• Wall of worry. China worries, sticky UK inflation & a hawkish tone in the Fed minutes weighed on risk sentiment, pushed up US yields & supported the USD.

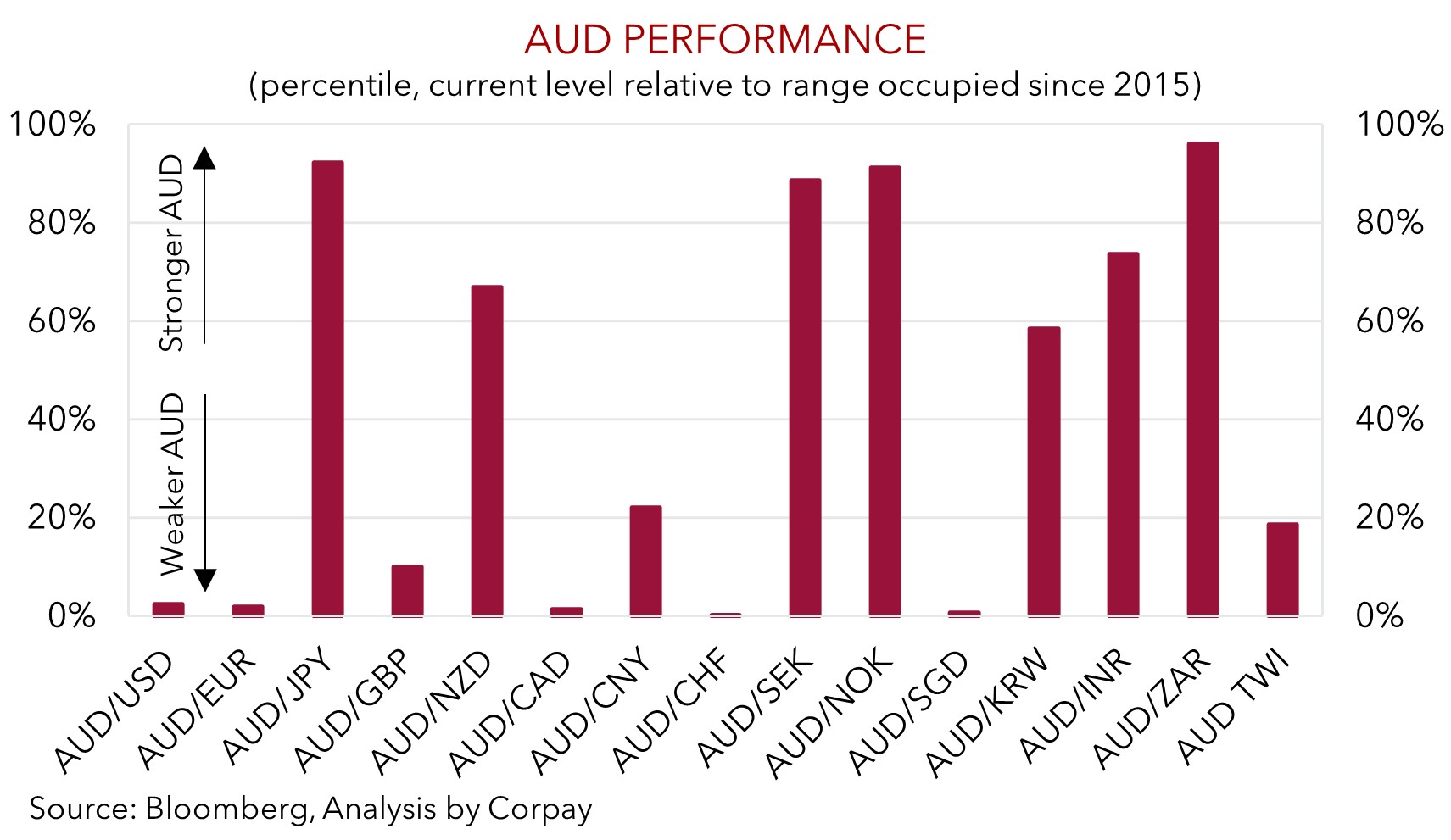

• AUD pressure. The backdrop has exerted more pressure on the AUD. The AUD is in rarefied air. Since 2015 AUD/USD has only been lower in ~2% of trading days.

• AU jobs. July labour force report released today. The labour market is a lagging indicator. Consensus is looking for unemployment to tick up slightly to 3.6%.

Familiar themes have continued to drive markets. On the one hand concerns about the state of play in China remain front-of-mind with news that Zhongrong International Trust, one of China’s biggest shadow banks, hasn’t made payments on several products adding to worries that issues in the property sector are broadening. On the other hand, the inflation challenge across the major western economies is ongoing. Data showed that while UK headline inflation slowed it didn’t fall back as far as predicted (now 6.8%pa), with sticky core inflation holding steady at a historically high 6.9%pa. In the US, the positive run of economic data continued with industrial production and housing starts better than anticipated. And the minutes of the late-July US Fed meeting (where rates were raised by 25bps) had a ‘hawkish’ tone. “Most” Fed participants still saw “significant upside risk to inflation, which could require further policy tightening”. This is consistent with the Fed’s June “dot plot” which projected one more rate hike this year.

On net, the China worries coupled with lingering inflation pressures and outlook for rates to be ‘higher for longer’ has continued to weigh on risk sentiment. US equities fell again overnight (S&P500 -0.8%, NASDAQ -1.2%) with US bond yields rising. The US 10-year yield rose another ~4bps to now be at 4.25%, near its highest level since last October. UK yields also increased, up 6-7bps across the curve as markets tweaked their Bank of England assumptions. Markets are pricing nearly 80bps worth of additional BoE tightening, with another full hike added to the UK interest rate curve over the past week following the stronger wages and CPI reports.

In FX, the USD has strengthened with EUR slipping under ~$1.09 and USD/JPY (now ~146.27) tracking the move up in US bond yields to hit its highest level since early-November. GBP has held its ground against the USD. By contrast, NZD (now ~$0.5934) unwound yesterday’s modest RBNZ inspired bump. While the RBNZ held rates steady at 5.5% its updated forecast track indicated that there is a slight chance that another hike is delivered this cycle. The backdrop saw AUD (now ~$0.6421) touch yet another fresh 2023 low.

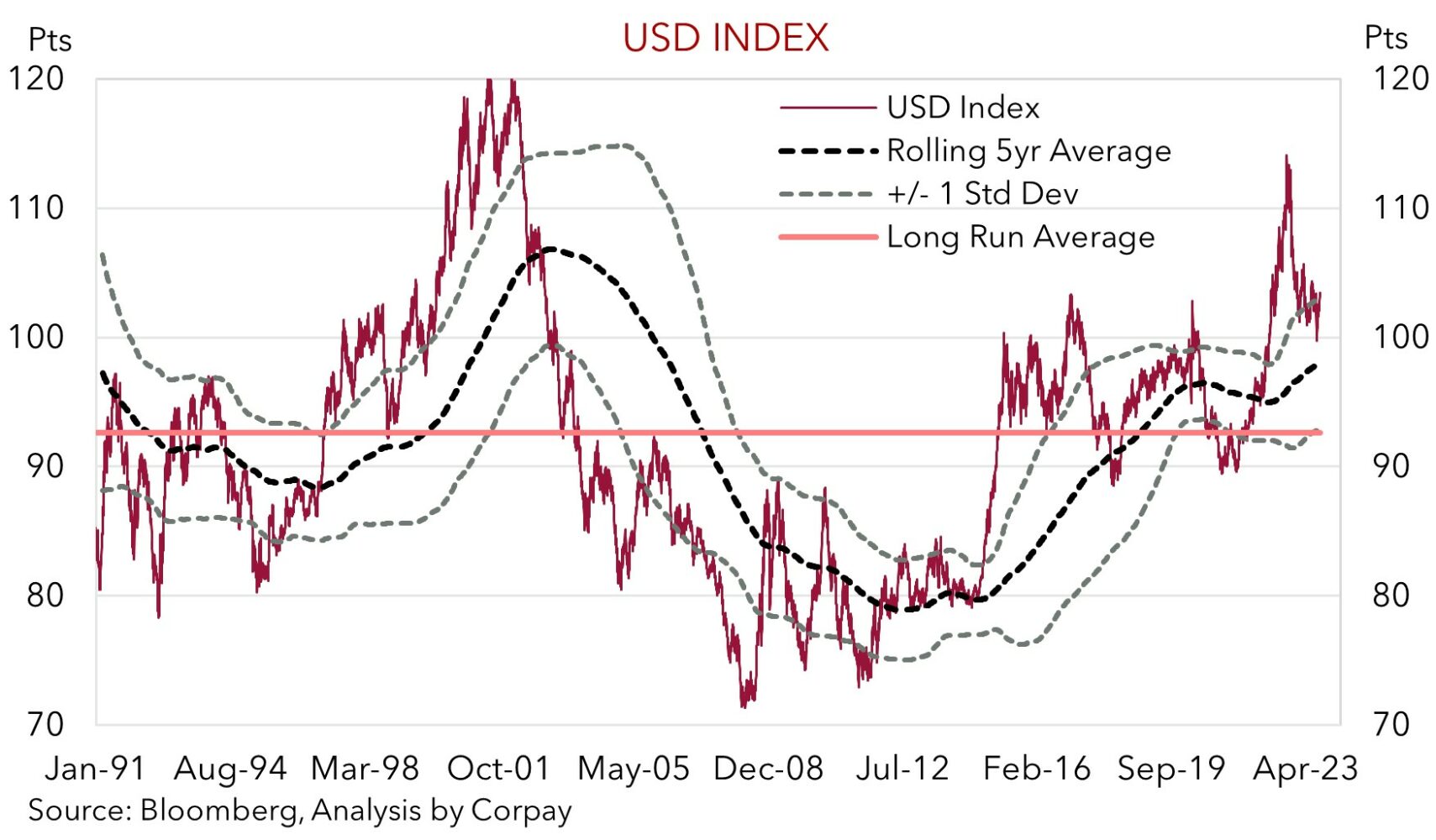

The relative strength of the US economy has underpinned the USD, with the usual positive seasonal factors at this time of year coming through once again (see Market Musings: History doesn’t repeat, but…). As our chart shows although the USD index is below its cyclical peak it remains historically high. While we think the underlying macro picture can remain USD supportive over the near-term, we doubt the USD’s outperformance will continue over the medium-term, and we continue to forecast the USD to weaken over a ~12-month horizon. The more optimistic views around the US economy means that it should now be harder for the US data to positively surprise. At the same time, tighter credit conditions and the drawdown of ‘excess savings’ points to US consumer spending and the economy slowing over coming months.

Global event radar: Japan CPI (Fri), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

AUD corner

The AUD’s underperformance has continued. Lingering concerns about the situation in China and a weaker CNH have combined with worries inflation could persist in the major economies and a ‘hawkish’ tone in the minutes of the recent Fed meeting to weigh on risk sentiment and push up US bond yields and the USD (see above). As a result, the AUD (now ~$0.6421) touched its lowest level since early-November 2022. The AUD has also remained sluggish on the crosses. AUD/GBP (-0.7%, now ~0.5045) is at its lowest point since April 2020 with the shift in relative interest rate expectations GBP positive (see above), while AUD/EUR (-0.3% to ~0.5903) hit its lowest level since May 2020. AUD/NZD has consolidated just above its 200-day moving average (~1.0807) in the wake of the RBNZ meeting. Things won’t move in a straight line, however, over the medium term as relative growth, labour market, and capital flow trends move in favour of Australia we see AUD/NZD trending higher (up towards ~1.14 in a years’ time) (see Market Musings: Cross-Check: AUD/NZD – Stay the course).

Today, local attention will be on the July labour force report (11:30am AEST). The labour market is a lagging indicator. Based on the time it takes to translate a job ad to a new hire the July data reflects economic conditions ~6mths ago. While forward-looking indicators point to slower employment growth and/or higher unemployment over the next year as the lagged effects of higher interest rates bite, the data for July is expected to remain positive with consensus looking for ~15,000 jobs and the unemployment ticking up slightly to a still historically low 3.6%. We think another solid labour report could give the beleaguered AUD some modest support. However, external headwinds remain, such as slowing global/China growth and a firm USD, and hence we don’t see the AUD bouncing back strongly just yet.

However, further out we continue to forecast the AUD to rebound back into the low 0.70’s by mid-2024. Fundamentals including Australia’s current account surplus (now ~1.4% of GDP), flows related to the increasing pool of offshore investments undertaken by the superannuation industry, and the high level of the terms-of-trade should, in our view, provide solid AUD support around current levels (since 2015 the AUD has only traded below current spot ~2% of trading days). Added to that, as discussed above, we expect the USD to weaken as the US’ relative economic strength fades and with seasonal trends set to become more negative later this year, and with the weak CNH and JPY projected to rebound on the back of more growth-friendly stimulus in China and moves by the BoJ to normalise its policy stance (see Market Musings: History doesn’t repeat, but…).

AUD event radar: AU Jobs (Today), Japan CPI (Fri), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), AU Retail Sales (28th Aug), RBA Deputy Gov. Bullock Speaks (29th Aug), AU CPI (30th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

AUD levels to watch (support / resistance): 0.6350, 0.6403 / 0.6547, 0.6600

SGD corner

The upswing in USD/SGD has continued. Worries about developments in China, signs inflation remains quite ‘sticky’ in the major economies, and a ‘hawkish’ tone from the US Fed meeting minutes pushed up bond yields, sapped risk sentiment, and supported the USD (see above). USD/SGD (now ~$1.3595) is around its highest level since mid-December 2022. On the crosses, EUR/SGD (now ~1.4794) has continued to consolidate at the upper end of its year-to-date range, while SGD/JPY (now ~107.59) touched a new historic high with the JPY remaining under downward pressure.

As outlined above, we think the USD can remain firm over the near term given the underlying impulses in the US economy and issues in China. In our opinion, this can see USD/SGD edge a bit higher over the short-term. However, over the medium- to longer-term, we continue to forecast the USD (and in turn USD/SGD) to lose ground as the US’ relative economic outperformance wanes on the back of tighter credit conditions, and based on our expectation that China may unveil more growth-supportive policy measures to help reinvigorate the faltering post-COVID recovery.

SGD event radar: Japan CPI (Fri), Singapore CPI (23rd Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

SGD levels to watch (support / resistance): 1.3391, 1.3413 / 1.3590, 1.3690