downward pressure on the AUD should remain in place over the near-term, particularly against currencies like the EUR, JPY, and GBP, and to a lesser extent the USD (see Market Musings: AUD: break-out or bull-trap? and Market Musings: JPY: Asymmetric risks building).

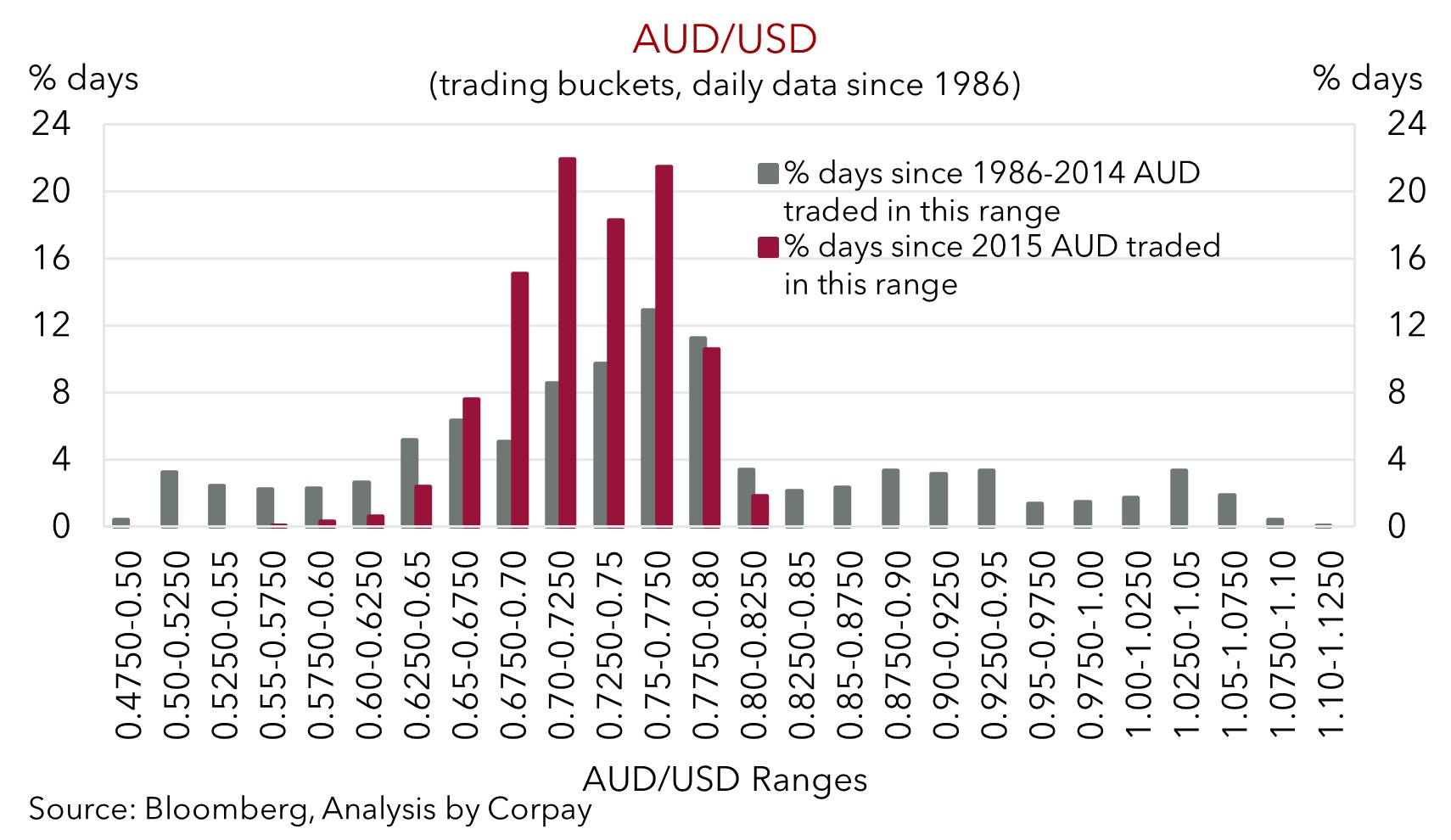

That said, while we see a bit more downside in AUD/USD, we also don’t want to be overly bearish down around current levels. While we don’t see the AUD snapping back sharply, we also think that fundamentals such as Australia’s current account surplus (now ~1.4% of GDP) and the high level of the terms of trade should act as a downside cushion. As we have seen repeatedly over the past few years the AUD tends to find solid support just below current levels because of these factors. As our chart shows, since 2015 the AUD has only traded sub-$0.6650 ~6% of the time.

AUD event radar: AU Monthly CPI (Weds), ECB Sintra Conference (Weds), AU Retail Sales (Thurs), Fed Chair Powell Speaks (Thurs), China PMIs (Fri), Eurozone CPI (Fri), US PCE Deflator (Fri), US ISM (4th July), RBA Meeting (4th July), US Jobs (7th July), China CPI (10th July), RBA Gov. Lowe Speaks (12th July), RBNZ Meeting (12th July), US CPI (12th July), Bank of Canada Meeting (13th July), China GDP (17th July), US Retail Sales (18th July), NZ CPI (19th July), UK CPI (19th July), AU Jobs (20th July), Japan CPI (21st July).

AUD levels to watch (support / resistance): 0.6600, 0.6664 / 0.6712, 0.6760

SGD corner

USD/SGD is tracking up near ~$1.3530, with the firmer USD and negative risk sentiment stemming from global growth worries supporting the pair (see above). On the crosses, EUR/SGD (now ~1.4760) is within striking distance of its late-April highs, while SGD/JPY is a touch below its peak with Japanese officials starting to become a bit more vocal about the weaker JPY. As outlined, given how weak the JPY now is, based on the global macro trends and Japanese inflation pulse, we think there are uneven risks around the JPY. In our view, further JPY weakness could be limited, but there are rising odds that the JPY strengthens sharply over the medium-term (see Market Musings: JPY: Asymmetric risks building).

As mentioned, over the near-term we think risk appetite could remain negative as global growth concerns remain in place and with central bankers likely to stress that the battle against high inflation still isn’t won. Fed Chair Powell, ECB President Lagarde, BoE Governor Bailey, and BoJ Governor Ueda are speaking on a panel at the Sintra Conference on Wednesday. We think this mix could give the USD (and USD/SGD) more support.

SGD event radar: ECB Sintra Conference (Weds), Fed Chair Powell Speaks (Thurs), China PMIs (Fri), Eurozone CPI (Fri), US PCE Deflator (Fri), US ISM (4th July), RBA Meeting (4th July), US Jobs (7th July), China CPI (10th July), Singapore GDP (10th-14th July), US CPI (12th July), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

SGD levels to watch (support / resistance): 1.3386, 1.3407 / 1.3564, 1.3590