• Weaker USD. Lower than expected US CPI was compounded by soft PPI inflation. US bond yields have fallen back further. The USD has weakened.

• Risk sentiment. The shift in interest rate expectations has boosted risk appetite. Equities & commodities higher. The AUD has jumped up.

• Too far too fast? Markets have moved a long way very quickly. Inflation is heading in the right direction, but central banks may not declare victory just yet.

The adjustment in markets following the lower-than-expected US CPI data (released two nights ago) has continued with softer producer price inflation reinforcing the ‘disinflation’ theme. Equities enjoyed another positive session with the US S&P500 rising ~0.9%. This takes the rally so far this week to ~2.5%. Elsewhere, bond yields fell back further as the ‘peak’ interest rate theme continues to be factored in. The US 10-year yield declined another ~9bps. At 3.76% the US 10-year yield is ~33bps below Monday’s high. The policy expectations driven US 2-year yield tumbled ~12bps to now be at 4.63% (this is nearly 0.5% below where it was a week ago). Across commodities, WTI crude is up ~1.5% to US$76.90/brl (a high since late-April), while industrial metals are also higher (copper +2.3%).

In FX, the USD has remained under pressure, in line with our expectations from earlier this week. The USD index hit its lowest since April 2022. EUR (the major USD alternative) has leapt above ~$1.12 for the first time in over a year, USD/JPY has added to its recent slide to now be near ~138 (nearly 5% below its late-June peak), and GBP (now ~$1.3130) is around a ~15-month high. AUD and NZD have also been propelled higher, boosted by the positive risk sentiment and weaker USD. The NZD (now ~$0.6390) is back near the top of the range it has occupied since mid-February, and the AUD (now ~$0.6885) is nearly ~2 cents above where it closed last week.

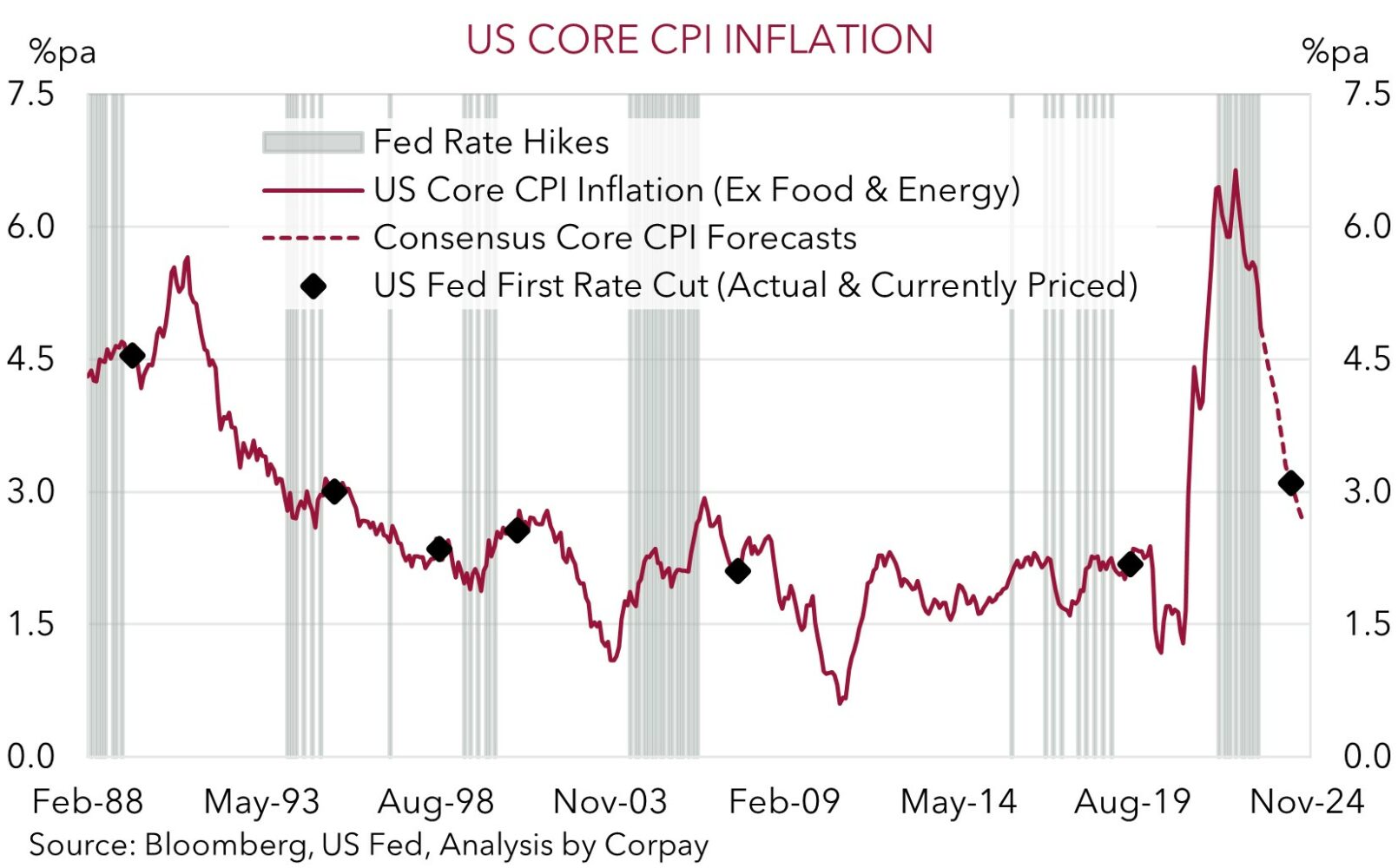

For the record, US CPI decelerated sharply in June, with the annual headline rate falling to 3%pa, the slowest growth in more than 2-years. Core inflation (i.e. ex food and energy) also undershot expectations, declining to 4.8%pa. Base effects as last year’s large price increases rolled out of calculations explained a large chunk of the drop, but there were other factors such as lower used car prices, slowing rents, and a plunge in airfare prices that came through. While another rate hike by the US Fed is still largely anticipated at the late-July meeting, thoughts that further tightening will follow have been watered down.

Inflation trends are heading in the right direction, but with core inflation still more than double the Fed’s target, the ‘easy mechanical wins’ now behind us, and the labour market still tight, we doubt policymakers will be as quick to declare victory as markets now assume. As our chart shows, over the past 5 cycles, the first Fed rate cut occurred when core inflation averaged ~2.3%pa. Markets are assuming Fed easing could kick off in May, at which point core inflation is likely to still be north of 3%pa. We expect the USD to remain under pressure over the short-term, however, over coming weeks we think it could claw back some ground against cyclical currencies like the AUD and NZD as global growth slows on the back of past policy tightening, and/or core inflation remains stickier than anticipated.

Global event radar: China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

AUD corner

The AUD has come roaring back to life over the past few days with the softer US CPI and PPI inflation data weighing on US bond yields and the USD, and simultaneously boosting risk sentiment (see above). We had been flagging the risk that US inflation undershoots market predictions earlier this week. The AUD has jumped up towards ~$0.6890, near its mid-June multi-month peak, and ~2 cents above where it ended last week. The positive risk appetite and higher energy/base metal prices have also helped the AUD outperform on the crosses. AUD/EUR has risen towards its 50-day moving average (~0.6152), AUD/JPY has rebounded back over ~95, and AUD/GBP is around ~0.5245. AUD/NZD is still hovering under ~1.08, with the NZD also strengthening over recent sessions.

As discussed, while the ‘disinflation’ theme continues to play out and markets continue to temper their longer-dated interest rate expectations, we believe risk sentiment should remain supported and that the USD can remain under pressure. This can push the AUD a little higher over the near-term, in our view. However, we also believe the AUD’s recent upswing is somewhat similar to the (unsustainable) jump up that occurred a month ago, and that it could also soon peter out. The AUD, and the USD, have moved a long way in a short space of time. And although US inflation is heading in the right direction, we feel markets could now be a bit complacent to how the US Fed may react and are becoming vulnerable to renewed positive US data surprises. US core inflation is still uncomfortably high, and labour market conditions are still tight. This points to high interest rates needing to be maintained for some time. Another rate hike by the US Fed at the late-July meeting and message that the door to further tightening remains open could rattle nerves and see the USD bounce back, particularly against cyclical currencies such as the AUD given the unfolding slowdown in global growth. In our judgement, the step down in global industrial activity remains a headwind for the AUD, particularly on crosses such as AUD/EUR and AUD/GBP given we also see further rate rises by the ECB and BoE.

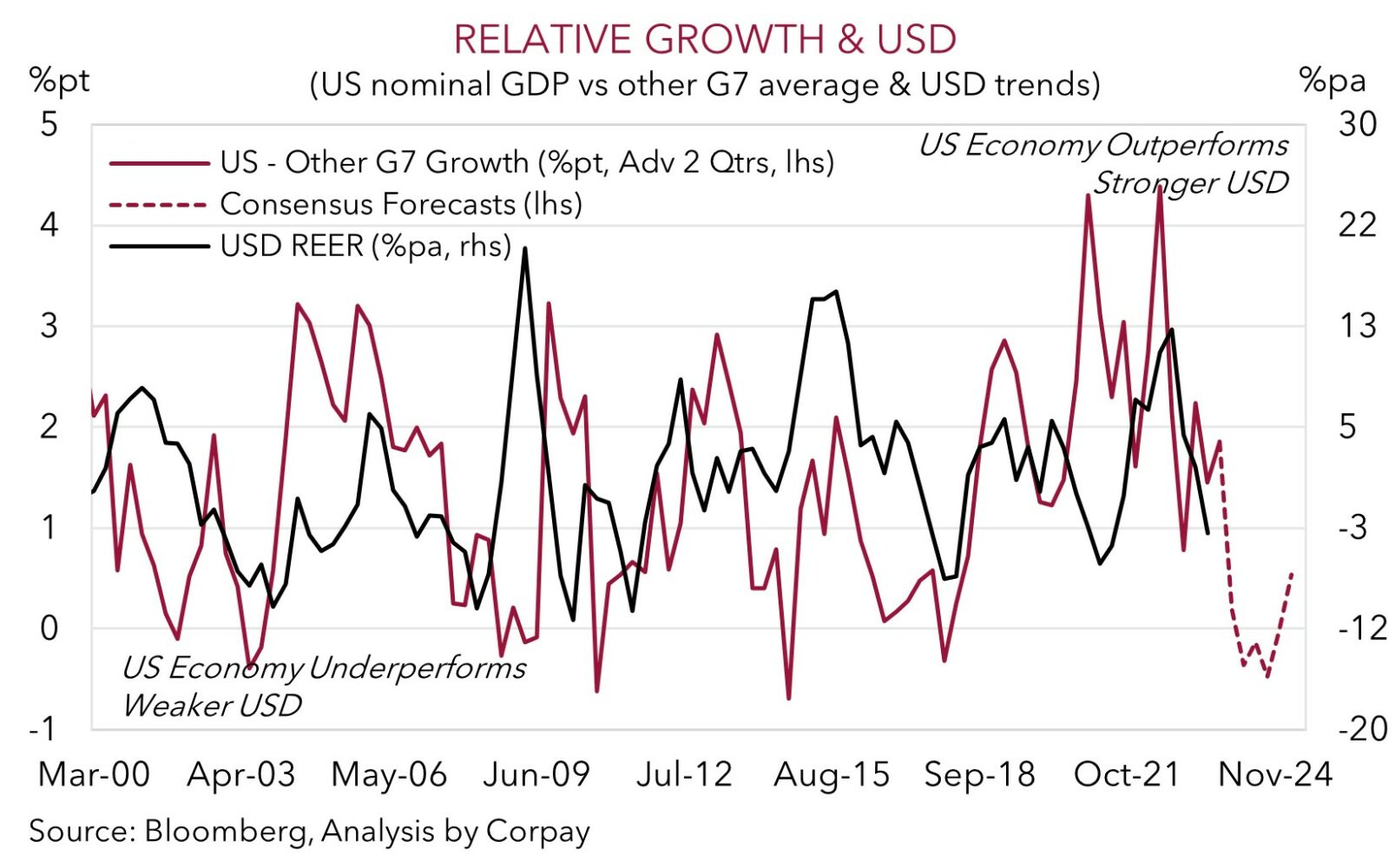

Overall, the lagged effects of past policy tightening around the world are still just only starting to show up. As they continue to come through we think the AUD’s upturn is likely to stall. We continue to forecast the AUD’s more sustained revival to only occur later this year and over early 2024 with AUD/USD projected to grind back into the low $0.70s over that time as the USD downturn broadens out on the back of the expected relative underperformance of the US economy (see chart below).

AUD event radar: China GDP (17th July), US Retail Sales (18th July), NZ CPI (19th July), UK CPI (19th July), AU Jobs (20th July), Japan CPI (21st July).

AUD levels to watch (support / resistance): 0.6706, 0.6781 / 0.6900, 0.6925

SGD corner

USD/SGD has continued to fall back over the past few days with the weaker US CPI and PPI inflation reports generating a downward adjustment in US yields and the USD (see above). At ~$1.3220 USD/SGD is near the bottom of the range it has traded in since mid-February. On the crosses, the jump up in the EUR has helped push EUR/SGD (now ~1.4845) to its highest level since April 2022. SGD/JPY is tracking down near its 50-day moving average (~104.27). As outlined before, we think there is scope for further falls in SGD/JPY given our views that the weak JPY should strengthen over the medium-term.

As discussed, the weaker US inflation data has raised doubts that the US Fed will need to hike rates beyond another move in late-July. As this adjustment and ‘disinflation’ theme continues to wash through markets, we expect the USD (and USD/SGD) to remain on the back foot over the near-term. However, looking further ahead we think the pull-back in USD/SGD may lost steam and could turn back around as global growth momentum continues to decelerate, core inflation holds up for longer than anticipated due to the ongoing tightness in labour markets and/or central banks like the ECB, BoE and US Fed continue to press on with interest rate hikes.

SGD event radar: Singapore GDP (Fri), China GDP (17th July), US Retail Sales (18th July), UK CPI (19th July), Japan CPI (21st July).

SGD levels to watch (support / resistance): 1.3140, 1.3210 / 1.3401, 1.3439