• Negative vibes. US on holiday, but European equities dipped & bond yields rose. Hawkish central bank rhetoric was a factor.

• China stimulus. Lack of an announcement by China on a stimulus package also weighed on sentiment. We think markets are too ‘bulled up’ about China stimulus.

• AUD softer. AUD has given back a little ground. RBA meeting minutes released today. RBA’s Kent & Bullock also due to speak.

With the US on holiday it was a relatively quiet night for markets, though risk appetite has been softer across those that were open. European equities dipped (EuroStoxx600 -1%), oil prices gave back a little ground (WTI crude -0.7%), while bond yields continue to move higher. Ahead of Thursday’s Bank of England meeting, where another ‘hawkish’ 25bp rate hike is anticipated, UK 2-year yields increased another ~14bps to 5.08%, a high since mid-2008. German yields also edged higher, rising by 3-4bps across the curve. Central bankers continue to talk tough on inflation. The ECB’s Schnabel noted that inflation risks are tilted to the upside, and that the central bank needed to err on the side of doing too much, while Vice President Guindos also flagged that the slowdown in core inflation may be limited. There were key lessons from the 1970’s inflation breakout. Global central bankers remain wary of repeating the same mistakes as back then when victory was declared too quickly, and policy was loosened too soon, which allowed inflation to come roaring back even stronger a few years later.

In FX, the USD Index drifted a touch higher with EUR slipping back towards ~$1.0920. Ahead of the BoE meeting GBP is hovering around ~$1.28, the top end of its ~2-year range, and USD/JPY (now ~141.92) is near its highest level since last November. NZD and AUD have eased back, with the shaky risk environment and China developments exerting some downward pressure. USD/CNH has unwound a lot of Friday’s fall to be back up near ~7.16. As outlined previously, there is a tight/inverse correlation between AUD/USD and USD/CNH, with a move higher in USD/CNH acting as a drag on the AUD. Markets appear somewhat disappointed by the lack of an announcement on a China stimulus package following Friday’s State Council meeting. As we have stated before, while more stimulus from China is anticipated in time, given high debt levels and worries about financial stability a targeted approach is more likely, and the markets lofty expectations may not be met.

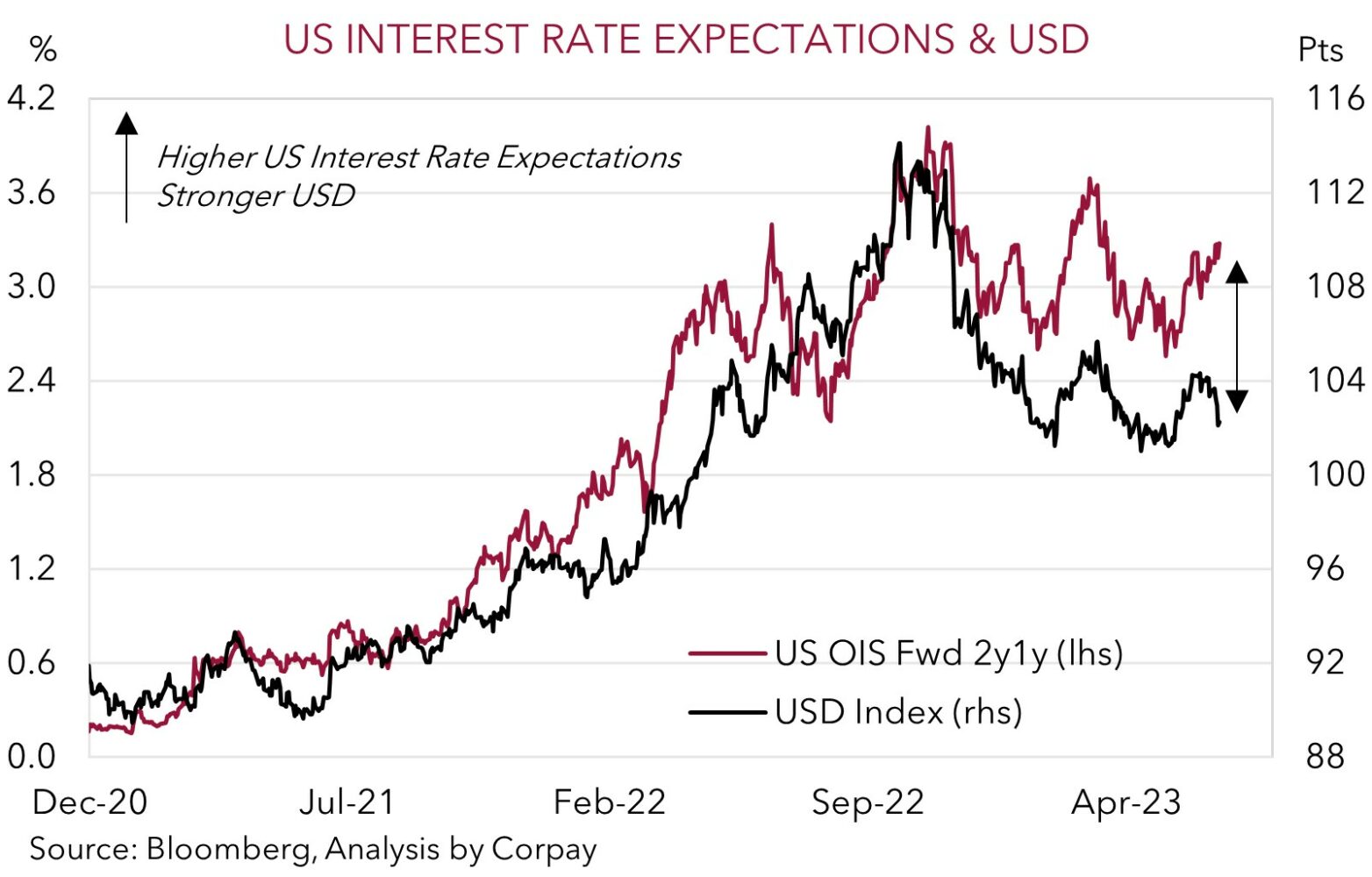

Globally the next major focus is Fed Chair Powell’s testimony to Congress (Thursday and Friday morning AEST). Chair Powell is speaking as the voice of the FOMC, and as such we expect him to reiterate the updated central view that further rate hikes are projected over the next few meetings, and that rate cuts are a long way off. In our opinion, markets are still underestimating the Fed’s determination to bring down inflation and a ‘hawkish’ message from Powell could see US rate expectations adjust higher. If realised, we think this could give the USD a bit of a boost.

Global event radar: Bank of England Meeting (Thurs), Fed Chair Powell Speaks (Thurs/Fri), Eurozone/UK/US PMIs (Fri), ECB Sintra Conference (28th June), China PMIs (30th June), Eurozone CPI (30th June), US PCE Deflator (30th June).

AUD corner

The AUD has drifted back slightly at the start of this week to be near ~$0.6850. The AUD has also given back a little ground against the EUR, GBP, and JPY over the past 24 hours. The modest bout of risk aversion generated by the lift in European bond yields on the back of ‘hawkish’ central bank rhetoric, disappointment by the lack of a China stimulus package announcement, and the weaker CNH has weighed on the AUD (see above).

As outlined previously, we continue to think that the AUD has moved too far too fast over recent weeks, and that the rebound is likely to lose steam as external headwinds re-emerge (see Market Musings: AUD: break-out or bull-trap?). In today’s Asian trade, the minutes of the June RBA meeting are released (11:30am AEST), and the RBA’s Kent (11:35am AEST) and Bullock (1:30pm AEST) speak. Given the minutes cover the meeting when the RBA surprised most by delivering another hike, they should read ‘hawkish’. However, with another ~2 hikes now factored in to markets, we believe the last stages of the RBA tightening cycle are discounted. By contrast, as discussed above, we expect Fed Chair Powell to sound a bit more ‘hawkish’ than markets are assuming when he testifies to Congress later this week (Thursday and Friday AEST). This could see relative yield differentials shift in favour of a lower AUD.

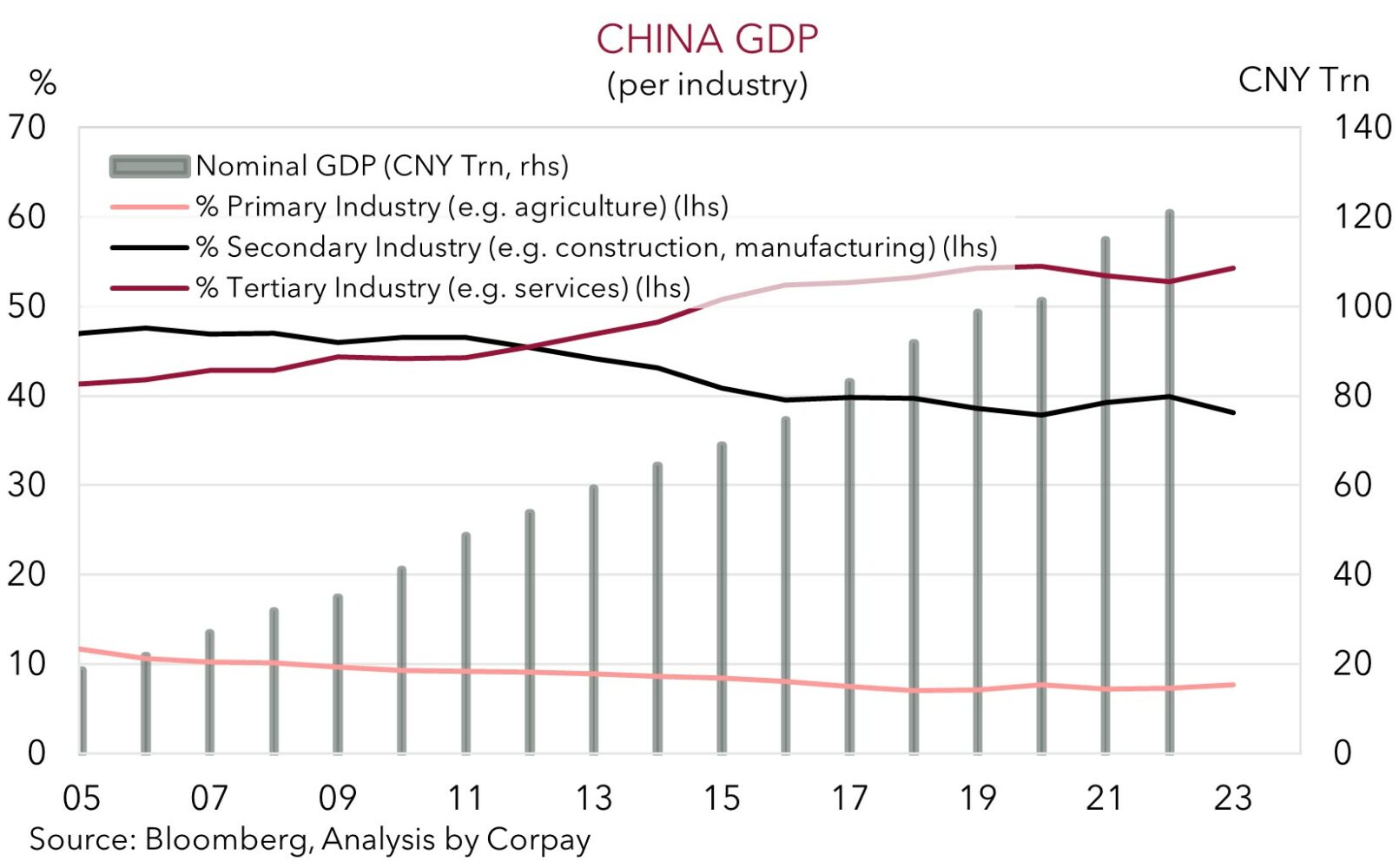

In terms of China, another small reduction (i.e. 10-15bps) in its 1-year and 5-year prime lending rates is expected today (11:15am AEST). If realised, this is likely to keep USD/CNH supported, which in turn can be a headwind for the AUD based on the inverse correlation between the two. More broadly, we continue to think that any stimulus package to support China’s faltering recovery could underwhelm. As our chart shows, China’s economy has become more skewed towards tertiary industries (i.e. services) over recent years. Based on China’s high youth unemployment rate, low consumer confidence, and financial stability concerns, we expect any support measures to be aimed at boosting labor-intensive consumption growth rather than commodity-intensive (and AUD positive) infrastructure spending.

AUD event radar: RBA Meeting Minutes (Today), Bank of England Meeting (Thurs), Fed Chair Powell Speaks (Thurs/Fri), Eurozone/UK/US PMIs (Fri), ECB Sintra Conference (28th June), AU Monthly CPI (28th June), AU Retail Sales (29th June), China PMIs (30th June), Eurozone CPI (30th June), US PCE Deflator (30th June).

AUD levels to watch (support / resistance): 0.6724, 0.6781 / 0.6925, 0.6975

SGD corner

USD/SGD has ticked back up towards ~$1.3410, after finding support around its 100-day moving average. The mix of a slightly firmer USD, and some negative risk sentiment stemming from the ‘hawkish’ commentary from European central bankers and the lack of a China stimulus package has supported USD/SGD (see above). EURSGD remains near its 1-month highs (~1.4647), while JPYSGD is very close to its October 2022 lows. We continue to think that the upswing in Japanese inflation and JPY weakness should see the Bank of Japan shift away from its ultra-accommodative policy stance at some point. As such, given the low starting point, we judge that there are more upside than downside risks to the JPY from here.

As discussed above, in terms of China, we continue to think that more stimulus measures are probable, however, a targeted approach, focused on monetary easing, boosting confidence, and supporting labor-intensive consumption is more likely. This may may keep the pressure on CNH, and other Asian currencies like the SGD, in our view. At the same time, we believe Fed Chair Powell could sound ‘hawkish’ compared to current interest rate pricing when he testifies to Congress later this week (Thursday and Friday). In our opinion, an upshift in interest rate expectations towards the Fed’s central case could give the USD (and USD/SGD) further support.

SGD event radar: Bank of England Meeting (Thurs), Fed Chair Powell Speaks (Thurs/Fri), Singapore CPI (Fri), Eurozone/UK/US PMIs (Fri), ECB Sintra Conference (28th June), China PMIs (30th June), Eurozone CPI (30th June), US PCE Deflator (30th June).

SGD levels to watch (support / resistance): 1.3200, 1.3320 / 1.3500, 1.3550