• Mixed fortunes. Equities higher, while European bond yields fell after the ECB’s Knot watered down future rate hike expectations.

• US data. Headline retail sales a bit softer, but the control group (which feeds into US GDP) was stronger. We expect another Fed hike next week.

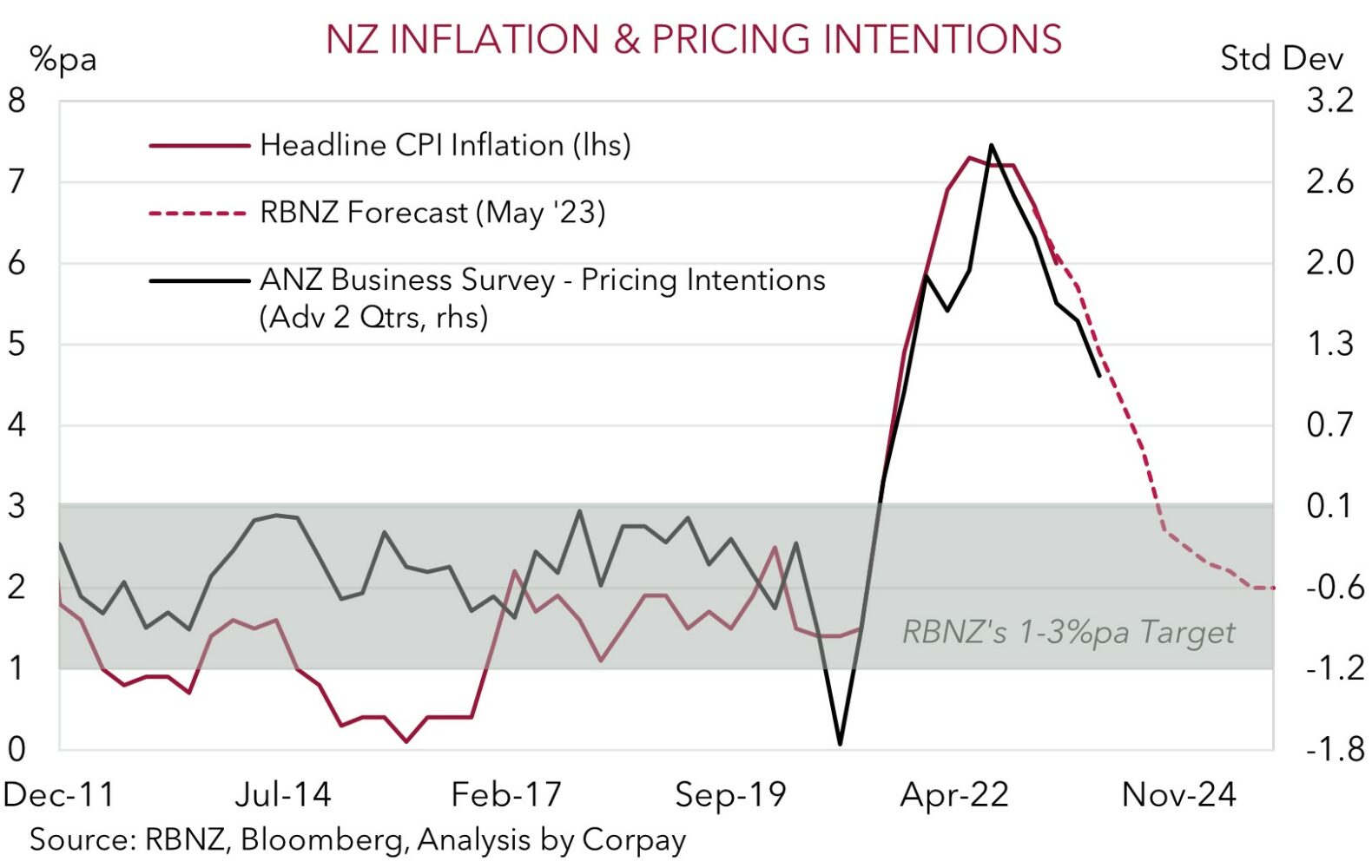

• NZ CPI. Annual headline inflation stepped down. Inflation is past its peak & NZ growth is slowing. We see AUD/NZD moving higher over the medium-term.

Diverging trends across markets. Solid earnings results and decent US retail sales data (see below) has helped underpin equities. The lift in bank and artificial intelligence linked stocks pushed the US S&P500 higher (+0.7%). In level terms the S&P500 is now at its highest since April 2022. At the same time, bond yields generally declined, with a big drop across Europe coming through. German and UK 10-year yields fell ~10bps (now 2.38% and 4.33% respectively), while the German 2-year yield declined a chunky ~13bps (now 3.06%) after markets pared back some of their interest rate hiking bets following somewhat ‘dovish’ rhetoric from the usually ‘hawkish’ ECB member Knot. According to Knot while another rate hike next week was a “necessity” beyond that moves are “a possibility but by no means a certainty”. By contrast, after being dragged down by European developments, US yields clawed their way back as trading rolled on. The US 2-year yield ended the day ~3bps higher (now 4.76%).

In FX, the EUR, GBP, and JPY all weakened a little against the USD as yield differentials moved in favour of the US. But at ~$1.1230 the EUR remains near the top of the range it has occupied since late-February 2022. GBP has slipped down towards ~$1.3040, while USD/JPY is hovering just under ~139. NZD underperformed ahead of this morning’s NZ CPI, with further falls in whole milk powder prices (-1.5%) at the overnight GDT auction also a factor. AUD oscillated around ~$0.6810, with stronger energy (WTI crude +2.2%) and equity markets counteracting the firmer USD.

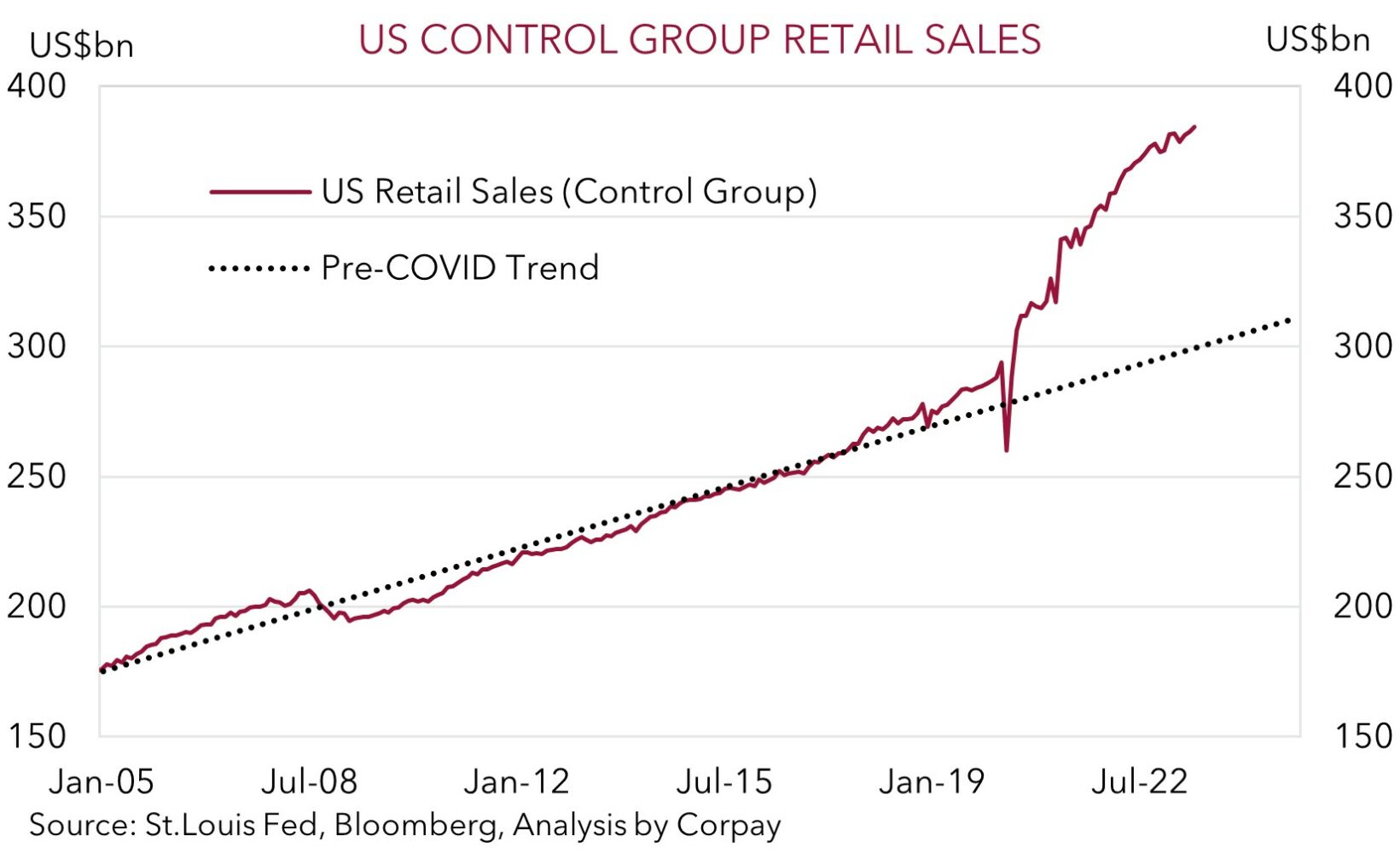

Data wise, in the US, although total retail sales looked a bit softer, increasing by a modest 0.2% in June, last months result was revised higher, and importantly, control group sales (which proxies broader spending and feeds into GDP) exceeded predictions. The control group rose 0.6%, and as our chart shows, while growth momentum has slowed, monthly turnover remains ~25% above its pre-COVID trend. The ongoing underlying strength in the US consumption (~3/4’s of US GDP) reinforces our thoughts that the US Fed will raise rates again next week (27 July AEST). And with US core inflation still too high and labour market conditions too tight we believe the Fed should reiterate that the door to further tightening remains open, and thoughts of rate cuts are a long way away. In our view, this could rattle nerves and generate a bit more support for the USD. Later today UK CPI is due (4pm AEST). Over recent months UK inflation has come in above market forecasts, with the surprises generating a jolt across bond markets and dampening risk sentiment. Consensus is looking for core UK inflation to hold at a well above target 7.1%pa.

Global event radar: UK CPI (Today), Japan CPI (Fri), Eurozone/UK PMIs (24th July), US FOMC Meeting (27th July), Fed Chair Powell Speaks (27th July), ECB Meeting (27th July), US GDP (27th July), Bank of Japan Meeting (28th July), US PCE Deflator (28th July), China PMIs (31st July), Eurozone GDP & CPI (31st July).

AUD corner

The AUD has had a quiet 24hrs. The AUD/USD (now ~$0.6813) is roughly where it was trading this time yesterday with the positive risk backdrop (as illustrated by the lift in energy and equity markets) offsetting the firmer USD (see above). On the crosses, AUD/EUR and AUD/JPY are also on net little changed, and while AUD/GBP is a bit higher (+0.2%), AUD/CAD has lost some ground (-0.3%, now ~0.8970). Slightly higher than forecast core inflation in Canada has kept the door open to the Bank of Canada delivering another rate hike.

Yesterday, the minutes of the July RBA meeting were released. The RBA held the cash rate steady in July, and in our view, the minutes read slightly more dovish than expected. While the RBA weighed up both a ‘pause’ and another hike, unlike last month the minutes didn’t label the decision as “finely balanced”. Added to that there seemed to be more concern about the growth and labour market outlook. This Thursday’s jobs report and next weeks Q2 CPI will be important inputs into the RBA’s 1 August decision. In our thinking, softer data outcomes are likely to see markets pare back future RBA rate hike expectations, which in turn could weigh on the AUD. We continue to see the RBA delivering 1 more rate hike this cycle, though this is factored into markets.

Overall, as flagged last week, in our view, the AUD’s recent upswing appears somewhat like the (unsustainable) rise that occurred in June, with global headwinds still in place. We think another hike by the US Fed at the 27 July meeting and message that the door to more tightening remains open given still high core inflation could see the USD recover against currencies such as the AUD.

After rising overnight, AUD/NZD has slipped back this morning (now ~1.08) with the NZD garnering some support from the Q2 NZ CPI data. There was a large step down in headline inflation (from 6.7%pa to 6%pa), and although this was a little higher than the market was penciling in (consensus 5.9%pa), it was a touch lower than what the RBNZ was looking for (RBNZ 6.1%pa). We don’t think the NZD’s lift is sustainable. In our view, NZ inflation is past its peak and when combined with the growth slowdown that is coming through, we expect the RBNZ to keep rates on hold from here. It will be a bumpy road, but over the next year we see AUD/NZD grinding up towards its long-run average (~1.18), with the AUD relatively supported by more favorable growth and labour market trends, current account dynamics, and commodity prices. For more see Market Musings: Cross-Check: AUD/NZD – Diverging trends.

AUD event radar: UK CPI (Today), AU Jobs (Thurs), Japan CPI (Fri), Eurozone/UK PMIs (24th July), AU CPI (26th July), US FOMC Meeting (27th July), Fed Chair Powell Speaks (27th July), ECB Meeting (27th July), US GDP (27th July), Bank of Japan Meeting (28th July), AU Retail Sales (28th July), US PCE Deflator (28th July), China PMIs (31st July), Eurozone GDP & CPI (31st July), RBA Meeting (1st Aug).

AUD levels to watch (support / resistance): 0.6708, 0.6781 / 0.6900, 0.6925

SGD corner

USD/SGD continued to consolidate near its recent lows (now ~$1.3228), with the firmer but still rangebound USD Index keeping the pair in check (see above). On the crosses, the slightly softer EUR on the back of the drop in European bond yields has seen EUR/SGD (now ~1.4855) dip back from its cyclical highs. SGD/JPY is tracking ~0.5% above its 50-day moving average (~104.47).

As discussed, while headline US retail sales came in a touch softer than predicted overnight the control group (which better proxies consumer spending and feeds into US GDP) was stronger than anticipated. The ongoing resilience in US consumption supports our thinking that the US Fed is likely to raise interest rates again next week, and reiterate that further tightening is possible given the inflation, labour market, and spending pulse. If realised, we expect this to be USD (and USD/SGD) supportive, particularly when combined with the slowdown that is still coming through in global industrial activity and the sluggish growth momentum in China. This is normally a headwind for cyclical currencies like the SGD.

SGD event radar: UK CPI (Today), Japan CPI (Fri), Singapore CPI (24th July), Eurozone/UK PMIs (24th July), US FOMC Meeting (27th July), Fed Chair Powell Speaks (27th July), ECB Meeting (27th July), US GDP (27th July), Bank of Japan Meeting (28th July), US PCE Deflator (28th July), China PMIs (31st July), Eurozone GDP & CPI (31st July), RBA Meeting (1st Aug).

SGD levels to watch (support / resistance): 1.3140, 1.3200 / 1.3377, 1.3439