• Mixed markets. US yields & the USD Index lower. But AUD underperforms as concerns about China’s economic trajectory remain in place.

• China deflation risks. China CPI/PPI inflation underwhelmed, another sign the post-COVID recovery is faltering. Measures are needed to reinvigorate demand.

• US inflation. US CPI (released Weds night AEST) is a focal point. Base-effects point to a further step down in inflation. This could exert more pressure on the USD.

A relatively quiet start to the new week across markets. Overnight, European and US equities posted modest gains (S&P500 +0.2%), oil prices gave back some ground (WTI crude -0.9%), while in fixed income US bond yields eased. The US 2-year yield fell ~9bps to 4.86% (where it got down to on Friday following the softer than predicted US payrolls report), while the 10-year declined to 3.99% (-7bps). In FX, the USD Index remains heavy. EUR (the major USD alternative) has pushed up towards ~$1.10, a ~2-week high. GBP hit a new 1-year high (now ~$1.2861), and USD/JPY has tracked the fall in US yields to be down near ~141.30 (~2.6% below its late-June high). As outlined just before USD/JPY hit its recent peak, we believe that the tide is turning and that given its low starting point there are more medium-term upside than downside risks to the JPY (see Market Musings: JPY: Asymmetric risks building). The AUD and NZD whipped around intra-day as risk sentiment shifted. But on net the AUD is a touch lower compared to 24hrs ago (-0.2%).

The pressure on US bond yields and the USD came through despite ‘hawkish’ rhetoric from US Fed officials Barr, Daly, and Mester who repeated that more rate hikes will be needed to help bring inflation down to the 2%pa target. The US CPI inflation report is released later this week (Wednesday night AEST). As discussed yesterday, base-effects, as large monthly price increases roll out of calculations, and other forces such as lower used car prices and rents point to US inflation decelerating further. Consensus expectations are looking for US headline inflation to drop to 3.1%pa and core CPI to slow more modestly to 5%pa. If realised, we believe this may keep the USD on the backfoot as markets tinker with their US interest rate expectations. However, with US core inflation set to remain uncomfortably high this could be a short-term move, particularly against cyclical currencies like the AUD, NZD, and Asian FX, with another rate hike by the US Fed still anticipated later this month.

In contrast to the rest of the world, China clearly doesn’t have an inflation problem. Data released yesterday showed that in the year to June headline inflation was flat, while producer price deflation worsened (-5.4%pa). A falling China PPI typically translates to lower ‘goods’ in other countries, however with the western world inflation problem now more a function of wages/services prices, this may not be as helpful as it once was. The subdued inflation pulse is another sign China’s post COVID recovery is faltering. And supports our thinking that authorities will try to reinvigorate the economy via monetary and fiscal measures aimed at boosting confidence and labour-intensive consumption growth. We think the late-July Politburo meeting (after the China Q2 GDP release) could be when concrete steps are outlined.

Global event radar: RBNZ Meeting (Weds), US CPI (Weds), Bank of Canada Meeting (Thurs), China Trade Data (Thurs), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

AUD corner

The AUD has underperformed at the start of the new week. The weak China CPI/PPI inflation data and concerns about China’s economic trajectory have outweighed the softer USD (see above). While AUD/USD has slipped back by ~0.2%, to now be near its 50-day moving average (~$0.6678), the AUD has weakened by ~0.5% against the EUR and ~0.7% against the JPY. At ~94.35 AUD/JPY is near a ~1-month low (~3.4% below its mid-June peak). As stated previously, we believe the case for a sustained pull-back in AUD/JPY has grown (see Market Musings: JPY: Asymmetric risks building).

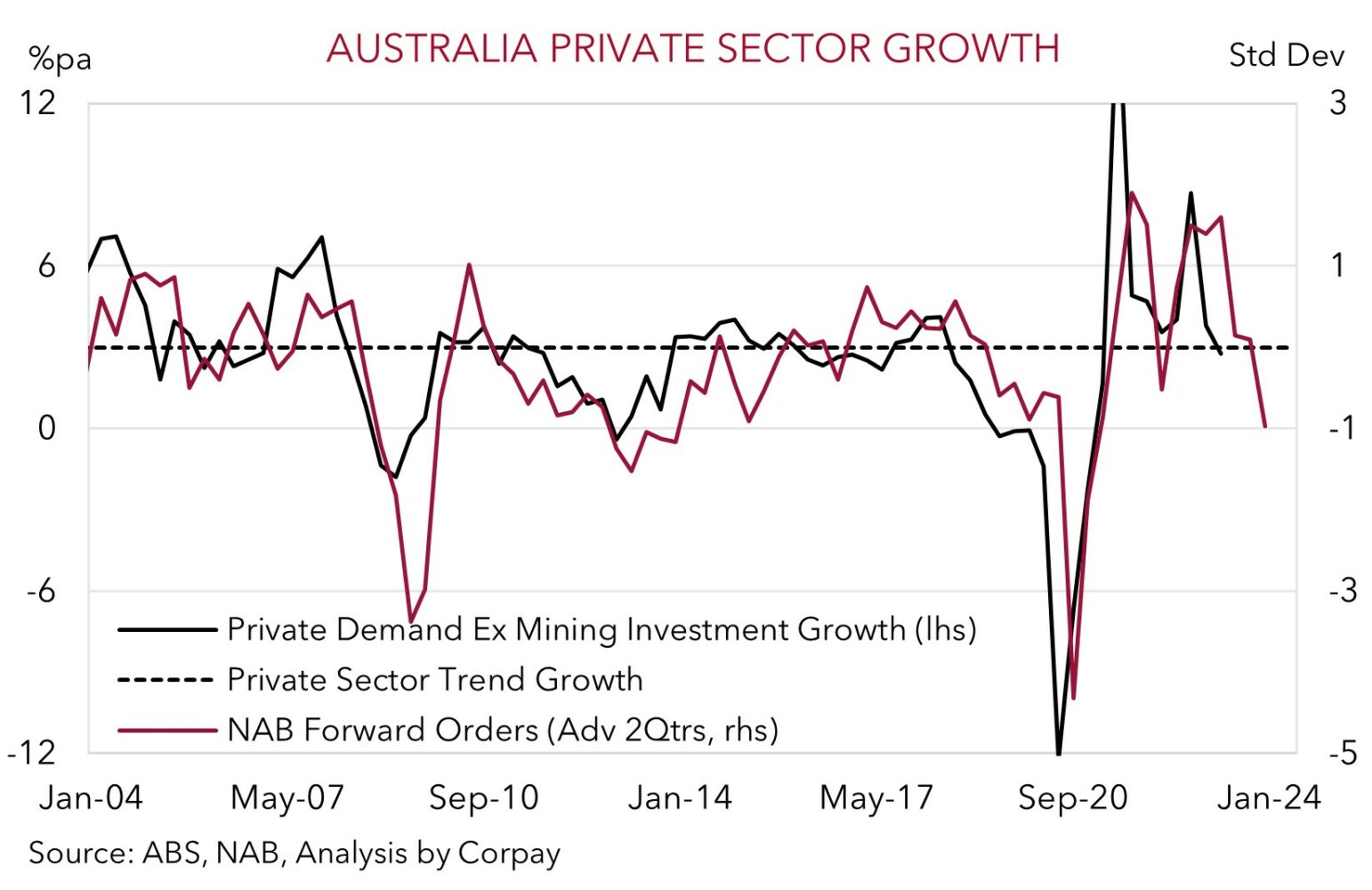

In today’s Asian trade, the latest readings on Australian consumer confidence (10:30am AEST) and business conditions (11:30am AEST) are due. Trends in household consumption are being looked at closely by the RBA in its assessment of whether rate hikes are biting. Similarly, business conditions provide a timely read on how the economy is tracking. As our chart below shows, components such as hiring intentions and forward orders provide a good guide to private demand. A further deterioration in conditions may see markets slightly temper their RBA rate hike expectations. This could generate some modest intra-day AUD volatility.

For the AUD, tomorrow is the focal point of the week with the RBNZ policy decision (Weds 12pm AEST), a speech by RBA Governor Lowe (Weds 1:10pm AEST), and US CPI inflation (Weds 10:30pm AEST) on the schedule. In our judgement, upcoming events could give AUD/USD some short-term support. Based on our reading of the underlying momentum across a few drivers, we see risks US inflation undershoots expectations. If this occurs, we expect the USD to remain under pressure. At the same time, we think RBA Governor Lowe could stress that the door to further tightening remains wide open given still too high inflation and tight labour market conditions. The short-term shift in relative interest rates may be AUD supportive, in our view.

That said, we continue to think that near-term AUD rebounds aren’t likely to extend too far or be sustainable. Headwinds for the AUD such as the slowing global economy remain firmly in place. Similarly, while more tightening by the RBA is looked for, further steps are still anticipated by the ECB, BoE, and US Fed over coming months. In our opinion, this suggests pairs like AUD/EUR, AUD/GBP, and to a lesser extent AUD/USD could struggle to definitively change course for a while yet. By contrast, we continue to see the AUD to outperforming the NZD over the medium-term. On balance, NZ economic developments since the late-May meeting suggest the RBNZ should keep rates on hold at 5.5%. This would be the first time the RBNZ hasn’t raised rates since August 2021. As hiking cycles end, other relative fundamentals such as growth, labour market trends, and capital flows should be more influential and on these metrics the AUD looks to be on better footing.

AUD event radar: RBA Gov. Lowe Speaks (Weds), RBNZ Meeting (Weds), US CPI (Weds), Bank of Canada Meeting (Thurs), China Trade Data (Thurs), China GDP (17th July), US Retail Sales (18th July), NZ CPI (19th July), UK CPI (19th July), AU Jobs (20th July), Japan CPI (21st July).

AUD levels to watch (support / resistance): 0.6547, 0.6600 / 0.6698, 0.6760

SGD corner

USD/SGD has remained under pressure, with the pair approaching the 50-day moving average (~$1.3442) due to the softer USD and lower US bond yields (see above). By contrast, on the crosses, EUR/SGD (now ~1.4802) is now within a whisker of its 1-year highs. SGD/JPY has also lost more ground, with the JPY tracking the dip in US yields. At ~105, SGD/JPY is nearly 2% below its recent historic highs. And as mentioned previously, we think there is scope for further falls in SGD/JPY given our thoughts that there are more upside risks for the still weak JPY over the medium-term.

As mentioned, attention this week will be on the latest US inflation data (Wednesday night). Base effects, as last year’s big price rises fall out of annual calculations, point to another large step down in US inflation. In our opinion, a further slowing in US inflation could see markets pare back their US Fed rate hike bets, which may weigh on the USD (and USD/SGD) a bit more over the short-term. But looking further out we don’t think the pull-back in USD/SGD will be sustained. The slowdown in global growth and further rate rises by the US Fed in its efforts to lower sticky core inflation should be supportive for USD/SGD down the line, in our view.

SGD event radar: US CPI (Weds), China Trade Data (Thurs), Singapore GDP (Fri), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

SGD levels to watch (support / resistance): 1.3377, 1.3407 / 1.3525, 1.3590