• Hawkish surprise. BoE delivered a 50bp hike. At 5% the BoE bank rate is at its highest since early-2008. High inflation points to more hikes to come.

• Markets thinking ahead. UK long-end bond yields & GBP dipped as the negative economic impacts of higher rates start to become more of a focus.

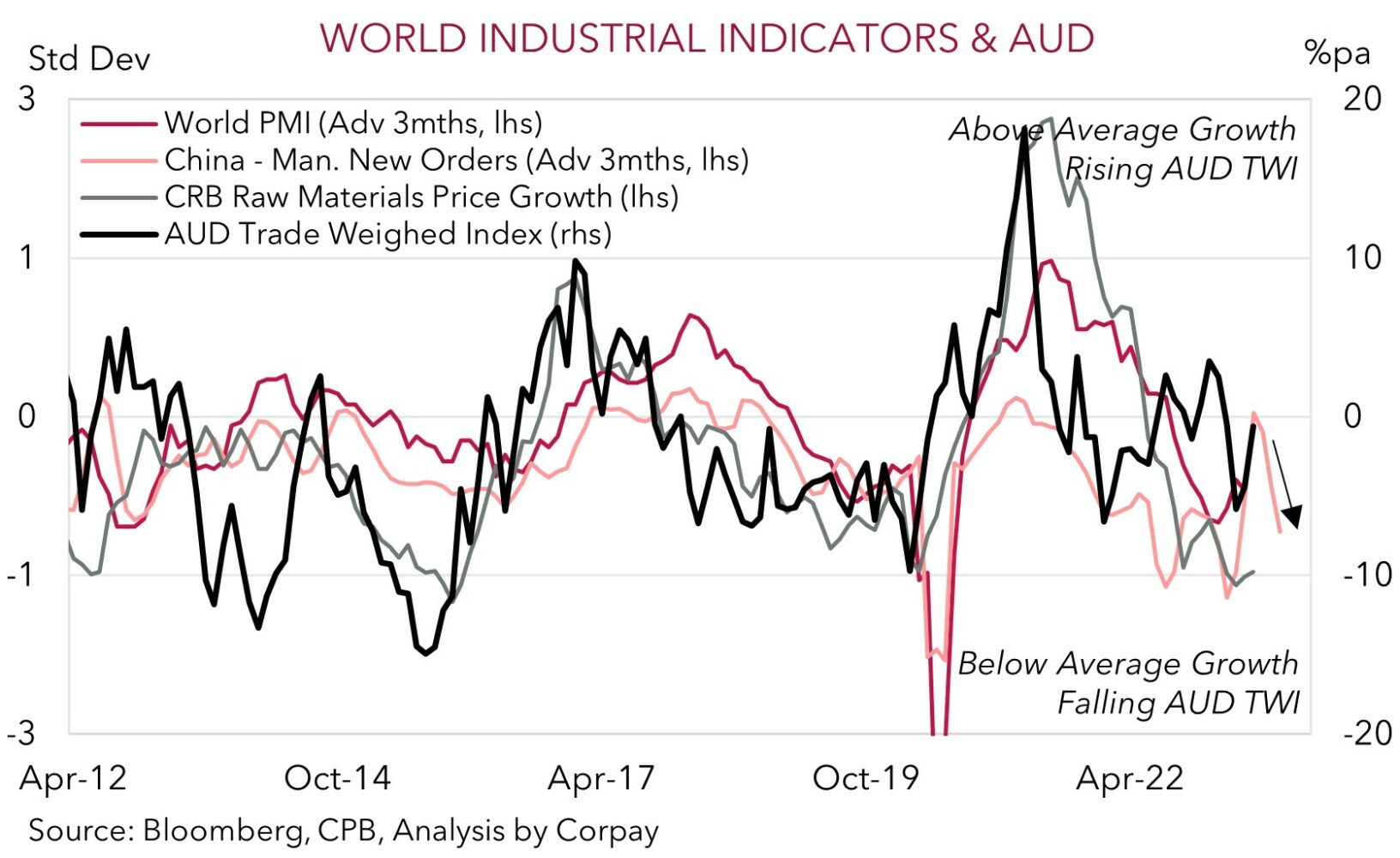

• Firmer USD. US yields & the USD rose. AUD slipped back further. Weaker global growth is a negative backdrop for risk sentiment & the AUD.

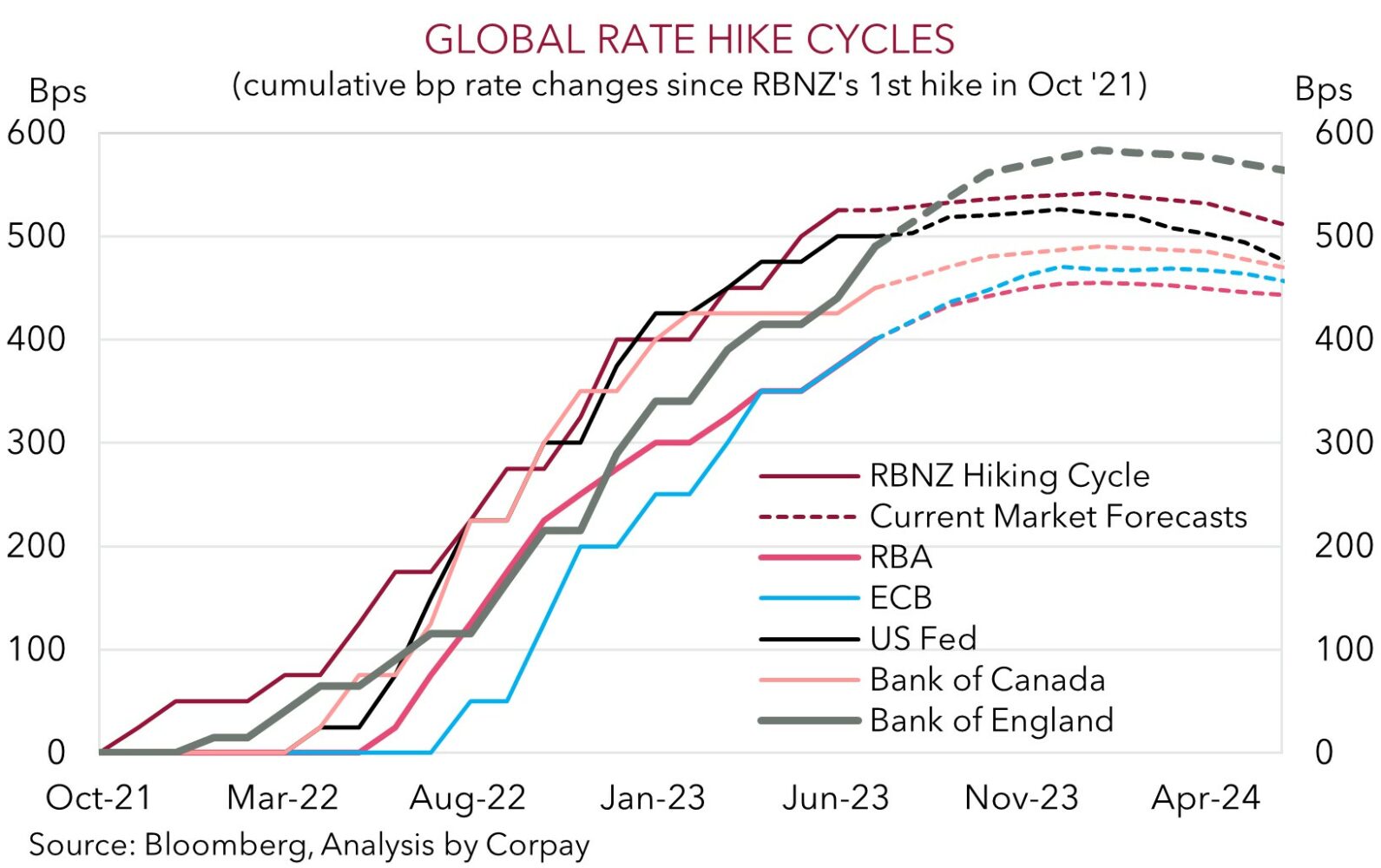

Central banks remain laser focused on breaking the back of high/sticky inflation, with growth considerations still down the pecking order. Overnight, the Bank of England surprised by hiking interest rates by a larger than anticipated 50bps with the run of stronger wage and inflation data and the spectre of a wage-price spiral forcing the central bank’s hand. This was the 13th straight meeting the BoE pulled the rate rise trigger. The BoE bank rate is now at 5%, a high since early 2008, and there is more to come. According to the BoE if there was more evidence of “persistent pressures, then further tightening in monetary policy would be required”. Markets are discounting the BoE rate to hit ~6% by the end of 2023. The BoE wasn’t alone. Norway’s Norges Bank also surprised with a 50bp hike and flagged more tightening with similar inflation worries the catalyst. The Swiss National Bank raised rates by 25bps.

In the US, Chair Powell repeated that the Fed is committed to getting inflation under control, that it “will be appropriate to raise rates” further this year, and that he “doesn’t see rate cuts happening anytime soon”. The still tight US labour market, as illustrated by initial jobless claims hovering at a low 264,000, supports the Fed’s guidance. There was a similar message in Europe where the ECB’s Nagel stressed that rates haven’t reached a “high enough” level.

The ‘hawkish’ moves and rhetoric saw Eurozone and US bond yields rise another 6-8bps. The German 2-year is now at 3.22%, while the US 2-year is at 4.79%. Both are at their highest levels since early-March. The upswing in yields and growth worries weighed on European equities (EuroStoxx50 -0.4%), however the US S&P500 managed to eke out a small gain (+0.4%). Notably, the moves in UK assets suggest markets are starting to focus less on the policy tightening phase and more on the negative economic impacts the aggressive rate hikes are set to generate down the track. UK 10yr yields fell ~4bps, pushing the 2s/10s yield curve further into negative territory as recession risks intensify. The UK yield curve is now its most inverted since 1988. There was a similar story in FX, with GBP a little lower against the firmer USD compared to this time yesterday (now ~$1.2745). EUR also slipped back to ~1.0960, while the interest rate sensitive USD/JPY has tracked the rise in bond yields higher. At ~143 USD/JPY is at its highest since mid-November. The backdrop has exerted a bit more pressure on the AUD (now ~$0.6760).

The Japan (10:30am AEST), Eurozone (6pm AEST), UK (6:30pm AEST), and US (11:45pm AEST) PMIs for June will be in focus today. We think it could be a case of ‘good news is bad news’ with signs that services sectors are holding up likely to bolster the case for further central bank action. This in turn could dampen risk sentiment. This is normally a USD supportive environment.

Global event radar: Eurozone/UK/US PMIs (Today), ECB Sintra Conference (28th June), China PMIs (30th June), Eurozone CPI (30th June), US PCE Deflator (30th June).

AUD corner

The AUD has lost a bit more ground overnight, with the hawkish actions and rhetoric of offshore central banks pushing up bond yields and dampening risk appetite (see above). At ~$0.6760 the AUD is ~2% below last week’s high. Outside of AUD/JPY, the AUD has also underperformed the other major currencies over the past 24hrs. AUD/EUR is tracking just above its 50-day moving average (~0.6143) and AUD/GBP has edged down towards ~0.53 as short-term interest rate differentials shifted a little more in favour of GBP following the BoE’s larger than expected rate hike. AUD/NZD is back below ~1.10.

The renewed weakness in the AUD over the past few days, particularly against the EUR, GBP, and USD is in line with our thinking (see Market Musings: AUD: break-out or bull-trap?). And we think there could be a bit more to come, with the 100-day (~$0.6715) and 200-day (~$0.6692) moving averages in the AUD’s sights. As outlined before, when it comes to the AUD global forces are a major determinant, FX is a relative price, and outcomes compared to what is expected matter. Domestically, further tightening by the RBA over the next few months is anticipated, but with another ~40bps worth of hikes factored in, the back end of the RBA tightening cycle looks to be discounted, in our view. At the same time, external AUD headwinds remain in place.

The stickiness in core/services inflation underpins our expectations that offshore central banks also still have more work to do, and that the global economic downturn should gather pace over the next few months as higher interest rates and tighter credit conditions act to constrain activity. This is normally a negative backdrop for cyclical currencies like the AUD. Added to that, we believe that while policymakers in China are likely to announce further stimulus measures to support the faltering recovery, the scope and scale risks underwhelming expectations. Measures aimed at boosting labor-intensive consumption growth rather than commodity-intensive infrastructure spending, which is what we judge could happen, is a less favourable mix for the AUD.

Globally the focus today will be on the PMI data out of Europe, the UK, and the US. In our view, a combination of soft manufacturing and resilient service sector activity is the worst of both worlds for the AUD. Weaker manufacturing activity generally correlates with less commodity demand, while solid services momentum could bolster global rate rise expectations. The latter, if realised, may weigh on risk sentiment and the AUD.

AUD event radar: Eurozone/UK/US PMIs (Today), ECB Sintra Conference (28th June), AU Monthly CPI (28th June), AU Retail Sales (29th June), China PMIs (30th June), Eurozone CPI (30th June), US PCE Deflator (30th June).

AUD levels to watch (support / resistance): 0.6692, 0.6715 / 0.6800, 0.6835

SGD corner

USD/SGD has ticked back up towards ~$1.3450 with the firmer USD stemming from the negative risk sentiment and higher bond yields at play (see above). EUR/SGD remains near its recent highs (now ~1.4735), while SGDJPY hit a new peak. As mentioned previously, we continue to think that accelerating Japanese inflation and JPY weakness is likely to see the Bank of Japan shift away from its ultra-accommodative policy stance at some point. As a result, we judge that there are more upside than downside risks to the JPY from current low levels over the medium-term.

Today Singapore inflation data for May is released. Annual growth in headline and core inflation is forecast to slow. However, the external environment and trends should be more important for the SGD. As outlined, the hawkish surprises by central banks (as illustrated overnight by the larger than expected BoE rate rise) is a negative for global growth and risk appetite. The UK, Eurozone, and US PMIs are released today. Signs that manufacturing is losing steam and/or that services are still holding up, which in turn would reinforce the case for further interest rate rises over the period ahead, could be a negative for risk sentiment. This could give the USD (and USD/SGD) some more support, in our opinion.

SGD event radar: Singapore CPI (Today), Eurozone/UK/US PMIs (Today), ECB Sintra Conference (28th June), China PMIs (30th June), Eurozone CPI (30th June), US PCE Deflator (30th June).

SGD levels to watch (support / resistance): 1.3350, 1.3399 / 1.3500, 1.3550