• Rates reprice. Stronger than expected US & European data jolted bond yields higher. US 2yr yield spiked to a cyclical high before settling near ~5%.

• AUD struggles. AUD remains on the backfoot. Higher rates for longer is a negative for global growth. Policy expectations are also against the AUD.

• US payrolls. US non-farm payrolls data released tonight. Another solid report could reinforce the upswing in global interest rate pricing.

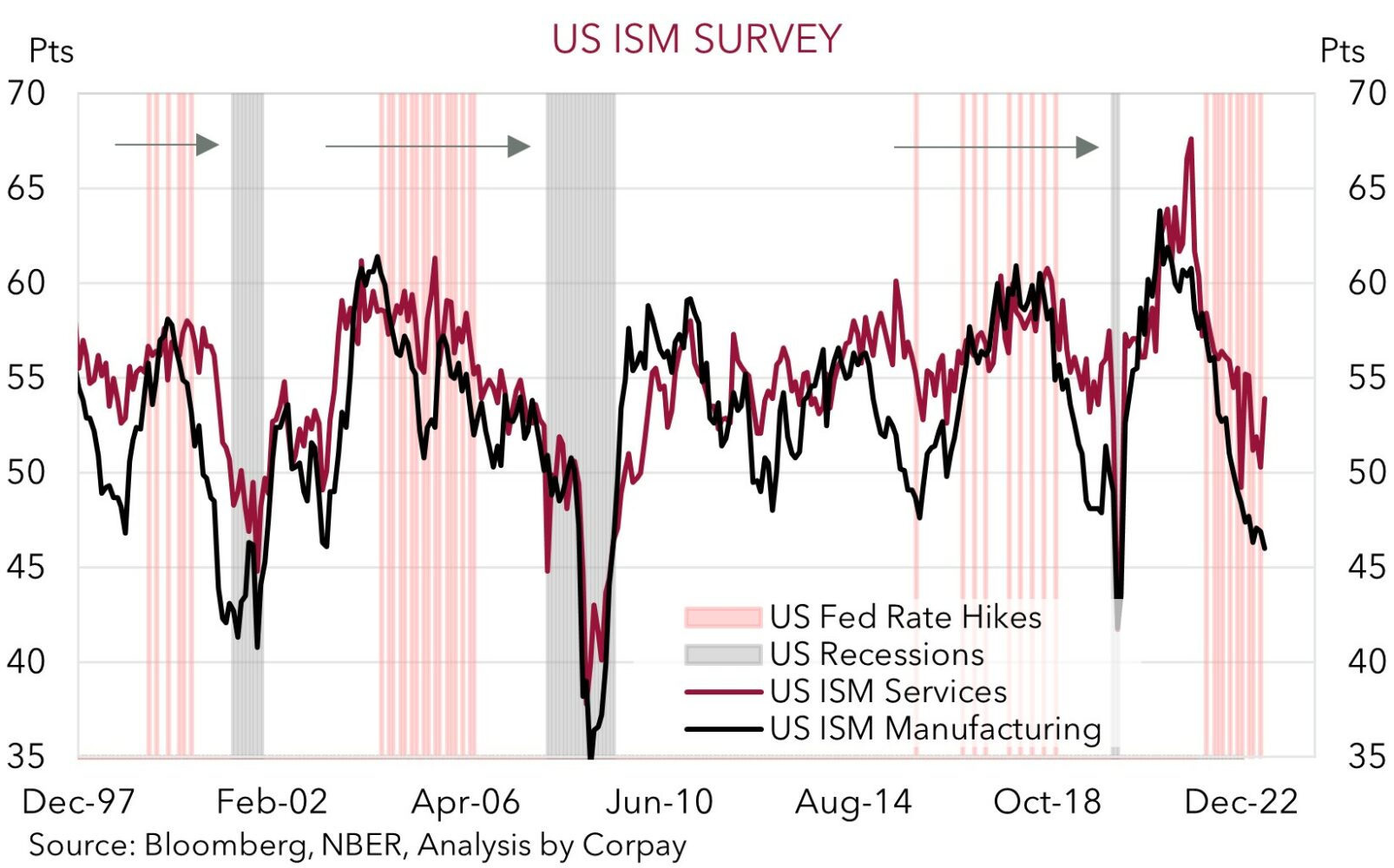

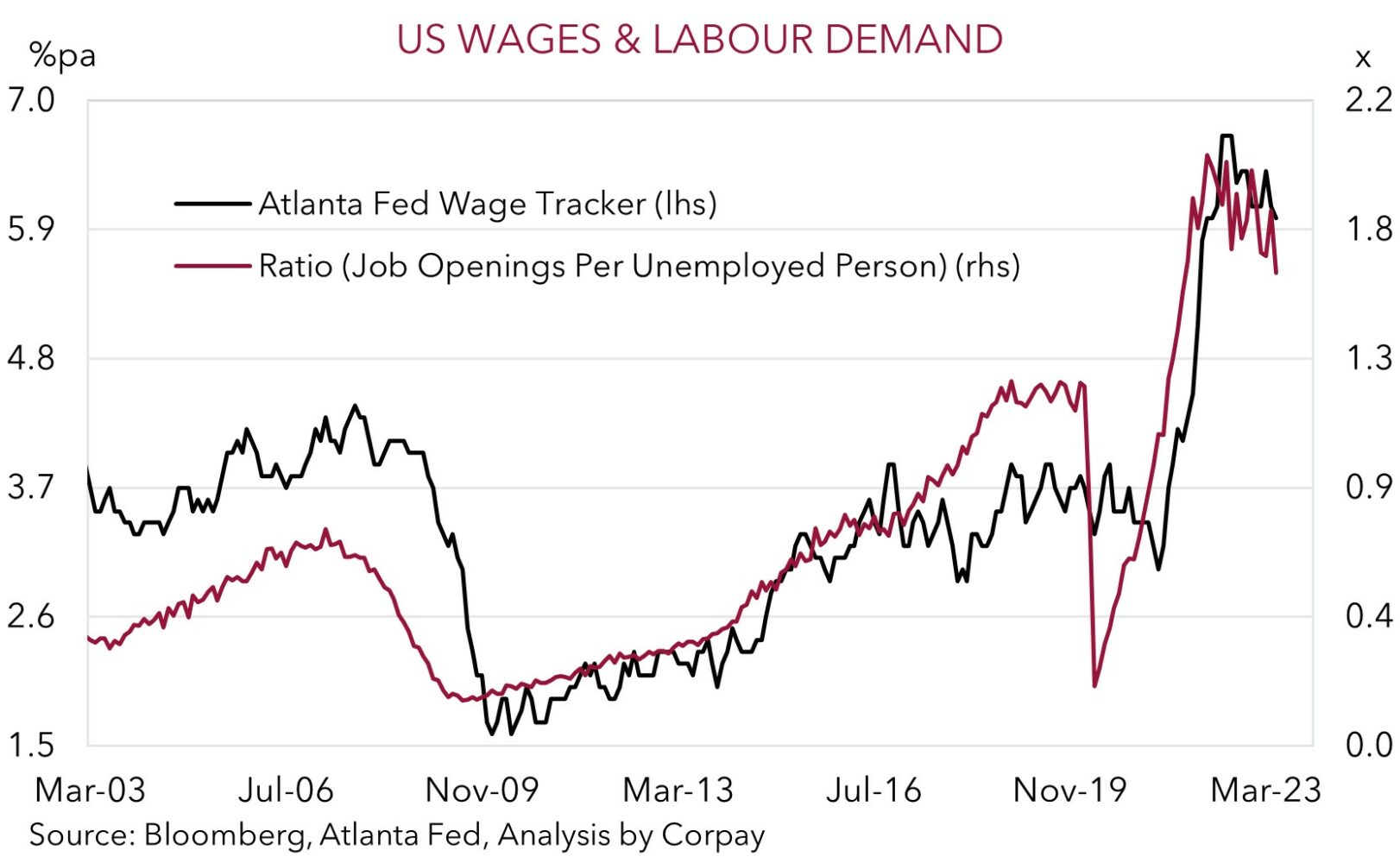

A case of good economic news is bad news for markets overnight. Robust data jolted markets into re-evaluating how high interest rates may need to go to take the heat out of labour markets and get inflation down to target. In the US, ADP private payrolls were a lot stronger than anticipated, rising by 497,000 in June. This was the fastest pace in nearly a year, and more than double consensus forecasts. Initial jobless claims, the weekly read on how many people are filing for unemployment benefits, remain historically low. And while the JOLTS data showed that job openings eased, at 9.8mn there are still ~1.6 vacancies per unemployed person in the US. This ratio needs to be closer to ~1 for wages to be consistent with the Fed’s 2%pa inflation goal. The ISM services index also rebounded more than predicted, rising to 53.9, a 4-month high. The US is a heavily services driven economy (~85% of GDP is services). The ISM data suggests that the services sector is (so far) barely showing any strong ill-effects from tighter monetary policy. In Europe, German factory orders also snapped back, rising by over 6% in May, a tentative sign that the manufacturing slump may also be easing.

In response, bond yields jumped up. 10-year yields in Germany and the UK rose ~15-17bps, while in the US the 10-year increased ~10bps to 4.03%. The US 10-year is within striking distance of its 2023 highs. At the policy influenced front-end of the curve yields also lifted, with the UK 2-year now 5.47% (+12bps) and the US 2-year ending the day at 4.98% after spiking as high as 5.12% during the session. Markets are now assigning a ~89% chance of a 25bp rate hike by the US Fed in late-July, and a better than even chance of another more by November. In Europe, a bit over 2 more hikes by the ECB are now discounted by year-end, and the Bank of England is expected to raise rates by another ~157bps by Q2 2024. The rise in bond yields flowed through negatively to equities. The US S&P500 fell 0.8%. In Europe the major stock markets were down 2-3%. In FX, the USD Index whipped around during the day. The larger shift in European yields supported the EUR (now ~$1.0890) and GBP (now ~$1.2740), while the JPY garnered some support from the negative risk sentiment. Cyclical currencies like the AUD and NZD lost ground, with the former slipping to ~$0.66 overnight before stabilising.

The focus will remain in the US tonight, with the monthly non-farm payrolls report due (10:30pm AEST). We expect the overall data batch to show that labour market conditions are tight, with unemployment historically low and average hourly earnings running north of 4%pa. We think this could reinforce US interest rate expectations and give the USD more support against currencies like the AUD, NZD, and Asian FX.

Global event radar: US Jobs (Today), China CPI (10th July), RBNZ Meeting (12th July), US CPI (12th July), Bank of Canada Meeting (13th July), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

AUD corner

The AUD’s underperformance has continued. Stronger than expected data, particularly in the US, has seen interest rate markets reprice higher (see above). This has dampened risk appetite, as illustrated by the weakness in equities and industrial metal prices, and weighed on cyclical currencies like the AUD. AUD/USD dipped down to ~$0.66 overnight before finding some support. On the crosses AUD/EUR has fallen back under 0.61, AUD/GBP touched its lowest level since May 2020 (now ~0.52), AUD/JPY (now ~95.44) is near the bottom of its ~3-week range, and AUD/NZD continues to track sub-1.08.

The US labour market and services data released overnight has reinforced the ‘hawkish’ message contained in the minutes of the recent FOMC meeting which outlined that the Fed thinks it has more work to do to tame still high/sticky inflation. That said, despite the rise in bond yields, US rates markets still aren’t fully inline with the Fed’s baseline assumption looking for 2 more rate hikes over the next 4 meetings. The US non-farm payrolls data is released tonight (10:30pm AEST). As discussed, although there are several moving parts to the report, overall, we expect it to show that conditions remain ‘tight’, and that further policy action will be needed for the US Fed to break the back of the US’ services/wages driven inflation problem. In our view, solid data, particularly a low US unemployment rate, could see US interest rate expectations converge towards the Fed’s baseline thinking, supporting the USD, and exerting more pressure on the AUD.

On the crosses, we also see more downside in pairs like AUD/EUR, AUD/GBP, and AUD/JPY. A further lift in bond yields on the back of policy tightening expectations is dampening global growth expectations, which is typically more of a relative headwind for the AUD. At the same time, while further tightening by the RBA is looked for, more steps are anticipated by the ECB and BoE. FX is a relative price, and interest rate pricing remains in favour of the EUR and GBP over the AUD. And as noted before, we think the case for a sustained pull-back in AUD/JPY is growing (see Market Musings: JPY: Asymmetric risks building).

Taking a step back, although we see some more near-term downside in AUD/USD we also don’t want to be overly bearish near current levels. While we don’t see AUD/USD snapping back sharply for a while yet given the sluggish global growth pulse, developments in China, and pressure on some major AUD crosses, we also believe that fundamentals such as Australia’s current account surplus (now ~1.4% of GDP) and the high level of the terms-of-trade should act as downside supports. Since 2015, AUD/USD has only traded sub-$0.66 ~5% of the time.

AUD event radar: US Jobs (Today), China CPI (10th July), RBA Gov. Lowe Speaks (12th July), RBNZ Meeting (12th July), US CPI (12th July), Bank of Canada Meeting (13th July), China GDP (17th July), US Retail Sales (18th July), NZ CPI (19th July), UK CPI (19th July), AU Jobs (20th July), Japan CPI (21st July).

AUD levels to watch (support / resistance): 0.6547, 0.6600 / 0.6696, 0.6760

SGD corner

USD/SGD endured some modest volatility over the past 24hrs, but on net the pair (now ~$1.3536) remains firm near its 200-day moving average. Higher US and European bond yields on the back of stronger than forecast data and repricing in interest rate expectations, combined with the negative spillover into risk markets has supported USD/SGD (see above). On the crosses, EUR/SGD (now ~1.4740) has recouped some lost ground and is now just ~0.5% below its one-year high. SGD/JPY has also drifted lower, with the JPY benefitting from the turn in risk appetite. As outlined before, given how weak the JPY now is, over the medium-term we believe there are far more upside risks from here.

As outlined above, focus tonight will be on the US non-farm payrolls data. Various leading indicators released overnight point to another solid US jobs report, with conditions remaining too ‘tight’ for inflation to be on a sustained path down to target without a further Fed policy response. Another robust report, which is where we think the risks reside, should reinforce the upswing in US interest rate expectations/bond yields, giving USD/SGD some more support.

SGD event radar: US Jobs (Today), China CPI (10th July), Singapore GDP (10th-14th July), US CPI (12th July), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

SGD levels to watch (support / resistance): 1.3405, 1.3436 / 1.3590, 1.3640