• China data. China’s post-COVID recovery continues to stumble. The pick-up in annual growth wasn’t as strong as anticipated.

• Shaky sentiment. Growth concerns exerted some downward pressure on bond yields, commodities, the CNH, the AUD & NZD.

• US trends. US retail sales due tonight. A solid report could see US rate expectations lift, supporting the USD. RBA minutes released today.

Mixed fortunes across markets at the start of the new week with China’s data batch in focus. China’s post-COVID recovery continues to stumble with the economy expanding by 0.8% in Q2. As a result, the pick-up in annual growth wasn’t as strong as anticipated (5.5%pa YTD vs mkt 6.1%). It was a similar ‘sluggish’ story across the monthly activity gauges. Retail sales slowed sharply in June (down to 3.1%pa), and on the commodity-intensive industrial side, production and fixed asset investment growth rates (now both 3.8%pa YTD) remain below pre-COVID averages.

China’s external facing sectors are being buffeted by slowing global growth, and the ongoing shift in spending from ‘goods’ to ‘services’. At the same time, domestic activity is being held back by low consumer confidence and a soft labour market (youth unemployment climbed above 21% in Q2). China’s 2023 ~5% GDP growth target looks at risk. The data pulse supports our view that policymakers are likely to inject more stimulus to reinvigorate the economy, with the late-July Politburo meeting a point when future measures could be flagged. However, as mentioned before, we believe support is likely to be skewed towards labour-intensive consumption growth rather than the more AUD and commodity friendly infrastructure/construction spending.

China growth concerns generally dampened risk sentiment. The EuroStoxx50 fell ~1%, while in the US markets edged a bit higher (S&P500 +0.4%). Bond yields eased in both regions, with the German and US 10-yrs down ~3bps to 2.47% and 3.81% respectively. Across commodities, oil prices declined ~1.7% and base metal prices were also lower (copper -2.3%). In FX, the USD Index tread water with EUR (now ~$1.1239) touching its highest level since February 2022, and USD/JPY hovering above ~138.50. The Chinese yuan weakened as policy easing expectations increased, with USD/CNH moving up to ~7.18. Cyclical currencies such as the AUD (-0.3%) and NZD (-0.6%) are also lower compared to this time yesterday.

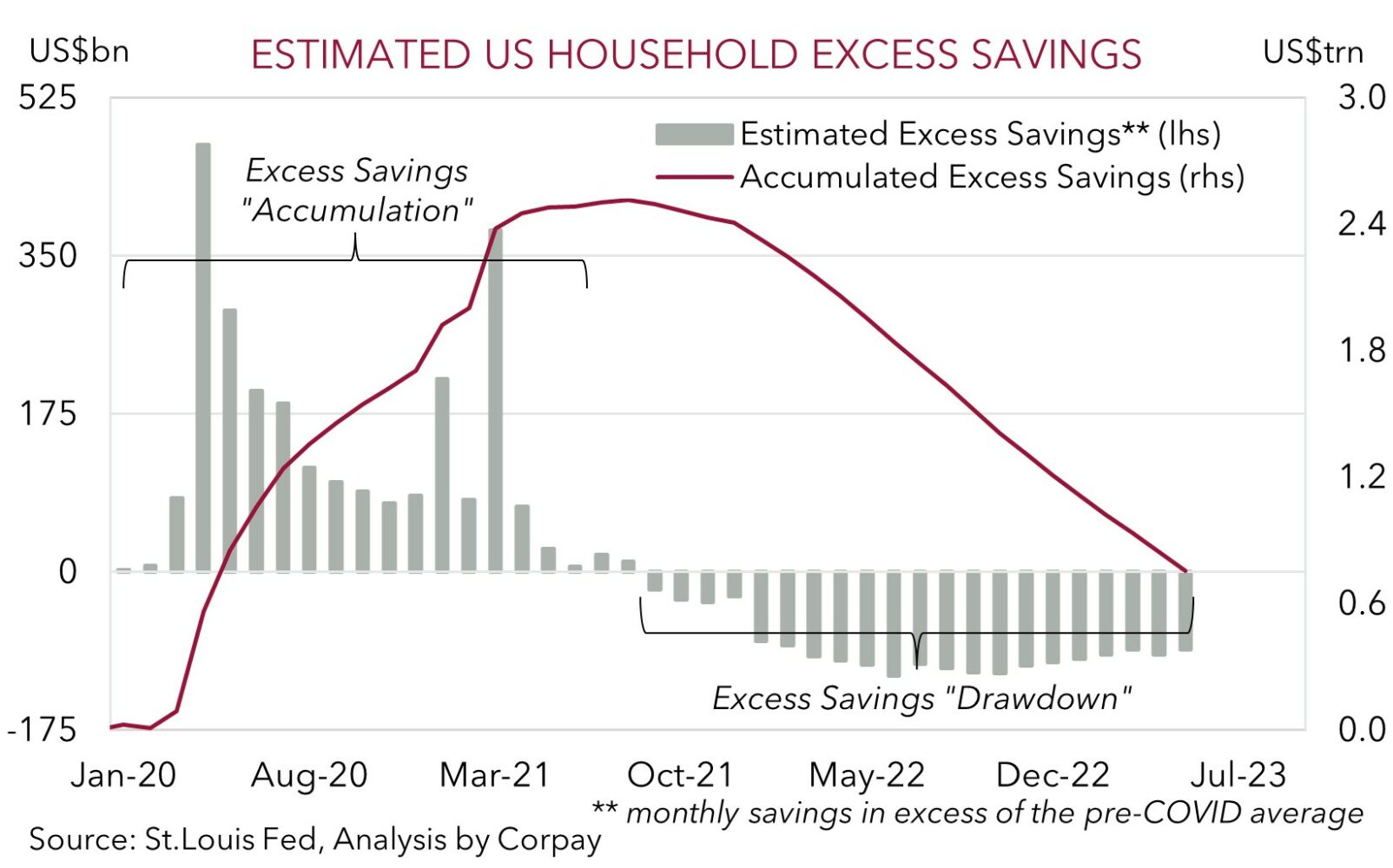

Global attention will be on tonights US retail sales data (10:30pm AEST). Although momentum has slowed, low unemployment and the ability to tap into the large war chest of ‘excess savings’ accumulated during COVID has helped to somewhat insulate the US household sector from cost-of-living pressures. In our view, a solid June US retail sales report (mkt +0.5%) could see US interest rate expectations shift up, supporting the USD. Consumer spending accounts for ~3/4’s of US GDP. Signs US retail sales are holding up may see markets question their assumption that the US Fed only has ~1 more rate hike (i.e. at next week’s meeting) this cycle.

Global event radar: US Retail Sales (Today), UK CPI (Weds), Japan CPI (Fri), Eurozone/UK PMIs (24th July), US FOMC Meeting (27th July), Fed Chair Powell Speaks (27th July), ECB Meeting (27th July), US GDP (27th July), Bank of Japan Meeting (28th July), US PCE Deflator (28th July), China PMIs (31st July), Eurozone GDP & CPI (31st July).

AUD corner

The AUD has continued to drift back with the underwhelming China data batch and softer CNH exerting a bit more downward pressure over the past 24hrs. At ~$0.6819, the AUD is ~1.2% below last Friday’s intra-day peak. Underperformance on the crosses has also been a factor. AUD/EUR (now ~0.6065) is near the bottom of the range it has occupied since mid-May. AUD/GBP (now ~0.5214) is ~1% from its 2023 lows, while AUD/JPY remains under ~95. AUD/NZD has bucked the trend, with a relatively weaker NZD supporting the pair (now ~1.0780).

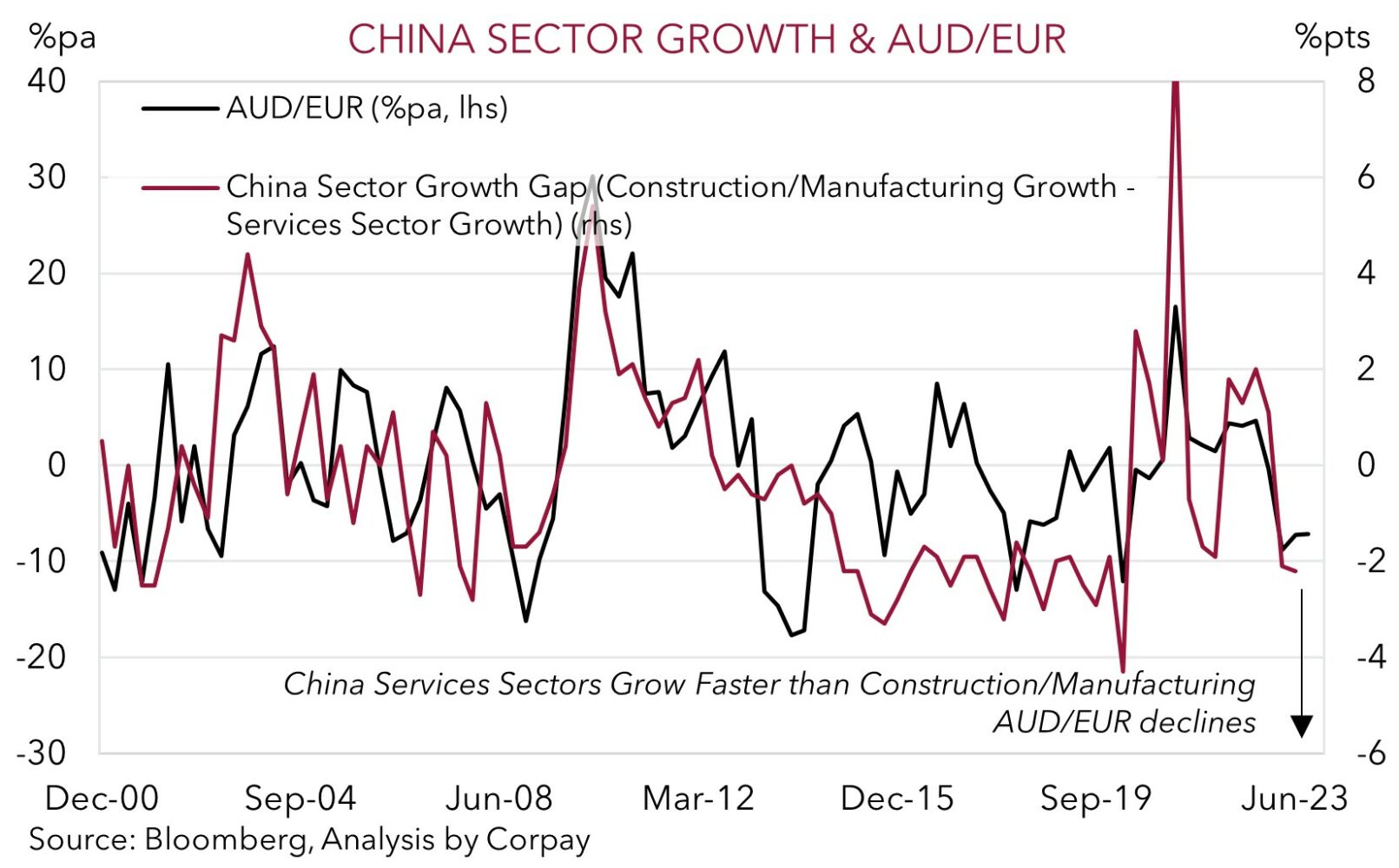

As discussed, the China data batch provided yet more evidence that the post-COVID recovery is faltering. And although we see more stimulus measures being announced down the track to support growth, we continue to think the focus is more likely to be on propping up labour-intensive consumption to boost confidence and lower youth unemployment. While firmer Chinese growth should be helpful for the AUD, this isn’t as AUD supportive as a commodity-intensive infrastructure push. Indeed, arguably the Eurozone has stronger linkages to this side of China’s economic story. As our chart show, periods when growth across China’s ‘tertiary’ sectors (i.e. services, consumption etc) outpaces ‘secondary’ sector growth (i.e. infrastructure, construction) normally sees the EUR outperform the AUD. Added to that we think AUD/EUR should also be weighed down by the outlook for relatively more rate increases by the ECB.

Today, the minutes of the July RBA meeting (11:30am AEST) and US retail sales (10:30pm AEST) are released. Given the subsequent speech by Governor Lowe, we doubt the minutes will reveal much new information with the decision to ‘skip’ a hike in July another ‘finely balanced’ call. As outlined above, we think that US retail sales could be quite solid (mkt +0.5%). If realised, this may see US interest rate expectations shift up in favour of a stronger USD, which in turn could see the AUD lose a bit more ground over the near-term. Further ahead, we think another rate hike by the US Fed at the 27 July meeting and message that the door to further tightening remains open given still too high core inflation could rattle nerves and generate more headwinds for cyclical currencies like the AUD.

Also on the crosses AUD/NZD will be in focus over the next few days. NZ Q2 CPI inflation is released tomorrow (Weds 8:45am AEST). The data should confirm that NZ CPI is past its peak, with headline inflation expected to slow sharply (from 6.7%pa to 5.9%pa). A sizeable step down in NZ inflation would support the view that the RBNZ rate hiking cycle has ended. It will be a bumpy road, but over the next year we see AUD/NZD grinding up above ~1.10 and towards its long-run average (~1.18), with the AUD garnering support from more favorable relative growth and labour market trends, current account dynamics, and commodity prices. For more see Market Musings: Cross-Check: AUD/NZD – Diverging trends.

AUD event radar: RBA Meeting Minutes (Today), US Retail Sales (Today), NZ CPI (Weds), UK CPI (Weds), AU Jobs (Thurs), Japan CPI (Fri), Eurozone/UK PMIs (24th July), AU CPI (26th July), US FOMC Meeting (27th July), Fed Chair Powell Speaks (27th July), ECB Meeting (27th July), US GDP (27th July), Bank of Japan Meeting (28th July), AU Retail Sales (28th July), US PCE Deflator (28th July), China PMIs (31st July), Eurozone GDP & CPI (31st July), RBA Meeting (1st Aug).

AUD levels to watch (support / resistance): 0.6708, 0.6781 / 0.6900, 0.6925

SGD corner

USD/SGD has continued to consolidate near its recent lows (now ~$1.3217), with the rangebound USD Index holding the pair down in face of softer risk sentiment stemming from the ‘sluggish’ China data pulse (see above). On the crosses, the ongoing resilience in the EUR has helped EUR/SGD (now ~1.4855) hit a fresh cyclical high, while SGD/JPY continues to track above its 50-day moving average (~104.40).

As mentioned above, the focus today for global markets should be the US retail sales report. In our opinion, a solid US retail sales print (mkt +0.5%) could see US interest rate expectations tick up as markets question their outlook looking for just ~1 more rate hike by the US Fed this cycle. If realised we expect this to be USD (and USD/SGD) supportive over the near-term. The US Fed meets next week, and in addition to hiking rates by another 25bps, we think policymakers are likely to reiterate that the door to more tightening remains open and thoughts of rate cuts are a long way off given still uncomfortably high inflation and tight labour market conditions.

SGD event radar: US Retail Sales (Today), UK CPI (Weds), Japan CPI (Fri), Singapore CPI (24th July), Eurozone/UK PMIs (24th July), US FOMC Meeting (27th July), Fed Chair Powell Speaks (27th July), ECB Meeting (27th July), US GDP (27th July), Bank of Japan Meeting (28th July), US PCE Deflator (28th July), China PMIs (31st July), Eurozone GDP & CPI (31st July), RBA Meeting (1st Aug).

SGD levels to watch (support / resistance): 1.3140, 1.3200 / 1.3377, 1.3439