• Bond yields. US 10-year yields at their highest since 2007. The upswing in real yields has been the driver. Despite the lift in yields US equities also rose.

• Stable FX. The USD & AUD consolidated. AUD remains near the bottom of its 2023 range. Is the AUD finding a base?

• Upcoming events. European/US PMIs (Weds), China developments, & upcoming speeches by Fed Chair Powell & ECB President Lagarde are in focus.

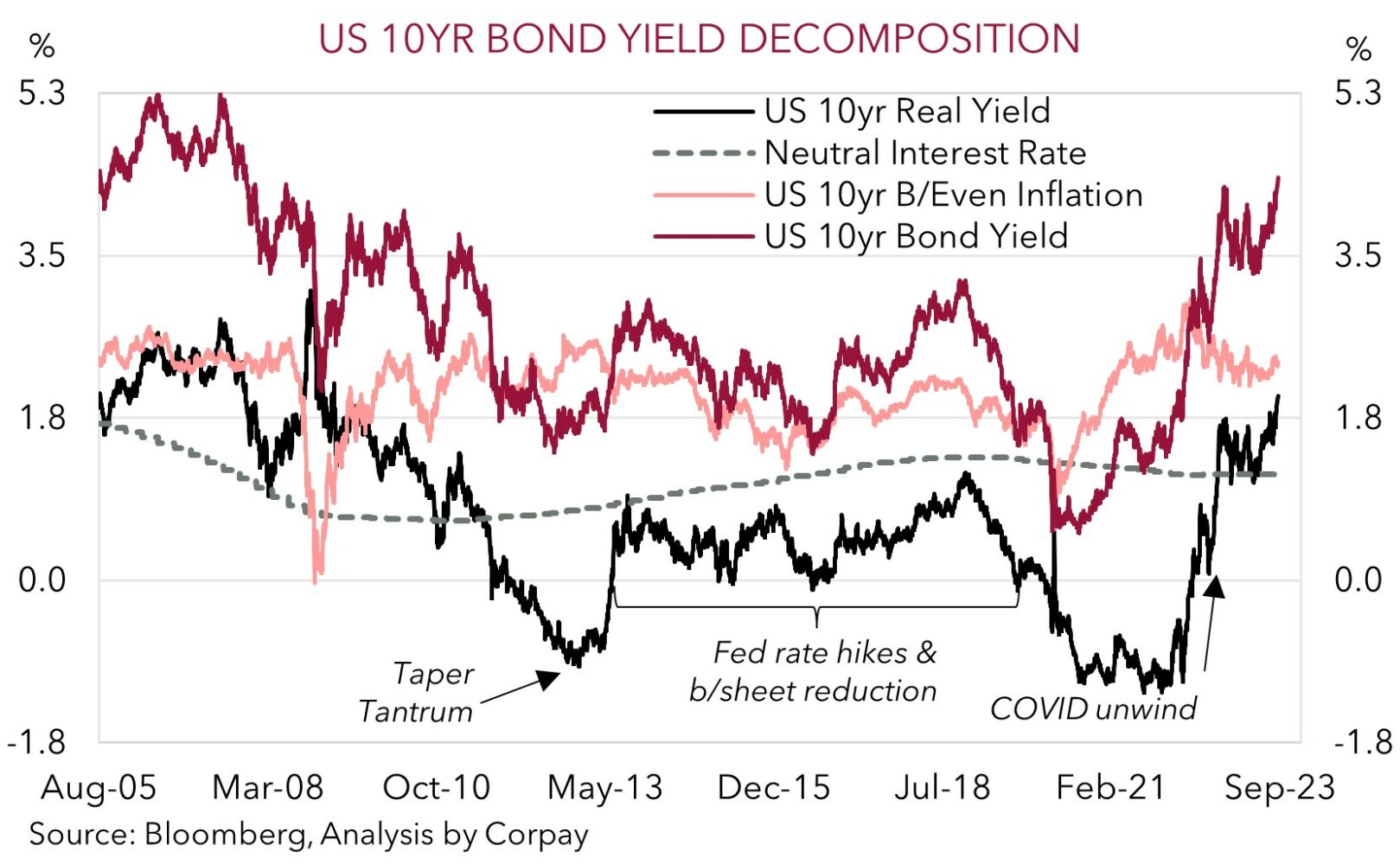

Despite the limited news flow bond yields have extended their upswing with markets focused on this week’s Jackson Hole Symposium and speeches by US Fed Chair Powell and ECB President Lagarde (both Saturday morning AEST). Bond yields in Europe rose 5-8bps, largely unwinding Friday’s pull-back, while in the US a few milestones were reached with the 10-year rate touching its highest level since 2007 (now 4.34%). Notably, as our chart shows, when you break things down the rise in US bond yields over the past couple of months has been driven by ‘real’ rates with the long-run inflation expectations component holding steady. The US 10-year real rate is now just under 2%, its highest since 2009. The outlook for interest rates needing to be ‘higher for longer’ to stamp out inflation, increased net bond supply, and greater economic uncertainty are some of the factors pushing up real yields.

Economically real rates are more important than nominal rates in driving activity because they are a truer reflection of the cost of capital, tend to directly impact loans and mortgage rates, and in turn influence business and consumer demand for credit. The gap between ‘real’ rates and ‘neutral’ is a gauge of how tight or loose settings are. And as things now stand things are arguably quite ‘restrictive’. In time we think this level of real yields can act to constrain US growth, and potentially act as a drag on asset price valuations. Yet despite the lift in yields, US equities ended the day higher with the S&P500 up 0.7% and the tech-focused NASDAQ outperforming (+1.6%) with shorter-term investors more focused on the upcoming results announcement by the AI bellwether Nvidia Corp (+7%).

In FX, the USD has consolidated with EUR shrugging off the spike in European natural gas prices (+9%) stemming from strike concerns by Australian LNG workers to be back near ~$1.09. USD/JPY has tracked the rise in US yields to be north of ~146, while the AUD is hovering just over ~$0.64 with the drop in USD/CNH under ~7.29 and tick up in US equity markets generating some support.

Tonight, the US Fed’s Barkin (9:30pm AEST), Goolsbee, and Bowman Speak (both 5:30am AEST), tomorrow night the European and US business PMIs are due, while the Jackson Hole speeches round out the week. As outlined yesterday, we think signs that services sectors are cooling, particularly in the US, could see the USD lose a bit of steam. And on the policy front we don’t expect strong hints from Fed Chair Powell regarding near-term steps outside of the usual rhetoric that they are watching the data or that easing may be a while away. If realised, we believe this may be a bit of a disappointment for markets causing yields and the USD to retrace some gains.

Global event radar: Eurozone PMIs (Weds), Jackson Hole Symposium (Thurs-Sat), US Fed Chair Powell Speaks (Sat), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

AUD corner

The AUD continues to hover around the bottom of its year-to-date range (now ~$0.6417), with the move up in US equity markets (despite the jump in US nominal and real yields) and the dip in USD/CNH down to ~7.29 following yet another stronger than predicated daily CNY fixing yesterday generating a bit of support. On the crosses the AUD has generally held steady with AUD/EUR and AUD/GBP still tracking near multi-year lows, while AUD/NZD and AUD/CNH are around the middle of their respective 1-year ranges. The softer JPY has seen AUD/JPY nudge up (+0.7% to ~93.80).

Based on the lack of domestic macro events this week offshore forces will be in the AUD driver’s seat. As set out above, following their strong run, we think bond yields and the USD could lose some ground over the period ahead with the European/US PMIs (Wednesday AEST) at risk of showing a softening across services sectors and/or a narrowing in the US’ relative strength. And from a policy perspective, with a ‘higher for longer’ environment now looking more appropriately discounted, we believe a repeat of the usual ‘data dependent approach from here’ rhetoric by Fed Chair Powell could underwhelm buoyant rates markets. In our opinion, without a fresh impulse bond yields and the USD may lose some steam over the near-term.

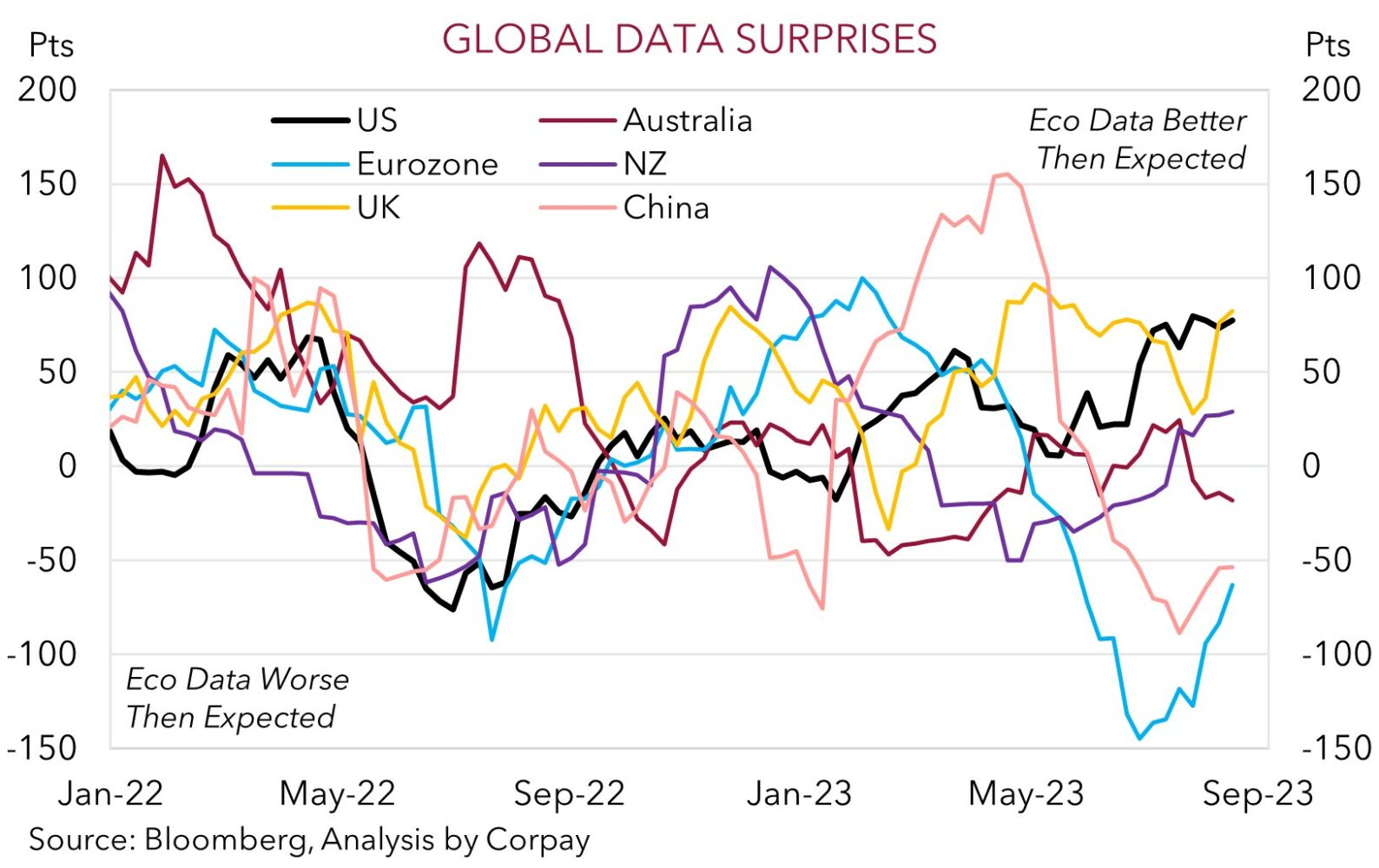

As outlined before, while we don’t expect the AUD to bounce back strongly for a while yet, we think down around current levels the AUD should find solid support. Fundamentals including Australia’s current account surplus (now ~1.4% of GDP), the high level of the terms-of-trade, efforts by China to restrain CNY weakness, and flows related to the increasing pool of offshore investments undertaken by the superannuation industry should, in our view, help the AUD level out. Beyond the challenging near-term we continue to forecast the AUD to edge back into the low 0.70’s by mid-2024, with the USD downtrend expected to recommence as seasonal trends become more AUD positive and USD negative (see Market Musings: History doesn’t repeat, but…) and as the US’ relative outperformance fades (or at the very least the data fails to match more upbeat analyst expectations). As our chart shows, data surprises for the US are now quite positive, while for Australian, the Eurozone, and China they are negative. Outcomes relative to expectations drive markets.

AUD event radar: Eurozone PMIs (Weds), Jackson Hole Symposium (Thurs-Sat), US Fed Chair Powell Speaks (Sat), AU Retail Sales (28th Aug), RBA Deputy Gov. Bullock Speaks (29th Aug), AU CPI (30th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep), RBA Meeting (5th Sep), AU GDP (6th Sep), RBA Gov. Lowe Speaks (7th Sep).

AUD levels to watch (support / resistance): 0.6310, 0.6370 / 0.6547, 0.6600

SGD corner

USD/SGD has continued to consolidate, as per the USD, with FX and US equity markets shrugging off the latest move up in US bond yields (see above). At ~$1.3578 USD/SGD is little changed from where it started the week. On the crosses, EUR/SGD (now ~1.4795) has ticked up with the 50-day moving average continuing to provide downside support, while SGD/JPY (now ~107.65) is at a historic high on the back of the weaker JPY.

As discussed above, over the next few days the focus for markets will be on the European/US PMIs (Wednesday), any China stimulus related developments, and the speeches by Fed Chair Powell and ECB President Lagarde at the Jackson Hole Symposium at the end of the week. Overall we think the USD is at risk of drifting back following its strong run, which if realised could see USD/SGD ease. As outlined, in our view, the PMI data could show a softening in services activity and/or that the gap between the US and Europe has tightened. And we don’t see Fed Chair Powell flagging anything different in terms of the near-term policy outlook that hasn’t already been mentioned.

SGD event radar: Singapore CPI (Weds), Eurozone PMIs (Weds), Jackson Hole Symposium (Thurs-Sat), US Fed Chair Powell Speaks (Sat), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

SGD levels to watch (support / resistance): 1.3400, 1.3421 / 1.3590, 1.3690