• Softer USD. Strong UK wages has bolstered BoE rate hike expectations, supporting GBP. The JPY has also continued to recover lost ground.

• US inflation. Large base-effects & some other drivers point to a sizeable step down in US CPI. If realised, this could exert more pressure on the USD.

• AUD events. Ahead of the US CPI, RBA Governor Lowe speaks & the RBNZ policy decision is announced. No change by the RBNZ is expected.

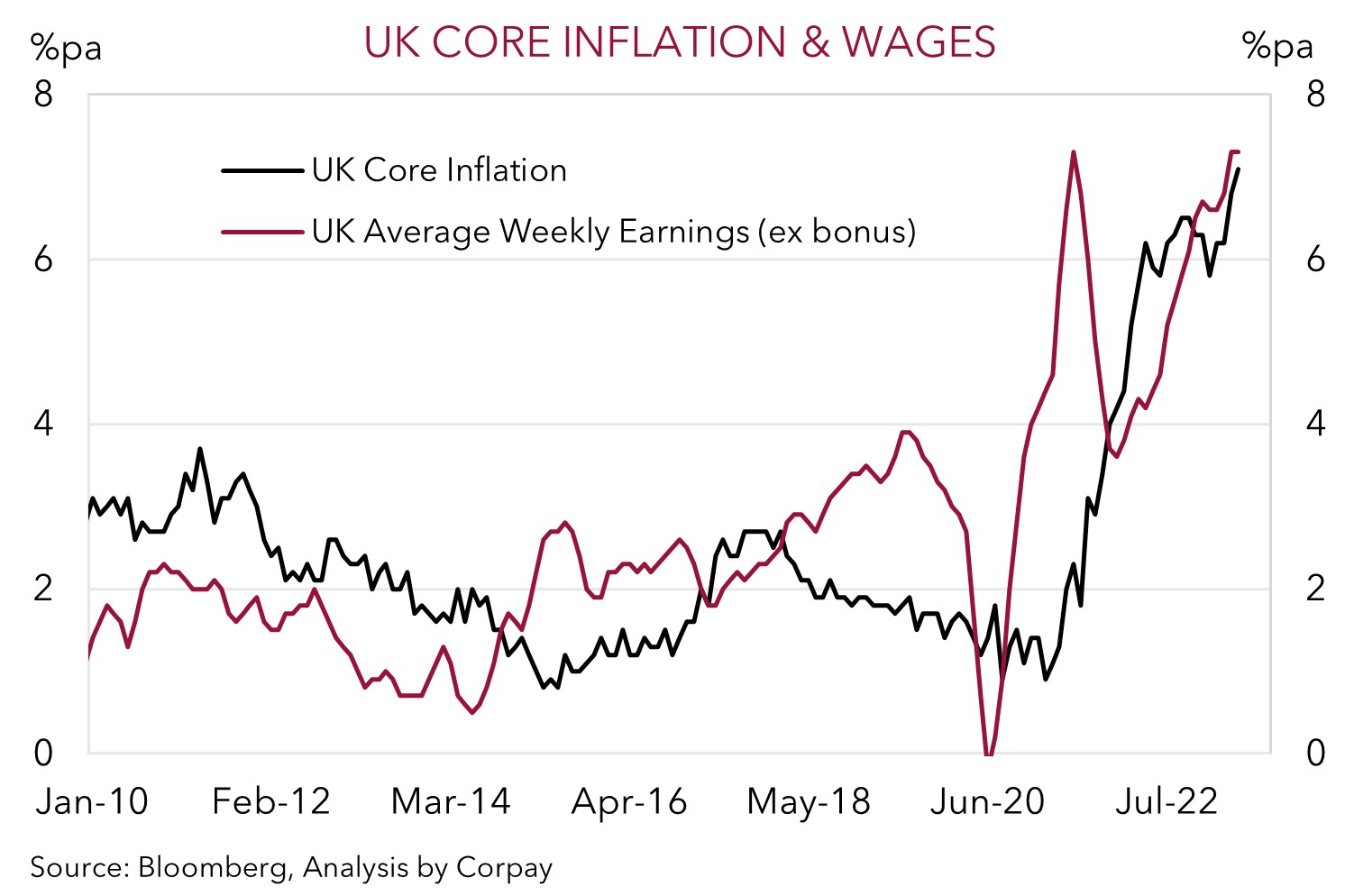

Mixed fortunes across markets, with focus still very much on tonight’s US CPI report (10:30pm AEST). Offshore equity indices edged higher (US S&P500 and EuroStoxx50 +0.7%), WTI crude oil rose ~2.5% to be at US$74.80/brl (the top of its 2-month range), and 2-year bond yields increased. The US 2-year yield ticked up ~2bps to 4.87%, while in the UK the 2-year yield is ~6bps higher (now 5.43%) after another strong UK labour market report bolstered expectations that the Bank of England could deliver another 50bp rate hike at its 3 August meeting. At 4% unemployment in the UK remains very low, and the tight conditions are feeding through to wages. Average weekly earnings (ex bonuses) are now running at 7.3%pa, and as our chart shows this is underpinning the very high UK core inflation. Market pricing has the BoE delivering another ~144bps worth of rate hikes by March 2024.

In FX, the USD Index has remained under pressure, with EUR holding above ~$1.10 despite a weak German ZEW survey reading raising doubts about how sturdy Germany’s economic recovery will be. GBP (now ~$1.2932) touching its highest level since April 2022 following the UK labour market report. USD/JPY has continued to slide back, and at ~140.30 it is over 3% below its late-June peak. As outlined previously, we believe that the tide is turning for the JPY and that there are more medium-term upside than downside risks (see Market Musings: JPY: Asymmetric risks building). The AUD has oscillated in a 0.7% range centered on ~$0.6675. Ahead of today’s RBNZ announcement (12pm AEST), where no change is unanimously expected, NZD is tracking around its 100-day moving average (~$0.6190). While USD/CAD is down near ~1.3230, with markets assigning a ~70% chance the Bank of Canada delivers another 25bp hike tonight, taking the policy rate to 5% (midnight AEST).

In addition to the central bank announcements mentioned, markets will be focused on the US CPI (10:30pm AEST). As discussed yesterday, base-effects, as large monthly price increases roll out of calculations, and other factors such as lower used car prices and rents point to US inflation decelerating further. Consensus is looking for US headline inflation to fall to 3.1%pa and core CPI to slow more modestly to 5%pa. If realised, we believe this may keep the USD on the backfoot as markets adjust their US interest rate assumptions. However, with US core inflation set to remain well above target, we feel this could be a short-term move, particularly against cyclical currencies like the AUD, NZD, and Asian FX, with further rate rises by the US Fed still anticipated over coming months. The Fed’s next meeting is on 27 July (4am AEST).

Global event radar: RBNZ Meeting (Today), US CPI (Tonight), Bank of Canada Meeting (Tonight), China Trade Data (Thurs), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

AUD corner

The AUD has traded in a ~0.7% range centered on ~$0.6675 over the past 24hrs. This is despite the weakness in the USD Index (see above), with the AUD underperforming GBP and the JPY. AUD/GBP touched its lowest level since May 2020 after the robust UK labour market report and high wage growth reinforced expectations that the Bank of England could deliver a string of further rate rises over H2 2023 (see above). AUD/JPY has slipped back under ~94 for the first time in ~1-month, with the JPY continuing to recover lost ground. As outlined before, we believe the case for a sustained pull-back in AUD/JPY has risen (see Market Musings: JPY: Asymmetric risks building).

In today’s Asian session, the RBNZ policy decision (12pm AEST) and speech by RBA Governor Lowe (1:04pm AEST) will be in focus. After moving early and going hard, the RBNZ is widely expected to keep rates on hold at 5.5%. If realised, this would be the first time the RBNZ hasn’t raised rates since the August 2021 meeting. NZ is already feeling the weight of the substantial tightening in monetary policy, with the economy already in a technical recession. RBA Governor Lowe is speaking on “The Reserve Bank Review and Monetary Policy”. We think the speech and Q&A could shed some light on the July ‘pause’, and in terms of the outlook, given the resilience in the economy (as illustrated by business conditions holding at an above average level in June) we believe Governor Lowe may reiterate that some more tightening may be needed. This may give the AUD a bit of support, particularly against the NZD. We continue to see the AUD outperforming the NZD over the medium-term. As hiking cycles end, other relative fundamentals such as growth, labour market trends, and capital flows should be more influential and on these metrics the AUD looks to be on better footing (see chart below).

As discussed, the global market focus is on tonight’s US CPI inflation report (10:30pm AEST). Based on our reading of the underlying momentum across a few drivers and the large base-effects in this month’s data, we see risks US inflation underwhelms. If this occurs, we expect the USD to remain under pressure, and risk sentiment (and the AUD) to be supported. That said, we continue to think that near-term AUD rebounds aren’t likely to extend too far. Headwinds for the AUD such as the slowing global economy remain in place. Similarly, while more tightening by the RBA is looked for, further (larger) steps are anticipated by the ECB, BoE, and US Fed over coming months. In our opinion, this suggests pairs like AUD/EUR and AUD/GBP should remain on the backfoot, while AUD/USD may hold within its recent range for a while yet.

AUD event radar: RBNZ Meeting (Today), RBA Gov. Lowe Speaks (Today), US CPI (Tonight), Bank of Canada Meeting (Tonight), China Trade Data (Thurs), China GDP (17th July), US Retail Sales (18th July), NZ CPI (19th July), UK CPI (19th July), AU Jobs (20th July), Japan CPI (21st July).

AUD levels to watch (support / resistance): 0.6547, 0.6600 / 0.6700, 0.6760

SGD corner

USD/SGD has given back more ground, with the pair hovering just above its 100-day moving average (~$1.3407). As discussed, the USD Index has remained heavy thanks in part to the firmer EUR, and appreciation in GBP and the JPY. On the crosses, EUR/SGD (now ~1.4760) remains within ~0.4% of its 1-year high, while SGD/JPY is approaching its 50-day moving average (~104.16). As outlined previously, we think there is scope for further falls in SGD/JPY given our views that the weak JPY should re-strengthen over the medium-term.

Focus for global markets is on tonight’s US CPI report. Base effects, as last year’s large price rises roll out of calculations, suggest there should be a rather sizeable drop in annual US inflation. In our view, a further slowing in US inflation could see markets trim their US Fed rate hike expectations, which may exert more pressure on the USD (and USD/SGD) over the near-term. However, looking further ahead we don’t believe the decline in USD/SGD will be sustained. In our judgement, the slowdown in global growth and further rate rises by the US Fed in order to bring down high/sticky core inflation may give USD/SGD some renewed support down the track.

SGD event radar: US CPI (Tonight), China Trade Data (Thurs), Singapore GDP (Fri), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

SGD levels to watch (support / resistance): 1.3320, 1.3377 / 1.3516, 1.3590