• US sentiment. US yields & the USD recovered some ground after US consumer confidence rebounded. US retail sales in focus ahead of next week’s Fed meeting.

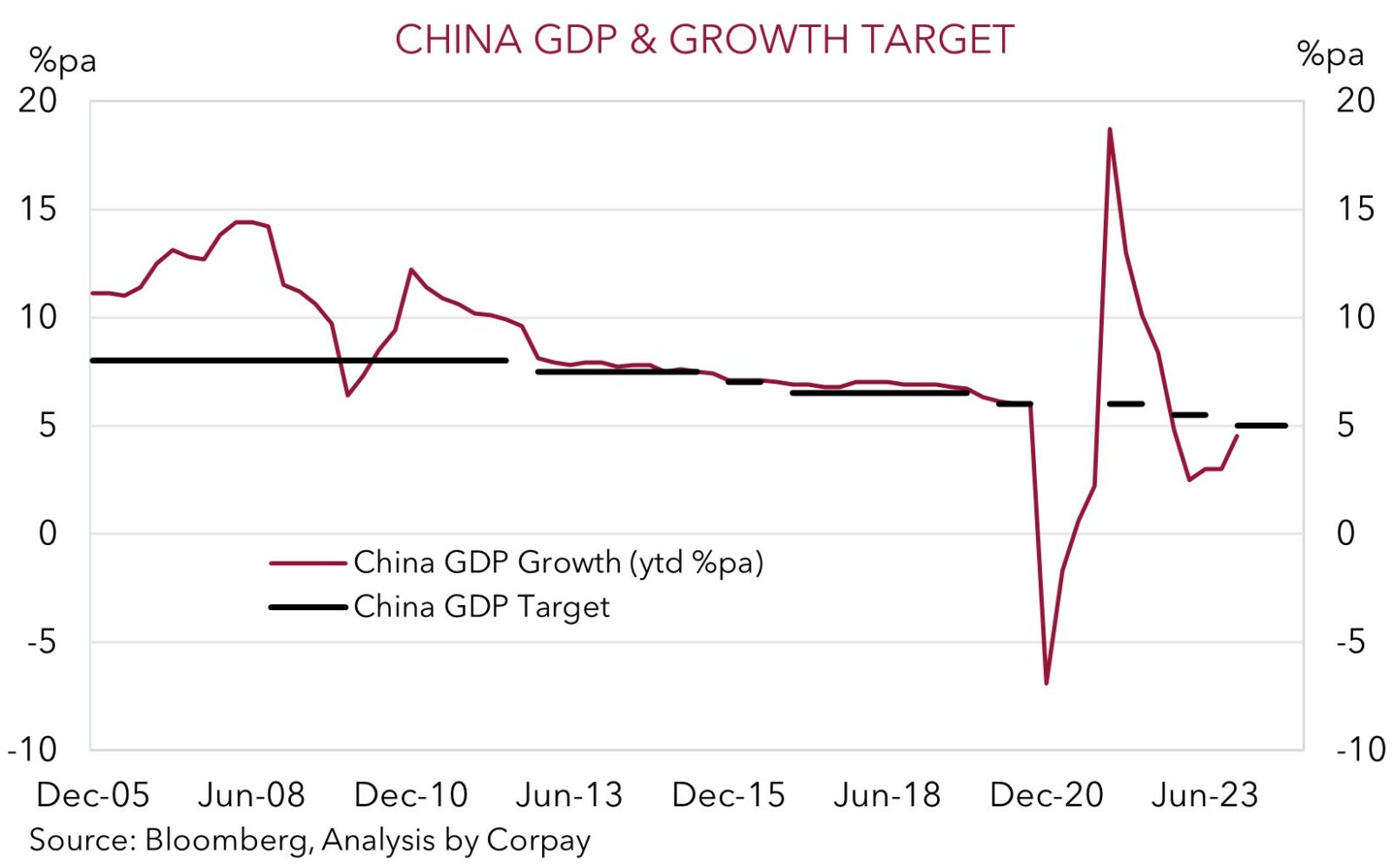

• China in focus. China Q2 GDP & monthly activity data released today. The post COVID recovery has been faltering. Soft data could dampen risk sentiment.

• AUD sluggish. The AUD’s upswing has lost steam. We think offshore forces could outweigh another solid Australian labour market report this week.

Relative to the substantial adjustment earlier in the week, markets were more sedate on Friday, with a bit of a reversal coming through in bonds and FX. The US economic release of note was the University of Michigan Consumer sentiment reading. Consumer confidence jumped its highest level in nearly two years, with both current conditions and views about the future improving. Importantly for the US Fed the inflation expectations measure also ticked up. Inflation expectations can influence actual inflation outcomes because a shift in perceptions may influence wage and price setting behaviours. The 5 to 10-year ahead inflation expectations gauge ticked up to 3.1%, the top of its cyclical range, another sign that the Fed’s battle against inflation is far from over.

After opening higher on the back of solid bank earnings reports, US equities closed Friday slightly in the red (S&P500 -0.1%), as the move up US yields dampened the mode. Across commodities, oil (WTI crude -1.9%) and industrial metals like copper and aluminium (-0.3%) also gave up some ground. Nevertheless, US equities still had a strong week. The S&P500’s 2.4% rise last week was the best performance in a month. In bonds, the lift in inflation expectations saw yields unwind the previous day’s falls. The US 2-year yield rose ~12bps to 4.76%, while the 10-year yield was up ~7bps (now 3.83%). Market pricing for another Fed rate hike at next week’s meeting was little changed, with a ~92% chance still assigned. Rather the data saw rate cut bets further out pared back. A full rate cut by the US Fed isn’t now factored in until June 2024. Earlier last week there were over two rate cuts discounted by this point. In FX, the adjustment in US interest rate expectations gave the beleaguered USD some support, particularly against cyclical currencies like the AUD and NZD. EUR continues to hover above ~$1.12, USD/JPY has drifted back up towards ~139, GBP has eased under ~$1.31, while the AUD (now ~$0.6840) is ~0.8% below Friday’s intra-day high.

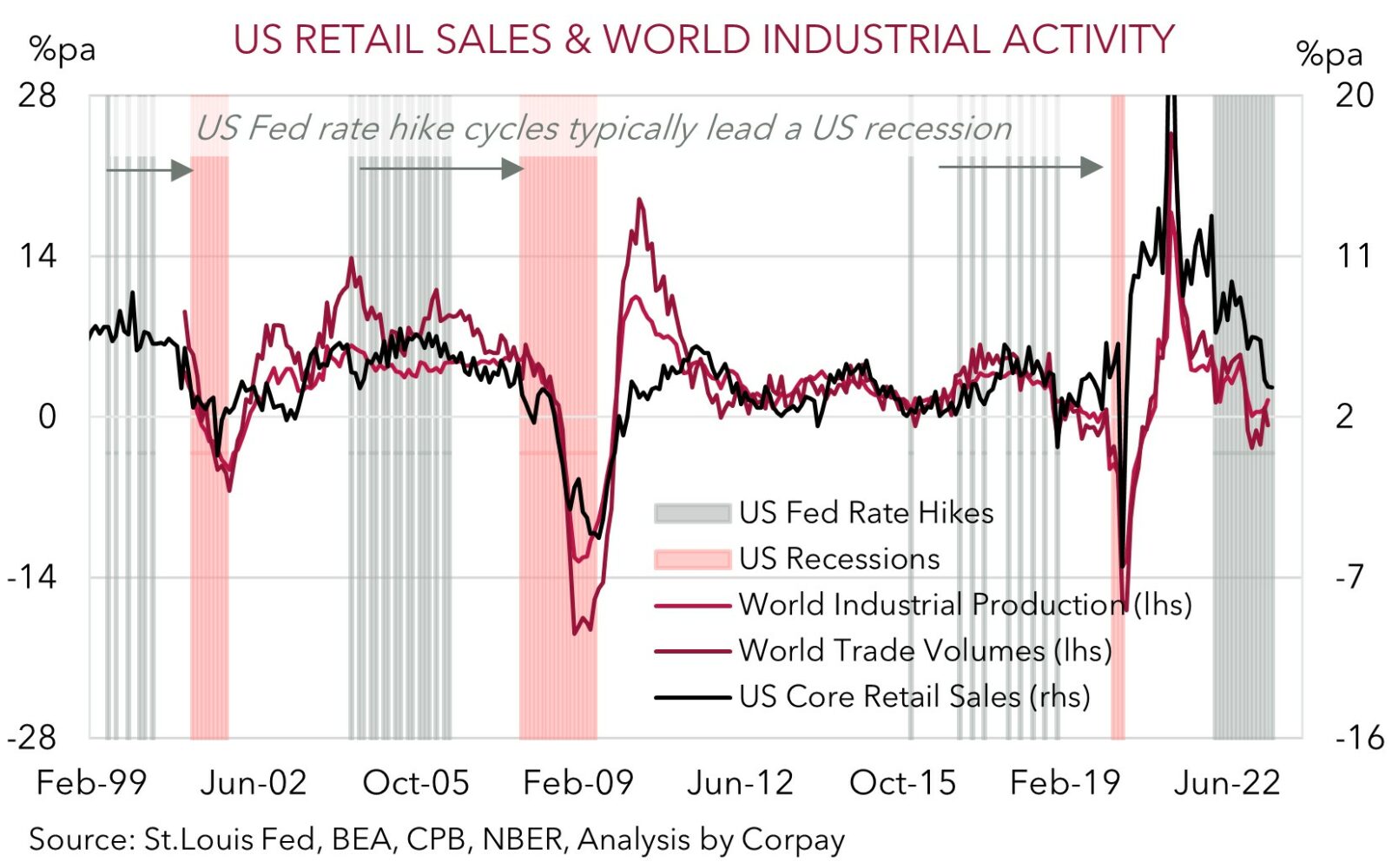

Offshore, today’s China economic data batch, which includes Q2 GDP, will be in focus (12pm AEST). In the US, with Fed officials now in a blackout period ahead of next week’s decision (27 July AEST), attention will be on retail sales (Tuesday night AEST), while UK inflation (Weds AEST) is also on the radar. China’s post COVID recovery is faltering, and quarterly growth is predicted to step down to 0.8%qoq. We think a soft China data set may dampen risk appetite, particularly if US retail sales and/or UK inflation exceed expectations later week and this triggers a further upward repricing in global interest rate expectations. In our view, this mix can help the USD claw back some lost ground against growth linked currencies such as the AUD and Asian FX.

Global event radar: China GDP (Mon), US Retail Sales (Tue), UK CPI (Weds), Japan CPI (Fri), Eurozone/UK PMIs (24th July), US FOMC Meeting (27th July), Fed Chair Powell Speaks (27th July), ECB Meeting (27th July), US GDP (27th July), Bank of Japan Meeting (28th July), US PCE Deflator (28th July), China PMIs (31st July), Eurozone GDP & CPI (31st July).

AUD corner

The AUD’s upswing has lost steam. The rebound in US bond yields in the wake of the better-than-expected US consumer confidence survey has given the USD some support, while the dip in oil and base metal prices has also exerted some pressure on the AUD (see above). At ~$0.6840 the AUD is ~0.8% below last Friday’s peak. On the crosses AUD/EUR has slipped back under ~0.61, AUD/JPY has drifted below ~95, AUD/GBP has eased down to ~0.5220, and AUD/NZD is tracking around ~1.0740.

As mentioned, ahead of next week’s US Fed, ECB and BoJ policy decisions, this week the global macro attention will be on the China data batch (today 12pm AEST), US retail sales (Tues AEST) and UK CPI inflation (Weds AEST). Locally, the July RBA meeting minutes (Tues AEST) and June labour market data (Thurs AEST) are in focus. We don’t expect the decision to replace RBA Governor Lowe on 18 September with current Deputy Governor Bullock to influence the AUD. It looks to be a rather status quo decision when it comes to policy. It must by remembered that the RBA Board make the decisions, not just the Governor, and Bullock attended every meeting since April 2022.

As discussed previously, FX is a relative price and global trends typically have a larger lasting influence on the AUD. Hence, while we think the Australian labour market report is likely to once again show that unemployment (which is a lagging economic indicator) remains historically low (now 3.6%), supporting the case for another rate rise by the RBA as soon as August, for the AUD this could be overwhelmed by offshore forces. In our opinion, another solid US retail sales report may generate a further USD supportive upward repricing in US interest rate expectations. At the same time, sluggish growth momentum in China, particularly across the commodity-intensive industrial side, could dampen risk appetite and weigh on global growth linked assets such as commodities and the AUD.

Overall, as flagged late last week, in our judgement, the AUD’s recent upswing appears somewhat like the (unsustainable) rise that occurred a month ago, with global headwinds still in place. We think another rate hike by the US Fed at the 27 July meeting and message that the door to further tightening remains open given still too high core inflation could rattle nerves and see the USD recover against cyclical currencies such as the AUD. Similarly, we think crosses such as AUD/EUR and AUD/GBP can remain under pressure given we also see further rate increases by the ECB and BoE, and with step down in global industrial activity more of a negative for the AUD.

AUD event radar: China GDP (Mon), RBA Meeting Minutes (Tues), US Retail Sales (Tue), NZ CPI (Weds), UK CPI (Weds), AU Jobs (Thurs), Japan CPI (Fri), Eurozone/UK PMIs (24th July), AU CPI (26th July), US FOMC Meeting (27th July), Fed Chair Powell Speaks (27th July), ECB Meeting (27th July), US GDP (27th July), Bank of Japan Meeting (28th July), AU Retail Sales (28th July), US PCE Deflator (28th July), China PMIs (31st July), Eurozone GDP & CPI (31st July), RBA Meeting (1st Aug).

AUD levels to watch (support / resistance): 0.6708, 0.6781 / 0.6900, 0.6925

SGD corner

USD/SGD has consolidated down near its recent lows (now ~$1.3219), with the rebound in US bond yields and firmer USD somewhat supportive (see above). On the crosses, the resilience in the EUR has helped EUR/SGD (now ~1.4840) touch its highest level since April 2022, while SGD/JPY has risen slightly and is now ~0.6% above its 50-day moving average (~104.34).

As discussed, the global focus this week will be on today’s China data batch, with US retail sales (Tues) and UK inflation (Weds) also on the markets radar over the next few days. China’s faltering post COVID recovery raises risks that the Q2 GDP and the monthly activity data underwhelms expectations. While at the same time, we think US retail sales and UK inflation could spring another positive surprise. We believe sluggish momentum in China may weigh on risk sentiment and cyclical regional currencies like the SGD. This, combined with a potential further upward repricing in US interest rate expectations on the back of solid consumer spending data could see the USD (and USD/SGD) edge higher over this week, in our opinion.

SGD event radar: China GDP (Mon), US Retail Sales (Tue), UK CPI (Weds), Japan CPI (Fri), Singapore CPI (24th July), Eurozone/UK PMIs (24th July), US FOMC Meeting (27th July), Fed Chair Powell Speaks (27th July), ECB Meeting (27th July), US GDP (27th July), Bank of Japan Meeting (28th July), US PCE Deflator (28th July), China PMIs (31st July), Eurozone GDP & CPI (31st July), RBA Meeting (1st Aug).

SGD levels to watch (support / resistance): 1.3140, 1.3200 / 1.3377, 1.3439