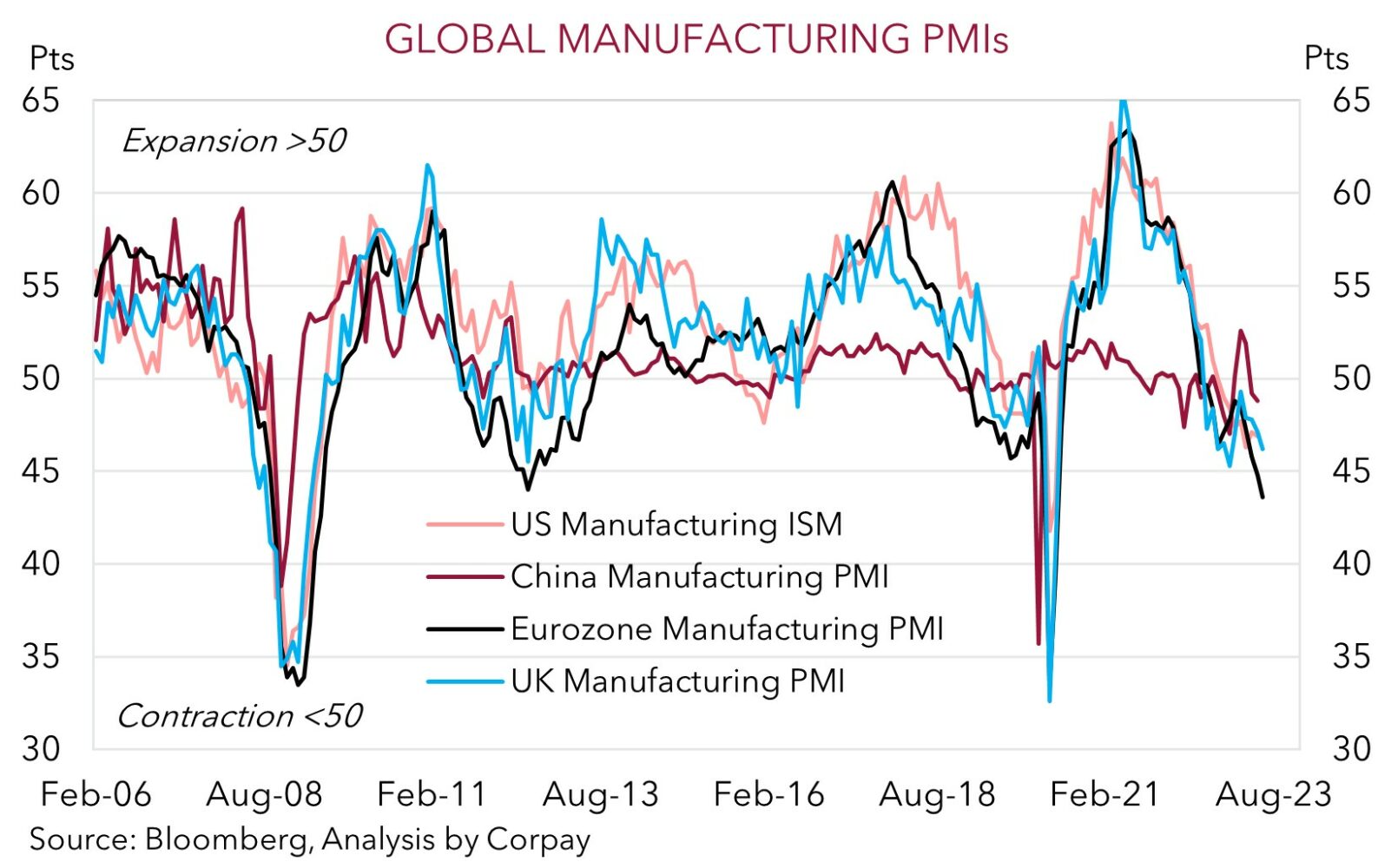

• Global worries. PMI data underwhelmed reinforcing recession concerns. Equities & bond yields fell, while the USD has strengthened.

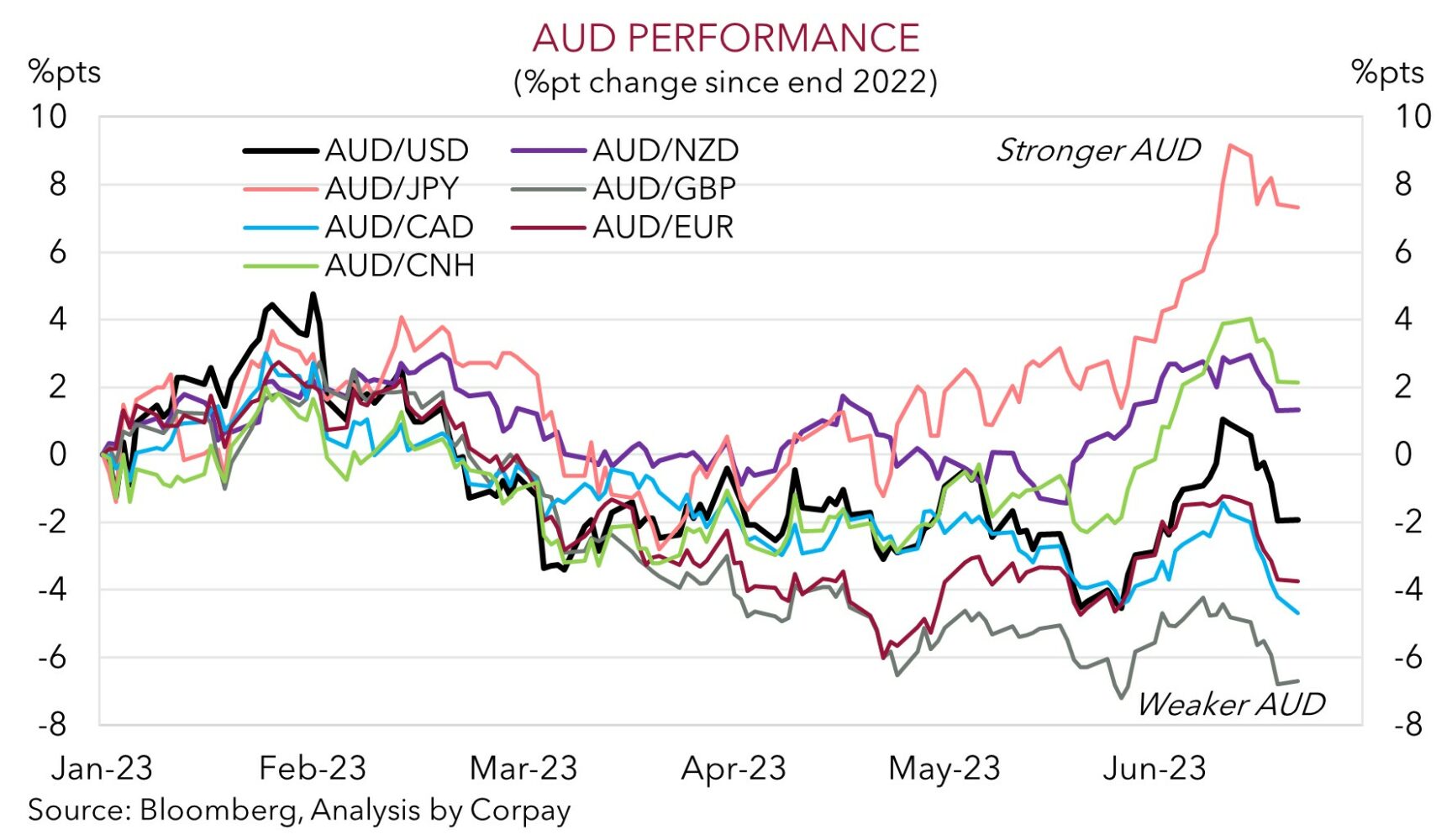

• AUD pressure. The backdrop has weighed on the cyclical AUD. Locally, the CPI indicator (Weds) & retail sales (Thurs) can influence RBA rate hike expectations.

• Central bankers. Fed Chair Powell, ECB President Lagarde, BoE Governor Bailey, & BoJ Governor Ueda speak on Wednesday.

Risks markets remained under pressure at the end of last week as global recession concerns rattled nerves. Weekend geopolitical developments in Russia is another thing to add to the ‘worry wall’. Economically, the June business PMIs for the UK, Eurozone, and the US were weaker than expected, with manufacturing in ‘contractionary’ territory and momentum in services, which has been underpinning the resilience in activity data and labour markets, also losing steam. Higher interest rates and tighter credit conditions are starting to bite, and given the lags with which policy changes work, we expect the global economic downturn to gather pace over the next few months.

Global equities fell on Friday, with the US S&P500 0.8% lower. As a result, the S&P500 experienced its largest weekly pullback (~1.4%) since the US regional banking issues flared up in March. Other growth-linked assets weakened. WTI crude oil slipped ~0.5% to be down near US$69/brl, while copper declined ~1.6%. The risk-off tone and recession fears saw bond yields dip. US bond yields endured some intra-day volatility, but on net were 5-6pbs lower across the curve. The US 2-year yield is now 4.74%. German 2-year yields tumbled ~11bps to 3.10% as growth worries intensified. By contrast, UK front-end yields rose (UK 2-year is now up at 5.14%) as stronger than expected UK retail sales offset the PMI data. Markets are now pricing a ‘peak’ Bank of England policy rate close to ~6.15%. The ~120bps of tightening factored in for the BoE by December is the largest among the major central banks.

In FX, the USD strengthened with EUR slipping back under ~$1.09 and GBP easing down towards ~$1.2710. USD/JPY moved above 143.50 for the first time since mid-November, with the shaky risk environment and further acceleration in Japanese core inflation (now 4.3%pa, the fastest since mid-1981) doing little to stop the upswing. Though we think asymmetric risks around the JPY are rising at current levels. The BoJ’s policy stance appears untenable, and USD/JPY is approaching levels that previously prompted ‘verbal’ and actual intervention by Japanese authorities. The negative global backdrop exerted more pressure on the AUD which has moved back below its 200-day moving average (~$0.6692). The AUD’s 2.84% fall last week was the largest weekly decline since last August.

Globally, the macro focus this week will be on the ECB’s Sintra Conference. Fed Chair Powell, ECB President Lagarde, BoE Governor Bailey, and BoJ Governor Ueda are speaking on a panel together on Wednesday. We think central bankers are likely to continue to stress that the fight against inflation still isn’t over, policy needs to stay tight for some time, and sub-trend growth is the price that needs to be paid to ensure inflation washes out of the system. In our view, this type of messaging is likely to keep risk sentiment on the backfoot, while developments in Russia are another factor that could generate volatility. Overall, we are looking for the USD to remain firm.

Global event radar: ECB Sintra Conference (Weds), Fed Chair Powell Speaks (Thurs), China PMIs (Fri), Eurozone CPI (Fri), US PCE Deflator (Fri), US ISM (4th July), RBA Meeting (4th July), US Jobs (7th July), China CPI (10th July), RBNZ Meeting (12th July), US CPI (12th July), Bank of Canada Meeting (13th July), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

AUD corner

The AUD remained under pressure at the end of last week with global recession worries weighing on growth-linked assets (see above). The global backdrop and stronger USD has seen the AUD fall back below its 200-day moving average (~$0.6692), with last week’s 2.84% fall the largest weekly decline since last August. The AUD has also lost ground on the crosses with AUD/EUR below its 50-day moving average (~0.6142), AUD/GBP (now 0.5251) back near its early-June lows, AUD/JPY sub ~96, and AUD/NZD under its 200-day moving average (~1.0875).

Last weeks renewed weakness in the AUD was is in line with our thinking, with the weakening global growth pulse, and view that buoyant risk markets were vulnerable to a ‘reality check’ underpinning our thoughts (see Market Musings: AUD: break-out or bull-trap?). We think the downward pressure on the AUD is likely to remain in place over the near-term, with a further unwind of the early-June upturn against currencies like the EUR, JPY, and GBP, and to a lesser extent the USD, expected.

As discussed above, we believe the global economic downturn should gather pace over the period ahead as the sharp jump in interest rates and tighter credit conditions constrain activity, particularly across commodity-intensive industrial sectors. This should be a headwind for cyclical currencies like the AUD. In our opinion, the mix of slowing global growth and ‘hawkish’ inflation fighting messages from the major central bankers when they speak at this week’s ECB Sintra Conference (Weds AEST) may also further dampen risk appetite, which in turn can keep the AUD on the backfoot given its positive correlation with equities and commodity prices.

Locally, we also think that the incoming economic data could see markets pare back RBA rate hike predictions, which if realised, would be another factor that weighs on the AUD. Markets are discounting another ~2 interest rate rises by the RBA by November. The monthly CPI indicator (released Weds) and retail sales (released Thurs) are due this week. Base-effects from the fall in fuel and holiday travel prices point to a large deceleration in annual CPI (mkt 6.1%pa from 6.8%pa in April). At the same time, the squeeze on household budgets from higher mortgage costs and lower consumer sentiment suggests retail sales may also underwhelm.

AUD event radar: AU Monthly CPI (Weds), ECB Sintra Conference (Weds), AU Retail Sales (Thurs), Fed Chair Powell Speaks (Thurs), China PMIs (Fri), Eurozone CPI (Fri), US PCE Deflator (Fri), US ISM (4th July), RBA Meeting (4th July), US Jobs (7th July), China CPI (10th July), RBA Gov. Lowe Speaks (12th July), RBNZ Meeting (12th July), US CPI (12th July), Bank of Canada Meeting (13th July), China GDP (17th July), US Retail Sales (18th July), NZ CPI (19th July), UK CPI (19th July), AU Jobs (20th July), Japan CPI (21st July).

AUD levels to watch (support / resistance): 0.6600, 0.6664 / 0.6712, 0.6760

SGD corner

USD/SGD has spiked up towards ~$1.3520, with the stronger USD and concerns about global growth factors at work (see above). Elsewhere, EUR/SGD is hovering near its recent highs (now ~1.4743), while SGDJPY has drifted a bit below its peak. As discussed before, we think that accelerating Japanese inflation and the weakness in the JPY is likely to see the Bank of Japan move away from its ultra-accommodative policy stance at some point. And as a result, we think there are more upside risks to the JPY from current low levels over the medium-term from here.

As outlined above, we believe risk sentiment could remain negative over the near term as global growth and geopolitical concerns continue to wash through, and central bankers stress that the fight against inflation still isn’t over. Fed Chair Powell, ECB President Lagarde, BoE Governor Bailey, and BoJ Governor Ueda are speaking on a panel together at the Sintra Conference on Wednesday. We think this mix could give the USD (and USD/SGD) some more support.

SGD event radar: ECB Sintra Conference (Weds), Fed Chair Powell Speaks (Thurs), China PMIs (Fri), Eurozone CPI (Fri), US PCE Deflator (Fri), US ISM (4th July), RBA Meeting (4th July), US Jobs (7th July), China CPI (10th July), Singapore GDP (10th-14th July), US CPI (12th July), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

SGD levels to watch (support / resistance): 1.3386, 1.3407 / 1.3564, 1.3590