• US payrolls. Non-farm payrolls came in lower than expected. But other detail in the report shows that the US labour market is still tight.

• Softer USD. The USD weakened. US CPI in focus this week. Base-effects point to a further step down in inflation. This could exert more pressure on the USD.

• AUD rebound. AUD has bounced back. In addition to the US CPI, RBA Governor Lowe speaks on Wednesday. We think the AUD may recover more ground.

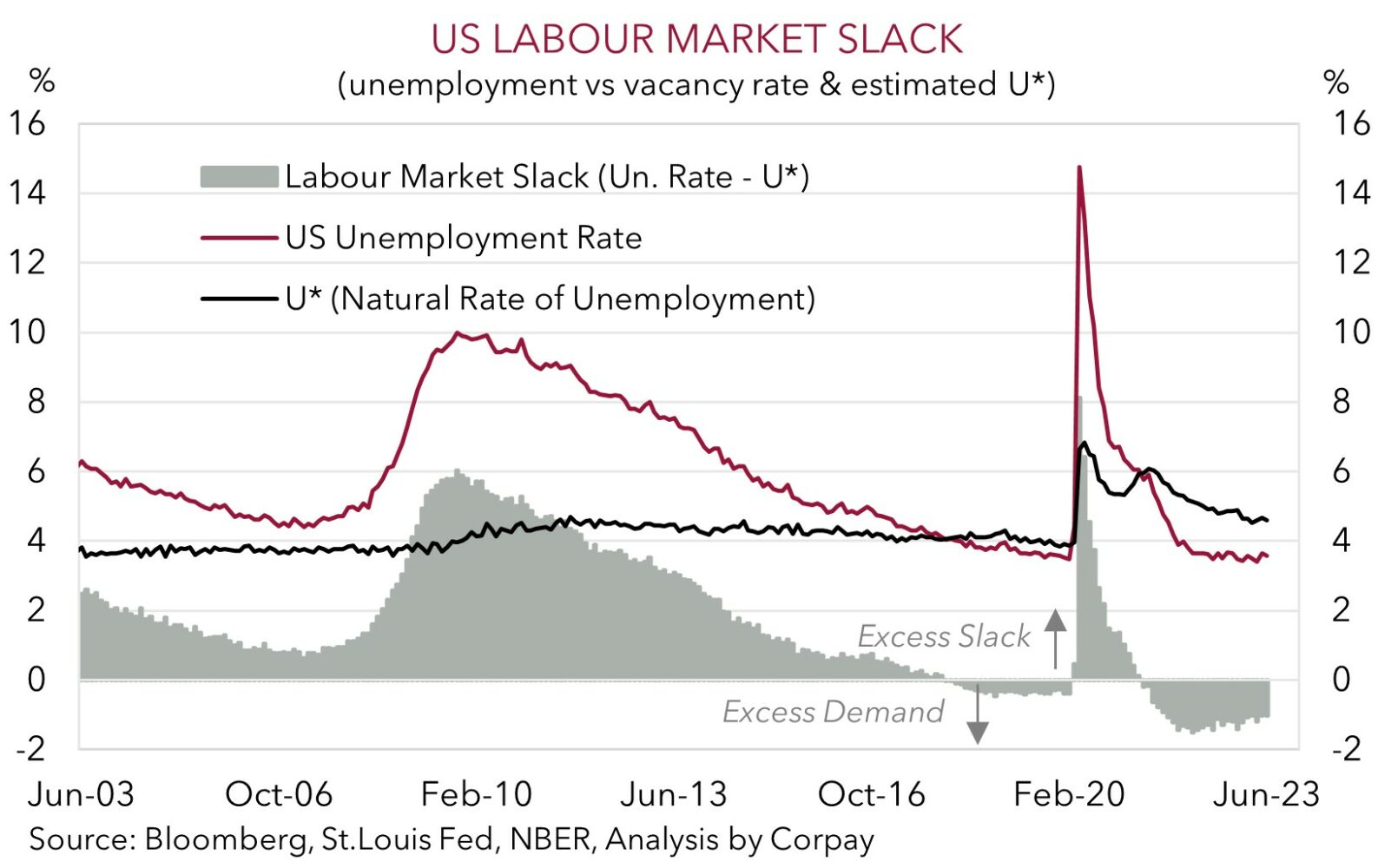

A tumultuous week for markets was brought to a close by the release of the US labour market report on Friday. And there was something for everyone in the data. For the first time in 15-months non-farm payrolls came in below consensus expectations. Payrolls rose by 209,000 in June, the smallest increase since late-2020. That said, despite the market’s laser-like focus, payrolls are just one part of the story. Other important bits and pieces show that the US labour market remains tight, and in our view, support the case for the US Fed lifting rates again in late-July and at least one more time after that. US unemployment fell to 3.6% (just above its ~50-year low), hours worked picked up, and average hourly earnings (a wage measure) is running at 4.4%pa (this is well above the 2.7%pa run-rate averaged in the 5-years pre-COVID). As our chart shows, the US labour market remains in a state of ‘excess demand’. While this is in place wages and services prices are unlikely to move down to levels consistent with the Fed’s 2%pa inflation target.

Volatility in bonds continued. US yields whipped around after the payrolls release before the rest of the data was digested. The US 2-year ended the day at 4.95%, a couple of basis points lower, but still higher compared to a week ago. The US 10-year yield ended Friday higher (now 4.06%, near the top of its 2023 range), taking its move over the week to +23bps. Elsewhere, US equities reversed earlier gains to end Friday in the red as the higher for longer rates view continues to sink in (S&P500 -0.3%). As a result, the S&P500 recorded only its 2nd weekly fall in ~2-months.

In FX, the USD Index lost ground with EUR (the major USD alternative) rising to ~$1.0965, a ~2-week high. GBP strengthened (now ~$1.2835, the upper bound of its 1-year range), while USD/JPY declined back below 142.30 (~2% below its late-June peak). The softer USD and another day of the People’s Bank of China fixing the CNY to a stronger than expected level (a sign of its ongoing discomfort with CNY weakness) helped the AUD recover. At ~$0.6690 the AUD is tracking between its 100- and 200-day moving averages.

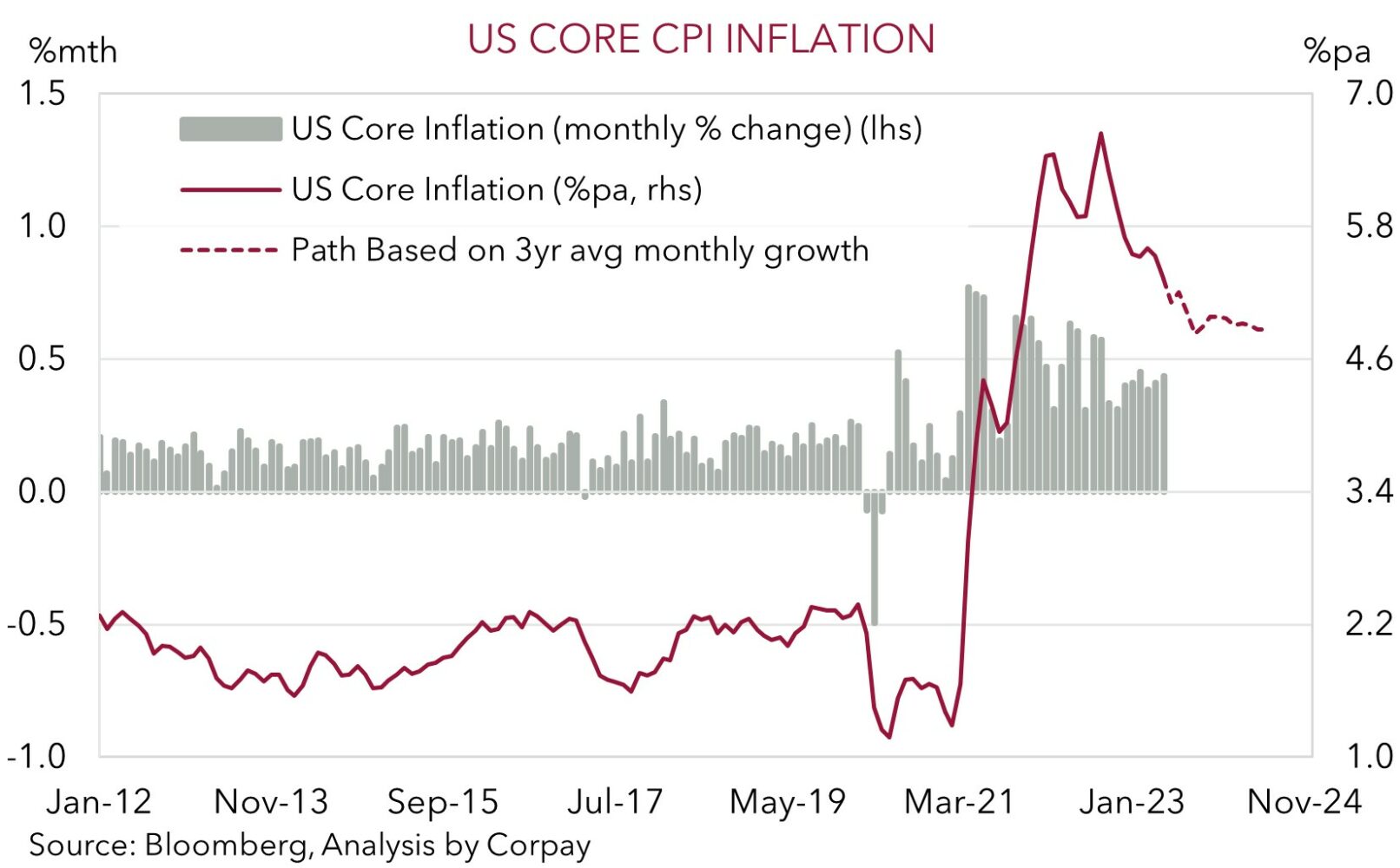

Focus should remain in the US this week with the CPI data the major release (Weds night AEST). Base-effects, as last years large price increases roll out of calculations and some other forces such as lower used car prices and rents point to US inflation decelerating further. If realised, we think this may take some more heat out of the USD. However, with US core inflation set to remain at uncomfortably high levels this could be a short-term move, particularly against cyclical currencies like the AUD, NZD and Asian FX, with another ‘hawkish’ rate hike by the US Fed looking likely later this month.

Global event radar: China CPI (Mon), RBNZ Meeting (Weds), US CPI (Weds), Bank of Canada Meeting (Thurs), China Trade Data (Thurs), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

AUD corner

The AUD bounced back on Friday, helped along by the softer USD post the US labour market report (see above), higher oil and industrial metal prices (WTI crude +2.9%, copper +1.3%), and firmer CNH after the People’s Bank of China once again fixed the currency to a stronger than predicted level. The repeated steps by the PBoC are a signal that weakness and one-sided moves in CNY/CNH aren’t something policymakers will tolerate. As pointed out before, the AUD/USD and USD/CNH have a tight/inverse correlation (i.e. a firmer CNH tends to be AUD supportive). The AUD also outperformed the other major currencies, apart from the JPY. On net the AUD rose by ~0.2% against the EUR, GBP, NZD, and CAD, while AUD/JPY slipped under ~95 for the first time since mid-June. As noted before, we think the case for a sustained pull-back in AUD/JPY is growing (see Market Musings: JPY: Asymmetric risks building).

This week we believe the AUD can recover a bit more ground. As mentioned, the global focus will be on the latest US CPI inflation data (Weds night AEST). Based on our reading of the underlying momentum across a few drivers, we see risks US inflation undershoots expectations (mkt 3.1%pa for headline and 5%pa for core CPI). If this occurs, we expect the USD to be weighed down by a tempering of US interest rate expectations. At the same time, RBA Governor Lowe, who is also speaking on Wednesday, is likely to stress that the door to further tightening remains wide open. The short-term shift in relative interest rates could be AUD supportive, in our opinion.

That said, we don’t expect the AUD’s upside move to extend too far or be sustainable. Underlying headwinds for the AUD such as the slowing global economy remain firmly in place. Similarly, FX is a relative price, and while further tightening by the RBA is looked for, more steps are still anticipated by the ECB, BoE, and US Fed over coming months. From our perspective, this points to renewed downside in pairs like AUD/EUR, AUD/GBP, and to a lesser extent AUD/USD down the track.

AUD/NZD will also be on the radar this week. AUD/NZD (now ~1.0780) has undergone a round trip recently having fallen by ~2.5% from its mid-June high. The RBNZ meets on Wednesday, and on balance, economic developments since the late-May meeting suggest the RBNZ should keep rates on hold at 5.5%. This would be the first time the RBNZ hasn’t raised rates since August 2021. Over the medium-term, we continue to see AUD/NZD moving higher. The RBNZ’s earlier and more aggressive actions compared to the RBA are generating more negative economic outcomes in NZ. As hiking cycles end, other relative fundamentals such as growth, labour market trends, and capital flows should be more influential. In addition to the growth outlook, Australia runs a current account surplus (~1.4% of GDP) while NZ continues to run a sizeable current account deficit (~8.5% of GDP).

AUD event radar: China CPI (Mon), RBA Gov. Lowe Speaks (Weds), RBNZ Meeting (Weds), US CPI (Weds), Bank of Canada Meeting (Thurs), China Trade Data (Thurs), China GDP (17th July), US Retail Sales (18th July), NZ CPI (19th July), UK CPI (19th July), AU Jobs (20th July), Japan CPI (21st July).

AUD levels to watch (support / resistance): 0.6547, 0.6600 / 0.6698, 0.6760

SGD corner

USD/SGD has fallen back, declining by ~0.5% to be currently trading near ~$1.3465. As outlined above, the USD weakened post the US labour market data, with FX markets focusing more on the headline non-farm payrolls outcome rather than the detail contained in the rest of the jobs report. On the crosses, EUR/SGD (now ~1.4765) has recovered more lost ground and is now less than ~0.3% below its one-year high. SGD/JPY has also eased back further, with the JPY supported by the dip in equity markets and front-end US bond yields. As flagged previously, given how weak the JPY still is, over the medium-term we believe there are far more upside than downside risks from here.

As outlined, focus this week will be on the US inflation data (Wednesday night). Base effects, as last year’s large price increases wash out of annual calculations, point to another step down in US inflation. In our view, over the short-term, a further deceleration in US inflation could see markets pare back their US Fed rate hike bets. This in turn may lead to more short-term USD (and USD/SGD) pressure (though this may also translate into more upside in EUR/SGD). However, beyond the short-term, we don’t think the pull-back in USD/SGD will be sustained. A slowing global economy and further rate rises by the US Fed should be supportive for USD/SGD down the line, in our view.

SGD event radar: China CPI (Mon), US CPI (Weds), China Trade Data (Thurs), Singapore GDP (Fri), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

SGD levels to watch (support / resistance): 1.3407, 1.3440 / 1.3525, 1.3590