• Mixed markets. Equities lower. US yields little changed but European yields rose. Fed Chair Powell reiterated that 2 more hikes is a “pretty good guess”.

• Hot UK inflation. UK core inflation at its highest since 1992. Bank of England set to hike again tonight. The debate is on the size of the move.

• AUD mixed. AUD hovering near ~$0.68. AUD has lost ground against the EUR & JPY over the past few days. External headwinds still in place for the AUD.

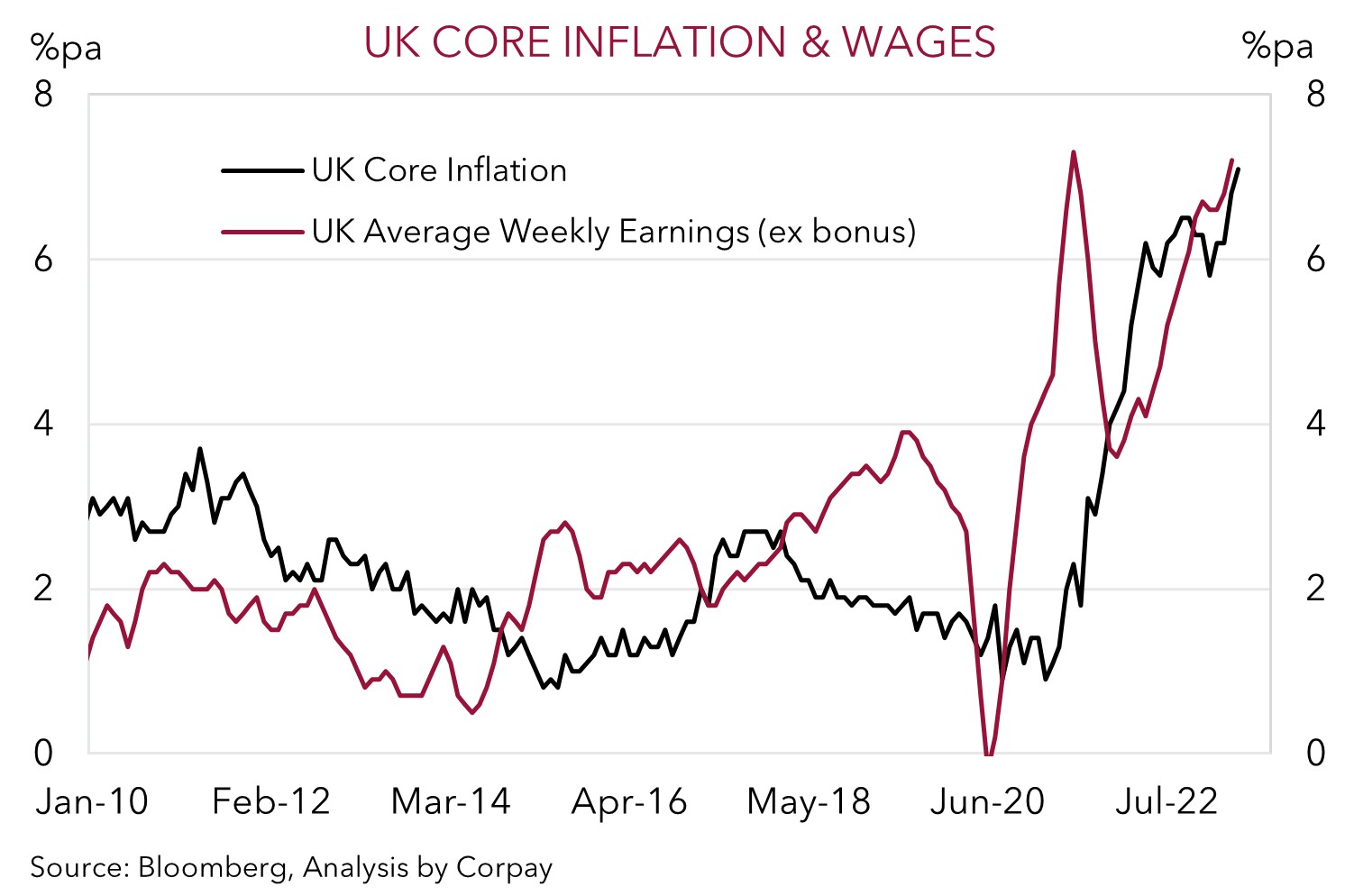

Mixed fortunes across markets overnight. Equities were a bit weaker, with the tech-focused NASDAQ underperforming (S&P500 & EuroStoxx50 -0.5%, NASDAQ -1.2%). And while US bond yields were little changed on the day (US 2-year yield is at 4.72%), European yields rose. UK bond yields spiked higher post another hotter than expected CPI report. The UK 2-year yield increased ~10bps to 5.02%. For the 4th straight month, UK CPI exceeded expectations. Headline UK inflation held steady at 8.7%pa (mkt 8.4%pa), with core inflation (i.e. ex food and energy) accelerating further (now 7.1%pa, the highest since Q1 1992).

The tight UK labour market is feeding through to wages, and this is boosting services/core inflation. The data bolstered market pricing for the Bank of England tightening cycle. The BoE announcement is tonight (9pm AEST). After raising rates at 12 meetings, the debate is whether the BoE hikes rates by 25bps or 50bps today. We think a ‘hawkish’ 25bp hike is the most likely outcome, with further rises delivered over coming months. Markets are discounting the BoE bank rate (now 4.5%) to reach ~6% by Q1. Despite the uplift in UK yields, GBP is little changed from this time yesterday, with markets starting to look beyond the hiking cycle and focusing more on the negative growth impacts all this tightening could generate down the track.

In the US, Fed Chair Powell testified to Congress. The messaging didn’t deviate from prior comments. According to Powell, the decision to ‘skip’ a hike in June reflected the current level of rates. In Powell’s words, “earlier in the process, speed was very important … It is not very important now”, however, more tightening should be anticipated. The two hikes in the FOMC’s updated dot plot are “a pretty good guess of what will happen if the economy performs about as expected”, and to reduce inflation a period of “below-trend growth and some softening of labor market conditions” is needed. In contrast to the Fed’s outlook, markets continue to discount less than 1 more rate hike in the US. The USD lost a bit of ground post Powell’s testimony. EUR has pushed up to ~1.0990 (~1-month high), while USD/JPY is hovering above 141.50. The AUD is tracking near ~$0.68.

In addition to the BoE announcement, US initial jobless claims (10:30pm AEST) and existing home sales (12am AEST) are released, and Fed Chair Powell speaks again (12am AEST). In our opinion, signs the US labour market is holding up could generate a lift in US rate expectations and the USD. Over recent weeks, jobless claims have ticked up, however a closer look below the surface suggests some of that could have been due to statistical/state-specific developments that may unwind.

Global event radar: Bank of England Meeting (Today), Fed Chair Powell Speaks (Fri), Eurozone/UK/US PMIs (Fri), ECB Sintra Conference (28th June), China PMIs (30th June), Eurozone CPI (30th June), US PCE Deflator (30th June).

AUD corner

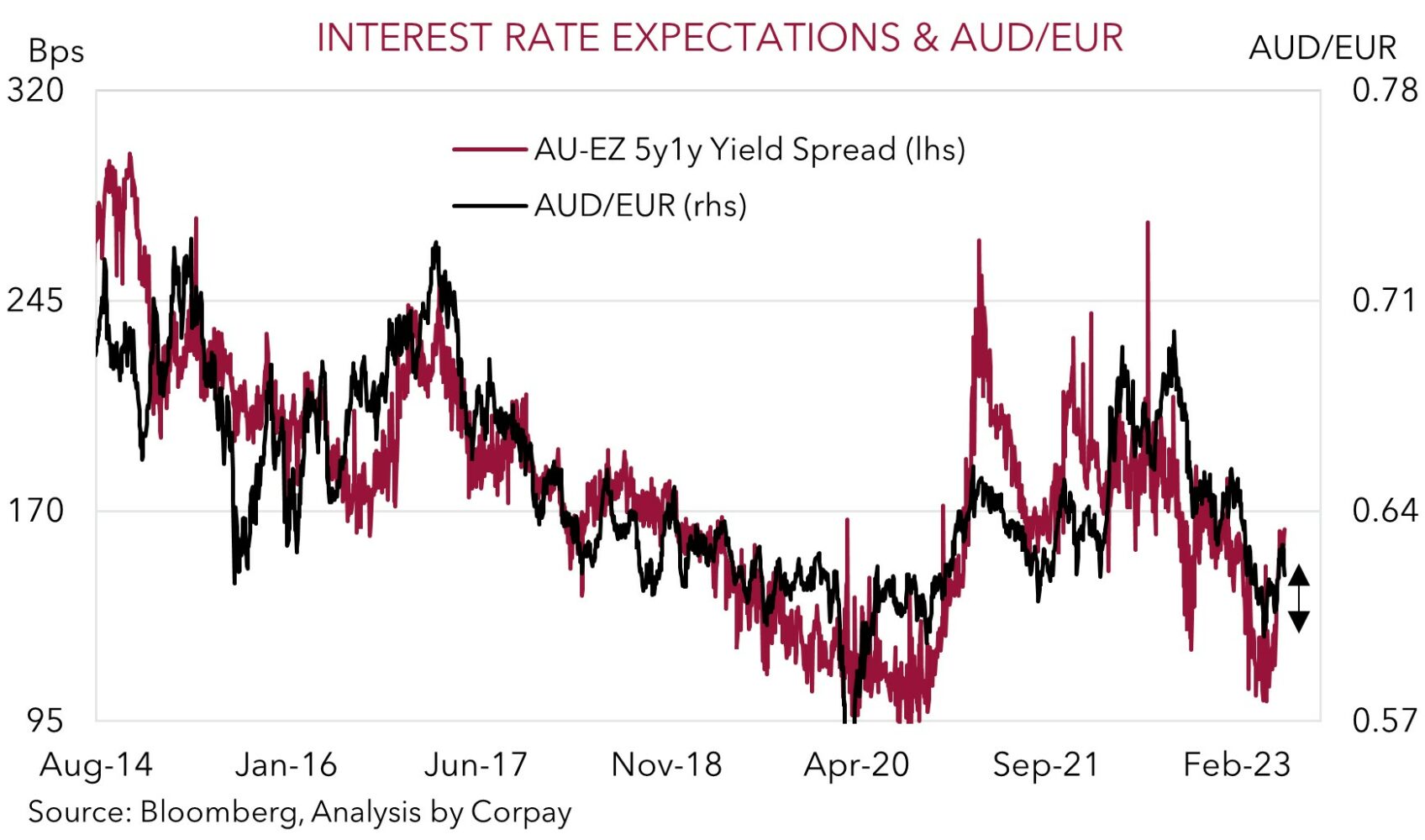

The AUD has endured a bit of volatility over the past 24 hours, with shaky risk sentiment on the back of the lift in European bond yields and stronger UK inflation data counteracted by a softer USD later in the US session. On the crosses, AUD/EUR (now ~0.6187) has continued to slip back as interest rate differentials move in favour of the EUR, while AUD/GBP is tracking below its 50-day moving average (0.5338) ahead of tonight’s Bank of England meeting where we expect a ‘hawkish’ 25bp rate hike to be delivered. AUD/JPY has also dipped over the past few days to be ~1.3% below its recent highs.

As discussed previously, we think the external backdrop remains a headwind for the AUD, and with another ~44bps worth of rate hikes factored in, the last legs of the RBA tightening cycle also now look to be discounted (see Market Musings: AUD: break-out or bull-trap?). Externally, there is still a lot of focus on when and what type of stimulus package China could unveil to boost its faltering post COVID recovery. We continue to believe that based on China’s high youth unemployment rate, low consumer confidence, and underlying financial stability concerns, any support measures are likely to be aimed at labor-intensive consumption growth rather than commodity-intensive infrastructure spending. This is a less favourable skew for the AUD. And in terms of the timing, the late-July Politburo meeting appears the most likely point when measures could be announced, in our opinion.

Today, in addition to the Bank of England decision (9pm AEST), US initial jobless claims (10:30pm AEST), and another appearance by Fed Chair Powell (12am AEST) are in focus. As outlined, we think risks are tilted to initial jobless claims improving. If realised, this could see US rate expectations lift, which in turn could give the USD a bit of a boost and exert some pressure on the AUD. That said, we expect the 100-day moving average (~$0.6717) to provide downside support over the period ahead.

AUD event radar: Bank of England Meeting (Today), Fed Chair Powell Speaks (Fri), Eurozone/UK/US PMIs (Fri), ECB Sintra Conference (28th June), AU Monthly CPI (28th June), AU Retail Sales (29th June), China PMIs (30th June), Eurozone CPI (30th June), US PCE Deflator (30th June).

AUD levels to watch (support / resistance): 0.6724, 0.6781 / 0.6925, 0.6975

SGD corner

USD/SGD has drifted down to its 50-day moving average (~$1.3398), with the USD losing a bit of ground post Fed Chair Powell’s testimony (see above). By contrast, the stronger EUR has helped EUR/SGD edge higher. At ~1.4725 EUR/SGD is now ~0.5% below its late-April highs. SGDJPY has eased back over the past few sessions. As discussed before, we continue to think that the upswing in Japanese inflation and JPY weakness should see the Bank of Japan shift away from its ultra-accommodative policy stance at some point. As such, given the low starting point, we judge that there are more upside than downside risks to the JPY over the medium-term.

In the short-term, markets will be focused on tonight’s Bank of England announcement, US initial jobless claims data, and another day of testimony by Fed Chair Powell. As outlined, we are looking for the BoE to deliver a ‘hawkish’ 25bp hike, while in the US we think jobless claims could improve after some softness over recent weeks. This mix could dampen risk sentiment and boost interest rate expectations. In our opinion, an upshift in US rate pricing towards the Fed’s central case looking for 2 more hikes over the next few months could be USD (and USD/SGD) supportive.

SGD event radar: Bank of England Meeting (Today), Fed Chair Powell Speaks (Fri), Singapore CPI (Fri), Eurozone/UK/US PMIs (Fri), ECB Sintra Conference (28th June), China PMIs (30th June), Eurozone CPI (30th June), US PCE Deflator (30th June).

SGD levels to watch (support / resistance): 1.3200, 1.3320 / 1.3500, 1.3550