• Calmer markets. US bond yields, the S&P500, & the USD consolidated on Friday, though underlying risk sentiment still looks somewhat fragile.

• Global events. European/US PMIs (Weds), week ending speeches by Fed Chair Powell & ECB President Lagarde, & China developments in focus this week.

• AUD consolidating. AUD treading water near its 2023 lows. There are no local events scheduled this week. AUD will be driven by offshore news.

After a busy few sessions markets consolidated on Friday with little new news coming through to move the needle or alter the fragile state of risk sentiment. The US S&P500 was flat on Friday, though the 2.1% fall over the week was the 3rd straight weekly decline, the longest negative streak since February. In bonds, while UK and German yields fell 7-10bps across their respective curves, US long-end yields were down only slightly (US 10yr -2bps to 4.26%). The major commodities were a touch firmer with oil prices higher (WTI crude rose ~1.1% to US$81.25/brl) and copper nudging up for the second consecutive day (+0.4%). In FX, the USD Index paused for breath up near the top of its ~2-month range. EUR is tracking under $1.09, USD/JPY is still north of ~145, and GBP is hovering just below its 50-day moving average (~$1.2792). The relative stability in USD/CNH (now ~7.30) following the move by the People’s Bank of China to set the daily CNY fixing rate at a much stronger than predicted level once again on Friday to counter currency weakness helped the AUD stabilise, albeit at low levels (now ~$0.6406).

There isn’t a lot on the data/event schedule early on this week, though things pick up later on with the European and US business PMIs (Wednesday AEST) and speeches by Fed Chair Powell and ECB President Lagarde (both Saturday morning AEST) at the annual Jackson Hole Symposium in focus. News out of China regarding any hints or moves to inject stimulus to bolster its faltering recovery will also on the radar.

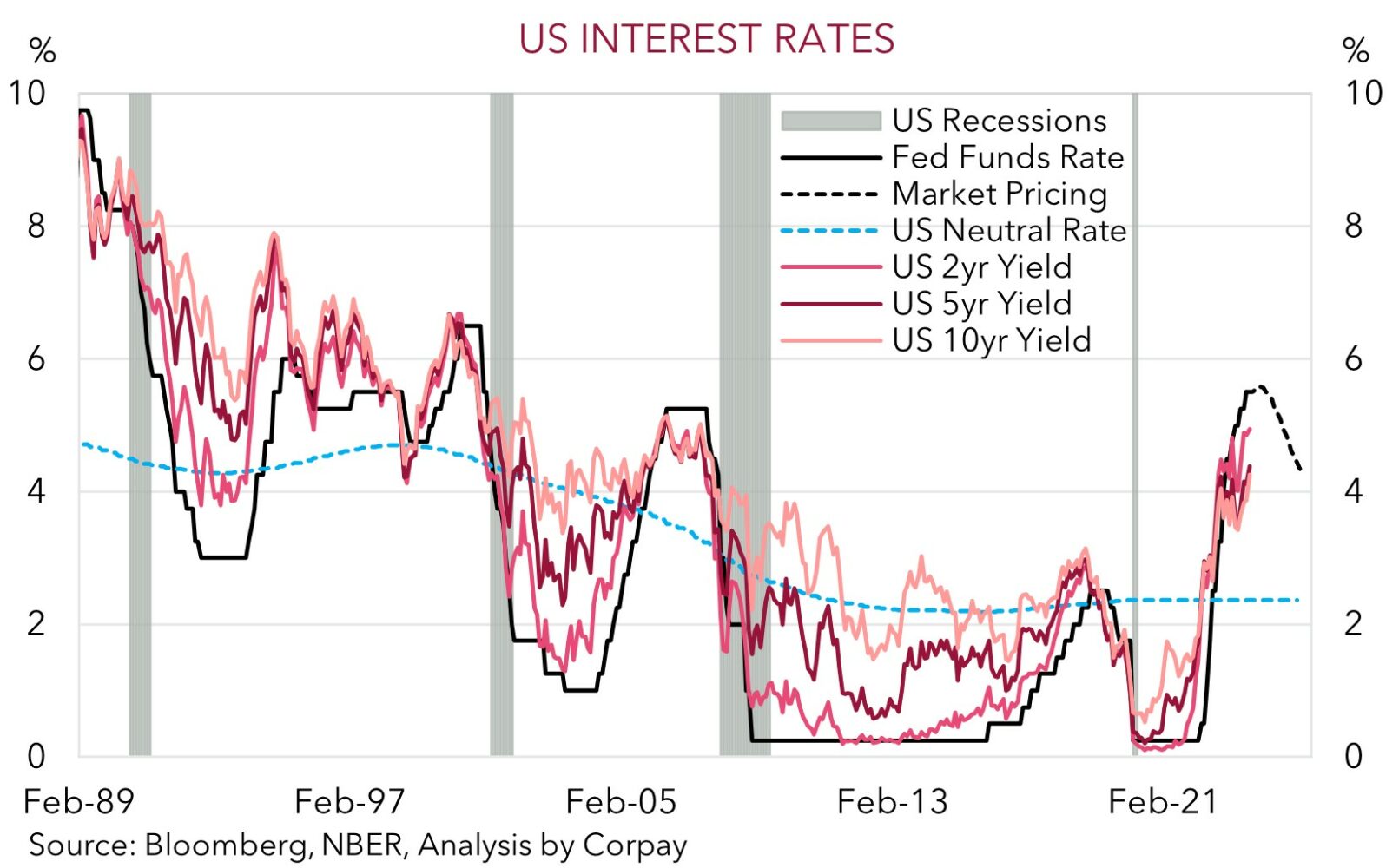

Data wise, attention to be on the extent to which the gap between the more resilient services sectors and weaker manufacturing side closes and/or whether the US’ relative outperformance over its peers is being maintained. In our view signs that services sectors are cooling, particularly in the US could see the USD lose a bit of steam. On the policy front, in past years the central bank symposium has been a platform for heavyweights from the US Fed or ECB to lay the foundations for a future shift in stance. This year’s topic is “Structural Shifts in the Global Economy”. While we don’t expect Chair Powell or President Lagarde to give strong signals about possible near-term policy decisions, which in turn may be taken slightly ‘dovishly’ by markets causing bond yields to retrace some of there recent gains and exert a bit of pressure on the USD, the topic is an interesting one that can have longer terms ramifications. The prospect of elevated sticky inflation and more investment being undertaken for the clean energy transition points to a higher ‘neutral rate’ and thereby a higher average level of interest rates and more volatility over the cycle than markets had grown used to in the post GFC period.

Global event radar: Eurozone PMIs (Weds), Jackson Hole Symposium (Thurs-Sat), US Fed Chair Powell Speaks (Sat), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

AUD corner

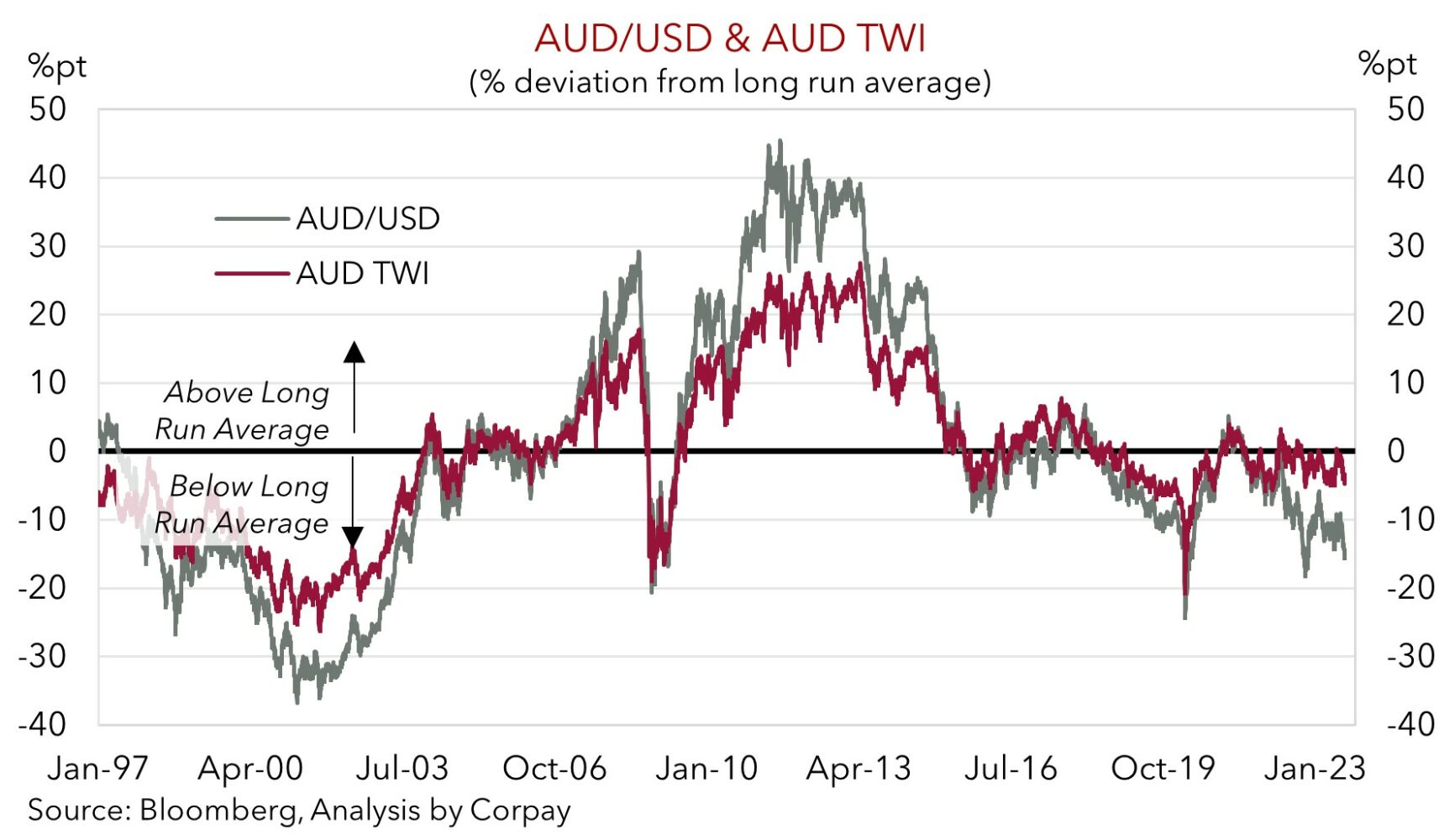

The AUD is treading water near the bottom of its 2023 range (now ~$0.6406). The relative calm in US markets on Friday and consolidation in USD/CNH on the back of a much stronger than predicated daily CNY fixing has helped the AUD hold its ground (see above). On the crosses, AUD/EUR (now -0.5892) and AUD/GBP (now ~0.5031) remain around levels last traded in Q2 2020. That said, other AUD crosses aren’t as low. AUD/JPY (now ~93.11) has drifted back recently, but it remains above its 1-year average, while AUD/NZD and AUD/CNH are only slightly below the mid-point of their respective 1-year ranges. As our chart shows, unlike AUD/USD which is now ~15% below its long run average, the AUD Trade Weighted Index is less than 5% from its long run average.

This week there is nothing major on the local economic calendar, however the lull doesn’t last for long with retail sales (28 August), a speech by RBA Deputy Governor Bullock (29 August), and monthly CPI (30 August) due next week. Given the lack of domestic events offshore developments will be the AUD driver near-term. As discussed above we think bond yields and the USD could ease back after a strong run with the European/US PMIs (Wednesday AEST) at risk of showing a softening across the services sectors and/or a reduction in the US’ relative outperformance. Similarly, while the topic of the annual Jackson Hole Symposium sounds like an interesting one for economic boffins we don’t expect strong hints from either Fed Chair Powell or ECB President Lagarde regarding near-term policy steps outside of the usual rhetoric that they are watching the data or that policy easing may be a while away. The ‘higher for longer’ backdrop now appears more adequately priced, in our judgement, and as such without anything new we think bond yields and the USD could give back a bit of ground. This in turn could see the AUD edge a little higher.

As outlined previously, while we don’t think the AUD will bounce back sharply for a while yet, we believe down around current levels the AUD should find solid support. Since 2015 AUD/USD has only traded sub-$0.64 ~2% of the time. Fundamentals including Australia’s current account surplus (now ~1.4% of GDP), flows related to the increasing pool of offshore investments undertaken by the superannuation industry, the high level of the terms-of-trade, and efforts by China to restrain CNY weakness, should, in our opinion, help the AUD find a base. Beyond the still tricky near-term we continue to forecast the AUD to grind back into the low 0.70’s by mid-2024, with the USD downtrend expected to recommence as the US’ relative strength fades (or at the very least the data fails to match lofty expectations) and with seasonal trends set to become more AUD favourable (see Market Musings: History doesn’t repeat, but…).

AUD event radar: Eurozone PMIs (Weds), Jackson Hole Symposium (Thurs-Sat), US Fed Chair Powell Speaks (Sat), AU Retail Sales (28th Aug), RBA Deputy Gov. Bullock Speaks (29th Aug), AU CPI (30th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep), RBA Meeting (5th Sep), AU GDP (6th Sep), RBA Gov. Lowe Speaks (7th Sep).

AUD levels to watch (support / resistance): 0.6310, 0.6370 / 0.6547, 0.6600

SGD corner

In line with the USD, CNH, and AUD USD/SGD consolidated on Friday with the pair tracking near ~$1.3570 (see above). On the crosses EUR/SGD (now ~1.4759) has held steady just above its 50-day moving average, while SGD/JPY (now ~107.06) has drifted down slightly from its historic highs.

As outlined above, this week the focus for global markets will be on the European/US PMIs (Wednesday), the week ending speeches from Fed Chair Powell and ECB President Lagarde at the annual Jackson Hole Symposium, and any China stimulus related developments. All up we believe the USD is at risk of easing back after its strong run, which if realised would drag USD/SGD slightly lower. We believe the PMI data could show a softening in services momentum and/or that the gap between the US and its European peers has narrowed. And we don’t foresee Chair Powell flagging anything different in terms of the near-term policy outlook that hasn’t already been discussed. The latest read on Singapore CPI inflation (Wednesday) is unlikely to be much of a SGD mover, in our opinion.

SGD event radar: Singapore CPI (Weds), Eurozone PMIs (Weds), Jackson Hole Symposium (Thurs-Sat), US Fed Chair Powell Speaks (Sat), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

SGD levels to watch (support / resistance): 1.3400, 1.3421 / 1.3590, 1.3690