• Bond moves. Yields have continued to rise. The US 10-yr is at its highest since late-2007. This has exerted more pressure on equities. USD remains firm.

• CNY focus. Trends in China & CNY remain in focus. Policymakers in China appear to be becoming uncomfortable with the CNY weakness.

• AU jobs. Labour market data undershot expectations. Unemployment rose in July, extending the AUD weakness. But is the AUD starting to find a base?

Developments in bond markets and China remain front of mind. Against a backdrop of light news and economic dataflow bond yields have risen further. Concerns that rates may need to stay ‘higher for longer’ because of sticky underlying inflation and economic resilience is being compounded by the outlook for greater bond supply due to still large budget deficits. US weekly initial jobless claims, the best real-time read on the state of the labour market, came in at a still low 239,000 last week. This is a level indicative of ongoing job creation and tight conditions.

10-year yields across Europe rose 6-10bps, with the UK rate now up at 4.75% (a high since mid-2008). The German 10-year yield (now 2.71%) is approaching its cyclical highs, while in the US the 2-year rate is hovering up at 4.92% (the top of its 5-month range) and the 10-year (now 4.27%) is at levels last seen in late-2007. The jump up in yields continues to exert downward pressure on global equities. The EuroStoxx50 fell 1.3%, with the US S&P500 down another 0.8% and the tech-focused NASDAQ underperforming (-1.2%).

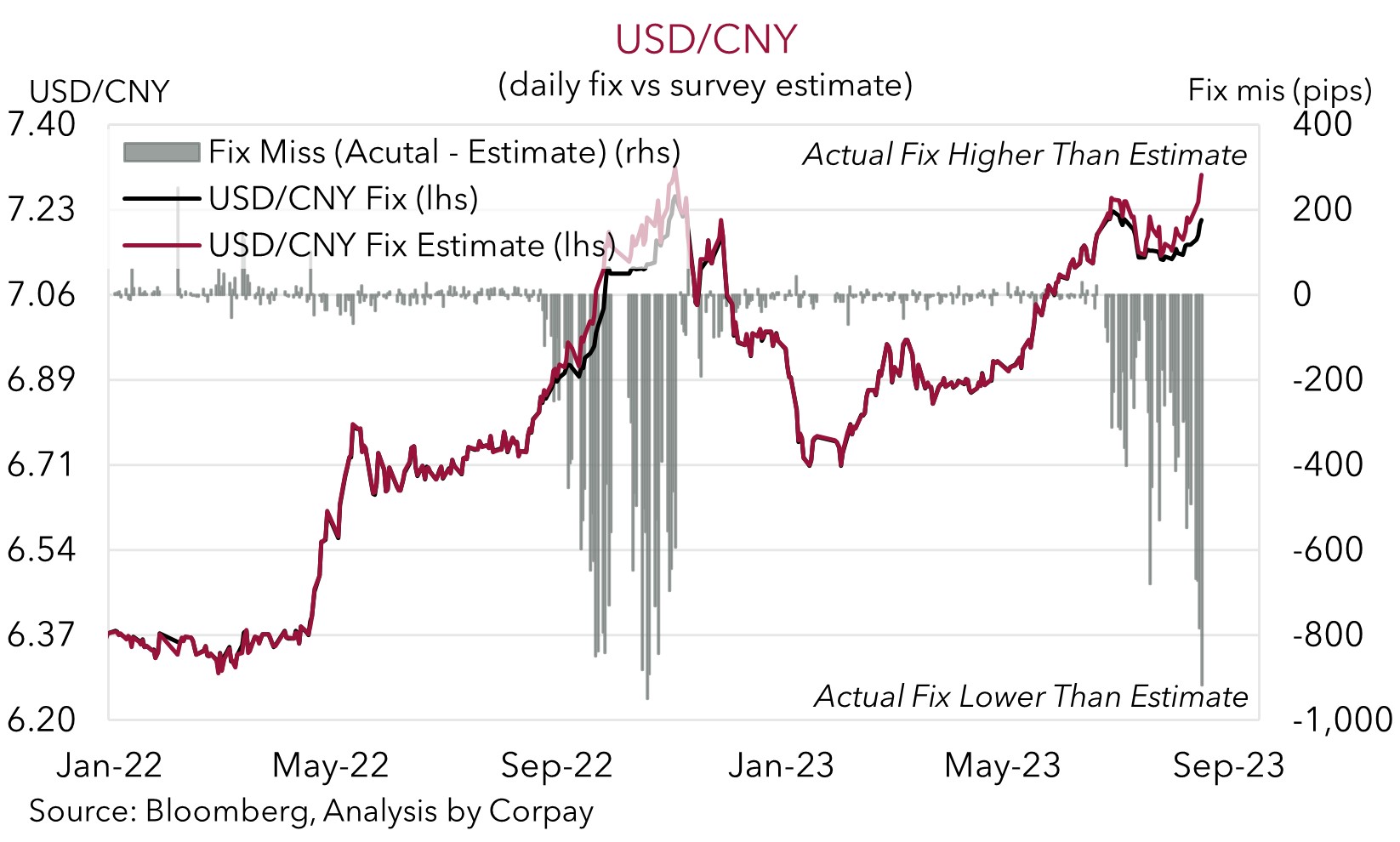

In FX, the USD Index consolidated recent gains. EUR and USD/JPY whipped around a little overnight, but on net the former is still near a ~6-week low and the bout of risk aversion has generated a bit of JPY strength. After touching another fresh 2023 low yesterday post the weaker than expected Australian labour market report the AUD (and NZD) found some support overnight with the pickup in CNH a helpful factor. USD/CNH is ~0.6% below yesterday’s 2023 peak. Reports that Chinese authorities told state-owned banks to step up their FX intervention efforts to prevent a surge in yuan volatility and that officials are looking at other tools such as cutting banks’ FX reserve requirements to stifle further rapid CNY depreciation was a shot across the bow of markets. This compounds moves by the People’s Bank of China to repeatedly set the daily CNY fixing rate at much stronger than expected levels to counter currency weakness stemming from China’s faltering post-COVID recovery, monetary policy easing steps and predictions for more. As our chart shows, yesterday’s ‘fix’ had the largest negative bias since October 2022, a clear signal policymakers are uncomfortable with recent CNY trends.

It is a light calendar today with Japanese inflation (9:30am AEST) and UK retail sales (4pm AEST) the major releases. As outlined yesterday, while we think the macro picture can remain USD supportive near-term, we doubt the USD’s outperformance will continue longer-term. We continue to forecast the USD to weaken over a ~12-month horizon as the US’ relative economic strength fades given the drawdown of ‘excess savings’ and tighter credit conditions, and our view authorities in China will inject more growth-friendly fiscal stimulus to reinvigorate the economy (and CNH).

Global event radar: Japan CPI (Today), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

AUD corner

The AUD has remained on the backfoot with recent trends extending on the back of the still negative risk backdrop stemming from the rise in bond yields and with the Australian labour market report undershooting expectations. The modest lift in CNH overnight has generated some respite for the beleaguered AUD (see above). Nevertheless, at ~$0.6402 the AUD remains near the bottom of its 2023 range, with the AUD also lower, on net, on the crosses compared to this time yesterday. AUD/EUR (-0.2% to ~0.5889) is around its lowest point since May 2020, AUD/GBP (-0.4% to ~0.5023) is at levels last traded in April 2020, while AUD/JPY (now ~93.32) and AUD/CNH (now ~4.68) are near the bottom of their respective ~2-month ranges.

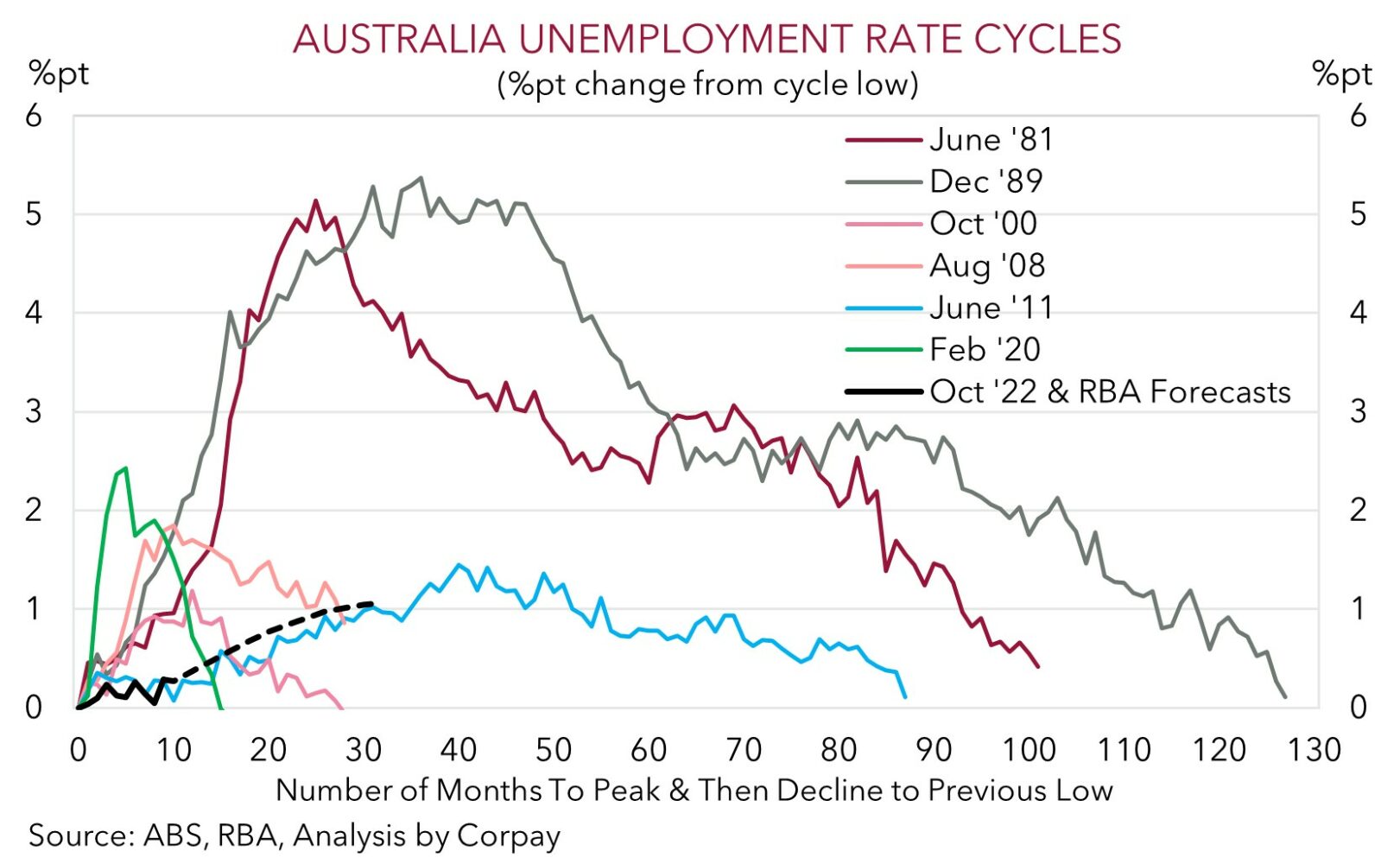

In terms of the local data, after a few surprisingly solid months the Australian labour market weakened in July. Employment fell 14,600, with full-time jobs declining (-24,200). With labour supply picking up given reopened international borders the unemployment rose to 3.7% (from 3.5%). This is still historically low, but the path of least resistance over the next year is for unemployment to trend higher. On our estimates the hurdle rate to keep unemployment steady is now around ~33,000 jobs per month. This type of run-rate was a hard task to achieve when the economy was firing on all cylinders never mind when momentum is decelerating. The RBA is forecasting unemployment to lift to 4.5% by mid-2025. As our chart shows, this would be an (optimistic) shallow lift in unemployment compared to past cycles. Signs the labour market is turning supports our thinking that the RBA is unlikely to hike rates further from here (see Market Wire: Australian labour market turning point?).

While we think the AUD is likely to remain heavy over the short-term as the negative domestic and global forces continue to play out, as we have pointed out before, down around current levels the AUD is tracking in somewhat rarefied air. Since 2015 AUD/USD has only traded sub-$0.64 ~2% of the time. Supportive fundamentals including Australia’s current account surplus (now ~1.4% of GDP), flows related to the increasing pool of offshore investments undertaken by the superannuation industry, the high level of the terms-of-trade, and efforts by China to restrain CNY weakness, should, in our view, help the AUD begin to stabilise. Beyond the still tricky near-term we continue to forecast the AUD to edge back into the low 0.70’s by mid-2024. Over coming months we expect the USD downtrend to recommence and broaden out as the US’ relative strength fades (or at the very least the data fails to match lofty expectations) and with seasonal trends set to become more challenging (see Market Musings: History doesn’t repeat, but…).

AUD event radar: Japan CPI (Today), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), AU Retail Sales (28th Aug), RBA Deputy Gov. Bullock Speaks (29th Aug), AU CPI (30th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

AUD levels to watch (support / resistance): 0.6310, 0.6370 / 0.6547, 0.6600

SGD corner

The upward trend in USD/SGD paused for breath with the pair oscillating around ~$1.3590 over the past 24hrs. This reflects the consolidation in the USD Index (see above). While the higher US bond yields have remained USD supportive against the EUR, the resultant fall in equity markets has generated a little JPY strength. On the crosses, EUR/SGD (now ~1.4764) has drifted back slightly, but it remains at the upper end of its year-to-date range. SGD/JPY (now ~107.37) has ticked down a touch from its historic highs.

As discussed above and over recent days we believe the USD can remain firm over the near-term based on trends in the US economy and bond markets, and issues in China. In our opinion, this can see USD/SGD nudge up a bit further over the short-term. But, over the longer-term we continue to forecast the USD (and in turn USD/SGD) to fall back as the US’ relative economic outperformance wanes as tighter credit conditions stifle growth, and based on our expectation China is likely to unveil more policy measures to help revive its sluggish growth pulse.

SGD event radar: Japan CPI (Today), Singapore CPI (23rd Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

SGD levels to watch (support / resistance): 1.3397, 1.3418 / 1.3590, 1.3690