• Consolidation. Quiet end to last week. US S&P500 hit another record. Bond yields ticked up while the USD remained range bound.

• China stimulus. More positive rhetoric but no specifics about the next wave of fiscal stimulus. But this looks to be a matter of when, not if.

• Event radar. Locally, jobs figures are due (Thurs). Offshore, ECB meets, while US retail sales, NZ CPI, UK CPI, & China GDP are released this week.

It was a rather subdued end to last week across markets. European and US equities ticked up with the S&P500 (+0.6%) touching yet another record high with solid quarterly earnings results across the banking sector supporting sentiment. The US S&P500 has now risen close to 22% year-to-date. Elsewhere, long end bond yields drifted higher with the benchmark US 10yr rate rising ~4bps to be at ~4.10%, the upper end of the range it has occupied since August. Base metals prices also rose with iron ore (+1.3%) edging up towards ~US$108/tonne. In FX, the USD tread water. EUR (now ~$1.0932) is hovering near the bottom of its 2-month range, GBP (now ~$1.3066) is around a 1-month low, and USD/JPY (now ~149) is approaching its 1-year average. NZD consolidated close to its 200-day moving average (~$0.6095) and the AUD (now ~$0.6739) continued to level off after its torrid spell in early-October.

Data wise, US Producer Price Inflation was unchanged in September with upstream pressures constrained by falls in petrol prices, while consumer confidence dipped as the Presidential Election comes closer into view. In China consumer and producer price inflation also undershot predictions. CPI inflation excluding food fell into outright deflation (now -0.2%pa), illustrating the weakness in domestic demand and why authorities in China are injecting more stimulus to revive growth. On that front however, it remains a matter of rhetoric over substance. China’s Finance Ministry held a briefing on fiscal policy over the weekend, and although more support for the struggling property sector and greater government borrowing was promised, there was again a lack of detail that may dampen sentiment early this week. That said, this information may be unveiled at the Standing Committee meeting likely to occur later this month.

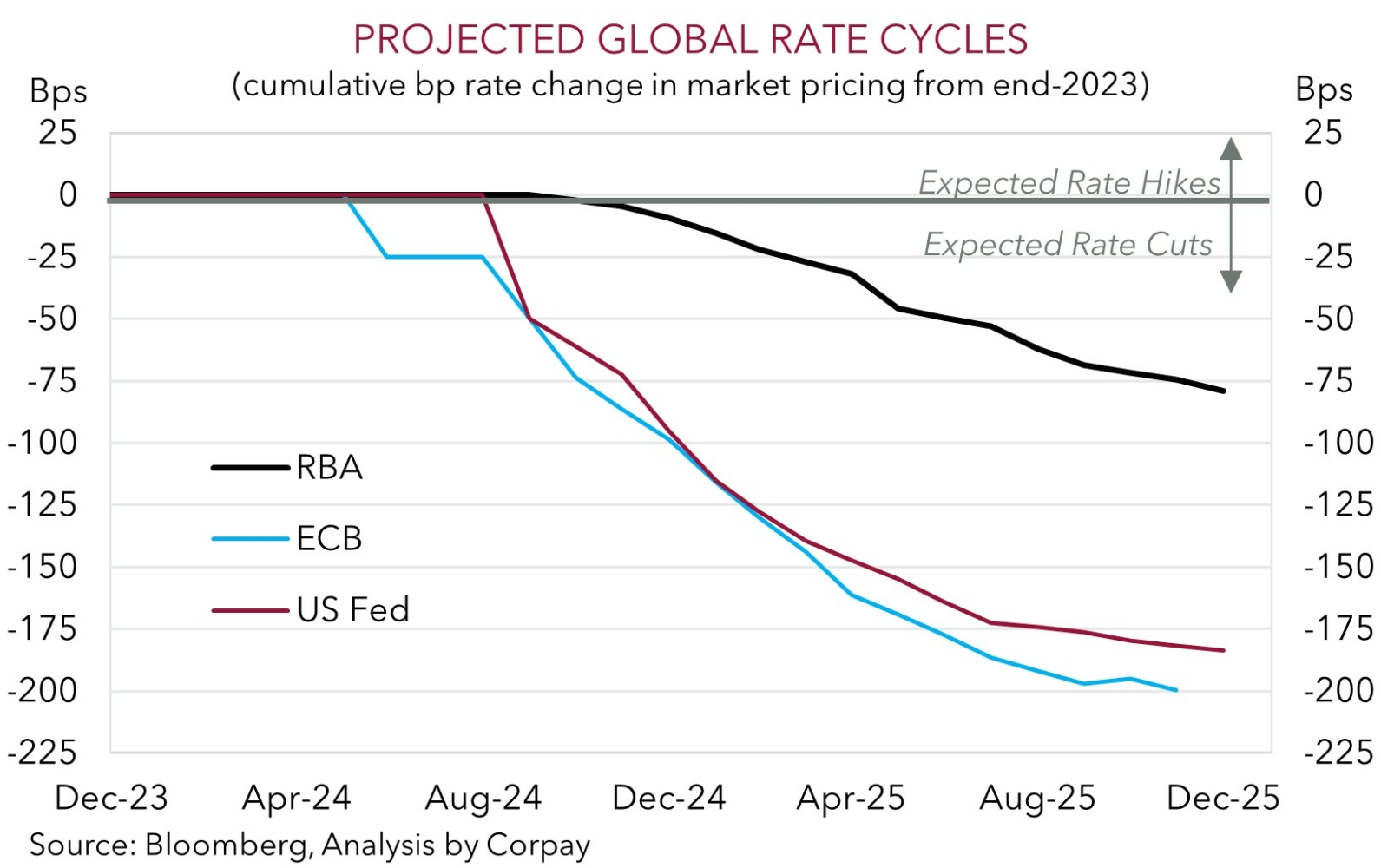

It is Columbus Day in the US today, but equities remain open. This week in addition to policy developments in China and swings in its asset markets, participants will also be focused on geopolitical news in the Middle East and various economic events. In the US, several Fed members are scheduled to speak and retail sales are due (Thurs night AEDT). China GDP is also released (Fri AEDT), while the European Central Bank is widely expected to cut interest rates by another 25bps (Thurs night AEDT). Indeed, ~24bps of rate cuts are factored in for this ECB meeting. On balance, we continue to believe that as US interest rate expectations have adjusted and are now broadly in line with the US Fed’s ‘dot plot’ forecasts, barring significant surprises in the US data and/or a sharp deterioration in risk appetite, further upside in the USD may be limited.

AUD Corner

The AUD (now ~$0.6739) is little different from where it was trading at this time on Friday. As discussed above, there was a quiet end to the week in markets with the USD treading water and limited new news to shift the dial. On the crosses, the AUD also remained range-bound. Outside of a ~0.3% lift in AUD/JPY (now ~100.40), the AUD has tracked sideways against the EUR, GBP, NZD, CAD, and CNH.

While we think the AUD might drift a bit lower at the start of this week given the disappointment likely to stem from the lack of fiscal stimulus details out of China over the weekend, we don’t believe the pull-back should be overly pronounced. In our view, after falling sharply over early-October, the AUD may now be in the process of carving out a bottom. On net, we think the broader set of fundamentals suggest the AUD is currently undervalued. The average across our suite of ‘fair value’ models indicates the AUD should be tracking closer to ~$0.6950 rather than ~$0.6750.

We believe key factors behind the AUD’s recent weakness, such as the upward adjustment in US bond yields, may be running out of steam. As flagged above and late last week, US interest rate expectations are on par with the US Fed’s ‘dot plot’ forecasts. This in turn means that without further upside US data surprises and/or a sharp deterioration in risk sentiment a ceiling on the USD could be in place. Concurrently, while China’s stimulus announcement underwhelmed lofty market ambitions, more concrete measures still look to be a matter of when, not if. We expect this to help revive China’s growth momentum over coming months which would be a tailwind for industrial metals and cyclical currencies like the AUD.

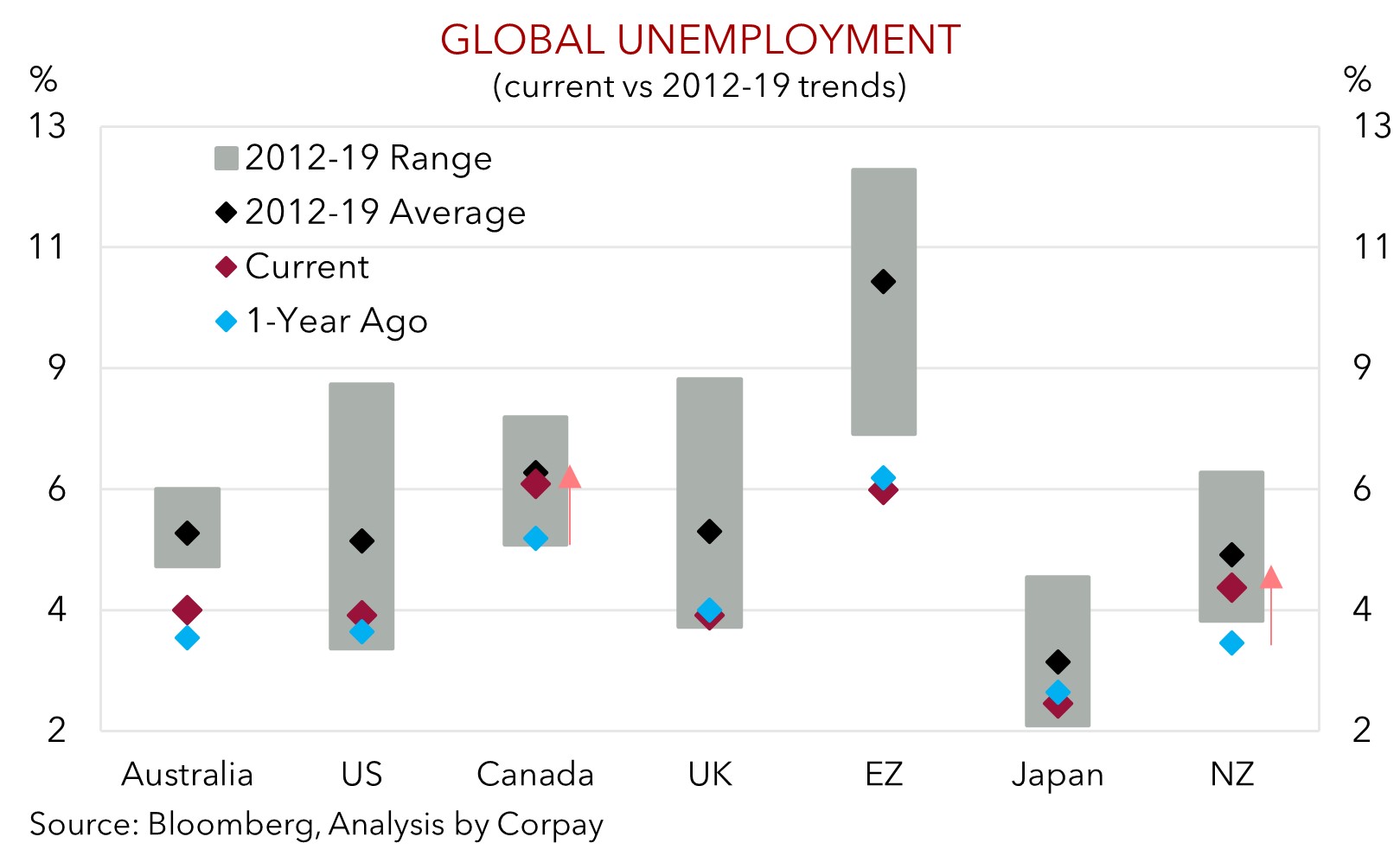

Locally, we also continue to believe that the mix of fiscal/income support that is flowing to households, sticky services inflation, lower interest rate starting point, and resilient labour market should see the RBA lag its peers in terms of when it starts and how far it goes during the global easing cycle. Another solid Australian labour market report is looked for this Thursday with jobs growth positive and the unemployment rate holding below ‘full-employment’. The relative swing in bond yield spreads in Australia’s favour should be AUD supportive, in our opinion, particularly against currencies like the EUR, CAD, GBP, NZD, and USD (albeit to a lesser extent) where their respective central banks have already begun to lower interest rates. Indeed, the ECB looks set to cut rates again this Thursday, while a step down in NZ and UK inflation (both Weds) should reinforce calls looking for more cuts by the RBNZ and Bank of England.