• Mixed signals. Weak China data & positive surprises in US retail sales, Canadian inflation, & UK wages has rattled market nerves.

• Negative vibes. The deluge of data has seen US/European bond yields rise & equity markets fall. USD remains firm. AUD touched another 2023 low.

• Upcoming events. No change expected from the RBNZ today. UK CPI, US housing & production data, & the FOMC meeting minutes also due.

It has been a busy 24hrs with markets digesting a deluge of data. There were mostly positive surprises with activity and/or inflation metrics generally coming in hotter than expected, though China was a standout in the other direction with the July activity data batch underwhelming.

US retail sales were much stronger than predicted, rising by 0.7% in July (vs mkt 0.4%). The ‘control group’ measure which feeds into GDP rose by an even stronger 1%. Most categories increased, but the main strength was due to the Amazon Prime Day Sales event. Consumer spending is the engine room of the US economy (consumption is ~3/4’s of GDP), so while the retail data is good news for near-term GDP growth, it complicates the picture for the US Fed as a slowdown and higher unemployment is needed to lower inflation.

Elsewhere, Japan GDP surged by a much stronger than forecast 1.5% in Q2. In Canada, headline inflation re-accelerated by more than assumed (from 2.8%pa to 3.3%pa), with core inflation hovering around an uncomfortably high ~3.7%pa. The slow progress on core inflation is keeping alive the chances of further hikes by the Bank of Canada. In the UK, although the labour market is showing signs of cracking (unemployment nudged up to 4.2%) the extended period of very tight conditions and higher inflation has seen wage growth accelerate to a record high 8.2%pa. This type of run-rate will keep services inflation very high and suggests the Bank of England still has more work to do. By contrast, growth momentum in China remains sluggish. Retail sales slowed more than anticipated (now 2.5%pa), with the more AUD-centric industrial side also weak (industrial production stepped down to 3.7%pa and fixed asset investment decelerated to 3.4%pa).

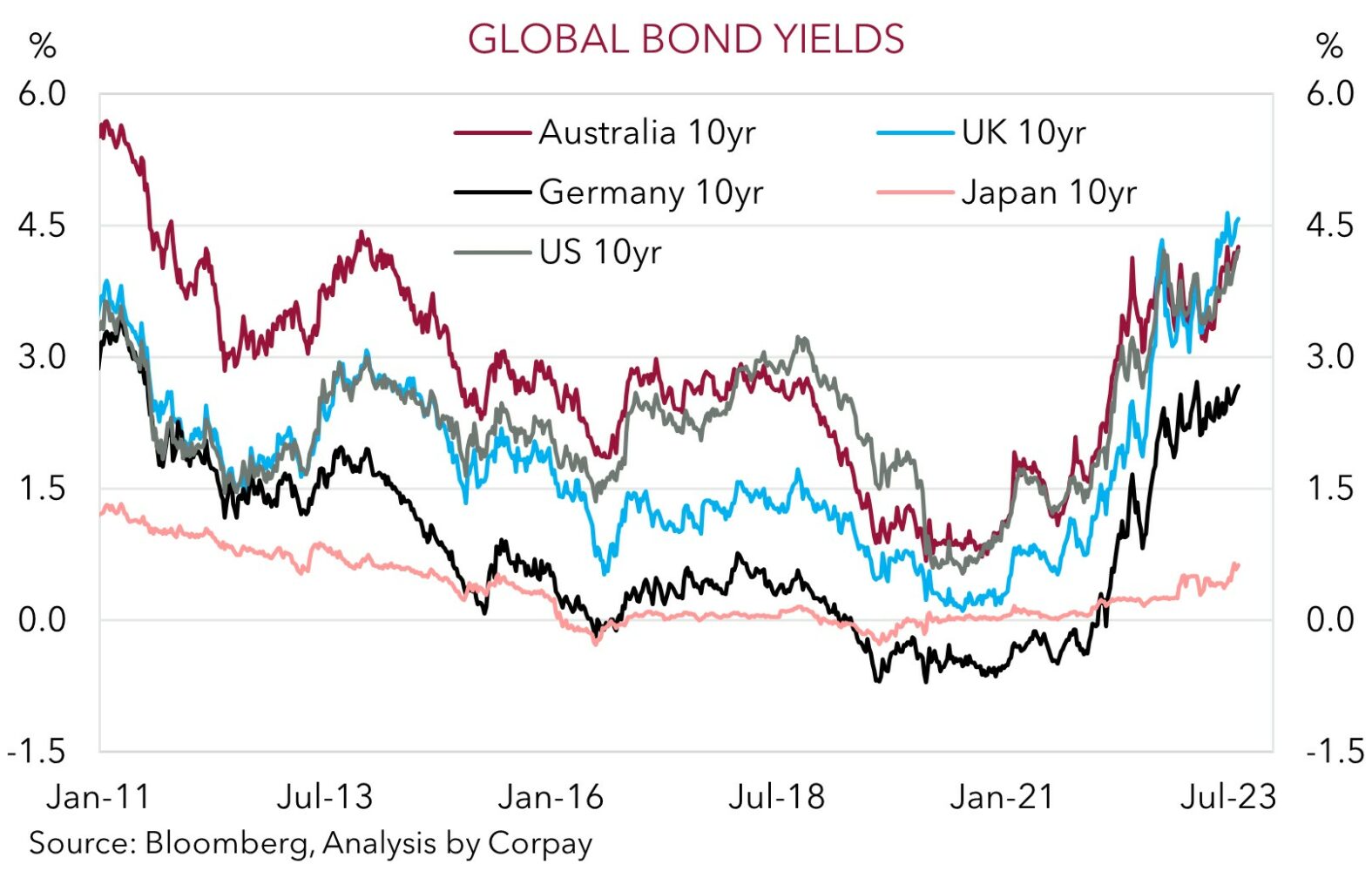

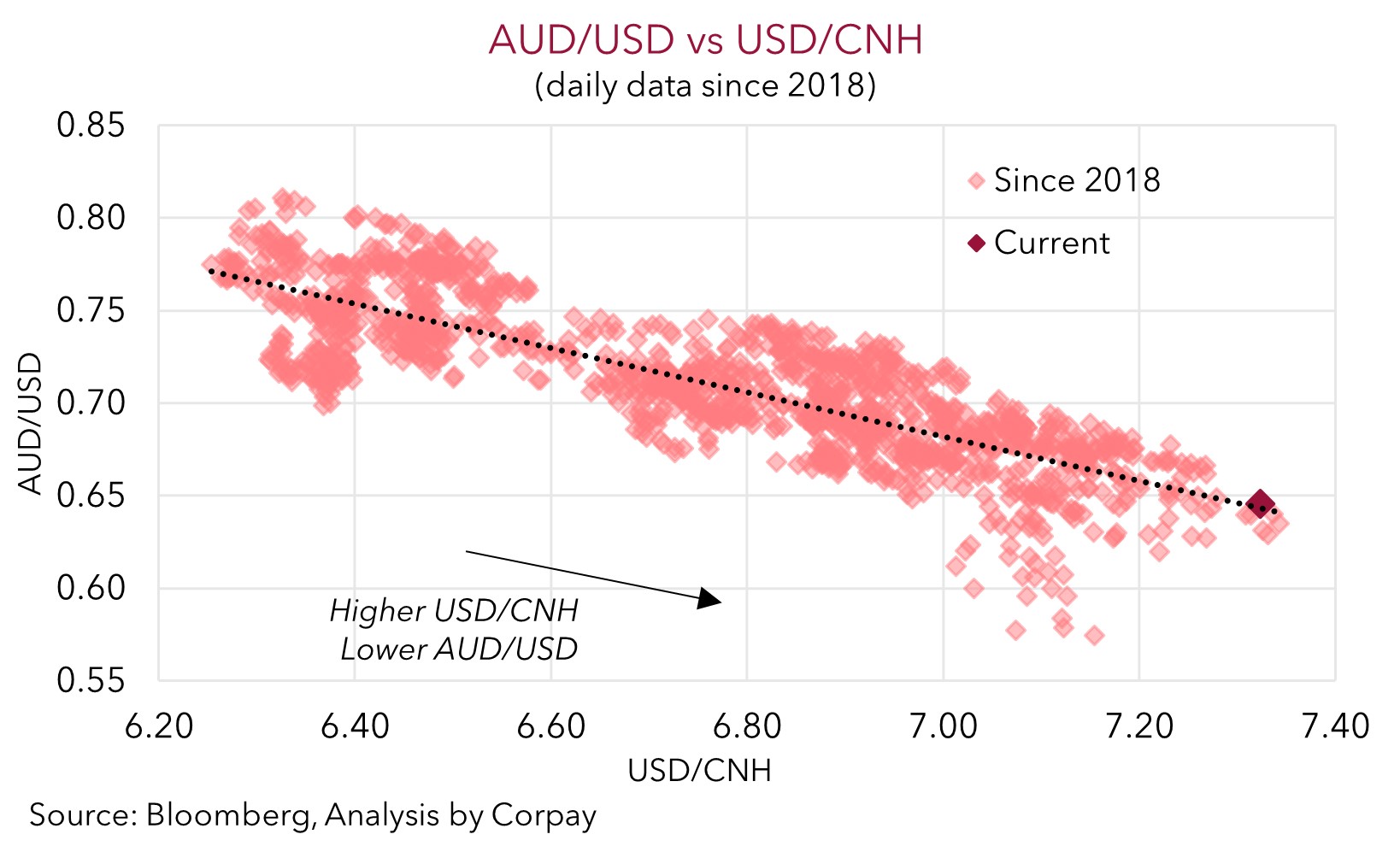

On net, the mix of China’s stuttering economy and upside surprises in the other global data dampened risk sentiment as markets tweaked their interest rate assumptions. Long-end bond yields in the US and Europe rose overnight, with the US 10-year (+2bps to 4.21%) touching its highest level since last October. Equities declined (US S&P500 -1.2%, EuroStoxx50 -1%), as have energy (WTI crude -1.8%) and base metal prices (copper -1.6%). In FX, the USD remains firm with the EUR down near ~$1.09 and USD/JPY above 145.50. USD/CNH has continued to push higher (now ~7.32) with yesterday’s surprise 15bp cut to the 1-year lending facility ahead of the China data and expectations for further action, exerting pressure on CNH. AUD remains heavy (now ~$0.6455) near its 2023 lows.

We expect recent trends to remain in place over the near-term. Globally focus today will be on the UK inflation report (4pm AEST), the US housing (10:30pm AEST) and industrial production (11:15pm AEST) data, and the minutes of the last US Fed meeting (4am AEST). In our view, positive surprises in the US data and/or a message from the FOMC minutes that policymakers are still open to raising rates or that rate cuts are some time away could generate more USD support.

Global event radar: RBNZ Meeting (Today), UK CPI (Today), FOMC Minutes (Thurs), Japan CPI (Fri), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

AUD corner

The AUD remains on the backfoot. The latest set of sluggish China data, monetary policy easing, and weaker CNH were compounded by soft Australian wages data and the negative risk environment overnight stemming from the upside surprise in US retail sales and further rise in bond yields (see above). This combination pushed the AUD (now ~$0.6455) to a fresh 2023 low. AUD has also underperformed on the crosses, with AUD/EUR (-0.5% to ~0.5920) back down near its lowest level since May 2020, and AUD/GBP (-0.6% to ~0.5083) hitting its lowest point since April 2020. Ahead of today’s RBNZ announcement (12pm AEST) AUD/NZD is tracking just under its 50-day moving average (~1.0860). We expect the RBNZ to keep rates on hold at 5.5% and think that although the bank could flag further tightening is possible the downside growth risks mean the hurdle is quite high.

Locally the Q2 wage data undershot consensus forecasts. The wage price index rose 0.8% in Q2, and as a result annual growth ticked down to 3.6%pa (mkt 3.7%pa). Though private sector wages are still running at a brisk 3.8%pa pace and a decent acceleration is anticipated in Q3 as the higher award and minimum wages across the public and private sectors flow through, markets seem to have taken the top line result as another sign the RBA will be a reluctant rate hiker from here due to the growth risks stemming from the sharp rise in mortgage costs running through the system. Markets are penciling in a ~75% chance of another RBA rate rise by February.

As mentioned above, we think the USD can remain firm over the near-term. Positive surprises in the US housing (10:30pm AEST) and production (11:15pm AEST) data and/or a message from the FOMC minutes (Thursday 4am AEST) that the door to further rate hikes is still open or that policy easing is still some time away could give the USD a bit more of a boost. This in turn can keep the AUD under pressure. But, as discussed before, although we don’t see the AUD bouncing back strongly for a while yet, we also don’t want to be overly downbeat around current levels given the fundamental supports provided by Australia’s current account surplus (now ~1.4% of GDP), flows related to the increasing pool of offshore investments undertaken by the superannuation industry, and the high level of the terms-of-trade. Since 2015, the AUD has traded below current levels less than ~3% of the time. Things always appear darkest before the dawn. Over the medium-term, with seasonal trends set to become more positive for the AUD (and negative for the USD) later this year (see Market Musings: History doesn’t repeat, but…), and with the weak CNH projected to rebound on the back of more growth-friendly stimulus in China over the period ahead, we continue to forecast the AUD grinding up into the low 0.70’s by mid-2024.

AUD event radar: RBNZ Meeting (Today), UK CPI (Today), FOMC Minutes (Thurs), AU Jobs (Thurs), Japan CPI (Fri), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), AU Retail Sales (28th Aug), RBA Deputy Gov. Bullock Speaks (29th Aug), AU CPI (30th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

AUD levels to watch (support / resistance): 0.6403, 0.6480 / 0.6610, 0.6664

SGD corner

USD/SGD has extended its upward run. The shaky risk sentiment generated by the unfolding slowdown in China, positive US retail sales surprise and resultant lift in US bond yields has pushed USD/SGD (now ~$1.3583) to its highest level since mid-December 2022 (see above). On the crosses, EUR/SGD (now ~1.4810) has remained in a holding pattern at the upper end of its year-to-date range, while SGD/JPY (now ~107.18) is still historically high.

As discussed above, we believe the USD can remain firm over the near term with tonight’s US housing and production reports at risk of also exceeding consensus forecasts. We also believe the US FOMC meeting minutes (released tomorrow morning) could appear somewhat ‘hawkish’ with policymakers likely to keep their options open around further rate rises and/or push back on the idea that policy easing could occur soon. In our view, this, in combination with slowing momentum in China, could see USD/SGD edge even higher.

SGD event radar: UK CPI (Today), FOMC Minutes (Thurs), Japan CPI (Fri), Singapore CPI (23rd Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

SGD levels to watch (support / resistance): 1.3385, 1.3417 / 1.3560, 1.3590