• Mixed signals. US equities ticked up, while bond yields slipped back. GBP, EUR, NZD, & AUD lost a bit of ground. US election is fast approaching.

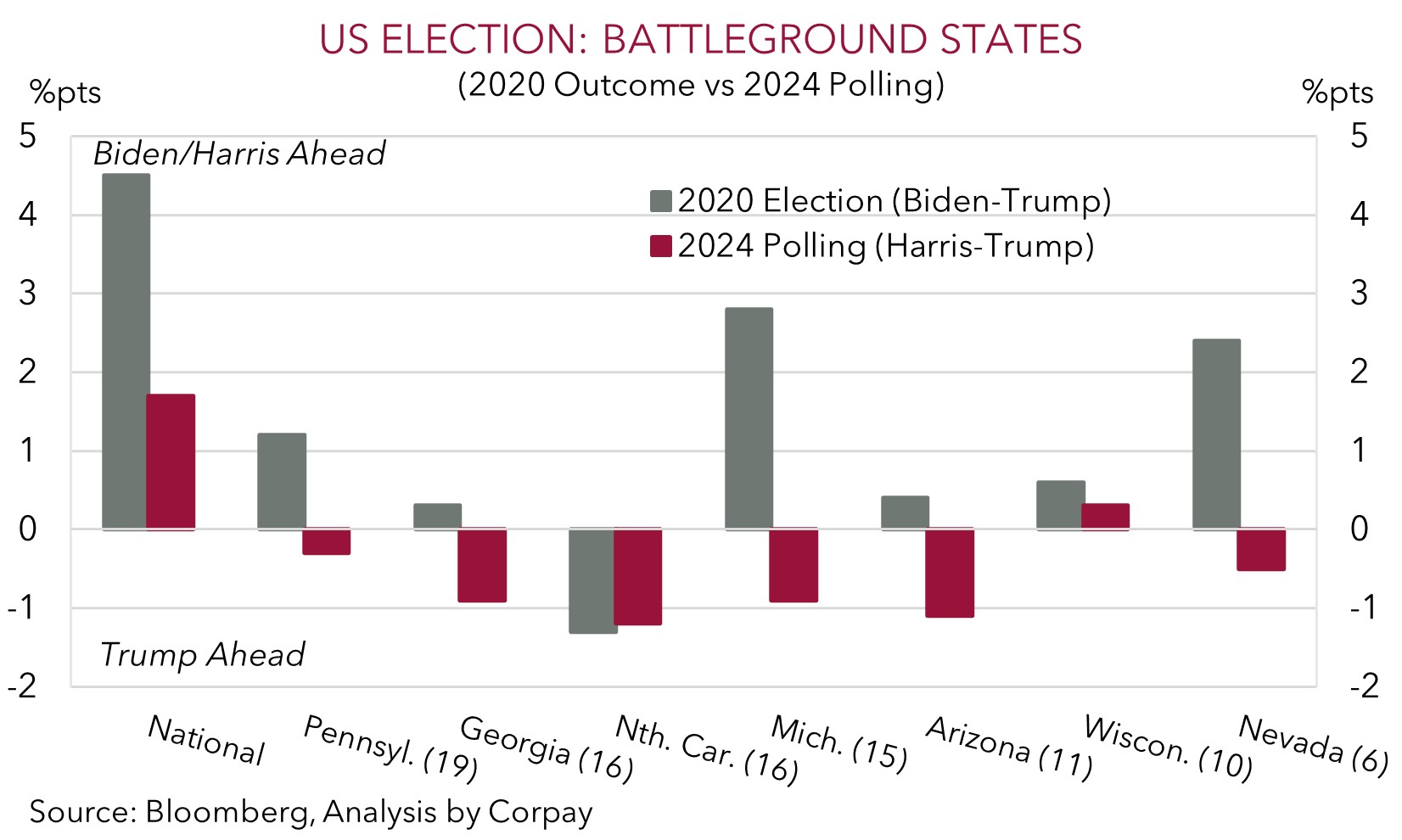

• US election. Trump is ahead in the polls across most of the battleground swing states. Given his policy platform this is supporting the USD.

• Event radar. Locally, the jobs report is due today. Tonight the ECB is expected to cut rates again, while in the US retail sales & jobless claims are due.

Mixed fortunes across markets overnight. US equities rebounded from the previous days dip with the S&P500 (+0.5%) hovering just below its record highs. A rotation by investors away from the megacap tech stocks towards the more economically sensitive small caps helped, particularly the strength in sectors that might benefit from former President Trumps policy agenda given the increased chances he may retake the White House. Elsewhere, bond yields lost ground, particularly in Europe. While the US 2yr yield tread water (now ~3.94%), the German 2yr rate shed ~4bps (now ~2.16%) and the UK 2yr tumbled ~11bps (now ~4.01%).

Weaker than anticipated UK CPI inflation data was the trigger. UK headline CPI slowed to just 1.7%pa, with a meaningful deceleration in sticky services prices also dragging down core inflation (now ~3.2%pa). The data bolstered expectations about further Bank of England rate cuts. Another 25bp reduction is now more than fully baked in for November, with ~4 rate cuts priced in by next May. This exerted downward pressure on GBP which is back below ~$1.30 for the first time since mid-August. Ahead of tonight’s ECB meeting (11:15pm AEDT) and press conference (11:45pm AEDT) where another 25bp rate cut looks fully discounted EUR eased (now ~$1.0860) towards levels last traded in early-August.

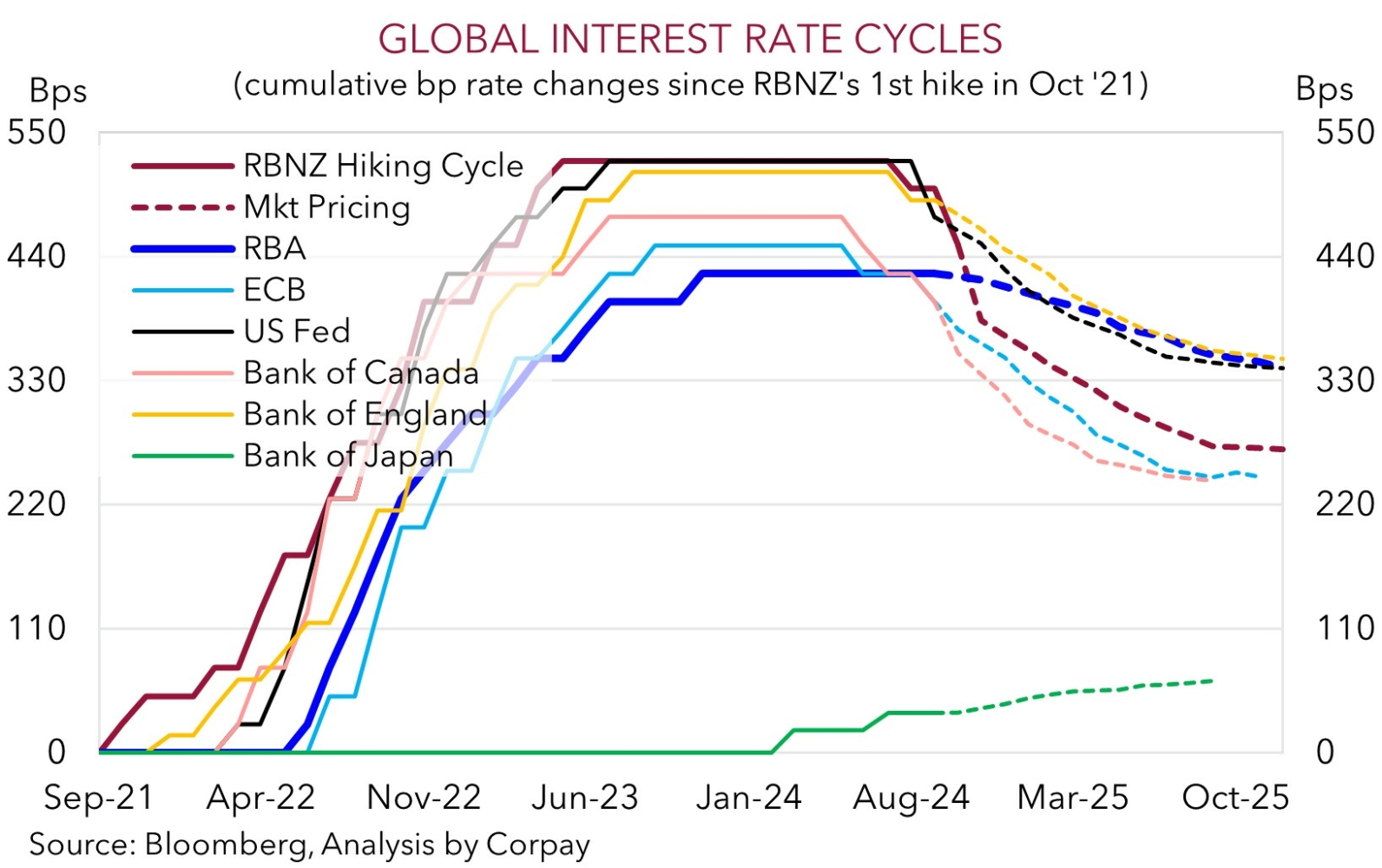

The relative adjustment in interest rate expectations in favour of the US and weaker European currencies supported the USD. Also providing a helping hand to the USD has been the swing in US election odds. Although Vice President Harris is still ahead on the National Polls, betting probabilities are now favouring former President Trump. Added to that, a closer look across the polling from the crucial battleground states also shows Trump is generally ahead in most of the ones President Biden won four years ago (see chart below). Given his vocal push for large-scale tariffs on US imports, particularly from China, and greater fiscal spending, a Trump win could rekindle inflation worries that would keep US interest rates higher than they otherwise might be, which in turn is a positive for the USD. Geopolitical worries, global growth risks stemming from a tit-for-tat trade war, and a Trump unpredictability factor are other dynamics that may also be USD supportive, in our view. The firmer USD has also weighed on the AUD (now ~$0.6666), which is around a 5-week low, with NZD also weakening (now ~$0.6057) to a ~2-month low. The stepdown in NZ inflation (now 2.2%pa) in Q3 reinforced the markets aggressive RBNZ rate cut bets.

Tonight, as mentioned the ECB looks set to lower rates again. In the US, retail sales are released, as are weekly initial jobless claims (both 11:30pm AEDT), and industrial production (12:15am AEDT). We believe signs the US consumer is holding up may compound the other positive USD factors currently washing through markets.

AUD Corner

The AUD has remained on the backfoot with the stronger USD stemming from weaker European currencies and shifting perceptions former President Trump may win the fast-approaching 5 November US election factors at play (see above). At ~$0.6666 the AUD is back down where it was trading in the first half of September, almost 4% below its late-September cyclical peak. The AUD has also eased on most of the major crosses with falls of ~0.2% recorded against the EUR, JPY, and NZD over the past 24hrs. AUD/CNH (now ~4.7575) is also back below its ~1-year average. By contrast, the softer UK CPI print and downward adjustment in UK interest rate expectations has helped AUD/GBP buck the trend (now ~0.5133).

Today, ahead of the anticipated ECB rate cut (11:15pm AEDT) and US retail sales data (11:30pm AEDT), the latest read on the Australian jobs market is due (11:30am AEDT). The Australian labour market has defied the odds over the past ~18-months with the sharp jump up in interest rates cooling demand without generating the large-scale job losses many had feared and that came through in previous downturns. This has been what the RBA has been striving for. In our opinion, the still elevated level of demand across the aggregate economy, particularly in the labour-intensive services sector, might see job creation remain positive (mkt +25,000 in September) and hold the unemployment rate steady (mkt 4.2%). Another solid showing could reinforce views the RBA is on a slightly different path to its global peers with rate cuts here set to lag the global cycle. This also reflects the fiscal/income support that is flowing into the household sector, sticky services prices, and lower interest rate starting point.

We believe the diverging monetary policy impulses between the RBA and others should be AUD supportive over the medium-term, particularly against currencies like the EUR, CAD, GBP, and NZD, where their respective central banks have begun to reduce interest rates. Working against the AUD however in the short-term is the resurgent USD and increased attention on the looming US Presidential Election. As discussed above, given his push to implement large scale tariffs, especially on China, a Trump win could be USD positive, with fears about another trade war, spillover global growth risks, and what this might mean for the CNH factors that may exert more downward pressure on the already undervalued AUD over the period ahead.