• Choppy markets. Developments in China weighed on risk sentiment yesterday, but things settled down overnight. US equities & bond yields higher.

• Stronger USD. Higher US yields & China-related nerves pushed the USD to year-to-date highs against the CNH, JPY, SGD, NZD, & AUD.

• Data focus. RBA meeting minutes, Q2 AU wages, China activity data batch, UK labour stats, & US retail sales due today.

It has been a choppy start to the week for markets. Negative sentiment around developments in China weighed on sentiment during yesterday’s Asian session with investors appearing somewhat concerned about potential fallout from troubles in Country Garden Holdings (once China’s biggest developer) and fresh jitters related to large financial conglomerate/private-wealth manager Zhongzhi Enterprise Group. Hong Kong’s Hang Seng (-1.6%) and China’s CSI300 (-0.7%) fell further, with both now in negative territory for the year. CNH has also remained on the backfoot with USD/CNH (now ~7.28) reaching a new 2023 high.

Markets settled down overnight with risk appetite improving. US equities ended the day higher, with the tech-focused NASDAQ outperforming (+1.1% vs S&P500 +0.6%). Bond yields remained in an upward trend. The US 2-year yield rose ~8bps to 4.97%, a high since early-July, while the 10-year rate increased ~4bps (now 4.19%, the top of the range it has occupied since November). The outlook for greater bond supply because of eye-watering budget deficits and lingering inflation worries are supporting bond yields. In FX, the mix of China-related nerves, dip in oil (WTI crude -0.7%) and base metal prices (aluminum -1.3%, iron ore -0.5%), and rising US yields has bolstered the USD. In addition to USD/CNH touching a 2023 high, the USD also reached a year-to-date peak against the JPY (USD/JPY is now ~145.56), NZD (now ~$0.5975), and AUD (now ~$0.6486). EUR has slipped back towards ~$1.09, with GBP treading water just under ~$1.27.

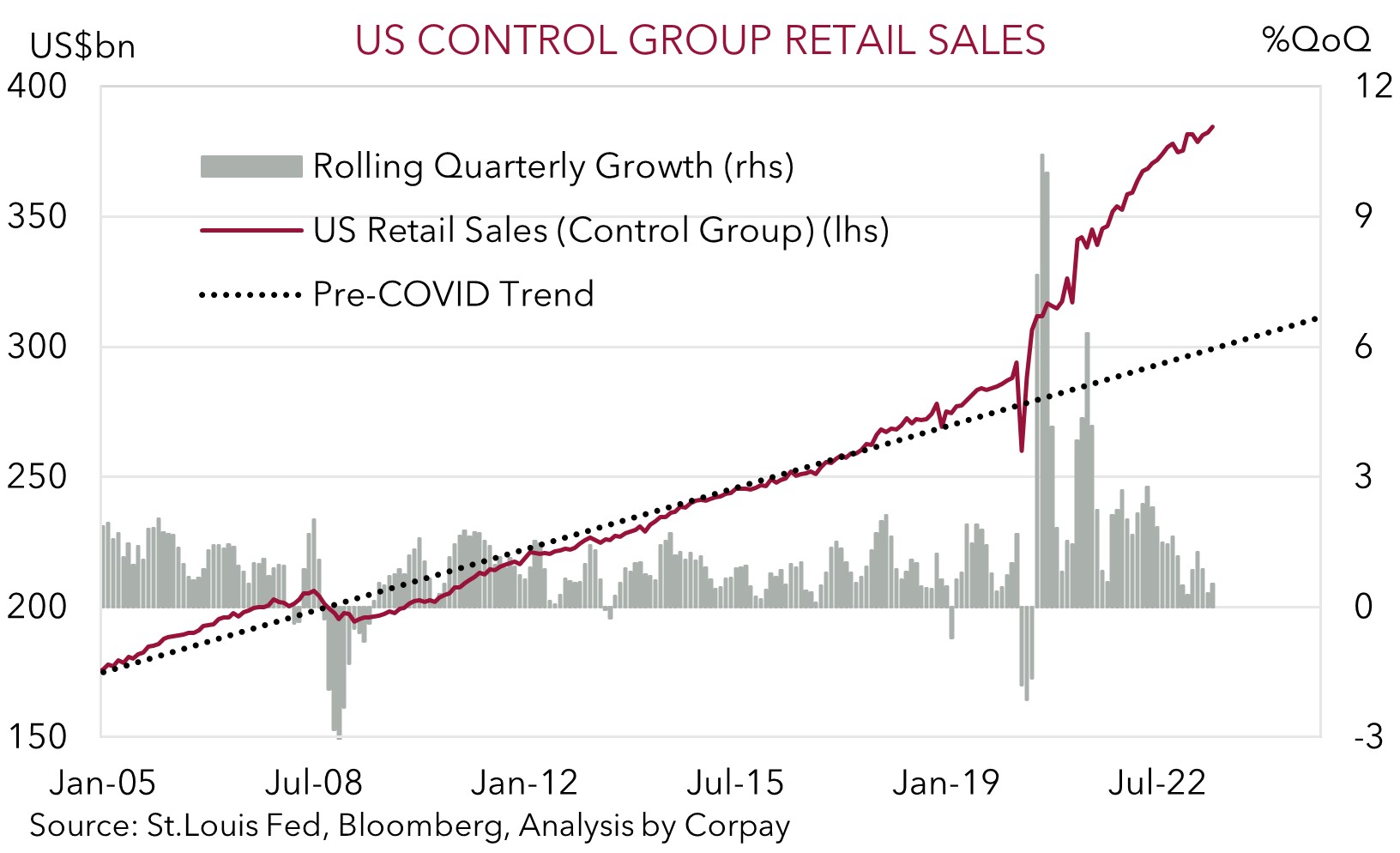

The themes and trends mentioned look set to remain in place over the near-term. Global attention today will be on Q2 GDP from Japan (9:50am AEST), the monthly China activity data batch (12pm AEST), the UK labour market stats (4pm AEST), and the US retail sales report (10:30pm AEST). As noted yesterday, based on the sluggish credit impulse, low consumer confidence, and global slowdown, we think the China data risks underwhelming, particularly once base-effects reflecting last year’s lockdowns are considered. If realised, this could dampen sentiment and weigh on growth linked assets like commodities and cyclical currencies. By contrast, we believe Prime Day sales events and higher gasoline prices may have given US retail sales a boost. In our view, solid consumer spending (the engine room of the US economy) could generate a USD supportive upward repricing in interest rate expectations.

Global event radar: China Activity Data (Today), US Retail Sales (Today), RBNZ Meeting (Weds), UK CPI (Weds), FOMC Minutes (Thurs), Japan CPI (Fri), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

AUD corner

The AUD has remained under pressure at the start of the new week as China concerns dampened risk sentiment and the CNH, and higher US bond yields supported the USD (see above). The mix of factors pushed the AUD (now ~$0.6486) to a fresh 2023 low overnight before the bounce back in US equity markets helped the AUD to stabilize. Notably, the AUD has consolidated on the crosses, illustrating that the weakness over the past 24hrs has been more a positive USD rather than negative AUD story.

As discussed above, we think the USD can remain firm over the near-term which in turn can keep the AUD heavy. We believe the China activity data (12pm AEST) could undershoot consensus predictions due to the tepid credit growth, subdued consumer confidence, high youth unemployment and slowing global economy. At the same time, in our view, US retail sales (10:30pm AEST) risks coming in better than expected. Solid US retail sales (mkt 0.4%) could see markets question their assumption that the US Fed is unlikely to deliver another rate rise this cycle, particularly given signs inflation pressures remain uncomfortably high. Increased chances of another hike by the US Fed and/or the pushing out of rate cut odds could be USD supportive.

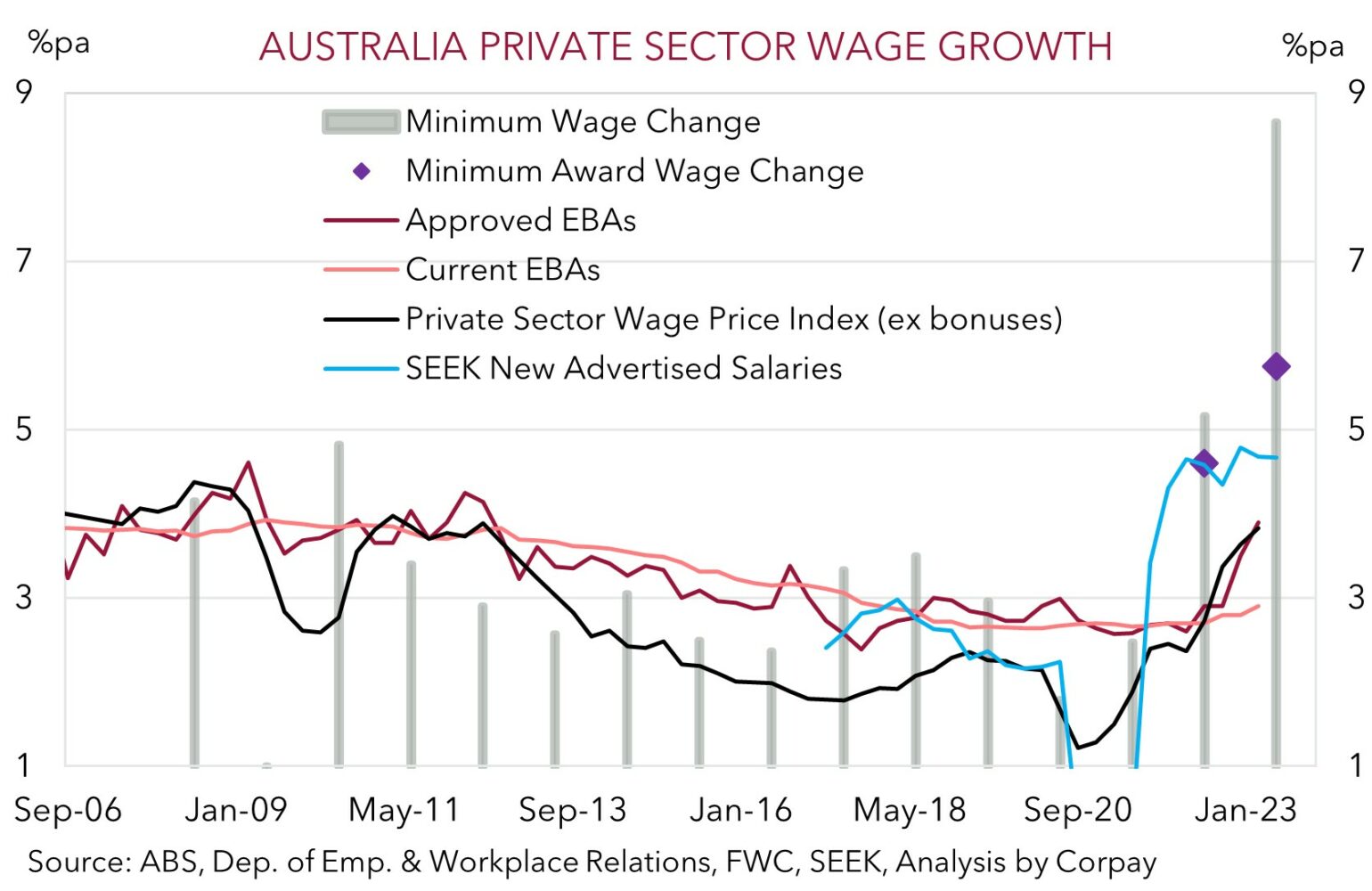

However, as outlined previously, although we don’t see the AUD bouncing back strongly for a while yet, we also don’t want to be overly bearish down around current levels given the fundamental supports provided by Australia’s current account surplus (now ~1.4% of GDP), flows related to the increasing pool of offshore investments undertaken by the superannuation industry, and the high level of the terms-of-trade. Since 2015, the AUD has only traded below current levels ~3% of the time. Added to that we think that today’s Q2 Australian wage data (11:30am AEST) and the July jobs report (Thurs AEST) could generate some support for the AUD on the crosses. Labour market stats are a lagging indicator. Based on the tightness in conditions wages are forecast to nudge up (with a bigger lift coming through in Q3 due to the sizeable rise in award wages), while jobs growth is projected to remain positive with solid demand soaking up greater labour supply. In our judgement, a still sturdy labour market may see the AUD claw back lost ground against currencies like the EUR, GBP, and JPY, while we see AUD/NZD remaining supported with the RBNZ expected to keep rates on hold and flag that further tightening is data dependent (Weds AEST).

AUD event radar: AU Wages (Today), China Activity Data (Today), US Retail Sales (Today), RBNZ Meeting (Weds), UK CPI (Weds), FOMC Minutes (Thurs), AU Jobs (Thurs), Japan CPI (Fri), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), AU Retail Sales (28th Aug), RBA Deputy Gov. Bullock Speaks (29th Aug), AU CPI (30th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

AUD levels to watch (support / resistance): 0.6403, 0.6480 / 0.6610, 0.6664

SGD corner

USD/SGD has added to its gains with the firmer USD on the back of the lift in US bond yields and lingering concerns about developments in China supporting the pair (see above). USD/SGD (now ~$1.3559) touched a new 2023 high yesterday. On the crosses, EUR/SGD (now ~1.4789) has continued to consolidate at the upper end of its year-to-date range, while SGD/JPY (now ~107.31) is near a historic peak.

As outlined above, we believe the USD can remain supported over the near term with tonight’s US retail sales data and the upcoming US housing and production reports at risk of exceeding consensus expectations. If realised, this may provide another shot in the arm for US interest rate pricing. Concurrently, we think today’s China activity data batch may undershoot market estimates, fanning concerns about the outlook for regional growth. This mix, in our judgement, could give USD/SGD a further boost.

SGD event radar: China Activity Data (Today), US Retail Sales (Today), UK CPI (Weds), FOMC Minutes (Thurs), Japan CPI (Fri), Singapore CPI (23rd Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

SGD levels to watch (support / resistance): 1.3385, 1.3417 / 1.3560, 1.3590